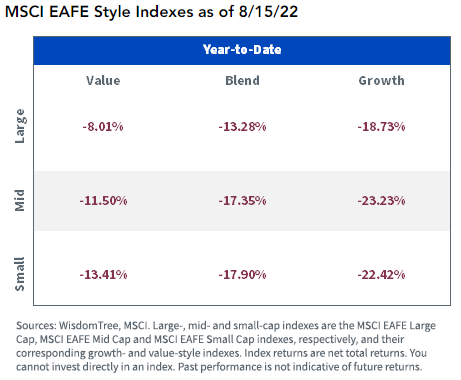

The performance shift from growth to value hasn’t been a phenomenon confined just to U.S. markets this year. It played out on the world stage as well, with developed small-, mid-, and large-cap international stocks performing better than growth or even blended strategies according to Matt Wagner, CFA, associate director of research at WisdomTree, in a recent blog post.

Image source: WisdomTree Blog

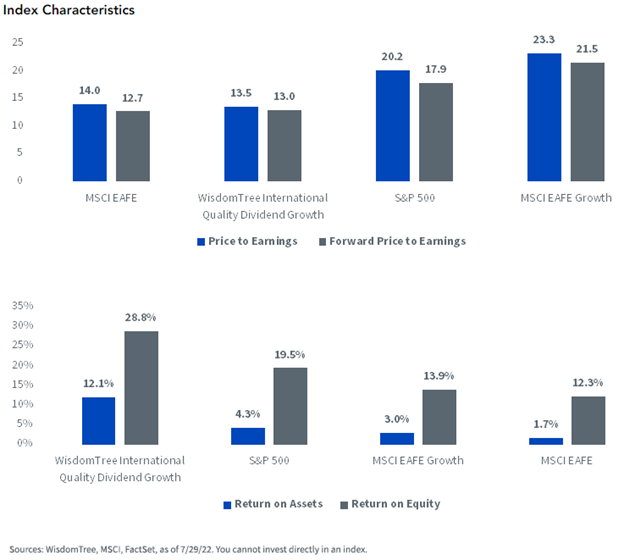

When looking to invest internationally, the reflexive temptation might be to invest in quality but not all indexes are created equal when it comes to how they define and screen for quality. Wagner cautions that quality indexes with a focus on profitability typically skew towards the growth end of the spectrum, and therefore has resulted in international quality indexes underperforming value-focused indexes like high dividends.

“WisdomTree’s definition of quality includes metrics associated with dividend growth — the existence of a regular cash dividend, high return on equity and return on assets, and high growth expectations,” Wagner explained.

The WisdomTree International Quality Dividend Growth Fund (IQDG) seeks to track the WisdomTree International Quality Dividend Growth Index which is comprised of dividend-paying growth-oriented companies in developed markets but excludes the U.S. and Canada. Companies included are screened for quality and growth.

The index is dividend-weighted which has produced valuations that more closely follow the broad MSCI EAFE Index compared to the MSCI EAFE Growth Index, all while offering a premium return on assets and equity.

Image source: WisdomTree Blog

“The intention of including dividends as an element of quality was to combine a profitability and growth screen with an element of valuation discipline — Dividend Stream weighting — that would better balance the risk of overpaying for high-growth/quality companies,” wrote Wagner.

The index utilizes a 20% cap for both sector and country representation, providing guardrails for overrepresentation within the portfolio while also increasing diversification compared to the broader universe.

Investing for Currency Risk Within International Value

The continuing strength of the U.S. dollar has had a much bigger role in international allocations this year than in previous years. Hedging for currency can provide the opportunity for better capture of local returns without currency fluctuations, a significant concern in current markets.

“In local currency terms, without the impact of currency movements, the MSCI EAFE Index is down just 5.15%, more than 300 basis points better than the S&P 500 Index return of -8.8%,” explained Wagner. “With the dollar strengthening more than 10% against the euro and the yen, the unhedged MSCI EAFE Index is down more than 14%.”

The WisdomTree International Hedged Quality Dividend Growth Fund (IHDG) offers exposure to dividend-paying companies in the developed world, excluding the U.S. and Canada, while hedging for currency fluctuations.

IHDG seeks to track the WisdomTree International Hedged Quality Dividend Growth Index which consists of dividend-paying companies that exhibit growth characteristics (ex U.S. and Canada), while simultaneously hedging against a basket of currencies. It has the same basket of equities as the WisdomTree International Quality Dividend Growth Index, while also currency hedging.

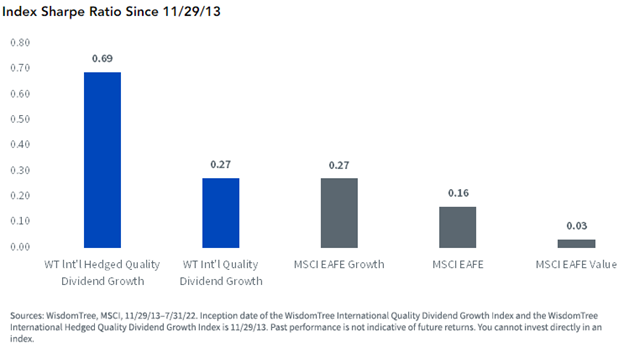

Image source: WisdomTree Blog

“Over the long run, mitigating the incremental risk of the currency exposure — along with a period of general dollar strength — has contributed to the higher risk-adjusted returns for the currency-hedged index compared to the unhedged MSCI EAFE indexes,” wrote Wagner.

For more news, information, and strategy, visit the Modern Alpha Channel.