[ad_1]

metamorworks/iStock via Getty Images

Back in the mid-2000s Microsoft (NASDAQ:MSFT) was the only information technology company among the top publicly traded companies alongside oil majors. By 2011 it had been replaced by Apple (NASDAQ:AAPL) which maintains the lead to this day. Well, this thesis does not aim to convince you to choose one at the expense of the other, but rather to profit from both stocks using the iShares U.S. Technology ETF (NYSEARCA:IYW). At the same time I will show why despite its higher fees, this ETF constitutes a better choice than the Vanguard Information Technology ETF (NYSEARCA:VGT) in view of its higher exposure to the software industry.

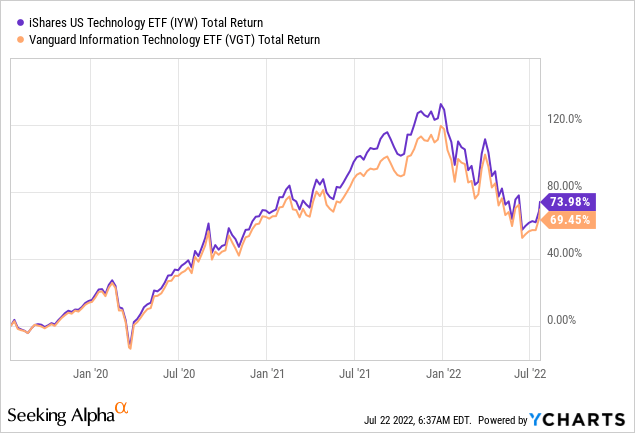

As a prelude to what will follow, the blue chart shows how IYW has outperformed VGT by over 4.5% during the last three years by delivering higher total returns, which represent the price performance plus dividends in case these are reinvested.

I start by comparing the sectors.

A sector-level comparison

First, both ETFs provide exposure to U.S companies, with IYW tracking the Russel 1000 Technology RIC 22.5/45 Capped Index while it is the MSCI Investable Market Information Technology 25/50 Index for VGT. Consequently, they follow different indices but most of their top holdings overlap as I will show later.

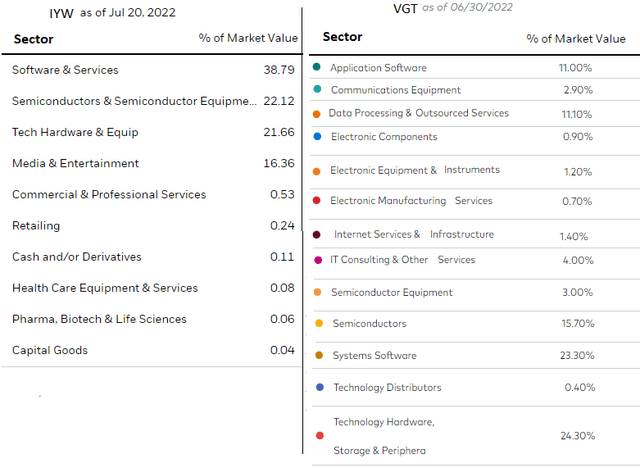

For now, a sector-level comparison of the two shows that IYW holds more software assets as a percentage of the total, namely at 38.79% compared to VGT’s 34.3% (which is obtained by adding application software and systems software) as depicted in the right-hand side table below.

Sector level comparison (www.ishares.com)

This may not be a like-to-like comparison as it also includes the services component, but, nonetheless, it has the merit of showing IYW’s focus on software.

At this stage, it is important to differentiate between technology and its subset, information technology (“IT”) which covers anything from computer hardware, electronics, semiconductor, and software. Moreover, while most people will tell you that technology has emerged as the key driver for all sectors of the economy, I would be more precise and say that instead, it is IT software. This is particularly relevant in the current economic context.

Hence, while it is true that innovations like robotics, Industry 4.0, and 5G enable automation at a degree never seen before, their application also involves considerable capital expenses. On the other hand, software tools are relatively cheaper and, as such, are within the IT budgets of most companies.

Examples range from using simple databases to manage data or emails for communicating, to the application of analytics tools available through cheap monthly subscriptions which deliver more efficiency to corporate spending. This brings us to the cost factor, as accustomed to using cheap money in the past decade of monetary supply easing by the Federal Reserve, the new economic reality implies higher borrowing costs and may render the adoption of sophisticated hardware more difficult, except for the cash-rich corporations.

For this matter, financial technologies like fintech, health tech, and edutech (education technology) provide evidence of how whole sectors have been redesigned, via software, while not forgetting the platform part.

The holdings and Risks associated with Tech

In this respect, platform owners Apple and Microsoft also sell devices in the form of laptops and smartphones respectively, which can be viewed as interfaces connecting their clouds to the physical world. In addition, these companies are monetizing on the secular digital transformation trend, which is now encompassing more aspects of people’s life.

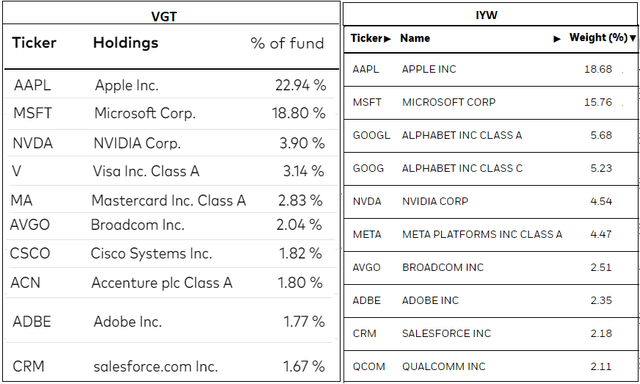

These two stocks constitute the topmost holdings of both ETFs as shown in the tables below, but there are differences in the third, fourth and fifth positions.

