[ad_1]

ivotheeditors

Thesis

Mid-cap stocks are thought to offer a middle ground to the risks and rewards of their smaller and larger counterparts while being overlooked by many investors. Vanguard Mid cap ETF (NYSEARCA:VO) is one of the popular investment vehicles for gaining exposure to this category of equities.

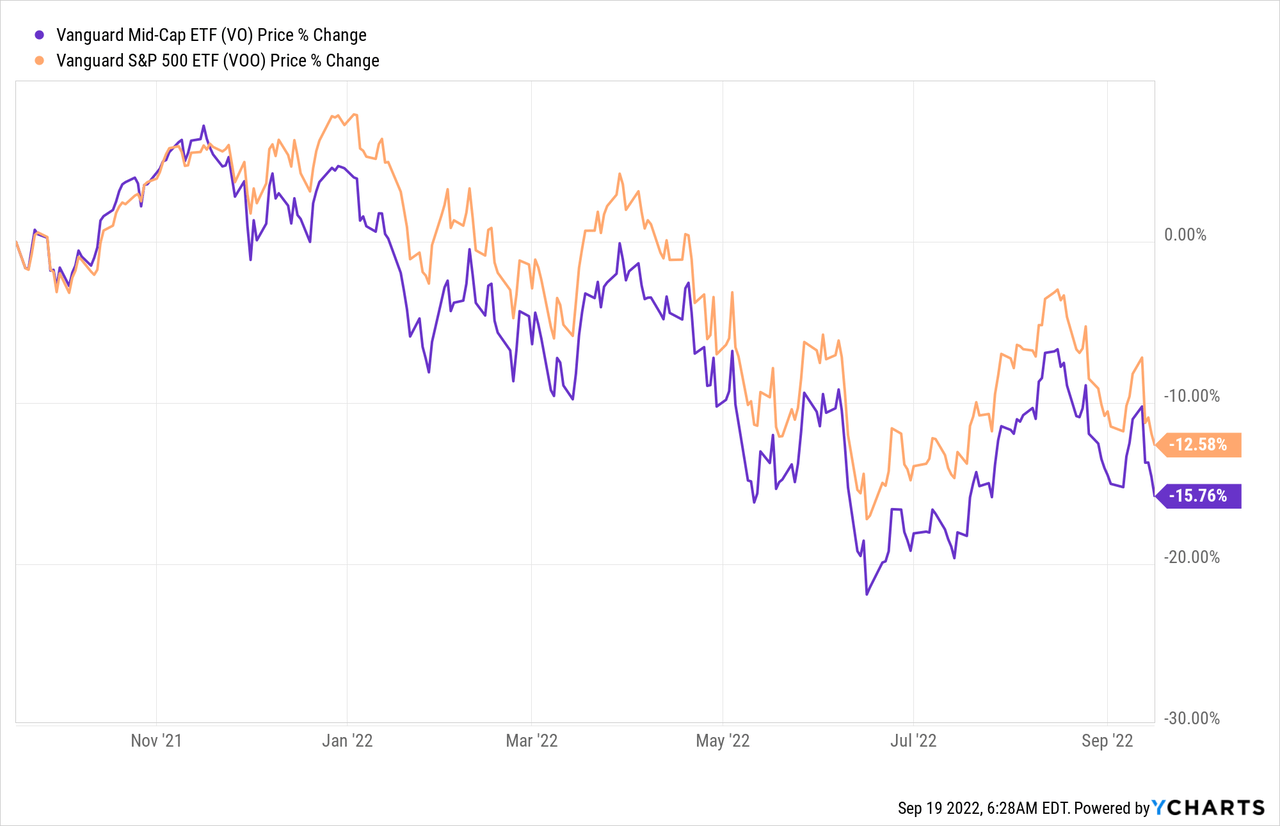

Since the beginning of the year, mid-caps have underperformed the S&P 500, recording losses of -15.76%. As uncertainty still looms over equity markets, performance until year-end should be telling for mid-term prospects.

Midcaps: The Stock Market’s Sweet Spot

The Mid-cap universe of stocks consists of companies with total market capitalization in the range of $2 billion to $10 billion. While often overlooked by investors, mid-caps are thought by analysts to be the “sweet spot” of equities. That is because they offer a compromise between the growth, risk and volatility tradeoffs of their larger and smaller counterparts. Large-cap are household names, often stable, mature companies that provide security to investors but, in theory at least, moderate returns. Small-caps on the other hand are more risky and volatile, most in the earlier stages of the business cycle but are thought to provide higher potential upside.

