[ad_1]

Elena Perova

The iShares U.S. Consumer Staples ETF (NYSEARCA:IYK) captures some of the biggest brands in the world. The ETF is very expensive relative to even the broader market, but it has admittedly flouted some of our concerns by defending well against downtrading. The marquee brands contained inside IYK seem to be delivering the resilience that consumer staples as a segment promises, although due to the high multiple we’d refrain from buying it, especially since the full effects of a recession if rates were to continue to rise are yet to be felt by investors.

Breakdown

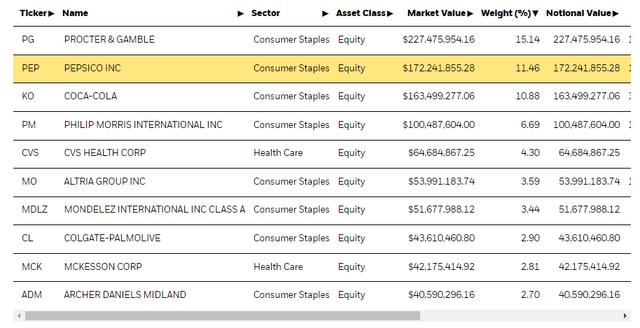

Let’s remind ourselves of the top exposures. The ETF is quite dependent on a few allocations, so we can focus the discussion there.

Top Holdings (iShares.com)

The first 4 stocks account for about 33% of the overall allocation. In our last article, our concern was focused primarily on P&G (PG), PepsiCo (PEP) and Philip Morris (PM) where we saw the most potential for downtrading. PG has a lot of European exposure, and that’s where private labels have more bite. Philip Morris had to deal with the fact that Ukraine and Russia, both big markets, had been damaged for both traditional and heat-not-burn. Being a huge margin hit, they’d be forced to raise prices a fair bit to outrun inflation and lost markets, giving way for Imperial Brands (OTCQX:IMBBY). PepsiCo has a larger brand portfolio that could see a hit from downtrading in areas other than the Pepsi beverage, which would likely be pretty resilient.

How did our predictions stand up to reality? PG did reasonably well. They managed to produce some EPS growth, although inflation reduced that growth relative to sales growth which was driven by price. They suffered a little in Family Care with share losses to private label and downtrading, and in general European markets saw more pressure from private label, but they have gotten some share growth elsewhere regardless in areas where brand would be expected to matter more. They do comment interestingly the following:

We’re seeing price increases on private label brands and on mid-tier offerings that are even higher in some cases than our own price increases. I just offer that perspective as it relates to the ability to hold pricing and what it might mean for market share. As Andre said, it’s a fairly constructive environment.

Jon Moeller, PG CEO

PM saw a surprising increase in volumes still of 1.1% and consequently in the tobacco fashion were able to produce EPS growth. They are doing better than Imperial Brands, but it might be because the USA market was a big drag on IMB results and PM doesn’t operate there directly, and in general IMB has some worse markets structurally. Volumes declined 0.7% for IMB. So there wasn’t any sign of downtrading. IMB only acknowledges downtrading in Australia where tax pressures essentially assure downtrading will happen. Pepsi didn’t do as well. Volumes started going slightly down, while prices did keep things looking up. The effects of spending being allocated elsewhere were supposedly what started to be seen there.

Coca-Cola (KO) was resilient but actually performed more or less in line with Pepsi. Pricing action kept revenues growing, and volumes were fine, but inflation took its toll. Also more non-US dollar exposure had an impact as well on topline and easy margin. Ignoring the impairment, operating profits were slightly down.

Remarks

Overall, the stocks did not seem to be getting majorly affected by downtrading. The same cannot be said for European consumer staples counterparts. In general, Europeans are more ready to buy private label supermarket brands. Indeed, I exclusively do so at my supermarkets. The US exposure can be enhanced by IYK as opposed to broader or European focused consumer staple ETFs. In addition to resilience to the first wave of consumer confidence declines, the second lever of pain from downtrading does not seem to be taking a major toll. Only really PG has confirmed effects from downtrading coming in, with Pepsi getting slightly sprayed by consumer confidence declines.

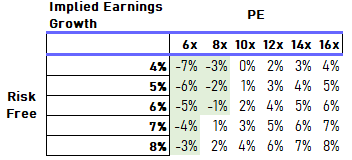

If the economy continues to decline as rates continue their likely hike, more spending may be allocated to things other than beverages and snacks, affecting Pepsi and KO more, and downtrading becomes more pronounced as consumers become increasingly hard pressed, these consumer staples will see pressure. While they will remain relatively resilient compared to other sectors, the 21x PE means earnings yield really less than half a point above risk free rates. EPS growth is already pretty small, and it could get into negative territory soon. It has with even Coke. The multiple isn’t acceptable to us, but we do respect the resilience so far demonstrated.

Value Chart, VTS

[ad_2]

Source links Google News