[ad_1]

PM Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

This is my third and final coverage of the Metaurus US Equity Cumulative Dividends Fund-Series 2027 ETF (NYSEARCA:IDIV). In my first, IDIV: Earn S&P 500 Dividends Without Stock Ownership Risk, But Concerns Remain, I gave it a SELL rating as I could not wrap my head around it. After I thought I had a better understanding, three months later I changed to a BUY rating: IDIV: Taking A Second Look At This Unique Dividend ETF.

Here I will review what IDIV is trying to accomplish to the best of my understanding. The SELL is purely based on its performance and use of ROC (return of capital) to make payouts since it started in February of 2018. I then list three other dividend-focused exchange-traded funds (“ETFs”) to consider.

Manager Review

metaurus.com

Understanding the management firm and their philosophy is important when considering a unique ETF. This is how one financial reporter describes Metaurus:

Metaurus Advisors helps clients change the approach to portfolio construction through creatively designed, customizable solutions.

We strive to deliver innovative strategies that focus on isolating and optimizing the components of investment return and creating outcome-focused financial products and portfolios. Our team has decades of multi-asset investment and financial structuring experience.

METAURUS SOLUTIONS is a suite of strategies designed to change the approach to portfolio construction and achieve customizable investment exposure. They focus on unbundling and optimizing dividend cash flows, dividend risk premia, and the sources of investment returns.

We apply a “duration” framework to equity assets – similar to what has been done in the fixed income markets for decades. The approach effectively creates short and long duration equity exposures that may be a more precise tool for financial advisors and institutional investors. A proprietary, systematic commodity trend-following strategy may also help asset diversification.

Source: metaurus.com

Metaurus US Equity Cumulative Dividends Fund-Series 2027 ETF

Seeking Alpha describes this ETF as:

The investment seeks investment results that, before fees and expenses, correspond to the performance of the Metaurus U.S. Cumulative Dividends Index-Series 2027 (the “Metaurus Dividend Index”) over each calendar year. The advisor intends primarily to invest its assets in the component instruments of the underlying index. The component instruments of the index consist of U.S. Treasury Securities and long positions in annual futures contracts listed on the CME that provide exposure to dividends paid on the S&P 500 constituent companies pro rata for each year of the life of the fund. IDIV launched on 2/8/2018.

Source: seekingalpha.com IDIV

After 4+ years, IDIV still has under $30m in assets, with $50m considered the minimum assets under management (“AUM”) to survive. IDIV had just $1m less 14 months ago. The managers charge 87bps in fees, which I consider high these days for what I see as a passively-managed ETF. The yield will be covered later.

Metaurus describes their ETF and its benefits as:

IDIV seeks to provide monthly payments that, before fees and expenses, replicate the actual dividends paid by the S&P 500, without price exposure, as represented by the Metaurus US Cumulative Dividends Index – Series 2027.

Essentially, IDIV allows investors to access the potential dividend income of the S&P 500 Index without stock price exposure. IDIV has an initial 10-year life and expects to make monthly distributions.

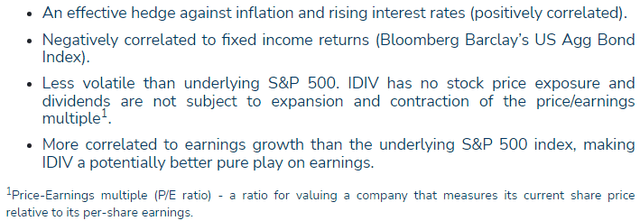

Investors benefit in the following ways:

No stock price exposure

Potential dividend growth

Monthly distributions

Can use IDIV to customize amount of cash flow generated by a portfolio

Passive investment and no sector concentration

Source: metaurus.com/idiv

A focus on dividends, historically, has shown these traits:

metaurus.com/idiv

Index review

IDIV invests based on an index developed by Solactive AG. Metaurus provides this information about the index:

The Index aims to represent the discounted present value of all listed annual S&P 500 Dividend Index Futures contracts out to and including the December 2027 dividend futures expiry. To accomplish this, each S&P 500 Dividend Index Future market price will be discounted by using the computed yield of a specified U.S. Treasury Security with a similar or prior maturity date as the corresponding S&P 500 Dividend Index Future expiry. After expiry of any S&P 500 Dividend Futures contract, such futures contract and its corresponding U.S. Treasury Security will be removed from the Index. The Index is a price only index.

Source: metaurus.com index

Holdings review

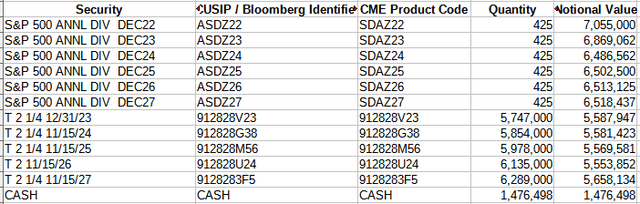

metaurus.com/idiv/holdings

Each December, the Future and T-Bill for that year matures and the proceeds distributed to investors. IDIV will cease to exist after 2027.

