[ad_1]

Dilok Klaisataporn/iStock via Getty Images

Thesis

By definition, the Consumer discretionary sector includes industries that tend to be sensitive to economic cycles. Some of these industries are: automotive, home goods, apparel, hospitality, media services, and many more. While the fear of a recession has many investors shy away from cyclicals, it is possible that most of the downside has already been priced in and the sector currently offers an attractive entry point from a value perspective. In this analysis after a brief overview of the SPDR Consumer Discretionary ETF (NYSEARCA:XLY) is given, the current position of the U.S consumer is examined along with a comparative performance analysis of the XLY ETF.

Fund Overview

As with all 11 sector ETFs provided by State Street Global Advisors, the Consumer Discretionary Select Sector SPDR® Fund represents the most popular and arguably most effective choice for gaining direct exposure in the sector. With more than $15B of Assets Under Management XLY charges a low 0.10% expense ratio while paying a 0.75% dividend yield.

XLY’s 10 largest holdings (combined for over 50% of total holdings) include names like AMAZON (AMZN), Tesla (TSLA), Home Depot (HD), Nike (NKE), and others. The fund’s most heavily weighted industries include Internet & Direct Marketing Retail (24% weight), AUTOMOBILES (23%), Specialty Retail (20%), and Hotels, Restaurants & Leisure (17%).

Recent Stock Market Developments

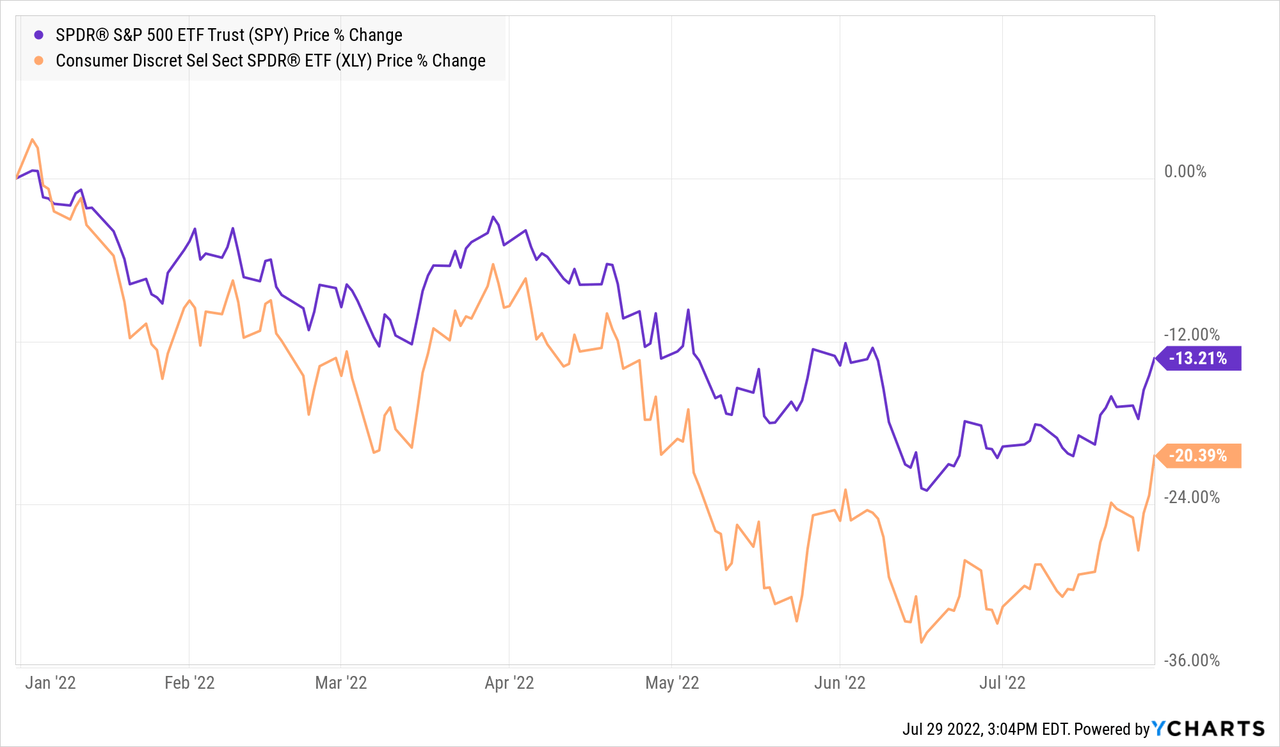

Since the beginning of the year, stocks have mounted significant losses with both the S&P 500 and the NASDAQ entering a bear market, as inflationary pressures increased and the Fed began rotating towards contractionary policies. Over the past couple of weeks, bullish sentiment has taken over, signaling that the rest of the year might actually restore returns for investors. The Consumer Discretionary sector has underperformed the market yielding -20,4% YTD, versus -13,21% for the S&P 500. Valuations in the sector have also significantly contracted, offering better entry points across the board.

As the stock market looks for stability, bouncing off June lows, analysts are turning optimistic, arguing that perhaps the tough of the bear market is behind us, offering a rather bullish perspective on discretionary stocks. However, as supply chain disruptions have yet to substantially ease and China-related worries persist, the road ahead is likely to be bumpy, at least over the short term.

Consumers Remain In Good Standing

Despite a sizable retreat in the stock market and mounting macroeconomic concerns on a global scale, consumers in the United States maintain a firm standing for the most part.

