[ad_1]

PM Images/DigitalVision via Getty Images

The Virtus InfraCap U.S. Preferred Stock ETF (NYSEARCA:PFFA) is the highest-yielding preferred shares fund in the market today, boasting a strong, fully-covered 8.8% yield. Dividends will likely grow in the coming years, too, due to rising interest rates. On the other hand, PFFA is a relatively risky investment, due to its undiversified, low-quality holdings, and use of leverage. PFFA is a classic high-risk high-reward investment opportunity, but one which will ultimately prove to be quite profitable for investors, in my opinion at least. As such, I rate the fund a buy.

PFFA – Overview

PFFA is an actively-managed ETF investing in U.S. preferred shares. These securities have characteristics of both equities and bonds but, in practice, behave like high-risk high-yield junior bonds / fixed-income securities. As such, PFFA is roughly comparable to a high-yield corporate bond ETF, such as the iShares iBoxx $ High Yield Corporate Bond ETF (HYG).

PFFA’s preferred share investments generate a lot of income, but potential capital gains are low, and risks and losses during downturns are high. The fund’s use of leverage, with a 1.32X leverage ratio, boosts income, returns, and risks further still. PFFA is thus a classic high-risk high-yield investment opportunity, and behaves as one. Expect strong returns during favorable market conditions, significant losses during recessions, downturns and the like.

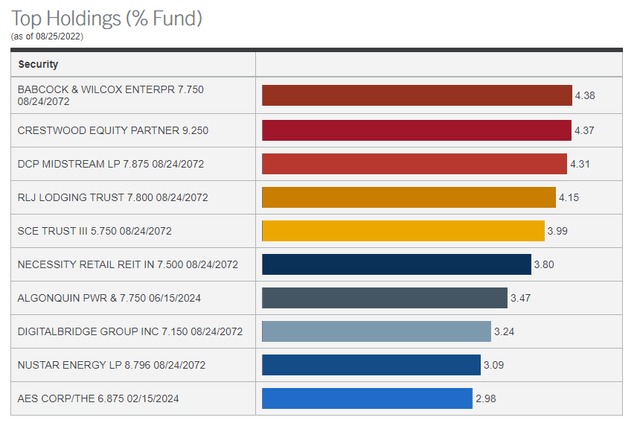

PFFA is actively-managed, so asset allocation and security selection are ultimately at management’s discretion. Management mostly focuses on preferred shares with above-average yields, to boost income and returns. Diversification somewhat suffers as a result, with the fund focusing on energy and REIT preferreds, while mostly foregoing financials, the largest preferred issuers. Concentration is a bit higher than average, with the fund’s top ten holdings accounting for 38% of its value. PFFA does invest in over 150 securities, a reasonably good amount, albeit lower than that of most relevant preferred share index ETFs. In general terms, PFFA has some diversification, but materially less than average / than relevant indexes.

PFFA

As mentioned previously, PFFA is overweight energy, with significant investment in preferreds issued by energy companies, including Crestwood Equity Partners (CEQP) and DCP Midstream (DCP). In my opinion, being overweight these securities is a positive, as these securities are being mispriced by the market. Energy preferreds are trading at relatively low prices / high yields, even as industry conditions / energy prices are quite favorable. Focusing on energy increases yields without significantly increasing risks, a benefit for the fund and its shareholders.

