[ad_1]

JLGutierrez

(This article was co-produced with Hoya Capital Real Estate)

Introduction

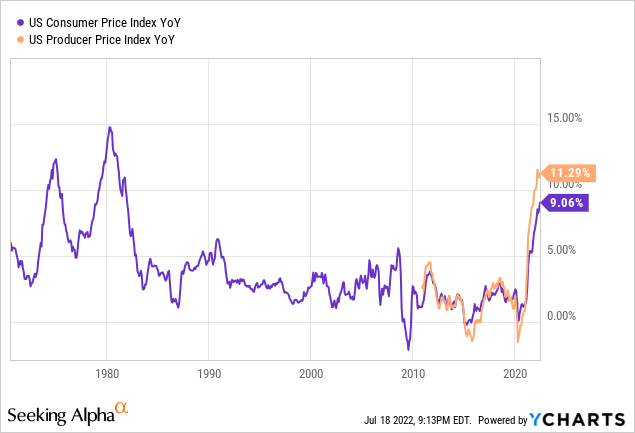

As the evening news reminds us and the chart above shows, the U.S. hasn’t seen the inflationary pressures experienced in 2022 since the early 1980s! Neither the stock nor bond markets is reacting well out of concern over what the Federal Reserve will need to do with the Fed Funds Rate to get inflation down to its 2% target rate. With supply chain issues, labor shortages, and a war in Ukraine, and inflationary pressures mostly beyond their control, this cycle could last a long time.

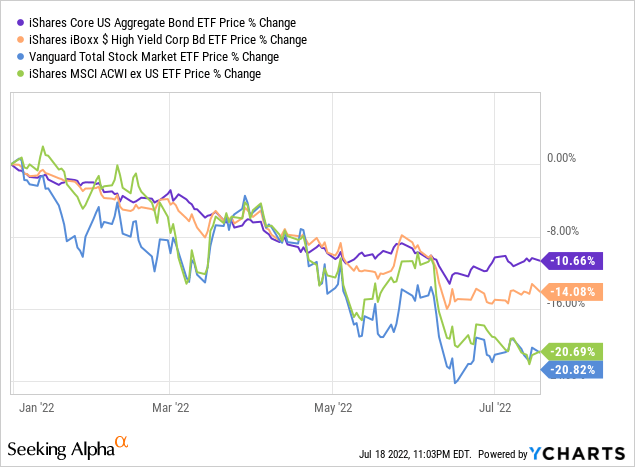

That possibility has investors looking for ways to grow their assets faster than inflation, i.e., achieve real returns or at least do better than the broad indices shown above. Individuals have turned to I-bonds but purchase limits constrain this option. BlackRock recently launched two exchange-traded funds (“ETFs”) to help investors out, both of which I review in this article. They are:

- iShares Inflation Hedged U.S. Aggregate Bond ETF (NYSEARCA:AGIH)

- iShares Inflation Hedged High Yield Bond ETF (NYSEARCA:HYGI).

Understanding the Indices Used

Even the underlying indices only have a few months of history, not enough to give a Buy recommendation to either ETF, but both are worth keeping an eye on. BlackRock provides a common overview of the indices used by these ETFs:

Each Index within the BlackRock Rate Hedged Series of Indices (the “Series”) provides exposure to a specific Fixed Income ETF, while seeking to minimize the Interest Rate or Inflation exposure of the constituents of the ETF. Through a rules-based approach, each Index will hold up to 10 Interest Rate or Inflation Swaps, whose weights are dynamically updated daily. In addition, each Index will also hold a cash position that is intended to reflect the collateral that must be held to manage the swaps positions by any fund tracking the Index. Each Index is rebalanced monthly. Inflation Swaps are used to transfer inflation risk from. One party pays a fixed rate cash flow on a notional principal amount while the other party pays a floating rate linked to an inflation index

Source: blackrock.com Index Methodology

What is an IFS Swap?

Both ETFs use IFS Swaps as their means of hedging for inflation. IFS stands for Incremental Fixed Swap. I found this definition and link that explains what they are.

