[ad_1]

Justin Paget

Thesis

The ProShares UltraShort 7-10 Year Treasury ETF (NYSEARCA:PST) is an exchange traded fund (“ETF”) from the leveraged suite of products. As per the fund’s literature:

ProShares UltraShort 7-10 Year Treasury seeks a return that is -2x the return of its index (target) for a single day, as measured from one NAV calculation to the next. Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return and ProShares’ returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period.

The target index, in this case, is the ICE U.S. Treasury 7-10 Year Bond Index. An investor should think about PST as the inverse multiplied by two of the iShares 7-10 Year Treasury Bond ETF (IEF). As yields rose in 2022 and IEF plummeted, PST gained more than +15% year to date. The fund proved to be a good tool to use to bet that short-term rates were going to rise substantially this year. With the Fed raising rates as expected yesterday to a neutral rate, the market expectations for an aggressive front-loading are being met. That means the violent move up in front-end rates earlier in the year is not to be repeated. The curve has already shifted to accommodate the peak Fed rates views, and inflation has begun to show signs of peaking.

In our view, the Fed is behind the ball in fighting inflation, hence its very aggressive stance in raising rates last month and this week. We expect another 50-75 bps hike in September, followed by a pause. We feel the Fed will do what it can to move rates aggressively and then wait for data to come out while benchmarking inflation readings with general economic health metrics. In our view, the market has already priced this steep move and, with the economy slowing down, the chance for surprise rate hikes is diminishing. In fact, the market rallied strongly led by Tech yesterday in light of rate cuts expected at some point in 2023.

As a leveraged vehicle, PST performs best when aggressive and unexpected rate hikes and views materialize. We saw that happen in the first half of the year, and PST performed admirably. We feel the market correctly priced the front-loading of rate hikes by the Fed and is now searching for the inflection point when rates are going to be lowered. Lower rates equate to a lower price for PST in the future. While that future is still somewhere in 2023, we feel the bulk of the gains for a long PST trade have already been realized with risks skewed to the downside from here. The Fed has delivered on front-loading rate hikes, and that makes short treasury trades a dangerous delta positioning to have going forward. We feel the long PST trade as an expression of Fed rate surprises is over.

Rates

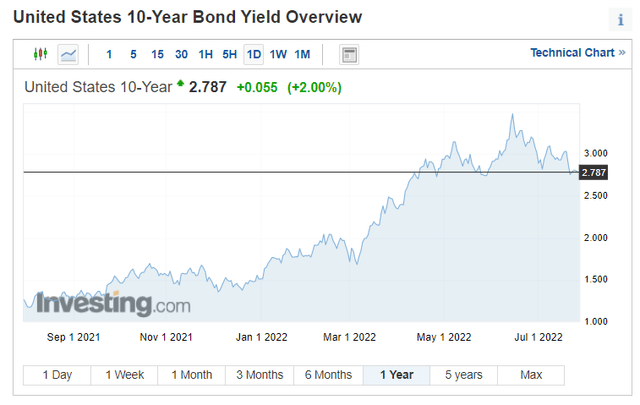

The 10-year yield is consolidating just below 3%:

10-Year Yields (Investing.com)

After jumping as high as 3.48% earlier in the year as inflation readings came in above expectations, the 10-year yield is finding its footing around 3%.

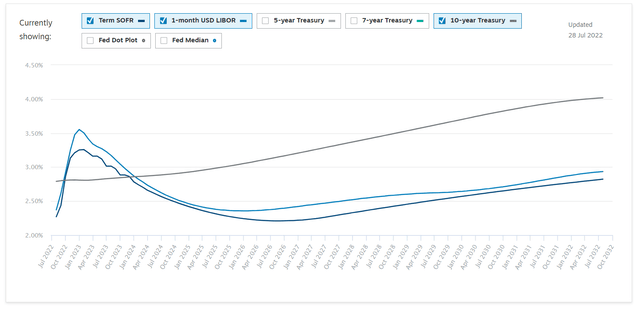

Market expectations now show a 3.5% peak short-term rate:

SOFR & Libor Curves (Chatham)

Courtesy of Chatham, we can see where the current term SOFR and 1mL curves are. Inflation and inflation expectations are abating. We feel the Fed will continue to raise short-term rates and further tighten financial conditions, which is going to result in a future downward pressure on inflation.

We can only see another spike in 10-year rates if inflation and inflation expectations start increasing again.

Performance

The fund is up more than +15% year to date:

YTD Performance (Seeking Alpha)

We can see the nice mirror image we are expecting versus the long bond fund IEF. PST comes with 2x leverage, hence double the IEF performance on the positive side with the implicit leveraged fund basis.

On a 5-year range, the fund is down:

5-Year Performance (Seeking Alpha)

PST Holdings

The fund utilizes swaps and futures to achieve its goals:

During the year ended May 31, 2021, the Fund invested in swap agreements and futures contracts in order to gain inverse leveraged exposure to the Index. These derivatives generally tracked the performance of their underlying index and the Fund was generally negatively impacted by financing rates associated with swap agreements. The Fund entered into swap agreements with counterparties that the Fund’s advisor determined to be major, global financial institutions. If a counterparty becomes insolvent or otherwise fails to perform on its obligations, the value of investments in the Fund may decline. The Fund has sought to mitigate this risk by generally requiring counterparties for the Fund to post collateral for the benefit of the Fund, marked to market daily, in an amount approximately equal to the amount the counterparty owed the Fund, subject to certain minimum thresholds.

Source: Annual Report

Conclusion

The ProShares UltraShort 7-10 Year Treasury Fund is an exchange traded fund seeking -2x the daily performance of the ICE U.S. Treasury 7-10 Year Bond Index. The vehicle outperformed earlier in the year as inflation came in above expectations and the market started pricing in a more aggressive Fed. With another 75 bps hike yesterday, the Fed is delivering on its front-loaded hike schedule and the market is now looking for an inflection point for rates to actually start decreasing. With financial conditions tightening and inflation moderating, we feel the long PST trade as an expression of upside rate surprises is over.

[ad_2]

Source links Google News