[ad_1]

TexBr

VNM ETF summary

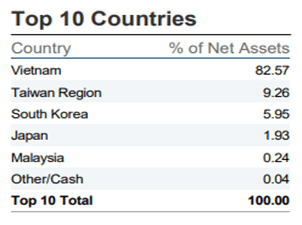

The VanEck Vietnam ETF (BATS:VNM) according to its latest fact sheet, “seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS Vietnam Index (MVVNMTR), which includes securities of publicly traded companies that are incorporated in Vietnam or that are incorporated outside of Vietnam but have at least 50% of their revenues/related assets in Vietnam.”

A key point here is that this ETF may hold stocks that are not listed in Vietnam. In fact, the latest monthly update for July 31st shows more than 17% of the fund is listed offshore.

VanEck Vietnam ETF Fact Sheet

Therefore when you see the performance of VNM differ greatly from the widely quoted Vietnam stock market benchmark (VN-Index), one should not be surprised.

The expense ratio for VNM is 0.59%. Although this is more expensive than many other country’s equity index ETFs, it is a lot cheaper than the hefty fees Vietnam active funds charge.

“Cheap” however should be seen in the context of the performance you get after fees. Then we should also compare with after fee performance of other Vietnam stock market funds.

VNM ETF long-term performance

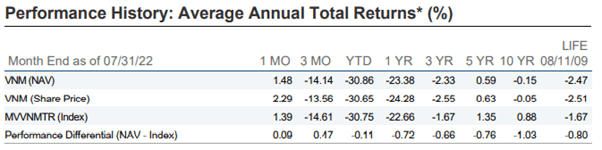

There are not too many ways to spin the below performance table into a positive. Negative returns over very long time periods and since inception.

VanEck Vietnam ETF Fact Sheet

You wouldn’t know it from the performance table above, but the Vietnam stock market has been a good market to be exposed to for a very long time now.

Despite Vietnam stocks experiencing similar falls to the US market this year, returns over the last few years have been strong. Likewise with returns going back over the last decade. It has just been that the VNM ETF has been a poor way to play this trend.

So let’s not give up on considering Vietnam stocks just yet because of the above performance table. Later in this article I shall come back to some more data on longer term Vietnam stock market performance.

First I shall highlight the positive macroeconomic backdrop that exists in Vietnam, even as the global economy is looking increasingly uncertain.

Vietnam economic tailwinds

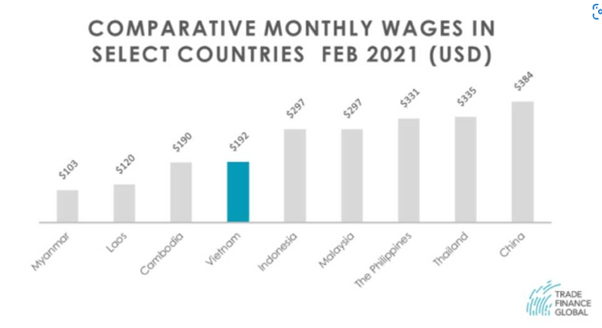

Investors may be attracted to Vietnam’s relatively strong economic growth seen for decades now. Some key factors underpinning this are a manufacturing-based workforce that is cheap, efficient and has favorable demographics.

Here is a more recent article from last month on why Vietnam continues to be a more attractive manufacturing alternative to China when considering options in the ASEAN region.

Key factors noted in the article include Vietnam’s relative political stability, strategic location and efficiencies, and integration via significant free trade agreements.

From this article, below are some various labor cost comparisons.

tradefinanceglobal.com

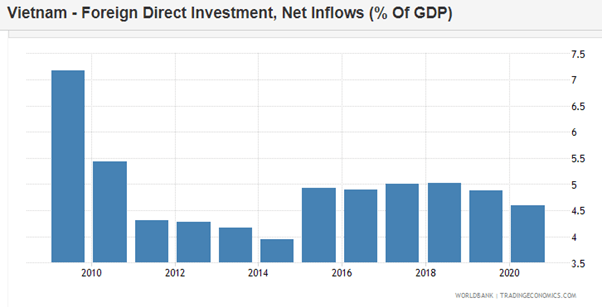

This is unsurprisingly resulting in positive trends in foreign direct investment.

tradingeconomics.com

These fundamentals are helping drive Vietnam economic growth forecasts of circa 6- 7% over the next 2 years. If we leave aside recent pandemic affected data, this sort of growth is normal for Vietnam over the last few decades.

Vietnam historical stock market returns

Despite such favorable economic tailwinds, one should be aware that they alone do not necessarily mean the stock market will do well. Often in frontier / emerging stock markets you can see far better economic growth, yet they can lag the performance of more developed markets. This can be due to poor corporate governance, lack of confidence over the regulatory environment, and political instability just to name a few factors.

