[ad_1]

Far700

The Alerian Energy Infrastructure ETF (NYSEARCA:ENFR) is a midstream energy exchange-traded fund (“ETF”). The Fund:

“seeks investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian Midstream Energy Select Index (CME: AMEI), the “Index.”

The Index is a composite of North American midstream energy infrastructure companies, including corporations and master limited partnerships (MLPs). Potential fund advantages are no K-1s (1099 tax reporting), no fund-level taxation, no leverage, and IRA and 401(k) eligibility.

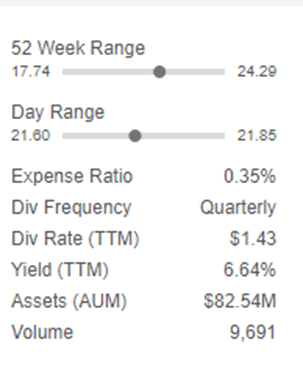

The Fund has an Expense Ratio of 0.35% and its Assets Under Management (“AUM”) are about $82.5 million.

Seeking Alpha

Seeking Alpha has graded the Expense Ratio a “B-.”

Seeking Alpha

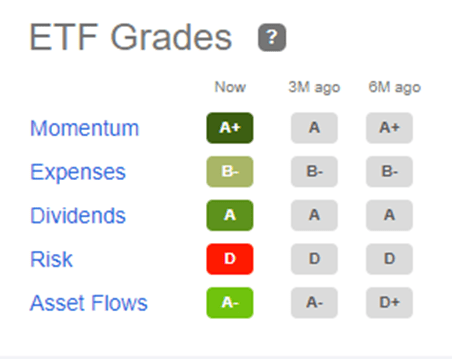

Midstream energy firms engage in pipeline transportation, storage, and processing of energy commodities, primarily oil and natural gas products. They generally provide services based on fees and are not directly impacted by commodity prices in their pricing structures; however, oil and gas prices do impact product volumes over time, and so they are indirectly affected by price trends. Therefore, the short- and long-term outlook for consumption of oil and natural gas products is critical for assessing the volumes and fees that these assets will generate over time.

ALPS

There are significant barriers to entry in the industry due to the capital required to build and operate such assets. There are also strict regulatory and environmental hurdles for new projects.

ALPS

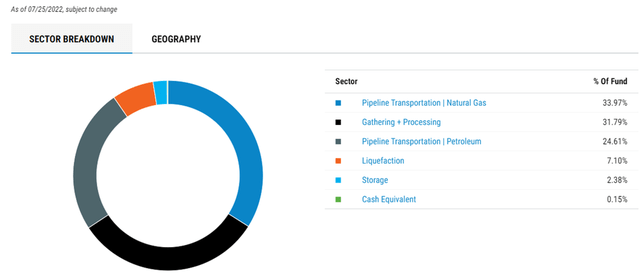

The breakdown of companies in the Fund is depicted below. The largest segments are pipeline transportation of natural gas, gathering and processing, and pipeline transportation of petroleum products.

