[ad_1]

Starcevic

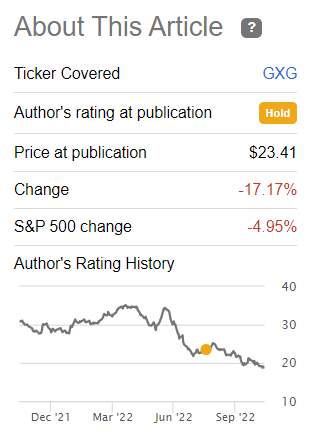

In my August note on the Global X MSCI Colombia ETF (NYSEARCA:GXG), I pointed out that playing the global inflation theme with this investment vehicle does not make sense owing to weakness in the Colombian peso amid political headwinds, even despite it is a financials- and energy-heavy fund, in theory, capable of benefiting from surging crude prices and decisively hawkish monetary policy, a mix we have seen in Colombia’s case.

It appeared that I was right, yet I did not expect a sell-off of such a magnitude. Since then, the fund has fallen by ~17.2%, dwarfing the S&P 500’s inflation, interest rates, and tech earnings-driven decline of ~5%.

Seeking Alpha

Today, it is certainly worth providing an update to answer the question of whether the sell-off brought the fund’s price to an attractive level.

As a quick investment strategy recap, GXG’s primary purpose is to track the MSCI All Colombia Select 25/50 Index as closely as possible. Its closest peer the iShares MSCI Colombia ETF (traded with a ticker ICOL) closed its doors in August, so GXG remains the only fund targeting this Latin American nation’s equities, at least, I am not aware of the one with a similar level of assets or liquidity.

For GXG, nothing has changed tectonically in terms of sector exposure as financials still dominate the mix, with over 40% of the net assets followed by utilities (23.2%), and then energy (21.6%) being the last in the top trio.

Now, the question is what has been the primary driver of GXG’s slump? Expectedly, the Colombian peso’s utterly lackluster performance is the principal culprit. Since the beginning of the year, the COP has dropped by over 37% against the USD, losing over 6% over the last month only. By contrast, the Mexican peso and Brazilian real are up in single digits YTD.

And the Andean nation’s currency’s weakness was, in turn, partly engendered by political factors.

Inflation in Colombia has been unwilling to relax its grip of late; for August to September, total annual inflation advanced from 10.8% to 11.4%, while the target is 3%. This made the central bank increase the interest rate even further, by 100 bps to 11% on October 28. For better context, the September interest rate increase was also 100 bps after the headline inflation in August climbed to 10.8% overshooting the expected 9.9%.

There is no denying that the currency’s slump looks totally counterintuitive owing to the fact that the Banco de la República has continued to remove excess liquidity to quell excruciating inflation. Yet this is one of the cases (see Sweden’s monetary policy/FX paradox) when the ultra-hawkish stance does little to bolster national currencies, unable to outweigh more potent bearish factors in the mix, like the political issues in the case of the peso.

Besides, it would be pertinent to remark that in the October press release, among other headwinds, the regulator also mentioned “the exchange rate pass-through to tradable goods,” which is another way of saying the sluggish peso performance has been causing the imported inflation problem.

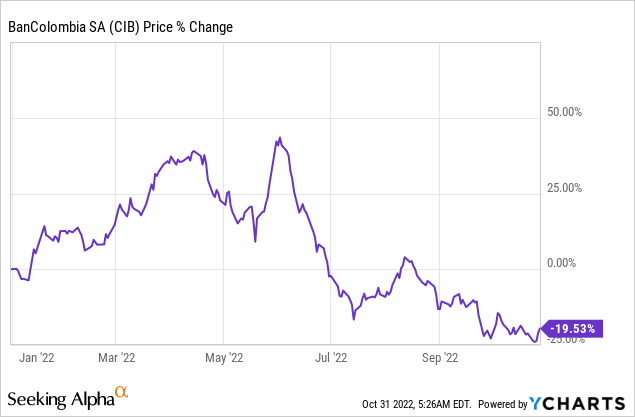

For GXG’s holdings from the financial sector, hawkishness is a boon. For example, Bancolombia S.A. (CIB), common and preferred shares in which account for 22.4% of the GXG net assets, said in its Q2 report that

Net interest income before provisions increased 16.6% and totaled COP 4.315 billion in 2Q22.

And “the loan portfolio repricing as an effect of the contractionary monetary policy” was one of the main drivers. Yet CIB is still down 19.5% YTD in New York, with the weak COP being the top detractor.

Importantly, the September super-sized rate increase was strongly opposed by the incumbent. As reported by Bloomberg, Gustavo Petro, a leftist president who was elected in June, criticized the central bank’s inflation-fighting schema in a slew of tweets, instead proposing a tax on capital outflows, an idea that only contributed to the peso’s decline as traders cranked up their bearish bets. The silver lining here is that Finance Minister Jose Antonio Ocampo quickly addressed investors’ concerns, clarifying that capital controls were not considered. As I said above, the peso still dropped by over 6% in October.