In the case of Vietnam such factors may not hold back their future stock market returns. Over the last decade or so they haven’t. Although it does not appear so from the VNM ETF performance, many other investors with exposure to Vietnam via different methods would be very happy with the last decade’s returns.

I shall get to some of the active Vietnam funds later, but you can observe from looking at the 10-year chart of the VN-Index that the Vietnam stock market has been a strong performer.

VN-Index 10 years to August 4th, 2022 (tradingeconomics.com )

Falling Vietnam stock market in 2022 is a buying opportunity

A lot of my focus above has been on historical data over the last decade. This year we have seen the Vietnam stock market slip into bear market territory. With the rising uncertainty over the global economy, a reasonable question to ask is if this positive economic run for Vietnam is at risk.

The poor performance for Vietnam stocks in 2022 has in a large part been due to factors I consider at odds with the fundamentals. In summary these factors are:

- Panic from retail investors who dominate trading volumes. (There was huge growth in new retail accounts in the last few years and they don’t always act rationally).

- A crackdown on corruption leading to arrests related to stockbrokers and property developers. (Longer term such crackdowns could ironically improve confidence in the system).

- Vietnam stocks simply following the negative lead from the US and inflation concerns there. (Yet Vietnam’s inflation rate is under control).

For those that want to go in a bit more depth into these factors, I covered this more in my recent article about the VinaCapital Vietnam Opportunity Fund (OTCPK:VCVOF).

Vietnam economic tailwinds in the post-pandemic world

As far as other developments since the pandemic go, Vietnam remains in a good position for positive trends to continue.

For example, the problems China is facing has only further highlighted to global firms the need to potentially diversify their global outsourcing of manufacturing capabilities.

One of Vietnam’s leading export categories was in furniture, and the work from home thematic was an unexpected positive during the pandemic.

Vietnam’s trend of positive FDI inflows only saw a moderate slowdown after 2020. This was shown in the FDI chart I included in this article further above.

Although there have been many geopolitical issues surfacing in 2022, you probably won’t find Vietnam in the news much with strong opinions concerning these. This relative “neutral” type of approach is a good sign for Vietnam stock market investors.

From a local perspective in Vietnam, the pandemic highlighted the trust in government that still remained strong despite a period of such turmoil.

Now that I have covered many positive tailwinds that should help VNM’s future performance, there are some reasons why they still may not match the performance of other Vietnam funds.

Vietnam foreign ownership limits (FOLs)

One issue is FOLs, and the fact that VNM is set up as a foreign based ETF from Vietnam’s perspective.

Many publicly traded Vietnam companies, as this article explains, are subject to FOLs of 49%. Vietnam banks have FOLs of 30%.

At various times, certain Vietnam stocks might already be very close to such FOLs. If so, it becomes difficult for a foreign setup investor like VNM to source stock.

The problems with “low cost” index investing in Vietnam

The low MER of 59 basis points might seem cheap compared with Vietnam active funds at first glance. In fact, you will soon see some examples of some Vietnam CEFs, which have relatively far more “expensive” fees.

I use inverted commas above because at the end of the day it is more relevant to consider what the returns are on various alternative products on an after-fee basis.

Earlier I noted that VNM gives the impression that the Vietnam stock market might have been a poor choice of market to be exposed to, which is not really the case.

Further evidence is shown by the performance of three Vietnam CEFs. These funds have done even better than the VN-Index over the last decade.

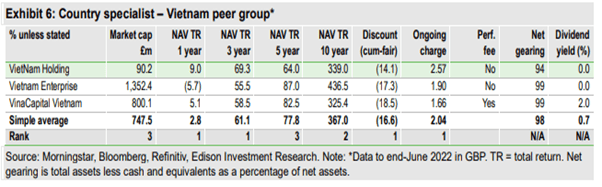

Here is some research on three Vietnam CEFs listed on the London Stock Exchange that have very respectable returns.

Edison Investment Research Report for Vietnam Holding July 29, 2022

They therefore don’t deserve to trade at such large discounts to NAV, although for prospective investors that could be a good opportunity.

These Vietnam active funds can invest in companies well before they get included in the indexes. Sometimes this can be via attractive IPOs, or even entering positions at private equity stage. They can hunt for smaller companies than the large indexes own. They don’t own stocks listed on other Asian stock exchanges. They can run concentrated stock exposures and avoid the less desirable stocks that the Vietnam ETFs are forced to own.

In a frontier market like Vietnam where there are still relatively few active fund managers set up and therefore less competition, I am not surprised some are easily outperforming VNM. With retail investors accounting for a lot of the Vietnam stock market turnover, they are also better positioned to take advantage of inefficiencies from that perspective.

VNM ETF shorter-term performance in the 2022 bear market

With the last decade being a very positive one for the Vietnam stock market, it is worth checking and seeing how these active funds tend to do in down markets.

Is it a case of them being more aggressive than ETFs, and therefore they might underperform in a bear market?