ALPS

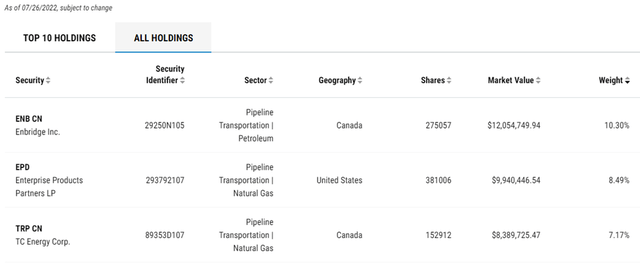

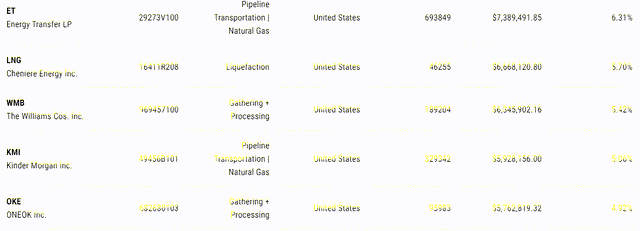

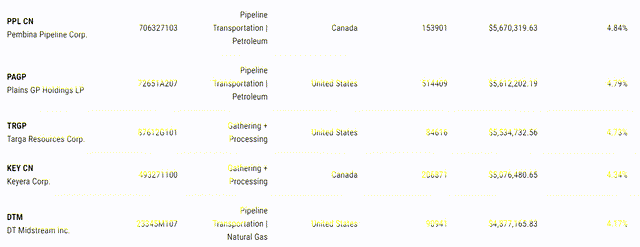

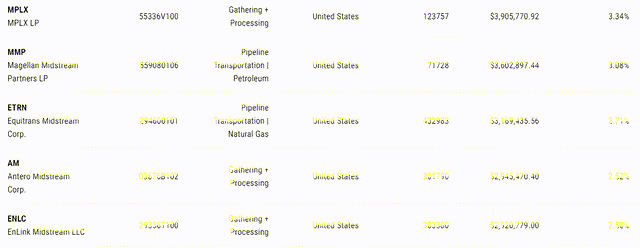

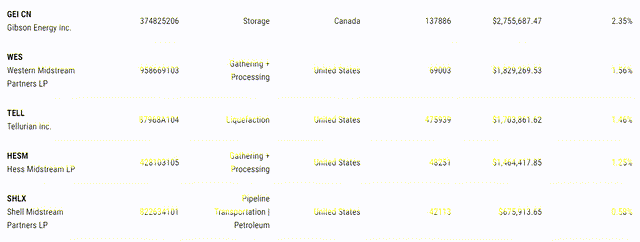

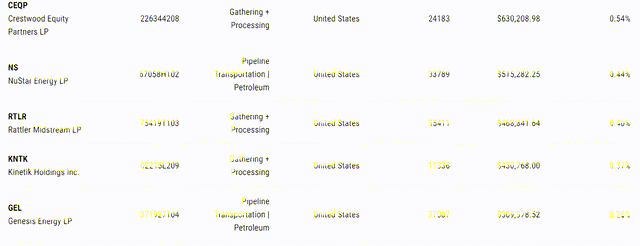

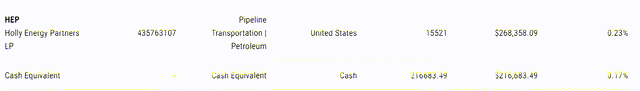

The complete listing of companies in the Fund’s portfolio are named below, along with their percentage weights. Many of these companies with larger weights are also in the Kayne Anderson Infrastructure Fund (KYN), and I recently provided a business summary of each company in my article on Seeking Alpha, Kayne Anderson Energy Infrastructure Prospects And DIY Portfolio (Part 1).

ALPS

ALPS

ALPS

ALPS

ALPS

ALPS

ALPS

Performance

Over the past 12 months, ENFR’s total return has been 18.93%. That compares favorably to the 9.6% loss from the SP500TR.

Seeking Alpha

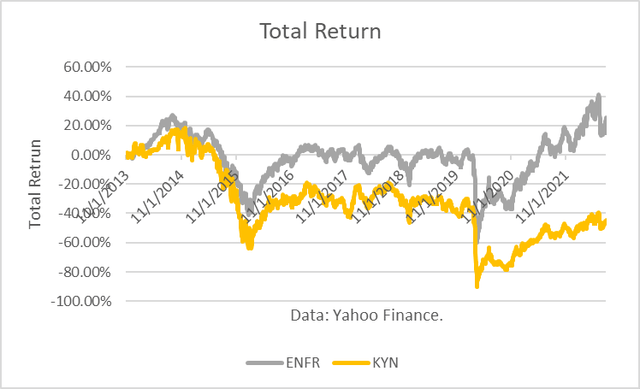

However, since inception in November 2013, ENFR’s total return has only been 25.4%. But I calculated the total return from the KYN closed-end fund over the same periods and found it to be -44.4%. And so it somewhat surprising that KYN has $1.5 billion in AUM, whereas ENFR has only $82 million.

Yahoo Finance data

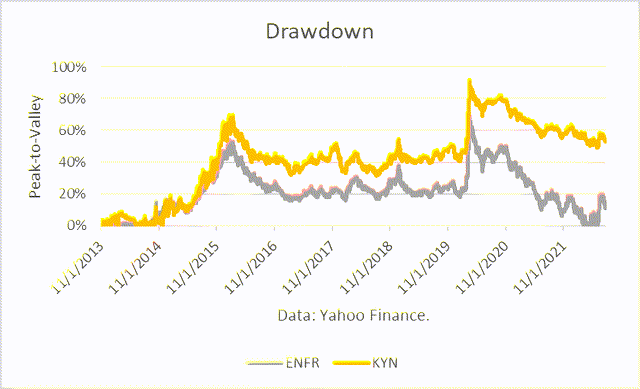

Typically, downside risk is measured as Peak-to-Valley (“P2V”) and the maximum drawdown (“MD”) over a period is the largest P2V experienced. For more about P2V calculations, read here ere. I take the opposite sign of the drawdown so that it is a positive number.

According to my calculations, ENFR has had a lower Maximum Drawdown (“MD”) over the period. Though it was high (69%), it did not approach the MD of KYN, which was 92%.