PFFA – Benefits And Investment Thesis

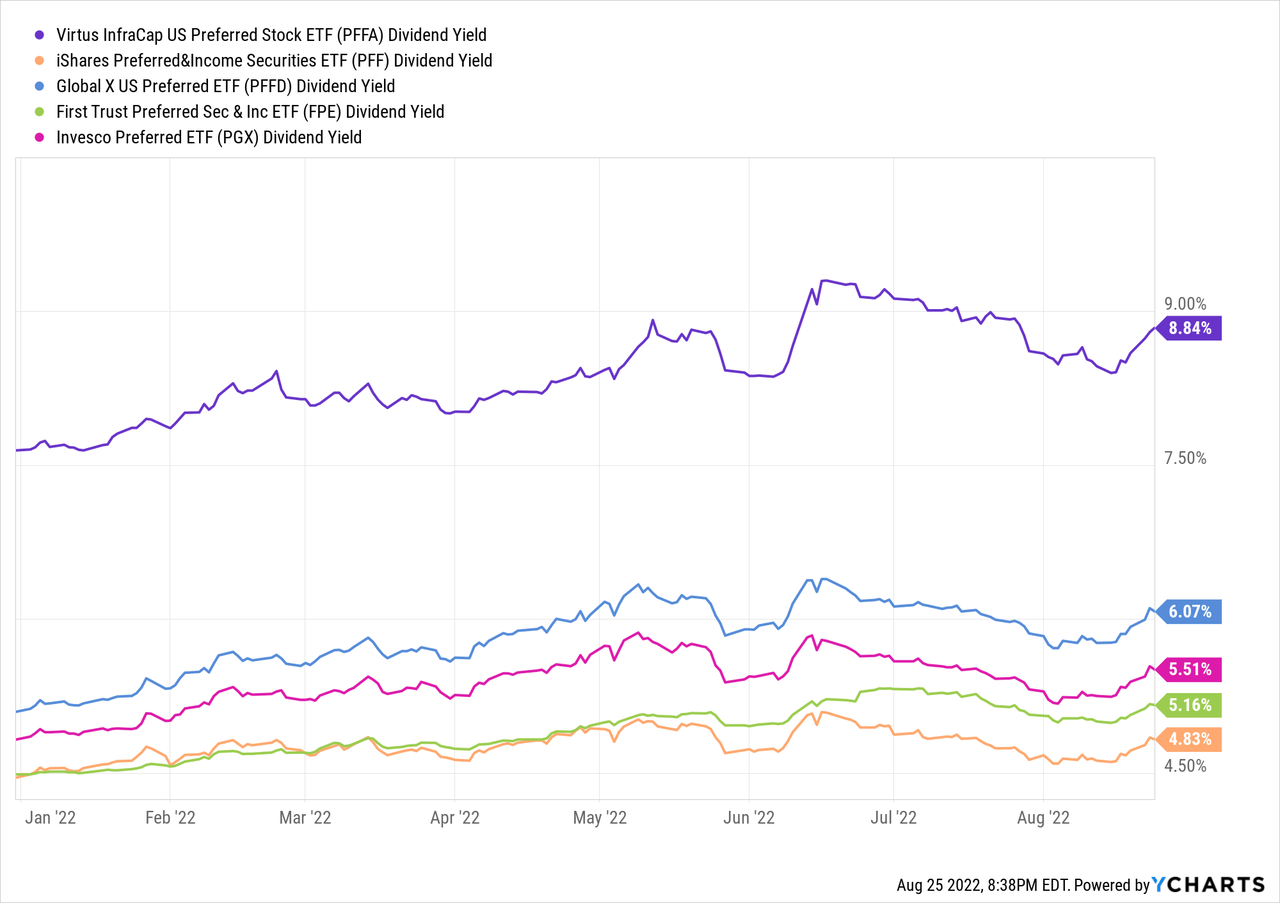

PFFA’s most significant benefit and core investment thesis is the fund’s strong, fully-covered 8.8% dividend yield. It is an incredibly strong yield on an absolute basis, quite a bit higher than the fund’s 8.0% historical average yield, and significantly higher than average for a preferred shares ETF.

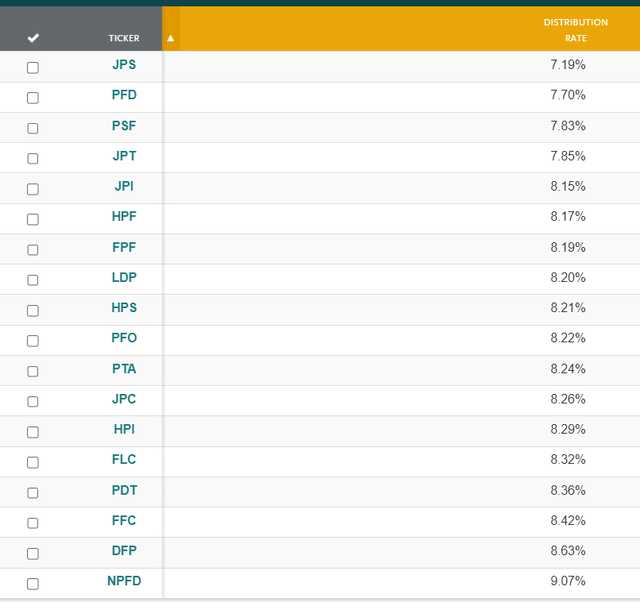

CEFConnect

PFFA’s strong yield is also fully-covered by underlying generation of income, with the fund sporting a SEC yield of 9.3%, as of 7/31/2022. SEC yields are a standardized measure of the actual income generated by a fund, taking into consideration dividends, expenses, fees, and the like, and explicitly disregarding return of capital distributions. PFFA’s 8.9% SEC yield more than covers the fund’s current dividends. Under current conditions, the fund’s yield is quite safe, and dividend cuts unlikely.