Distribution review

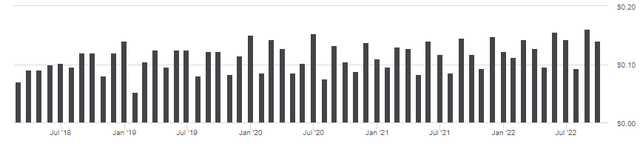

seekingalpha.com IDIV DVDs

For the most part, the monthly distributions have been between $.09-.15. Since late 2018, they have all come from ROC, which helps explain the large decrease in the NAV. Here is the payout disclaimer provided on the IDIV website:

The Fund will be treated as a partnership for U.S. federal income tax purposes and will issue a Schedule K-1 to investors. Monthly cash distributions made to IDIV investors in 2019 should be treated entirely (100%) as a return of a Shareholder’s tax basis (not less than zero) and should not be subject to withholding. Holders of IDIV should expect to be allocated a modest amount of Federally taxable interest income as a result of the U.S. Treasury securities and cash held by the Fund. Taxable investors should also expect to see an allocation of capital gain or loss attributable to certain investment contracts held by the Fund. Tax forms will break out the amount of short- and long-term capital gain or loss reportable by you. Investors will be allocated a proportionate amount of the Fund’s expenses that will also appear on your tax form. Each of these items will result in an adjustment to your cost basis in the Fund’s shares. For your convenience, your personalized tax form will provide you with your ending adjusted cost basis in the Fund’s shares.

Source: metaurus.com

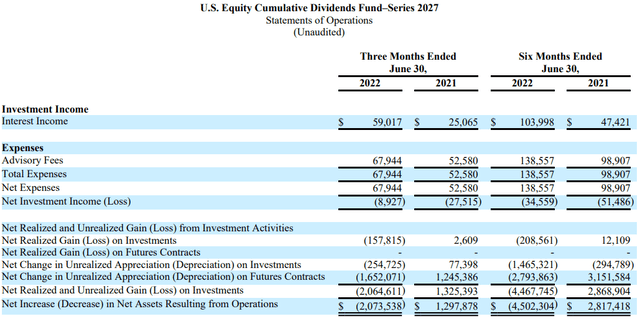

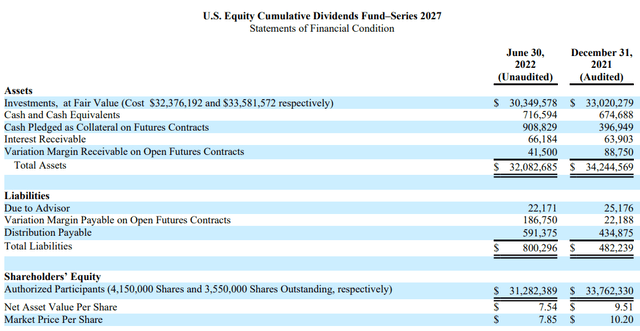

Financials review

metaurus.com/assets/doc

The past three and six months have not gone well for IDIV’s investments. This is then reflected in a drop in the NAV since 2021, which is way down from its inception level.

metaurus.com/assets/doc

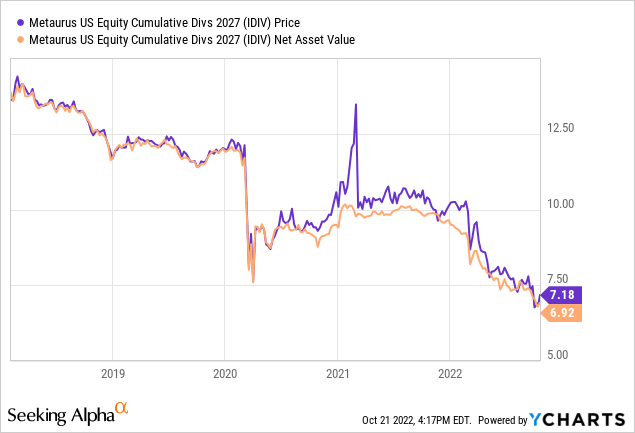

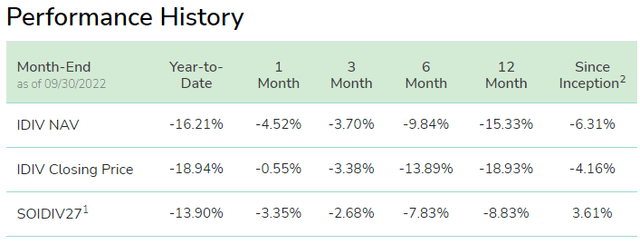

Performance review

metaurus.com returns

A strike against IDIV is they have underperformed the index they supposedly invest based on.

Portfolio Strategy

due.com

Following Peter Lynch’s advice, I’m back to a Strong Sell on this ETF. I admit I still don’t understand some details, but the results speak loudly for themselves. Next, I list two possible dividend ETFs for readers to consider. The second has been reviewed by me also: JEPI Vs. SPY: More Differences Than Just Yield And CAGR.

