[ad_1]

FG Trade/E+ via Getty Images

Main Thesis / Background

The purpose of this article is to evaluate the iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSEARCA:LQD) as an investment option at its current market price. This fund has a stated objective “to track the investment results of an index composed of U.S. dollar-denominated, investment grade corporate bonds”.

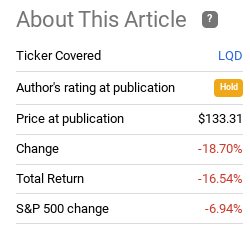

I have not owned LQD for a long time, consistently giving it a “hold” rating as I saw pros and cons but not enough pros to warrant buying it. In September 2021, this remained the case. Looking back, this caution was vindicated. LQD has seen a steep loss, despite an environment where equities are also down:

Fund Performance (Seeking Alpha)

With this understanding, I wanted to once again revisit LQD to evaluate if I should upgrade my outlook heading into the new year. After consideration, I continue to see a balancing act for this sector idea. Corporate bonds have seen their value proposition improve slightly, but not enough that I really feel comfortable owning this space. As a result, I will keep the “hold” rating in place, and will explain why in more detail below.

A Buy Case Could Be Made For The Income

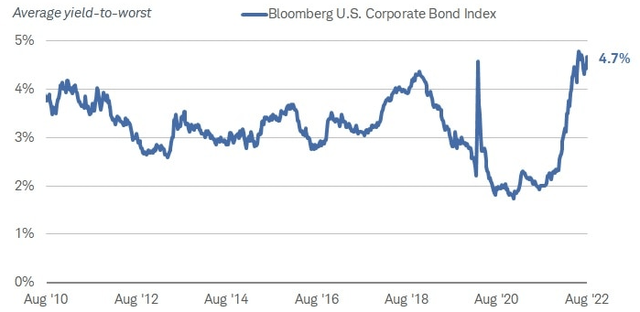

I will start this review with a look at one of the reasons why an investor may want to be buying LQD right now. This primarily has to do with the income story behind the sector. As readers are surely aware, 2022 has been a year of rising interest rates. While this has rattled debt and equity markets alike, the net result is that the income offered by fixed-income securities has also been growing. This is logical because as interest rates rise, the cost of borrowing goes up. While bad for borrowers, the next result is lenders (or investors who buy the debt up) can earn a higher yield in turn. This is clearly reflected in the yield curve for corporate bonds, with current yields touching a 12-year high:

Current Yields – Corporate Bonds (Charles Schwab)

The focus area here is that those looking at the sector from an income perspective have got to like what they see to some degree. After years of 3% yields (or less), IG corporate bonds are finally offering a reasonable income stream.

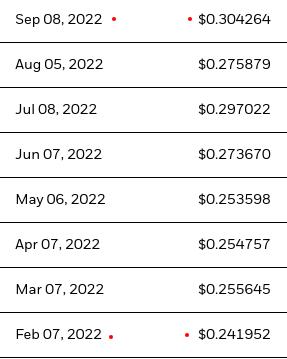

Fortunately, this is reflected in LQD as well. The SEC yield (a short-term measure of a fund’s yield) is sitting at 4.76%. This is partly due to the drop in the share price (which pushes up the current yield), but also because distributions have been rising.

LQD’s 2022 Distributions (BlackRock)

This is a very strong development. Distributions are up year-over-year, and September’s distributions show 25% growth from February. This is an impressive story. The conclusion to me is that a “sell” or bearish rating on this fund and sector is not appropriate because the income growth is too strong. While I have other concerns, which I will get to, the fact is that conservative investors who want a growing income stream with little credit risk could indeed find it in this option.

Net Debt Is On The Decline, Limits Credit Risk

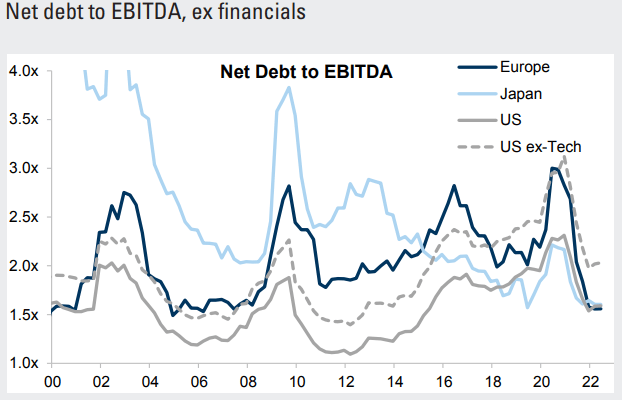

My next topic focuses on a trend that has been ongoing for a while. This is that credit risk within the corporate bond space – especially IG corporates – remains very low. While this has not stopped the sector from registering losses, the primary driver behind that has been rising interest rates (prices move inversely with yields). While that has posed a real challenge for investors, the bright side of this is that underlying support within the sector itself has not deteriorated. Total return can be influenced by the underlying quality of the bonds themselves. In this vein, defaults and delinquencies have been low and upgrades of credit ratings have also been on the rise. This has been consistent for the last two years, and remains so to this day.

