[ad_1]

DNY59

I have recently been asked by a member of the mainstream financial media for my thoughts on the ProShares Ultra VIX Short-Term Futures ETF (BATS:UVXY). With the recent stock market rout, when the S&P 500 (SPY) dipped by over 4% in a single session, UVXY jumped 13% just as quickly. When it seems so hard to make money in the markets nowadays, betting on an asset that tends to benefit from bearishness and increased volatility may sound like a compelling proposition.

But in line with my previous thoughts on this ETF, I continue to think that all investors and even most short-term traders should be very careful with UVXY, if not avoid it altogether. Below, I explain why, in more detail.

A quick word on UVXY

The ProShares Ultra VIX Short-Term Futures ETF is a 1.5x leveraged VIX fund that places long bets on short-term VIX futures contracts. Mechanically, the ETF is positioned today as follows:

- $1.15 billion in cash, which is effectively the size of the fund

- $1.45 billion in notional value allocated to the VIX October contract

- $279 million in notional value allocated to the VIX September contract

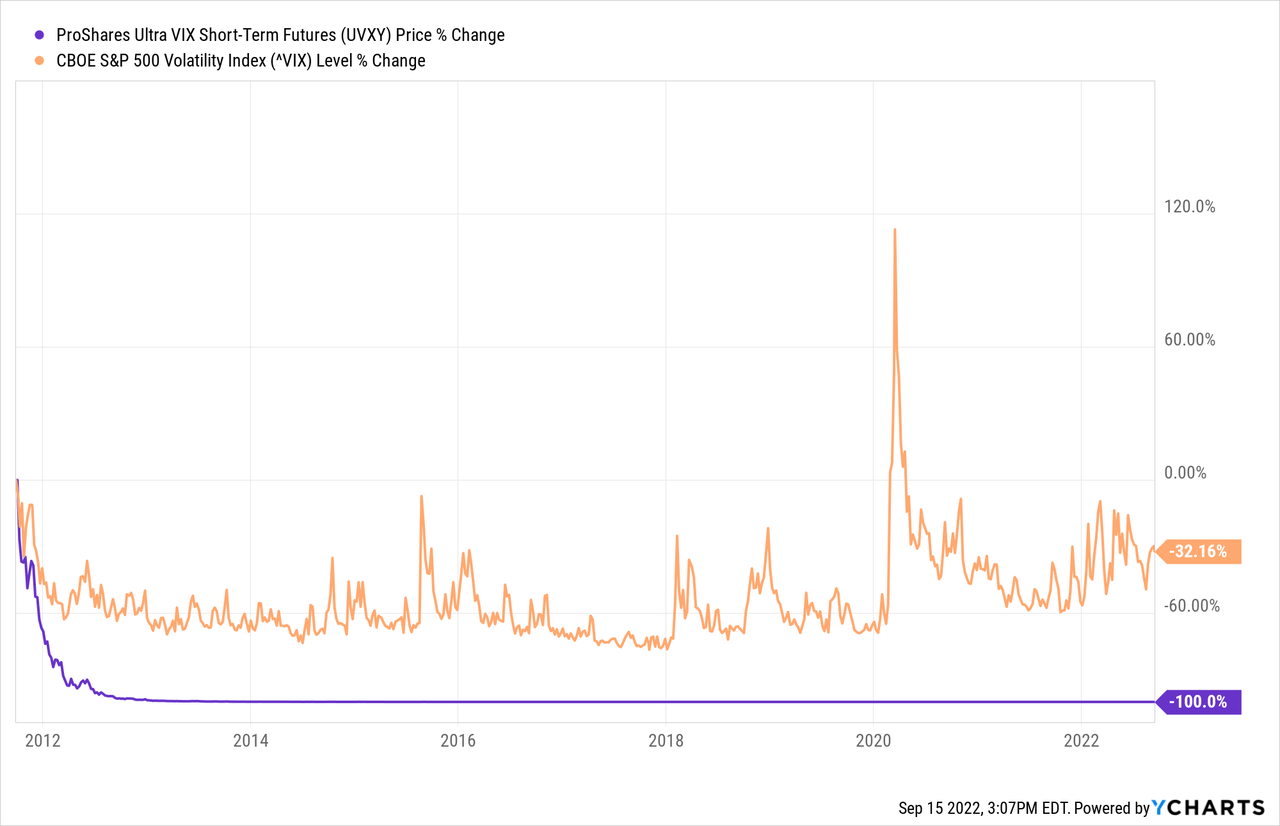

The fund has been around since 2011. Over this period of time, it has produced cumulative returns of -99.99%, as the following chart depicts, despite the VIX itself having held up much better (more on this phenomenon further below). UVXY trades about 60 million shares daily, making it highly liquid. The expense ratio is high, at 95 bps per year.