An interest rate swap in which the fixed rate leg is only payable on a specific percentage of its notional principal amount. The remaining percentage is assigned as the floating rate leg. The fixed portion of this swap increases as the reference floating rate (LIBOR) moves up according to a predetermined resetting schedule. In other words, the fixed-rate payer pays the swap rate on a resettable notional amount. Since it is not always applied to the notional amount in whole, the incremental fixed swap rate is relatively much higher than that of a vanilla or regular swap.

This swap is mainly instrumental to floating rate borrowers who expect interest rates to remain considerably below the level at which the fixed rate is payable on a large proportion of the notional amount. Like an interest rate cap, the incremental fixed swap places a ceiling on a cost of funds, but contrary to a regular cap which requires an upfront premium, a fixed rate payer pays a higher swap rate for the protection this swap provides against substantial rate rises.

Source: IFS Swaps

Both ETF’s Prospectuses describe the risk involved in using Swaps:

Inflation-Linked Instruments Risk. There can be no assurance that the Consumer Price Index (“CPI”), which typically is referenced by inflation swaps, or any other inflation index will accurately measure the rate of inflation experienced in the U.S. or the rate of expected future inflation reflected in the prices and yields of bonds held by the Fund. CPI swaps may cause the Fund’s NAV and returns to be more volatile and expose the Fund to counterparty risk. The Fund could lose money on both the inflation hedging instruments and the investment-grade bonds, and the present value of the Fund’s portfolio investments could decrease if inflation increases.

Source: blackrock.com Prospectus

iShares Inflation Hedged U.S. Aggregate Bond ETF Review

Seeking Alpha describes this new ETF as:

The iShares Inflation Hedged U.S. Aggregate Bond ETF managed by BlackRock Fund Advisors. The fund invests in the fixed income markets. It invests through other funds and through derivatives in U.S. dollar-denominated, investment-grade bonds with at least one year to maturity. It uses derivatives such as swaps to create its portfolio. The fund seeks to track the performance of the BlackRock Inflation Hedged U.S. Aggregate Bond Index. AGIH just started on 6/22/2022.

Source: seekingalpha.com AGIH

AGIH has just $5m in assets. BlackRock charges 13bps in fees after the 3bps fee waiver which covers the expense of investing in other ETFs and lasts until 2028. Yield is currently unknown as no distribution has been made. I think investors might expect a yield near the 1.96% provided by the iShares ETF owned by this ETF.

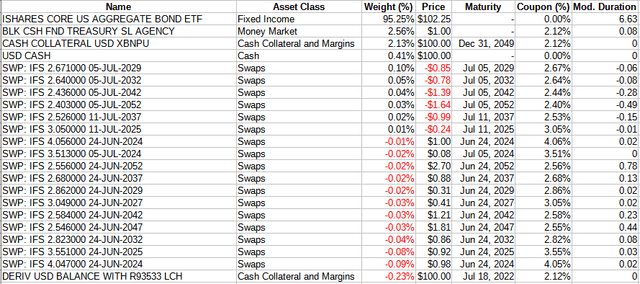

AGIH holdings

ishares.com AGIH; compiled by Author

The owned ETF is the iShares Core U.S. Aggregate Bond ETF (AGG), which seeks to track the investment results of an index composed of the total U.S. investment-grade bond market. The Swaps are used to accomplish the hedging strategy.

AGIH distribution review

I expect AGIH to announce their first payout soon since AGG uses a monthly payout schedule. Not sure how the use of Swaps and holding cash will affect the level, but AGG’s current yield is just below 2%.

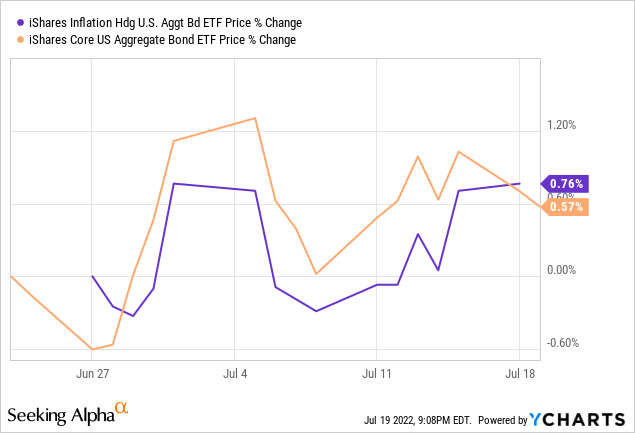

AGIH price review

BlackRock has Index data back to April, which shows a 2.2% drop. This compares to AGG seeing its price drop only .21%.

