[ad_1]

Richard Drury

The share price of Global X SuperDividend ETF (NYSEARCA:SDIV) lost more than 40% of its value over the past twelve months due to the Chinese property crisis, economic headwinds, and high-interest rates. While SDIV has shifted its portfolio from tumbling Chinese real estate companies, its portfolio is still heavily dominated by high-risk real estate, materials, and financial sectors. The fund’s dividends also look unsafe, despite a recent dividend cut. Further, as the performance of most of its portfolio holdings is directly correlated with economic growth and interest rates, which are likely to remain unfavorable in the coming quarters, there is also a risk of limited price appreciation.

Economic and Interest Rate Headwinds

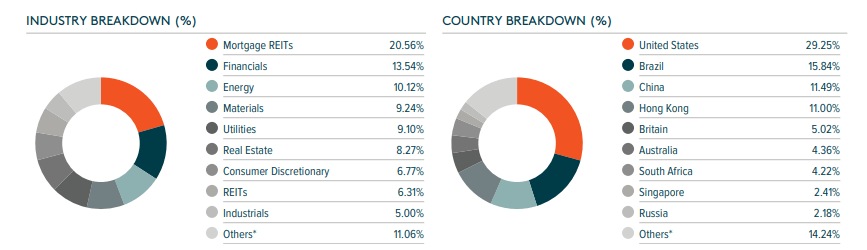

The Global X SuperDividend ETF’s performance is directly influenced by global economic and interest rate policies, particularly those of the United States. As of August, several global markets make up the fund’s portfolio, with US stocks accounting for 29%, Brazil 15%, and Hong Kong and China each accounting for 11%. Moreover, the fund heavily invests in US REITs, mortgage REITs, and real estate.

Portfolio Concentration (globalxetfs.com)

The S&P 500 real estate sector has already lost 30% of its value in 2022 due to declining demand and rising interest rates. In the past few months, the Fed has raised rates multiple times to a range of 3.0 to 3.25 with expectations that rates will rise to over 4% by the end of the year. Meanwhile, US GDP has already contracted in the last two quarters and forecasts suggest further contractions in the second half. Currently, the 10-year Treasury yield is around 4%, while the 2-year yield is 4.22%, the highest level in 10 years. Overall, the market dynamics in the United States don’t look promising for the entire real estate sector.

During the second quarter, the fund sold a majority of its stake in Chinese and Hong Kong-based property developers like Logan Property Holdings Co Ltd., China Evergrande Group, and Times China Holdings Ltd. However, it still held stakes in a couple of Chinese and Hong Kong property developers like Shenzhen Investment Ltd. The fundamentals of the Chinese and Hong Kong property market look more destructive than the US as many developers are struggling with high debt. Currently, Hong Kong’s stock exchange is hovering around ten-year lows, while Chinese stocks are experiencing significant losses due to the economic and property meltdown.

A Dividend Yield Trap

It has always been a good idea to chase high dividend yields in bear markets in order to increase returns and reduce portfolio volatility. However, it is important to be conscious of dividend yield traps since not all high-yielding stocks make suitable investments.

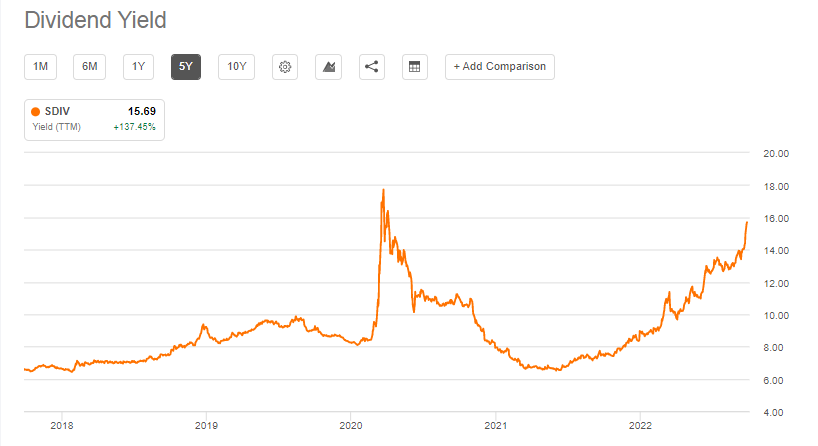

Dividend Yield (Seeking Alpha)

The drop in SDIV’s share price led to a sharp rise in its dividend yield in the last twelve months. Last month, the fund slashed its monthly dividend for the first time in 2022, but that cut doesn’t look enough to tame the rising yield. Moreover, its portfolio holdings are performing poorly, which means a risk of another significant dividend cut is looming. Many of its portfolio companies have already slashed their dividends, and several others are on the verge of doing so, particularly US-based real estate, REITs, and Mortgage REITs. Invesco Mortgage Capital (IVR), for instance, slashed its dividend for the third quarter of 2022 to retain cash. In addition, Armour Residential (ARR), Apollo Commercial (ARI), AGNC Investment Corp. (AGNC), and many more are experiencing unusually high yields, which may force them to slash dividends.

Furthermore, its portfolio companies in the materials sector, including Vale S.A. (VALE), BHP Group (BHP), and Rio Tinto (RIO), have already cut their dividends due to a global economic downturn along with property and industrial slowdown in China. So far in 2022, its portfolio holdings from the dry bulk industry haven’t worked well, with dividend yields of Golden Ocean Group (GOGL) and Star Bulk Carriers (SBLK) exceeding 30% due to a sharp share price selloff. In a slowing demand environment, these companies could also cut dividends to tame high yields. In general, SDIV has a long list of portfolio holdings that have either cut or are likely to cut their dividends in the future. It is therefore highly possible that SDIV will cut its dividends in the near future.

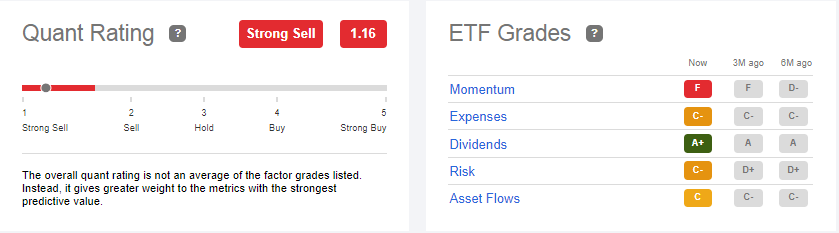

Quant Ratings

Quant Score (Seeking Alpha)

According to Seeking Alpha’s quant grading system, SDIV earned strong sell ratings based on five factors including momentum, dividends, expenses, asset flows, and risk. Quantitative ratings are important when making a buying decision because they eliminate emotions and rely only on figures. SDIV received an F on the momentum factor, which indicates that the shares will continue to decline. In addition, SDIV’s negative C grade on a risk factor points to a high risk associated with its future fundamentals. A C grade on asset flow also implies low investor confidence while an expense grade of C demonstrates a higher expense ratio compared to peers. As a whole, SDIV gained a 1.16 quant score with strong sell ratings. The fund ranks 378 out of 384 in its asset class and 5 out of 5 in its sub-asset class.

In Conclusion

When the world is experiencing one of the steepest economic slowdowns in decades, it’s not prudent to chase dividend-focused ETFs like SDIV. The ETF’s portfolio concentration and global footprints make it vulnerable to economic and interest rate headwinds. Its dividends are unsafe, and share price appreciation looks limited. Overall, prospects are high that SDIV might face tough market conditions in the quarters ahead, which makes it a poor choice for defensive investors.

[ad_2]

Source links Google News