Invesco S&P 500 BuyWrite ETF (PBP)

PBP seeks to track the performance of the CBOE S&P 500 BuyWrite Index.

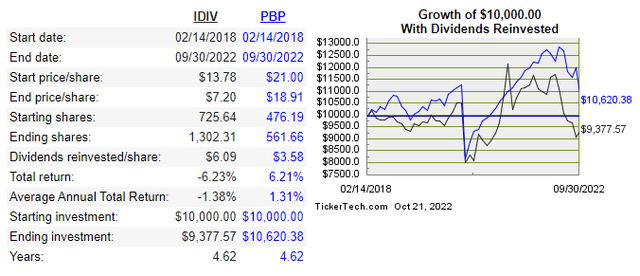

dividendchannel.com/drip-returns-calculator

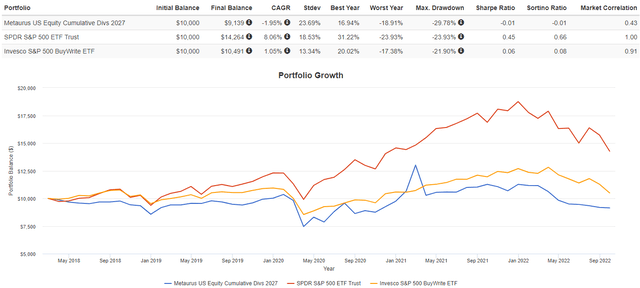

While IDIV is down 6.23% since inception, PBP is up 6.21% since then. Unlike IDIV, it does own the underlying equities in the index. More on that analysis in a bit.

JPMorgan Equity Premium Income ETF (JEPI)

JEPI mostly uses exchange-traded notes (“ETNs”) to generate its income and does give it equity exposure.

dividendchannel.com/drip-returns-calculator

While IDIV has performed better since post-COVID, JEPI still outperformed it by over 700bps. The next chart shows how these three ETFs have faired during 2022, a very large down market.

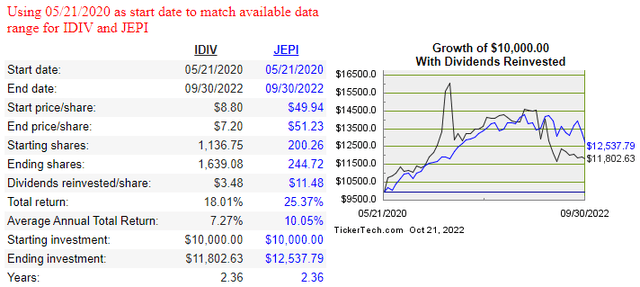

All three ETFs are down YTD, with IDIV down the most both in price and CAGR. IDIV’s higher distribution rate narrowed the deficit with the other ETFs. but still came in last. Two other

Final Thoughts

It appears to me that IDIV is self-liquidating by its need to use ROC to cover 100% of its payouts. I’m sure if I understood it better, that some of that is not destructive ROC, but the constant decline in the NAV seems to support my statement.

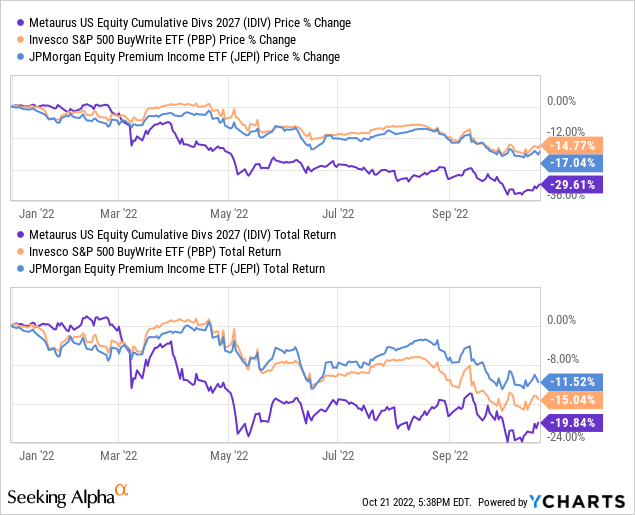

The other negative of most dividend-focused ETFs was mentioned above, so here is a chart to illustrate my point: these ETFs have lagged their index counterparts that aren’t dividend-focused. Investors could sell shares to make up the income difference.

While having equity exposure should be riskier than an ETF that tries to generate its income without that need, PortfolioVisualizer data shows otherwise, with the IDIV ETF actually having a negative Sharpe and Sortino ratios! One point I raise when reviewing dividend-focused ETFs is: “How much capital gains are you willing to trade away for that enhance income today?” The S&P 500 (SPY) has outpaced IDIV by almost 50% since IDIV’s inception!

PortfolioVisualizer.com

For another opinion on the IDIV ETF, Juan de la Hox penned this last year at this time: IDIV: Dividend Futures ETF, No Compelling Investment Thesis, Sell

[ad_2]

Source links Google News