In my opinion, dividend hikes are a distinct possibility, as interest rates have risen these past few months, and as the fund generates a bit more in income than is distributed to shareholders. From what I’ve seen, PFFA’s dividends only ever change in January, so a distribution hike in January 2023 is a distinct possibility.

PFFA’s strong, fully-covered 8.8% dividend yield is a significant benefit for the fund and its shareholders, and its core investment thesis.

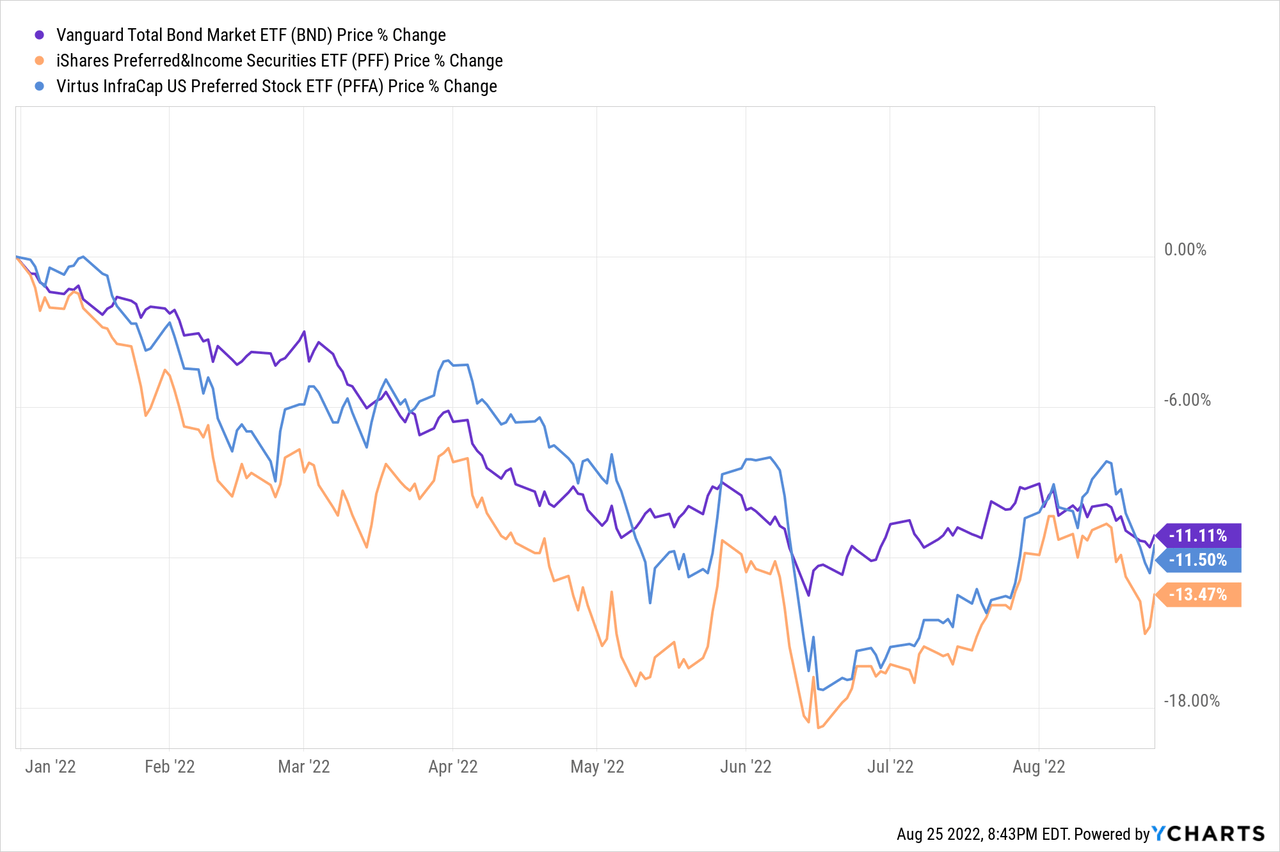

PFFA also offers investors the possibility of slight / moderate capital gains, contingent on preferreds maturing, or on economic and market conditions stabilizing. In simple terms, preferred share prices are down, and could recover as conditions improve. Prices have started to recover, since mid-June, but remain quite low, so further recovery / rising prices are possible.

