[ad_1]

Igor Kutyaev

Overview

Revisiting FAS: Direxion Daily Financial Bull 3x Shares ETF (NYSEARCA:FAS) allows money managers to take on turbo-charged risk exposure to the financial sector.

FAS provides 3x risk exposure to the market cap-weighted index of U.S. large cap financial institutions. This vaguely matches its distant cousin, Financial Select Sector SPDR ETF (XLF), which is the S&P500 financials benchmark exchange-traded fund (“ETF”). The fund commands about $1.50B in assets under management (“AUM”), significantly less than when I first covered the fund.

Founded in 2008, the product provides financial services overclocking, allowing traders to capitalize on yield curve steepening in a positive GDP growth environment. Unfortunately, today, nothing could be further from the truth; yield curves have flattened, and GDP growth is stalling.

Characteristically, FAS resorts to a basket of derivatives such as futures or swaps to produce the artificial hyper-leveraged glide path promoted by the fund manager, with ambitions to reproduce 3x leveraged daily performance of the Financials Select Sector Index.

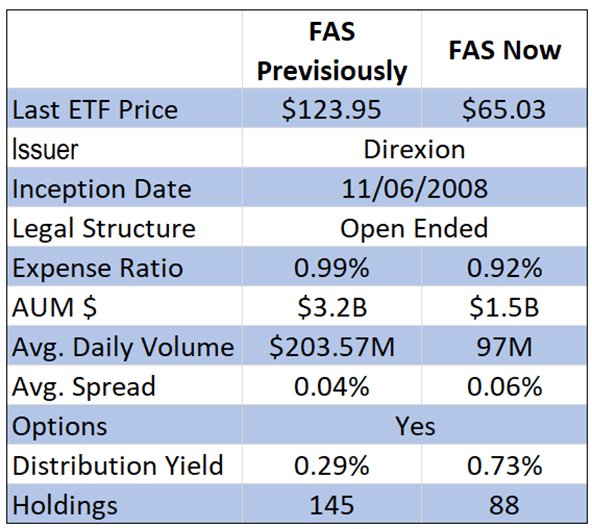

Spreadsheet developed by author with inputs from ETF.com

Comparative analysis FAS during previous analysis vs. FAS presently.

Compounding and path dependency, characteristics of super-leveraged funds, put this firmly in the category of short-term trades rather than buy-and-take-home-to-meet-mom-and-dad investments.

Its very nature heaps it with risk that investors need to be wary of. The fund has short-term tactical trade written all over it, possibly providing a useful hedge to your portfolio when required.

In any case, a grounded understanding of the distinct securities under the bonnet is required to best understand when to reach for it in the capital management toolbox.

Financial Services Sector Characteristics

A standout feature of financial services is interest rate sensitivity. Assets in this sector are exceptionally responsive to interest rates. Therefore, correctly identifying yield curve levels and shape, along with general monetary policy, is critical to position management.

Here, a steepening of the yield curve is where financials find their full strength; this is even more the case when GDP is moving to the upside.

In terms of representation, the fund’s distant cousin, XLF makes up ~10% of the S&P 500; it holds a correlation of 0.87 and slightly higher sensitivity at 1.14. While this is descriptive of XLF, commonality exists with FAS to a large extent as it replicates financial services, on steroids.

Underlying securities in financial services tend have low relative valuations and book values, representative of the banks, diversified financials, and insurance markets they make up.

Dividend payers by nature, these firms hold little in operating leverage, but meaningful amounts of financial leverage given the way their balance sheets are composed. Regulation is also a critical aspect of the sector.

Since the Great Financial Crisis which witnessed the wholesale implosion of the global banking sector, governments have gotten tougher, forcing banks to back liabilities with big liquidity. Consequently, gone are the days of overleveraged banks strung out in a wave of illiquidity.

Financial services come fully into their own during bouts of GDP growth and steepening yield curves. Right now, the opposite is true, making position taking in FAS somewhat difficult. Interest rate and business cycle sensitivity are common elements embraced by the underlying securities.