Betting on the volatility index

Some traders looking to place a bet on UVXY may start by thinking about the volatility index itself. The market is faced with a myriad of factors that add uncertainty to the mix — probably the biggest item being how long inflation will linger, and how far interest rates will rise as a result. This is fertile ground for the VIX to rise.

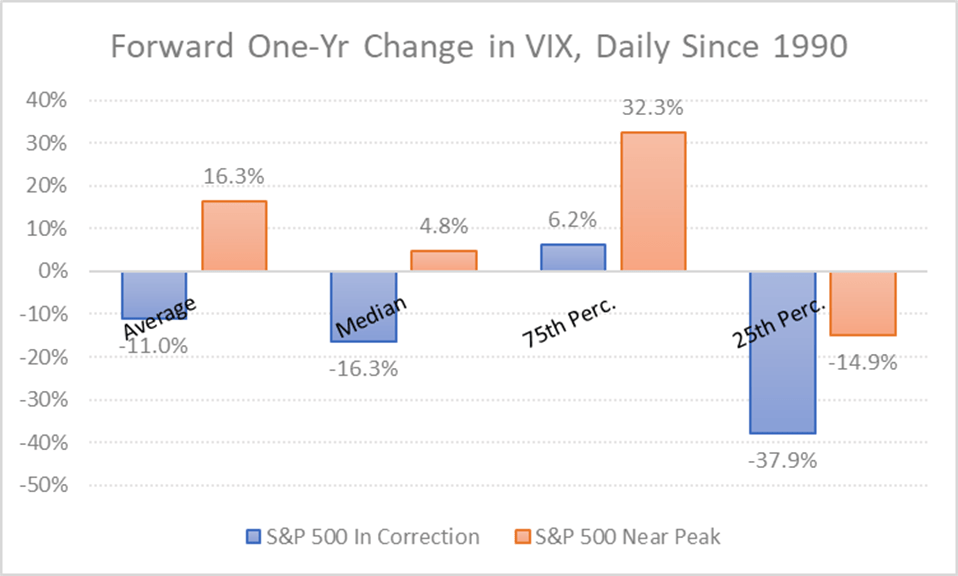

On the other hand, the VIX is already at 26, and the markets have been bracing for this choppy ride for a few months now. The volatility index has averaged 15 to 17 historically, and it tends to revert to the mean over time like clockwork. I have done the math in a previous article, in a backtest that went back to 1990 (see chart below), and concluded that betting on the VIX rising when it sits below the long-term average and the S&P 500 is hovering around its all-time high, not the opposite, is the better play.

DM Martins Research

UVXY is likely not the right tool

Regardless of the direction of the stock market and the VIX, UVXY is still unlikely to be a good bet today — and most other days, to be frank.

It is important to understand how UVXY establishes its positions. It goes long short-term VIX futures contracts, then rolls them forward each month. This process creates what is known as negative roll yield (assuming that the VIX curve is in contango, which it usually is), as the fund consistently “buys high and sells low”.

As a result, UVXY is designed to be a money loser over time. Notice, for example, that the ETF has been down 18% for the year, despite the VIX index itself being up nearly 50% during the same period. Therefore, even if a trader is right about the direction of the VIX, his or her UVXY bet may still end up being a money pit in the end.

Don’t be lured in

It is human nature to seek quick and “easy” gains whenever possible, especially when other market participants are struggling to turn a profit. Think of the start of the pandemic, in Q1 2020, when UVXY jumped 900% in only one month while the S&P 500 reached 32% below its all-time high.

But don’t be lured into the trap. History says that, given enough time, maybe as little as a few months, there is a much greater chance that UVXY will be a value destroyer, not a value creator.

For this reason, I don’t think that investors should get involved with the ProShares Ultra VIX Short-Term Futures ETF. I believe that UVXY is better suited for traders who can afford to keep an eye on price action daily, if not hourly. The price movements in a volatility fund tend to be sizable, let alone one that is leveraged at a factor of 1.5x. So, the risks of placing a bet here are substantial, and probably not worth the trouble.

[ad_2]

Source links Google News