Yahoo Finance data

Massive drawdowns would (or should) exceed the risk tolerance of any investor. And investors typically exit investments once losses exceed their risk tolerances, locking in the loss.

Market Outlook

In my article, Kayne Anderson Energy Infrastructure Prospects And DIY Portfolio (Part 2), I presented both a short-term market outlook through 2023 and a long-term market outlook through 2050. Both outlooks were prepared by the Energy Information Administration, which has an annual budget of about $120 million.

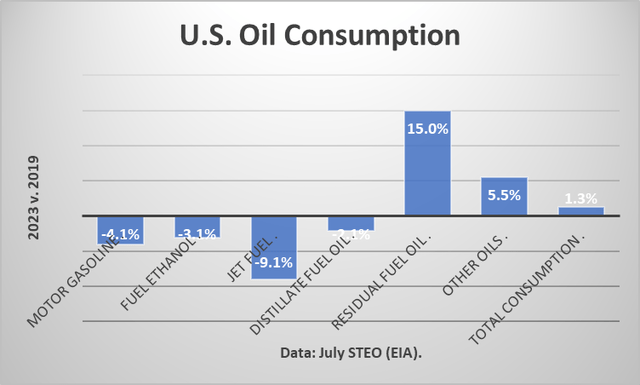

Based on the updated July 2022 EIA Short-Term Energy Outlook (“STEO”), U.S. petroleum product consumption is projected to rise just 1.3% in 2023 vs. the pre-pandemic 2019 average, with gasoline 4.1% lower, jet fuel 9.1% lower, and distillate fuel 3.1% lower.

EIA

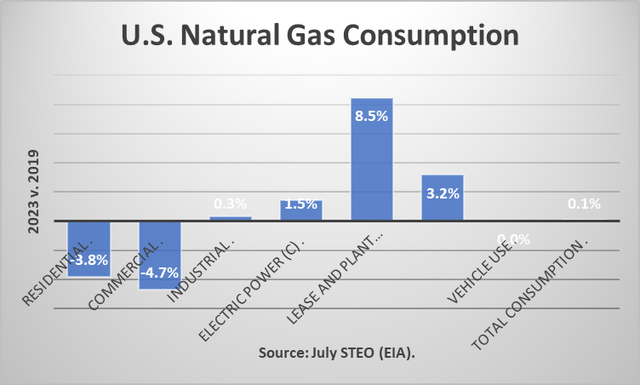

U.S. natural gas consumption is projected to rise just 0.1% in 2023 v. the pre-pandemic 2019 average, with residential use 5.8% lower, commercial use 4.7% lower, and industrial use 3.1% lower.

EIA

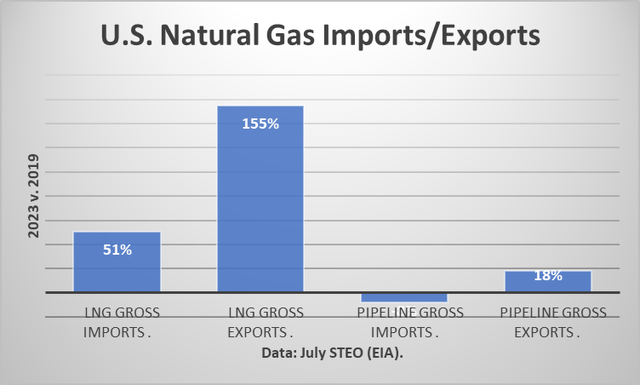

However, electric power use is projected to rise by 1.5% and LNG exports are forecasted to be 155% higher than in 2019.

EIA

The EIA released its Annual Energy Outlook in early March 2022 for projections through 2050, and so that has not changed since my previous article. It forecasts that U.S. gasoline consumption in light-duty vehicles (“LDV”) does not return to pre-pandemic levels through 2050.

U.S. petroleum refining capacity is not expected to rise through 2050. However, natural gas production and consumption are forecasted to increase over time.

Conclusions

I previously concluded that KYN’s largest allocations appeared to be petroleum-related. But as noted above, ENFR’s largest pipeline/transportation allocations are natural gas-related. Given the long-term EIA outlook for growth in natural gas production and consumption, and no growth in petroleum production and consumption, ENFR appears to be better positioned versus KYN.

Perhaps that is why ENFR has out-performed KYN returns and has had a lower drawdown. And so it is somewhat illogical that KYN has AUM of $1.5 billion and ENFR’s AUM is just $81 million.

I prefer the ENFR allocations to KYN’s. However, the do-it-yourself portfolio I proposed that is oriented to natural gas liquids may still provide the best returns longer term, given the expected growth in LNG and the need for Europe to source new natural gas supplies as it displaces Russian sources.

[ad_2]

Source links Google News