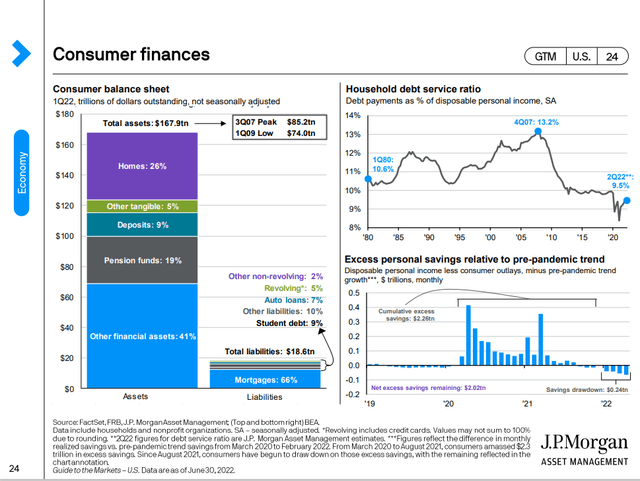

The labor market has also remained strong with the unemployment rate falling below the 4% mark, hovering around pre-pandemic levels. Total household assets have significantly increased over the past decade, with liabilities (debt) remaining at reasonable levels, despite some issues arising when it comes to automotive and student loans. Debt payments as a percentage of disposable income are also historically low, indicating that more income is available for consumption. Consumer spending has displayed resilience, while the wealth effect (people’s assets increasing in value lead to higher consumption) has also been a contributing factor. Demographics are also a mid to long-term tailwind, as millennials (a historically large demographic group) enter their prime work-life and home-buying years increasing their participation in consumption and asset purchases.

J.P. Morgan Asset Management

Sentiment Tells A Different Story

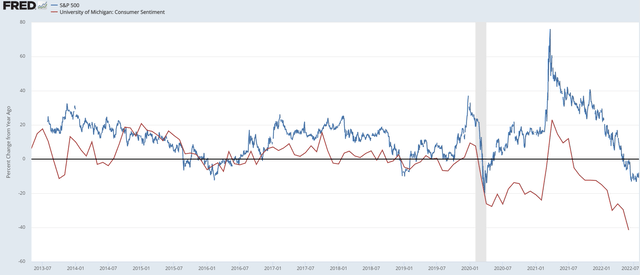

Despite the relatively good standing of the U.S consumer, sentiment has significantly deteriorated. While worsening sentiment is common in inflationary times, the current state of the consumer sentiment index (50.0 points as of June 2022) is the worst since 1980. Considering that the early 2000s war, the 2008 financial crisis, and the COVID-19 2020 crash had a smaller effect on decreasing consumer confidence, one could come to the conclusion that we are in fact, witnessing extraordinary economic times.

As should be expected, sentiment is key when it comes to economic growth and therefore stock market returns. Consumer spending covers a substantial percentage of GDP and slowing spending, stemming from a lack of consumer confidence can hurt the economy, corporate profits, and stock market performance. In fact, as shown in the chart below, stock market returns and changes in the consumer sentiment index have a tendency to move together.

fred.stlouisfed.org/

XLY vs S&P 500

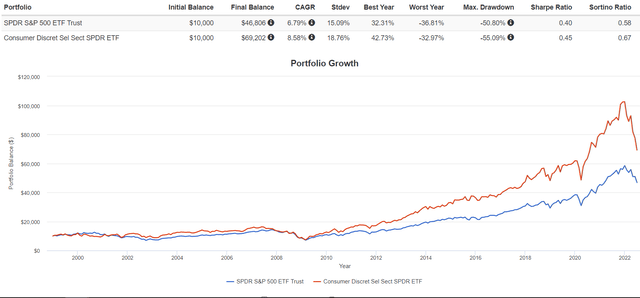

Despite falling short over the short term, as explained in the second segment, the long-term performance of XLY has been far more impressive. For a long-term fund performance analysis, the tools offered by the portfolio visualizer were employed. XLY’s risk-return metrics are contrasted to those of SPDR’s S&P 500 ETF (SPY), with metrics going back to late 1998. Dividend reinvesting and annual rebalancing are also assumed.

The Consumer Discretionary ETF has significantly overperformed the S&P 500 over the 20+ year period. XLY has delivered an 8.58% CAGR return compared to the S&P’s 6.79%. In retrospect, this means that a $10,00 initial investment in SPY would have translated into $46,800 today, while the same amount allocated to XLY would have yielded $69,200. Risk-adjusted returns also favor the Consumer Discretionary sector over the broader market, with XLY carrying higher Sharpe (0.45 vs. 0.40) and Sortino ratios (0.67 vs. 0.58). An argument for SPY over XLY could be made when risk metrics are concerned, however. As expected, broader diversification invites less risk and SPY displays a lower standard deviation, and a smaller worst-year loss and maximum drawdown.

Portfolio Visualizer

Of course, a choice between investing in the S&P 500 and the Consumer Discretionary sector is not binary as almost no investments in today’s market are mutually exclusive. Instead of favoring XLY over a broader index ETF, what the analysis shows, in my view, are the benefits of adding a historically strong performing sector into an otherwise well-diversified portfolio.

Final Thoughts

After all things are considered, the turbulence the market and the economy are currently experiencing has the Consumer Discretionary sector in a bear market, offering an attractive entry point for investors. Valuations have contracted, historical performance has been market-beating and despite loads of uncertainty and deteriorated sentiment, overall, fundamentals remain bullish for the sector. While the sort term might invite more uncertainty and even larger drawdowns, maintaining a long-term perspective, I would rate the Consumer Discretionary Sector ETF as a buy.

[ad_2]

Source links Google News