PFFA – Risks And Drawbacks

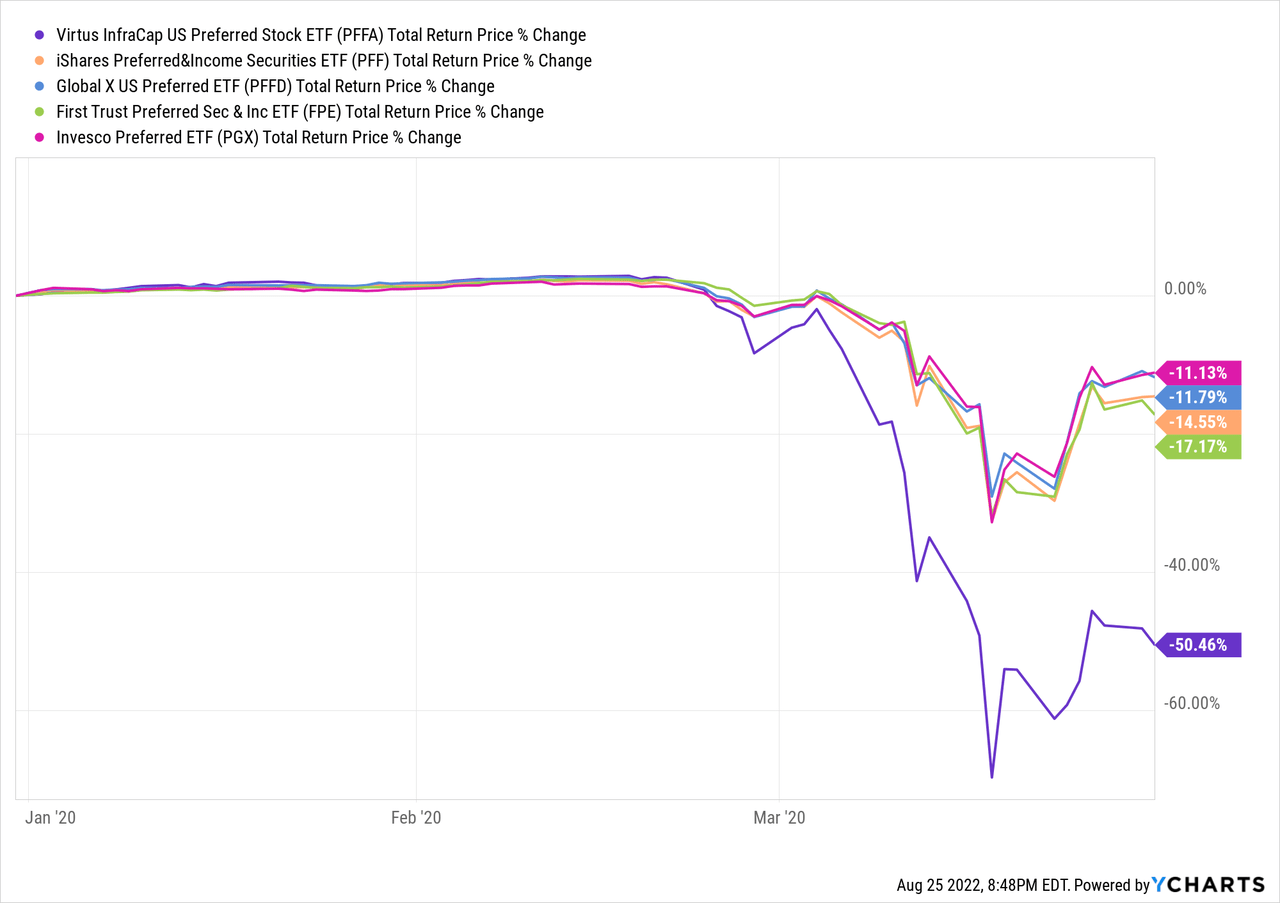

PFFA’s potential returns are quite high, but so are the risks. The fund focuses on preferred shares, a relatively risky asset class, at least compared to most bonds. PFFA further focuses on particularly high-yielding preferreds, which are significantly riskier than average. The fund’s leverage magnifies risks further, and would almost certainly result in forced asset sales during severe downturns and recessions. Expect significant losses and underperformance during any future downturns or recessions, especially if centered on energy or REITs. PFFA itself significantly underperformed during 1Q2020, the onset of the coronavirus pandemic, and the most recent recession.

PFFA is a relatively risky investment, and materially riskier than its peers. In my opinion, the fund’s strong 8.8% yield and potential for moderate capital gains outweigh its risks, but other more risk-averse investors could see things differently.

PFFA – Changes Since Prior Coverage

I generally write follow-up articles on funds every couple of months. I’ve been meaning to be more explicit about what has changed since my prior coverage, as I’m aware that some readers are well-aware about most of the general characteristics of these funds already.