Delving deeper, we encounter other possible culprits, namely Brazilian hedge funds’ decidedly bearish view of the COP. More likely, the Achilles heel they are trying to utilize in their opportunistic bearish bet is Colombia’s fiscal and current account deficit amid increasing public spending plans that would make the Andean nation more sensitive to the global economic headwinds.

Turning to the energy sector, there are also strong risks both for the peso and the GXG holdings. For example, Mr. Petro has an intention to end new hydrocarbon exploration projects in Colombia in order to stimulate a faster green transition.

Colombia’s sizeable oil production is no secret for investors closely following South and Central America. As of the BP Statistical Review of World Energy 2022, Colombia produced 738 thousand barrels a day in 2021, not the largest in the region, yet in the top trio, after Brazil and Venezuela. However, the issue here is that the production has been trending lower, with a 2.1% decline in 2011-2021. Also, the natural gas question is not to be overlooked. The country produced just 12.6 billion cubic metres in 2021, one of the lowest in the region, and consumed the exact same amount. The problem is that production came from offshore fields that are depleting rapidly, while demand is growing strongly. In a gloomy scenario, with no reserves added due to suspended exploration, the country could face shortages and ramp up pricey LNG imports. Amid the fundamental changes the natural gas supply chains, and especially its LNG segment, are facing, this could send electricity prices soaring and jeopardize energy security in the future. And in this regard, I would say the peso’s steep downward plunge is partly the consequence of the market slowly pricing in such a prospect.

Yet there is something for a “glass is half full” scenario. The risk might be overblown. Answering an analyst’s question touching upon the suspension of new exploration contracts during the Q2 earnings call, the Canacol Energy (OTCQX:CNNEF) President and CEO said that

…we hold interest in 11 exploration and production contracts, six in the lower Magdalena Valley, which is our core operating area. Five in the middle Magdalena Valley, which is our new high impact gas exploration area. On those 11 contracts, we have identified about 190 drilling locations, exploration drilling locations, containing on a gross enriched basis 18 TCF of prospective gas resource. So we have sufficient inventory to drill over on those 11 blocks for at least 10 years.

Canacol Energy is an exploration & production firm and GXG’s holding with a 2.8% weight.

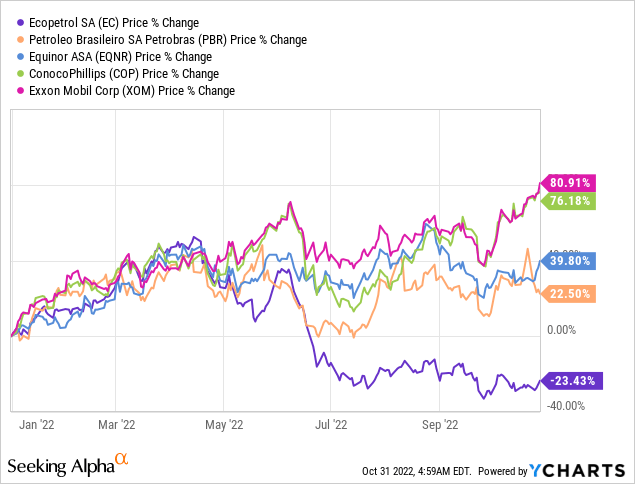

Another positive here is that the proposed 20% tax on oil and coal exports designed to boost government’s cash flow necessary to cover social spending plans was excluded from the proposed fiscal reform. And the move was expectedly hailed by the CEO of Ecopetrol (EC), an oil & gas company with a market value of $20.6 billion and GXG’s holding with a 14.3% weight. Amid headwinds for Colombian petroleum companies, the EC stock price has suffered badly this year, underperforming its peers like Petrobras (PBR) and Equinor (EQNR), let alone Exxon Mobil (XOM) and ConocoPhillips (COP).

The bottom line

In sum, what scenario the market has priced in the COP/USD rate and GXG’s holdings multiples? In short, they probably reflect the ideas to increase public spending which bode ill for the fiscal and current account deficit; mulling over the end of exploration could jeopardize the energy security of the country, as the natural gas production deficit would send electricity prices higher in the medium term, contributing to inflation, denting consumer confidence, and weighing on economic growth. Some risks might be overblown, yet the situation is highly uncertain.

In the meantime, there is no denying that GXG is insanely cheap, with a diminutive P/E of just 4.69x according to the data from AltaVista Research as of October 27.

All in all, my point is unchanged. Specifically, I see high risk/high reward here, assuming political concerns abate and the peso and equities reprice higher. However, uncertainty reigns, and I would not make an attempt to construct a bullish case here. I highlight a 7.9% forecast GDP growth rate for 2022 as a positive, yet insufficient for a strong bullish thesis for the peso and GXG.

[ad_2]

Source links Google News