blackrock.com

iShares Inflation Hedged High Yield Bond ETF Review

Seeking Alpha describes this new ETF as:

iShares Inflation Hedged High Yield Bond ETF is an exchange traded fund launched by BlackRock, Inc. The fund is managed by BlackRock Fund Advisors. The fund invests in the fixed income markets. It invests through other funds and through derivatives in U.S. dollar-denominated high yield corporate bonds. It uses derivatives such as swaps to create its portfolio. The fund seeks to track the performance of the BlackRock Inflation Hedged High Yield Bond Index. HYGI just started on 6/22/2022.

Source: seekingalpha.com HYGI

HYGI has just $5m in assets. BlackRock charges 52bps in fees after the 50bps fee waiver, which almost covers the expense of investing in other ETFs and lasts until 2028. Yield is currently unknown, as no distribution has been made. I think investors might expect a yield near the 4.75% provided by the ETF owned by this ETF.

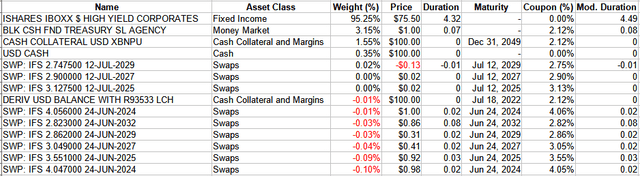

HYGI holdings

The owned ETF is the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), which invests in USD currency high yield corporate bonds with a maturities between one year and less than 15 years and a sub-investment grade rating. The use of Swaps is the same as with AGIH.

blackrock.com; complied by Author

HYGI distribution review

I expect HYGI to announce their first payout soon since HYG uses a monthly payout schedule. Not sure how the use of Swaps and holding cash will affect the level, but HYG’s current yield is a bit below 5%.

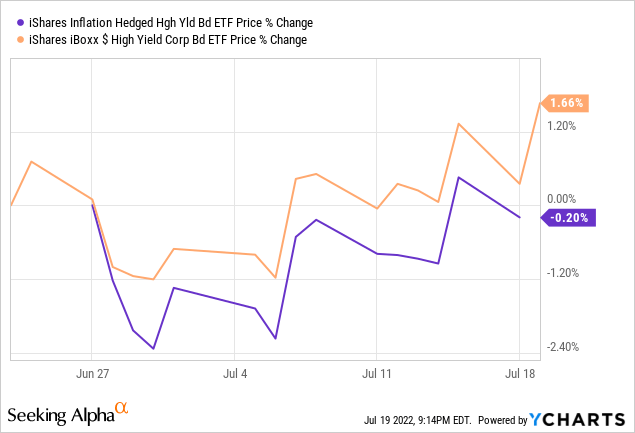

HYGI price review

Unlike its sister ETF, HYGI lags behind the HYG ETF. BlackRock has Index data back to April, which shows a 3.5% drop, compared to a 4.42% decline in price of the HYG ETF. So, over the longer time period, HYGI is ahead.

blackrock.com

Portfolio Strategy

Since both ETFs are the underlying ETF + Swaps, one test, though limited by the recent start of both funds, is to compare their price performance against that ETF, which you see above for both. Results back to April show HYGI performing better than HYG, but AGG outperforming AGIH. That difference should be related to how each ETF established their swap positions. I fully admit that this use of Swaps to control inflationary effects is new to me and I do not understand completely how they work. I do understand that each ETF’s effectiveness is linked to the Swaps-weighting algorithm, which is explained in detail in the Methodology PDF linked above.

Final Thought

BlackRock launched a third ETF also, geared to hedging interest-rate risk, the iShares Interest Rate Hedged U.S. Aggregate Bond ETF (AGRH), which was reviewed by another Seeking Alpha Contributor. Their article can be accessed here.

[ad_2]

Source links Google News