We are living through another chapter in the decade-old currency wars — and Japan is winning.

After a bold move from ¥103 to ¥138 per dollar in less than two years, suddenly the Japanese yen is at a weakness level not seen since 1998.

The yen’s collapse is even more remarkable when you consider that Japan’s consumer price inflation was 2.5% over the last year—a far cry from the 9.1% rate in the U.S. (figure 1).

Figure 1: Japanese Yen per U.S. Dollar

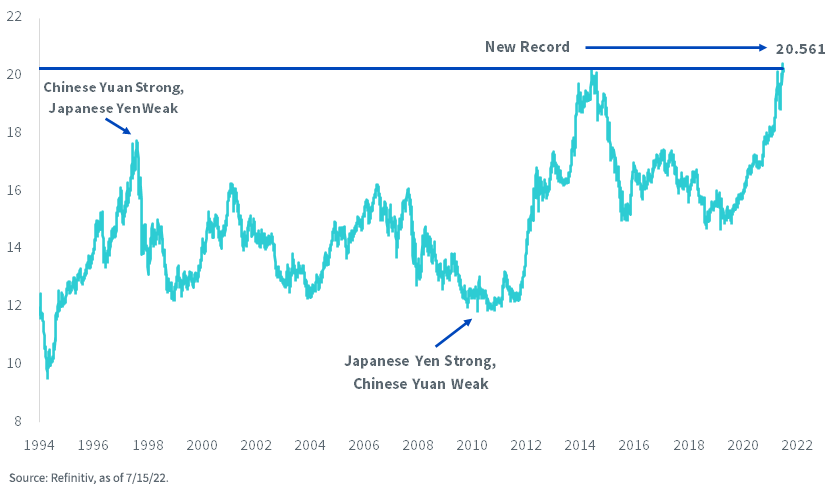

Dollar-yen isn’t the only pair that matters. There is also a moment of truth happening right now between the yen and the Chinese yuan.

Each country is the other’s largest regional trade rival, so it’s notable that the yen is attempting to break through ¥20.56 per Chinese yuan, which would mark uncharted weakness for Japan’s currency (figure 2).

It has created a situation in which Japanese corporations are becoming increasingly price competitive against companies based in China.

Figure 2: Japanese Yen to Chinese Yuan Exchange Rate

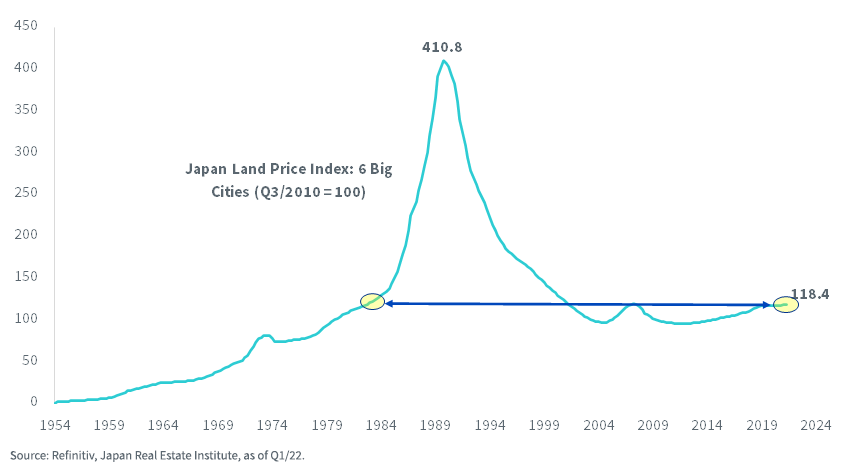

Unlike the U.S., which may have to spend the next few years contending with a housing market that appears to be rolling over, Japan’s speculative juices found their ugly end over three decades ago (figure 3).

Figure 3: Japan’s Land Prices Are at 1983 Levels

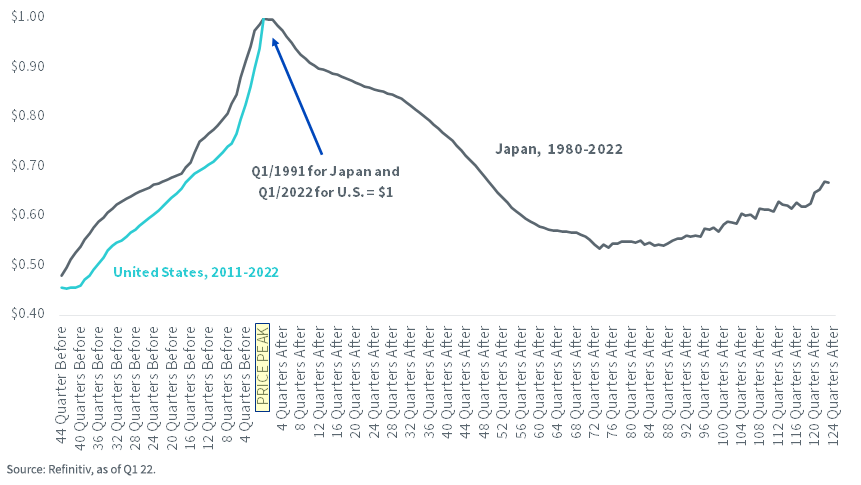

Interestingly, U.S. residential property prices appreciated more in the last 11 years than Japan’s did in the final 11 years of its bull market, which were from 1980–1991 (figure 4).

