[ad_1]

Andrii Yalanskyi

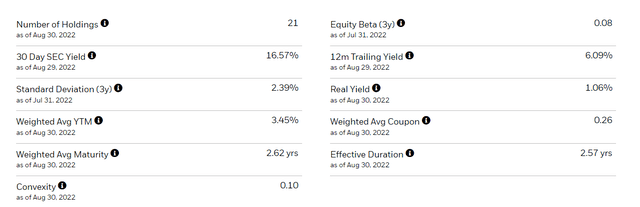

The iShares 0-5 Year TIPS Bond ETF (NYSEARCA:STIP) seeks to track the investment results of an index composed of inflation-protected U.S. Treasury bonds with remaining maturities of less than five years. The average maturity of the ETF is 2.6 years and the real yield to maturity is 1.06%. This real yield is based on the current nominal yield minus the average rate of inflation expected over the next 2-3 years. If investors hold this ETF for the next 2.6 years, they can expect to beat inflation by almost 1% per year, but there is also potential for capital gains. Furthermore, if the STIP were to lose money over the coming quarters, it would likely be because of credit crunch, which would leave the STIP as a major outperformer relative to most other assets.

STIP Portfolio Characteristics (ishares.com)

A 1% Real Yield Is Attractive For A Short-Term Bond Fund

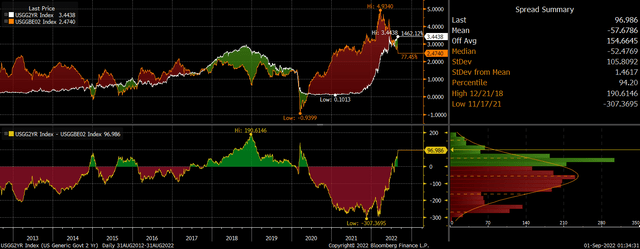

The combination of rising interest rate expectations and a sharp fall in inflation expectations over the past two months has seen the real yield on the STIP rise above 1%. Based on the historical yield on the 2-year TIP, this is relatively high. As the chart below shows, over the past 10 years, real yields have only been higher during the tail-end of the Fed’s hiking cycle in 2018 and during the height of the Covid crisis.

2-Year US Yields Vs 2-Year Breakeven Inflation Expectations (Bloomberg)

Short-term real yields are now even higher than long-term real yields thanks to the inversion of the bond yield curve over recent months and the sharp drop seen in short-term inflation expectations.

US 2 Year Vs 10 Year Inflation-Linked Bond Yields (Bloomberg)

Potential For Capital Gains As Fed Blinks

Short-term bond funds tend to be attractive to investors as they have low levels of duration and therefore little downside risk in the event of a rise in bond yields. At the same time, this tends to mean little prospect of short-term capital gains. However, from the height of the STIP selloff in February 2020, the ETF managed to post capital gains of almost 10% over the following 12 months as bond yields fell and inflation expectations recovered strongly.

US 2-Year Breakevens Vs Headline CPI (Bloomberg)

This time around, I would not be surprised to see a fall in nominal bond yields and a rise in inflation expectations result in similar capital gains over the next few quarters. Over the past few months, we have seen a sharp drop in inflation expectations thanks in part to the Fed’s ongoing hawkish rhetoric and rate hikes. As a result, 2-year inflation expectations have fallen to just 2.5%. Considering that trailing CPI is currently 8.5%, bond investors are expecting a collapse in inflation over the next two years. However, any signs of a drop in inflation are likely to cause the Fed to talk down further rate hikes, which in turn is likely to prevent a collapse in inflation. The most likely outcome in my view is a combination of falling nominal bond yields and a recovery in inflation expectations, resulting in short-term real yields falling back into negative territory and resulting in strong capital gains.

If The STIP Loses Money, It Will Likely Be Because Of A Financial Crisis

The biggest risk facing the STIP comes from the Fed maintaining its hawkish stance even as risk assets continue to decline. This would likely put further downside pressure on inflation in a potentially self-reinforcing manner. As we saw during the Covid crash and the global financial crisis, once such a deflationary credit crunch is set in motion, Fed easing tends to be too late to reflate asset markets.

Recent comments by Minneapolis Fed President Neel Kashkari that he was happy to see stocks fall following Jerome Powell’s Jackson Hole comments may indicate that the Fed is willing to see assets markets take a major hit in order to anchor inflation expectations, and this would certainly result in capital losses for the STIP. However, the good news is that TIPS comes with a deflation floor that protects the holder’s principal value if the Consumer Price Index is falling. The floor guarantees the TIPS owner either the inflation-adjusted principal or the par value at maturity – whichever is greater. Furthermore, even if the STIP suffers a large drawdown of the kind seen during the global financial crisis, it is still likely to outperform every other asset class with the exception of regular bonds.

Summary

The STIP is a good bet for investors looking to lock in respectable real returns over the coming years while also having the potential to realize strong capital gains in the event that the Fed eases up on its tightening policy allowing a fall in bond yields and a recovery in inflation expectations. As we saw during the global financial crisis, short-term TIPS are not without risk, but it would likely take another financial crisis to cause any meaningful weakness in the STIP, in which case, the ETF would almost certainly outperform most other assets.

[ad_2]

Source links Google News