I last covered PFFA in October of last year. In that article, I was neutral about the fund, as its overall risk-return profile seemed quite bad: potential returns were good, but risks were sky-high. Since then, fundamentals have materially improved.

Risks are somewhat lower, as interest rate hikes and worsening economic conditions have been priced in / share prices are lower. Risks remain high, however.

Returns are moderately higher, as the fund’s yield has risen from 7.6% to 8.8%, and bond prices have dropped, allowing for the possibility of moderate capital gains.

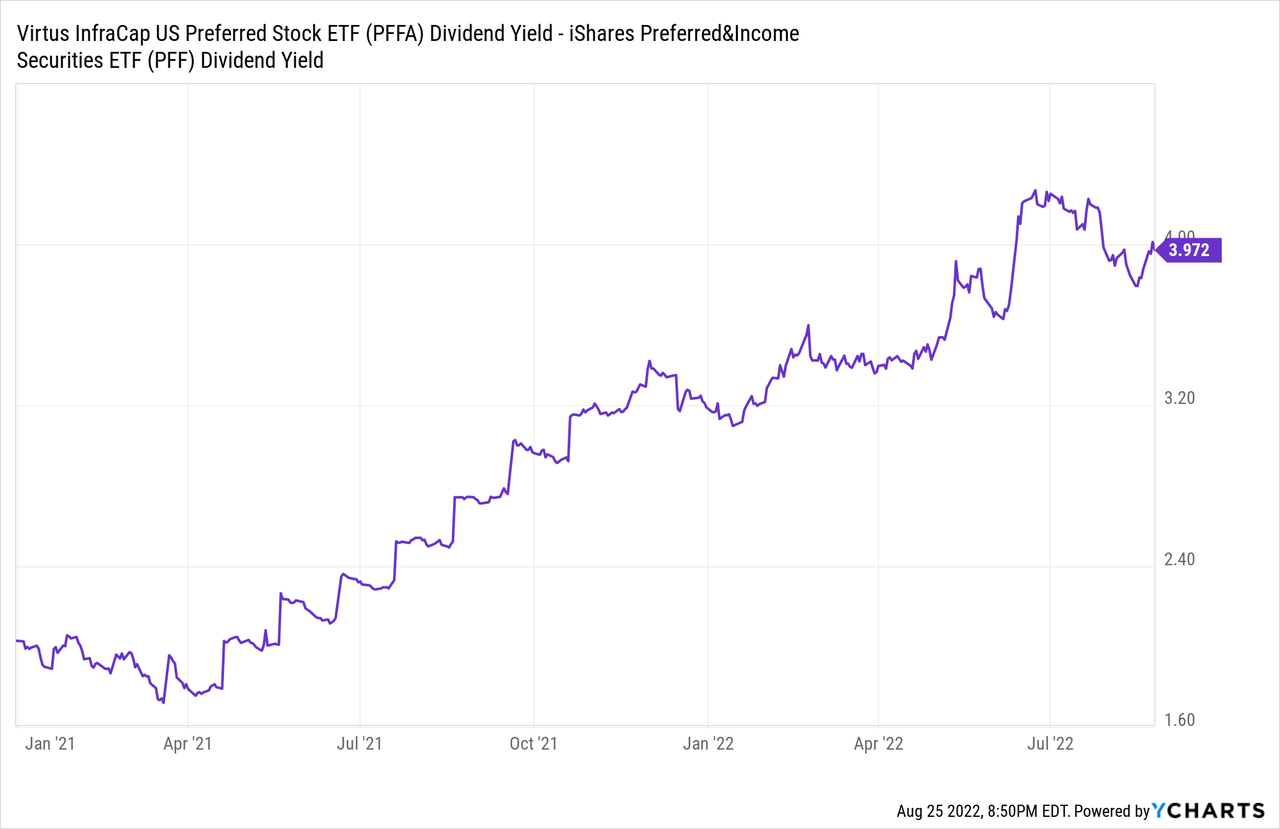

PFFA is also looking more attractive relative to its peers. The fund consistently yields more than average, but yield spreads have been widening since early 2021, and significantly so.

Conclusion

PFFA offers investors a strong, fully-covered 8.8% dividend yield, and the possibility of moderate capital gains if bond prices recover. The fund is also a relatively risky investment, due to its undiversified, low-quality holdings, and use of leverage. In my opinion, the fund’s benefits outweigh its negatives, and so the fund is a buy.

[ad_2]

Source links Google News