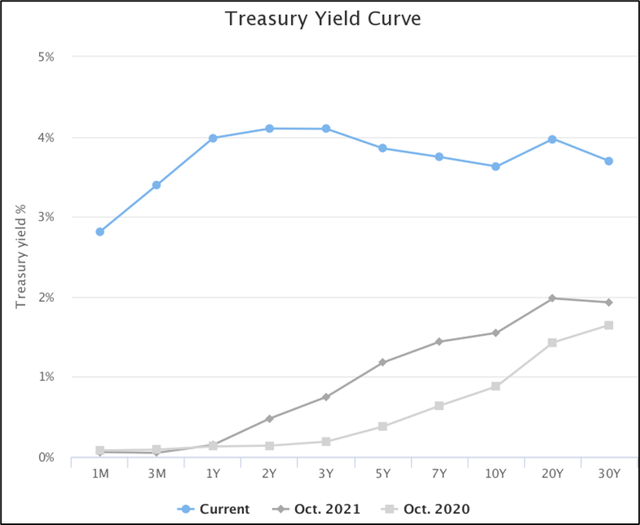

Source: Gurufocus.com

Treasury Yield Curve presently shows inversion at different maturities, signaling a deterioration of capital markets and, perhaps a looming recession.

Product Structure

It is noteworthy to remark several changes since my last review – on 1 August 2022, the fund ceased tracking the Russell 1000 financials. Since then, holdings have reduced (now roughly 88) as have assets under management.

An options market remains available for holders of the ETF to actively manage out risk while allowing for a payment of a dividend also, albeit only 0.73%.

Assets under management have since halved, now accounting for only circa $1.5B. In hand, spreads have marginally increased as have yields as prices plummet. Expense ratios remain at the top end for this kind of risky asset, coming in at 92 bps.

Trading volumes have dried up as investor appetite for risk capital has declined. Overall, this leveraged security has fallen out of favor with money managers.

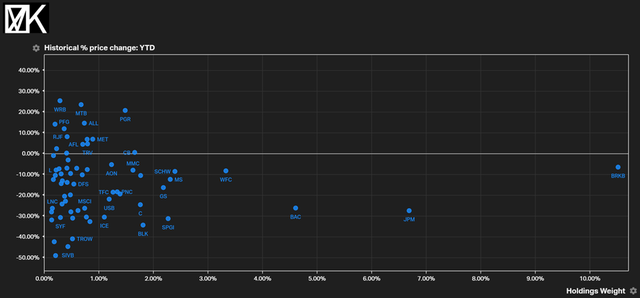

Source: Koyfin

Underlying holdings of the ETF have struggled as financial conditions become tighter in the broader economy.

Most of the ETF’s underlying holdings have found themselves deep underwater as financial conditions eroded. Year-to-date, the fund has witnessed a -44.49% decline in its value with all facets of financial services sector feeling the pain.

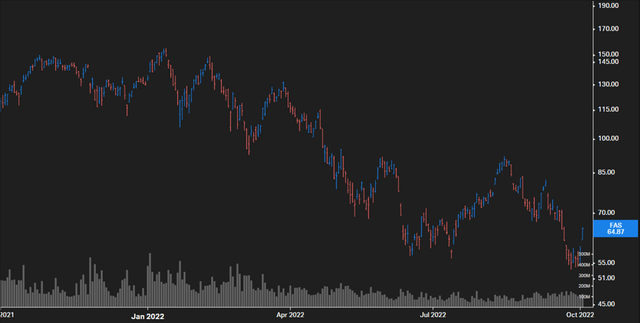

Source: Koyfin

Price action over past 12 months

Tightening monetary policy pushed by sovereign banks to stave off inflation has thrown yield curves, FX, and government bond markets into disarray. Inverted yield curves have sapped at the earnings potential, particularly of the banking industry, which generates earnings on yield curve steepness.

As the short end peaked and the long end flattened, earnings potential of banks has been squeezed, as has the available credit to fuel economic growth.

Inverted yield curves have generally preceded recessions. While this rule is not cast-in-stone, it has generally been a good indicator of downside economic movement. Accordingly, that provides further weight to a move away from financials, and risky assets, now.

Risks

Beyond the risks linked to capital assets in the financial services sector, holders run perils linked to the instruments used to generate leverage. In this instance, counterparty risk on the swap contracts along with credit risk, make up a meaningful chunk of the product’s risk profile.

All financial services securities contain sizable regulatory risk – the vestiges of the aftermath of the Great Financial Crisis – given systemic risk financial assets represent for the global economy.

Given the product’s turbo-charged leverage, it remains best suited to tactical trading or portfolio hedging rather than a long-term holding.

Key Takeaways

- FAS – Direxion Daily Financial Bull 3x Shares ETF turbocharges returns on risk capital linked to the financial services sector, best represented by XLF.

- It does this through recourse to a range of swap contracts and related derivatives meaning that counterparty risk-linked derivatives remains present.

- It is best suited to environments where yield curves steepen and GDP growth is moving to the upside.

- It remains a tactical tool for short term tactical trades or portfolio hedging – not long-term holding.

- Over the past year, the fund has lost a lot of its shine along with investor interest.

[ad_2]

Source links Google News