Mid-caps balance the two equity classes. In terms of risk, companies in this class are usually found in the middle of the business cycle, which means they no longer carry the same amount of survival risk they did when they went through their earlier phases. Even though mid-cap companies aren’t as well established as the household names that comprise the large-cap segment, they may experience rapid growth as they expand their market share. They are often targets of M&A from larger companies as well, and as such they can display great opportunities for price appreciation. On the other hand, the class also includes former large-cap companies that have fallen in size and dominance, as they enter the decline stage of their life cycle, therefore posing a threat to overall growth in the space.

Risks Should not be Overlooked

While the risk profile of the mid-cap equity space is less precarious than the one small-caps historically display, still, they are quite more volatile than larger companies.

In many industries they might capture relatively small market shares, struggling to keep up with market leaders. Inflationary pressures hit these companies harder, as they have less pricing power and brand loyalty than their large-cap counterparts. It is harder, as a result, to pass soaring input costs to consumers, without suffering reductions in demand and revenue decreases. The smaller size also means that effective economies of scale rarely develop within the mid-cap range. As a result, cost management becomes even more challenging and operating margins contract.

Another challenge that disproportionately affects mid-caps and small-caps relates to borrowing costs. Riskier operating models and unproven reputation results in inferior credit ratings. Financial institutions are less eager to lend and when they do it is often at less than optimal terms. Costs of debt and spreads are quite high and as interest rates increase, interest payments consume larger amounts of cash flow, rendering borrowing unfavorable.

ETF Overview

Even though a few ETFs offer exposure to mid-cap equities, Vanguard Mid Cap ETF remains the second most popular behind iShares Core S&P Mid-Cap ETF (IJH). With approximately $52B of AUM, VO seeks to track the performance of the CRSP US Mid Cap Index. The fund charges a very low 0.04% expense ratio and currently pays a 1.40% dividend yield, consistent with the market average. In terms of valuation multiples, according to Vanguard, the average P/E for VO stands at 17.6x and the P/B at 2.9x. When it comes to sector exposure, VO is significantly less overweight towards technology compared to the S&P 500 and most large-cap indexes (15.40% weighting). Other heavily-weighted sectors include Industrials (14.40%), Consumer Discretionary (12.50%) and Financials (12.10%).

Mid-cap vs Large-cap vs Small-cap: Risk & Return

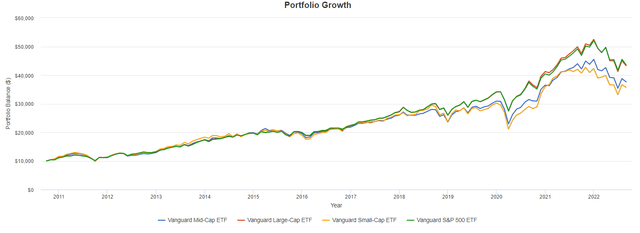

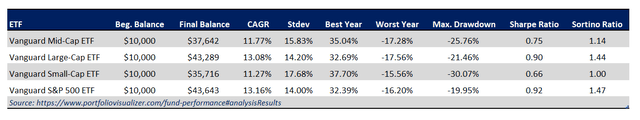

Employing the tools offered by Portfolio Visualizer, in this segment, I attempt an in-depth comparative attractiveness analysis of the Vanguard Mid-cap ETF. Back-tested along with large-caps (VV), small-caps (VB) and the S&P 500 (VOO), the simulation will examine risk and return parameters dating back to 2010. Annual rebalancing, an initial $10,000 investment and dividend reinvesting are assumed in the simulation.

Upon a first look at the graph provided below, it seems clear that large-caps, along with the S&P 500 have outperformed over the last decade. Especially when considering the strong bull-market rally after the Covid-19 pandemic, big tech companies were among the best performers, pushing the market ahead while also increasing their capitalizations relative to other companies.

Mid and Small-cap firms were hit harder by Covid-19, struggling to operate profitably and taking on more losses during the ongoing market pullback, with the fear being that an upcoming recession would hurt them disproportionately once again.

Portfolio Visualizer

An initial $10,000 investment back in 2010 would have yielded $43,600 in the S&P 500 and $43,300 in Vanguard’s large-cap ETF. The Mid and Small-cap ETFs would have returned $37,600 and $35,700. In terms of risk metrics, the small-cap ETF displays the higher standard deviation and maximum drawdown with VO following. Risk-adjustment returns also point to the conclusion that large-cap ETFs represent the better investment, at least for the period examined.

Portfolio Visualizer

Without being too eager to draw a definitive conclusion from this back-test, it is clear that the past decade in the stock markets has favored larger companies at the expense of smaller ones. While the performance data on excess returns from investing in mid and small-caps over a longer timeframe is there, still, it can be hard to shake the current market momentum at least for a few years going forward.

Final Thoughts

After all things are considered, VO represents a good way for investors to gain direct exposure to mid-caps. The equity class however has underperformed, especially as of recently, and whether a reversal of the current status quo or a continuation is forecasted should determine investing in the space.

[ad_2]

Source links Google News