Figure 4: U.S. Residential Property Price Appreciation, 2011–2022, Overlayed on Japan

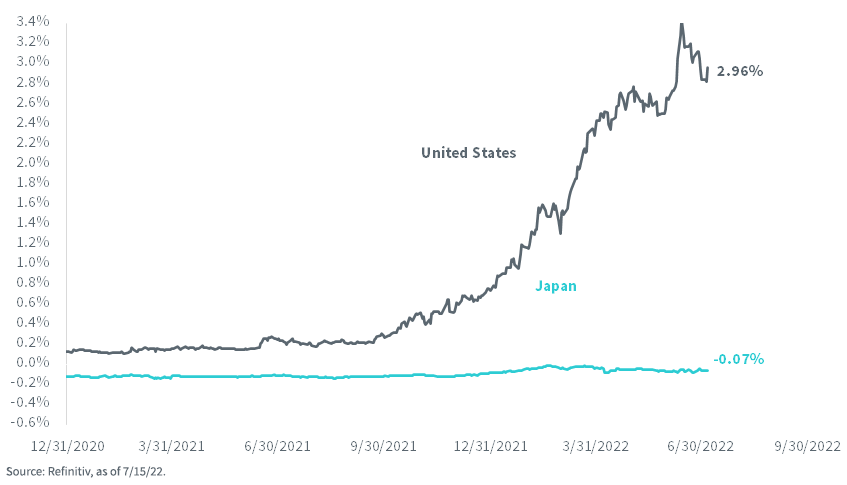

But because asset prices in the U.S. have melted up, now we have a relative value set-up that favors Japan from a “TINA” framework.

The acronym means “There Is No Alternative” available to investors beyond just biting their tongue and buying up stocks, because you couldn’t—past tense—find any yield in U.S. bonds. Though the TINA arithmetic has faded in the U.S. because of rising rates, Japan’s bond yields refused to follow along, owing to the country’s central bank bond purchases (figure 5).

Figure 5: 2-Year Government Bond Yield

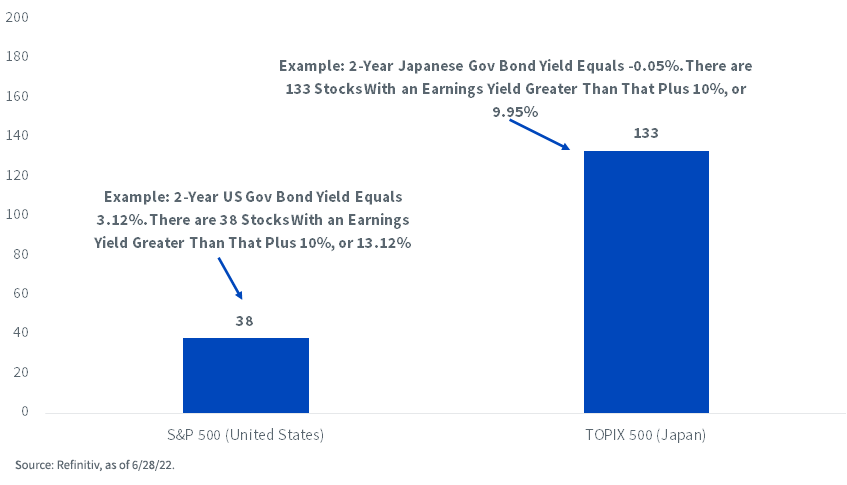

Try this exercise: make a list of all S&P 500 stocks that have an earnings yield that is at least 10 percentage points higher than the yield on two-year Treasuries.

There are 38 such companies.

In Japan, if you run the same exercise on the TOPIX 500, the screen comes up with 133 stocks that have earnings yields that are 10 points higher than two-year JGBs (figure 6).

Figure 6: Number of Index Members with Earnings Yields More than 10% Higher than Domestic 2-Year Government Bonds

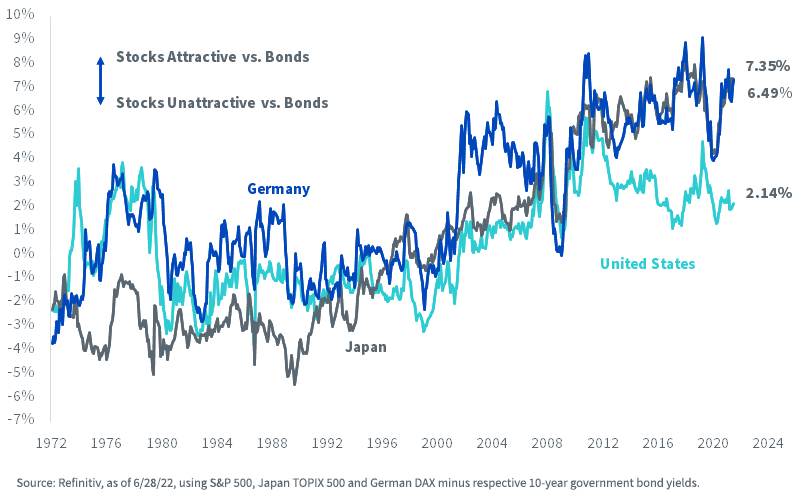

Figure 7 shows another stock-to-bond comparison: the broad market earnings yield gap over 10-year sovereigns. Japan’s TOPIX 500 offers a spread of 737 basis points (bps) over near-zero yielding JGBs, considerably more than the 161 bps spread offered by the S&P 500.

Figure 7: Stock Market Earnings Yield Minus 10-Year Government Bond Yield

We have two Japan ETFs, one that hedges the yen and one that does not.

If you want to avoid owning the stocks in yen, the one to review is the WisdomTree Japan Hedged Equity Fund (DXJ).

For investors that want Japanese stocks without the currency hedge, consider the WisdomTree SmallCap Dividend Fund (DFJ).

Originally published by WidsomTree on July 21, 2022.

For more news, information, and strategy, visit the Modern Alpha Channel.

Important Risks Related to this Article

DXJ: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investments which can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DFJ: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on smaller companies or certain sectors increase their vulnerability to any single economic or regulatory development. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.