Well with the first 6 months of 2022 when the VN-Index fell around 20%, this article showed that active Vietnam funds outperformed ETFs. The article showed that VNM came last for the returns over the first 6 months of 2022, from a comparison of 13 Vietnam fund products.

Vietnam stock market valuations and VNM ETF holdings

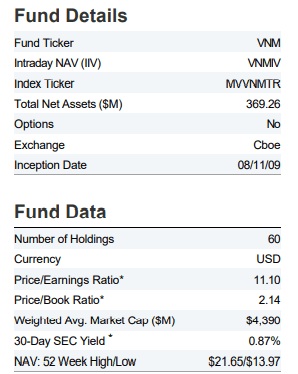

The large falls in the Vietnam stock market this year has resulted in very attractive valuations. Checking out the fund details as per below, the VNM ETF P/E ratio is just at 11 times, which is similar to the P/E ratio of the VN-Index.

VanEck Vietnam ETF Fact Sheet

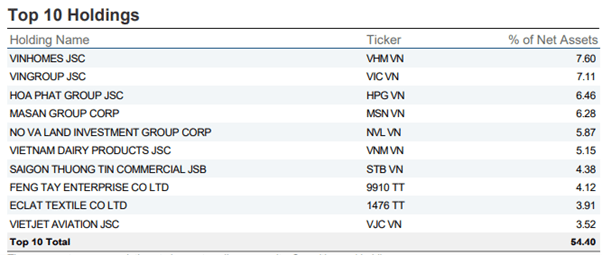

Below are the top ten VNM ETF holdings as at July 31, 2022.

VanEck Vietnam ETF Fact Sheet

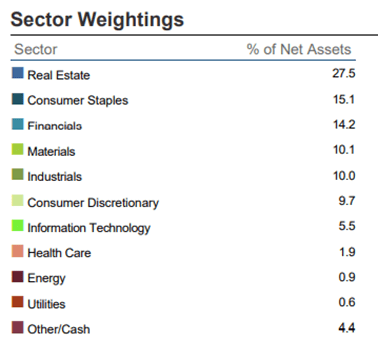

The VNM ETF sector weights are quite concentrated amongst Real Estate and Financials.

VanEck Vietnam ETF Fact Sheet

VNM ETF risks

Aside from the risks that VNM underperforms other Vietnam funds, one should be mindful of the risks to the positive Vietnam tailwinds I have been discussing.

In the shorter term the Vietnam market is still very sensitive to further negative developments resulting from the crackdown on corruption.

Although I highlighted their manufacturing capabilities as a positive, this also means they are quite exposed to a global economic slowdown. A lot of economic activity is generating from exporting to the likes of China, South Korea, Japan ,Europe and the US.

Vietnam fund options for US investors

I understand how US based investors may be easily tempted to own VNM to ride the positive Vietnam stock market trend. It is US listed, has plenty of liquidity and been around for more than a decade. Also the VanEck brand is well known, and the fees are ok given we are talking about a frontier market ETF.

I thought my article though may offer a chance for investors to be aware of some of the structural issues with this ETF before diving in too quickly.

These days investors are increasingly taking a global approach and it is not too uncommon for the small investor to have access to stocks on other global stock exchanges. Brokerage is getting more competitive in this regard, and may not be much of an issue anyway if one is investing long term. Vietnam CEFs listed on the London Stock Exchange are worth some thought for those that can trade in securities listed there.

Conclusion

VNM has not been a good ETF to play the rising Vietnam stock market over the last decade.

The three London listed CEFs that trade at large discounts to NAV are worth contemplating for those that have access to trading on the London Stock Exchange. In some cases with these CEFs, maybe even their volume traded on their US equivalent listings could suit. Yet I do urge caution here in that regard. The relevant funds in this respect are Vietnam Enterprise Investments (OTC:VTMEF), VinaCapital Vietnam Opportunity Fund and Vietnam Holding (OTCPK:VNMHF).

Should such CEFs not suit US based investors from an accessibility point of view, settling instead on the VNM ETF has not proved wise in the past. Structural issues suggest this could still be problematic going forward.

Having said that if I already owned VNM I wouldn’t rush out of it. Vietnam stocks have fallen substantially in 2022 and the tailwinds I have discussed for Vietnam should assist VNM’s performance over the next few years. I expect it can therefore produce reasonable returns in that time period, but nonetheless continue to underperform more desirable Vietnam fund options.

Perhaps VNM will not underperform as much in the future, if we believe that Vietnam stock markets are becoming a little more efficient compared with 5 to 10 years ago.

A potential upgrade of the Vietnam stock market from frontier to emerging market status could also be a positive catalyst to assist VNM’s performance. There is a good chance this will occur in the next 2 or 3 years. Global investors in recent years have shunned the Vietnam market, but this catalyst could soon see them as strong net buyers in the future.

[ad_2]

Source links Google News