Personally, I believe this story remains intact for 2023 as well. While economic growth concerns have made plenty of headlines recently, the fact remains that corporate America is well capitalized. This is actually a global story too. Revenues and profits have held up well, and cash on hand is high given how much refinancing corporations did when interest rates dropped. If we look at net debt ratios, we see there is little risk to IG corporates meeting their financial obligations in the short term:

Corporate Debt Ratios (Goldman Sachs)

What I see here is a corporate environment where there isn’t a major risk of deterioration in the credit space. Even in junk debt, defaults have been rare year-to-date. Until there is meaningful regression in that sector, I won’t worry too much about IG credit. When we consider debt ratios are lower now than they were last year, this is a supportive environment.

So, What’s The Problem?

As I have mentioned above, there are legitimate reasons for buying IG corporate bonds, and LQD by extension. I have not seen much of a buy opportunity in 2022 but I recognize the income and credit stories are more positive now than they have been in the past. This begs the question – why the reluctance to buying at these levels?

The answer to this question is a fundamental headwind that has plagued debt markets for the last year. This is rising yields and interest rates and, just as importantly, the prospect of continuously rising rates in the short term. This is important because IG corporate bonds are typically longer-term in nature. This makes them more interest rate-sensitive. LQD reflects this, offering investors exposure to many long-term maturities. The impact is a duration level (a measure of interest rate sensitivity) above 8 years:

LQD’s Duration (BlackRock)

This means that LQD continues to be very exposed to rising interest rates. Despite the fund’s distribution rate moving higher, these duration levels mean there is still plenty of downside risk. That income stream can be wiped up if interest rates move up another .5-1.5%. This is not an unrealistic prediction. In fact, markets are currently pricing in a .75-basis point move by the Fed when they meet later this month:

Market Expects Rates To Keep Rising (Yahoo Finance)

The way I see it, it is a foregone conclusion that the Fed will keep on raising rates for now. While I personally think 2023 is going to be more dovish than the Fed is projecting, over the remainder of 2022, there is still going to be a fairly hawkish tone. More hikes are on the way, and this spells some trouble for funds with high duration levels like LQD.

To Beat Inflation, You Have To Take More Risk

As my followers probably remember, I am exclusively into equities right now, with the exception of municipal bonds. Leveraged muni funds have competitive yields right now, especially on a tax-adjusted basis. While duration risks are similarly high compared to IG corporates, the credit quality is stronger and the tax savings offer a better risk-reward in my opinion. This reality has led me to fade away from LQD – essentially at the expense of what I see as better options.

In this vein, I want to illustrate that fixed-income investors have a myriad of options at the moment. The income story for LQD is better than it was a year ago, which I covered at the start of this article. However, that trend is pretty consistent across the fixed-income universe. As yields rose and bond prices declined across most sectors, current yields are finally offering investors something to get excited about.

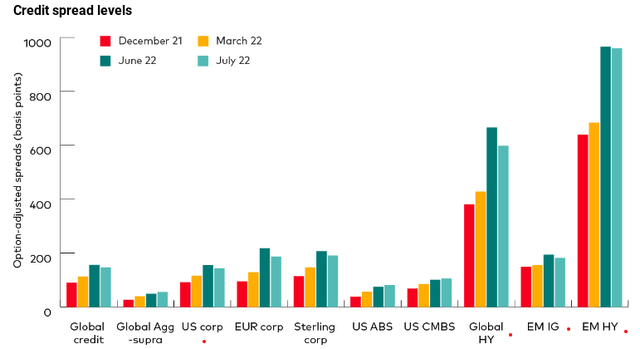

The caveat to this is that inflation remains red-hot. This means on a real yield basis, bond investors are probably not keeping up. To combat this backdrop, those interested in credit likely have to push the risk pedal a bit more than a fund such as LQD will offer. For me, I prefer leverage in the IG muni space. But for others who aren’t interested in that strategy, there are other options. The natural place to start looking is high yield, as well as IG debt in emerging market countries. As the graphic below shows, current spreads in those sectors are quite wide, especially relative to IG U.S. corporates:

Various Credit Spreads (By Sector) (Vanguard)

Now I am not suggesting these are the right investments for all readers. Quite the contrary. I am very transparent in my personal holdings (I keep it up-to-date on my profile page) and I do not own exposure to these areas. So that should be telling. But I am not long LQD either. And the truth is I see more value in high yield due to the wider credit spreads that offer high-income levels to offset inflation and interest rate risk. LQD is a much safer fund, but the truth is investors won’t keep up with the cost of living if that is what they choose to invest in. The good news is there are higher-yielding options out there, but readers should remember they carry quite a bit more risk.

Bottom-line

LQD has been going nowhere fast over the past year. Actually, that is being too kind. It has gone somewhere, and that somewhere is down. Despite the IG corporate bond sector seeing underlying strength, limited delinquencies, and some investor buying, the end result has been that inflation and Fed rate hiking were too much to contend with. I do believe the worst is over for LQD in the near term, but further Fed rate-hiking and stubborn inflation limit any upside we are likely to see in the short term. Therefore, I must keep my “hold” rating on LQD in place, and suggest readers approach this fund very selectively heading into Q4 and 2023.

[ad_2]

Source links Google News