Comparison of holdings (investor.vanguard.com)

To this end, the fund managers at iShares have added shares of Alphabet (NASDAQ:GOOG) (GOOGL) and Meta Platforms (NASDAQ:META), which form part of the communication sector, while VGT includes Visa (V), and Mastercard (MA) which are payment processors. One similarity between both is NVIDIA (NASDAQ:NVDA), which is a major semiconductor manufacturer and AI play.

Talking risks, IYW’s 13.5% exposure to the communications sector, has proven to be a source of volatility soon after Snap (SNAP) released worst-than-expected results. A prominent economist has associated this underperformance with general weakness in the economy, especially in the advertising sector. These impacted Google and Alphabet which lost 7% and 5% of their value respectively on Friday, in turn causing a downside of -2.47% in IYW compared to only -1.56% in VGT as part of the wider weakness in tech as shown in the chart below.

Comparison of price performance (www.seekingalpha.com)

However, Snap has its own problems like competition with TikTok and being vulnerable to privacy changes implemented by Apple. Thus, the downside in Google and Meta appears unjustified, as both are diversified, with Mark Zuckerberg famous for having told Congressmen in 2018 that his company builds enterprise software and his engineers write codes when asked whether he owned a media company. As for Google, in addition to its ads business, it has its AI-powered search engine, a global cloud platform, and the elaborate Android ecosystem which powers a large chunk of the world’s smartphones.

Thus, both Google and Meta are also software businesses.

Now, I do not mean that there are no risks in software as any business is likely to be impacted by an economic slowdown. Furthermore, a strong dollar is proving to be a headwind for the profitability of large U.S. tech companies which derive revenues from abroad and especially from Europe.

There are also regulatory risks stemming mainly from a lack of understanding of how software enables businesses to garner the sort of competitive advantage which cannot be explained by traditional methods of producing wealth. Regulators are also critical of the unprecedented amount of personal data collected by big techs which enables them to gain actionable insights about all aspects of our daily lives. This is viewed as an unfair source of competitive advantage, often to the detriment of other businesses.

Discussion

However, it is difficult for regulators to draw a red line that cannot be crossed as boundaries separating industries have become increasingly blurred in the last ten years and it is pretty common to find cross-industry players encroaching on each other’s turf. At the same time, traditional corporate interaction lines are being redrawn as the vertically integrated economic value chain shifts to the platform economy. Examples are how Google and Microsoft are digitalizing the supply chain using their AI and cloud infrastructures to build trusted relationships among partners, while Apple is expanding the number of healthcare applications in its Appstore.

Consequently, in this new set-up where business boundaries have blurred and traditional competitive advantages become obsolete, only those who adapt rapidly, namely through the use of software-led solutions. Consequently, as goes the saying, “every business is a software business”. In this context, the world’s largest service providers are part of IYW and VGT, but I favor the iShares ETF as:

– It offers more exposure to software, which is often underlooked in favor of the more visible hardware side.

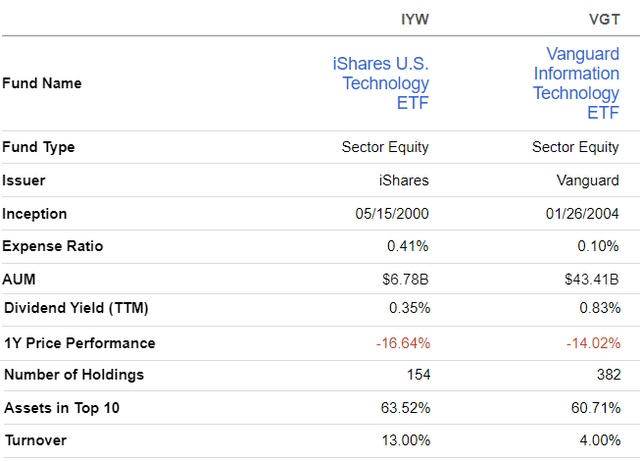

– As shown by the one-year performance in the table below, IYW has suffered from adverse news about Snapchat, both recently and in October 2021, while Meta’s shares took a beating in February 2022 after lower profits because of metaverse spending.

– Together Apple, Microsoft, Alphabet, and Meta make up 49.8% of IYW’s assets, which constitutes a sizable chunk.

Comparison of metrics (www.seekingalpha.com)

This said IYW is more concentrated with 154 holdings, or less than half of VGT’s, and, thus, it may be more volatile over the short term. Also, its turnover is three times more which indicates that changes are brought more frequently to its portfolio. However, it is better to have a more dynamic asset allocation strategy during current times.

Conclusion

The secular trend of digital transformation which is redefining industries whether it is in finance, manufacturing, or energy into techs through the use of software applications is also setting newer benchmarks for customer experience. In this new paradigm, companies are using communication tools embedded in the software itself to offer a technology-driven experience, a strategy that gained momentum by Covid-induced social distancing mandates.

Investors will also note that, while tech companies face headwinds, the software segment of the business is less likely to be impacted by supply chain-related issues or higher component prices due to higher inflation grappling different parts of the world. On the contrary, increasing software usage is synonymous with efficiency gains and can amortize the side effects of high inflation.

Finally, based on its higher dosage of software and historical performance as shown in the introductory chart, IYW could fetch $145 by 2025 based on a 70% upside applied to the current share price of $85.4. This said, both the Fed tightening the monetary supply and concentration risks will make the uptrend highly volatile, but this ETF is the best choice as it has delivered better returns compared to VGT despite possessing six times fewer assets under management, paying fewer dividends, and charging more fees.

[ad_2]

Source links Google News