[ad_1]

peterschreiber.media

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Forget What “Should” Be Happening And Focus On What Is Happening

As everybody knows, securities markets have heard of reality, but they’ve never taken any notice of it. Or rather, securities markets run to their own logic, and since markets are moved by those with the biggest accounts and those same folks tend to be the best informed, markets move ahead of the news, not in response to it. Because, by the way, the media mogul spoon-feeding you the news? That guy – always a guy – he’s big buddies with the guy – almost always a guy – running Big Money, LP. We can’t say that anyone does anything they shouldn’t. We can say, to quote Lou Reed who apparently quoted someone else, “Don’t Believe Half Of What You Hear, And None Of What You Read.” So if you’re trying to work out the direction of markets, don’t bother turning to the news for inspiration, unless you are in fact Big Money, LP and you want to know what Chad and the bros are going to be trading Monday, so you can trade in the opposite direction.

Next up, your own informed brain? Ignore it. You’re smart. You know about macro and earnings and inflation and all that. So you can construct a perfectly sensible narrative on the way to the office about how stocks should move today and tomorrow or, if not on a daily basis at least directionally over a few weeks.

Nope.

This is not the way to do it. Unless, again, you be Big Money, LP, because then you can just make it happen with the big ol chunks of change you are deploying into the market. Move the index down? Initiate an OTM SPY put rollout plan. Fat puts 5%-10% out of the money, force dealers to short the index to hedge the fat position you just bought off of them, that drags momentum players into selling, your puts look like being in the money … quick! … roll ’em out and down, rinse and repeat. This controlled demolition of Gramps’ 401k has been the story of H1 2022. If you’re Big Money now? Load up on calls. Or puts. Whatever. Because the market is going to follow you around.

If you are not Big Money, LP, then, fear not, because although you may not sit in the room with 14 Masters of the Universe plotting what’s next, you have an insight into what’s next that is both free and comes with just a slight delay. It’s called a stock chart. And if you learn to speak stock chart – it’s not that hard, just translate it into the ways you think that Big Money is trying to take your money off of you, and you can understand what’s happening with all the squiggly lines.

Right now this is in our view the best way to judge whether we’re soon once again going to be asking, Wen Moon, or, whether we’re going to be considering whether we can afford dinner tonight or whether maybe we aren’t hungry and could go, you know, a couple of days before we have to eat. (Actually, it’s summer, at least in our hemisphere. Don’t need firewood. Can you eat firewood? Maybe with a few fava beans?)

Let’s use NASDAQ:QQQ as a lens, because it’s highly liquid, traded by Big Money and Chad alike, and best of all, has these last few years conformed perfectly to certain technical analysis tools. And we can bring it all together as the QQQs attempt to reach escape velocity right now. What does the chart tell us could happen?

First, let’s look purely at history.

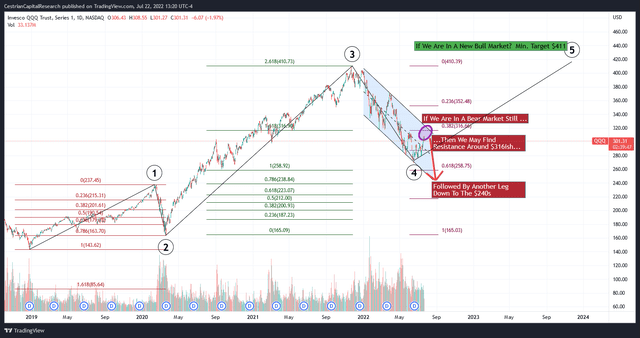

Looking backwards – the QQQ put in a Wave 1 up off the 2018 lows, peaking right before the COVID crisis. Wave 2 bottomed at the 0.786 retrace of that Wave 1 up – that’s a textbook Wave 2 low – in Q1 2020. Then a substantial Wave 3 up peaking at the 2.618 extension of Wave 1 – and then a move into a Wave 4 down which so far has bottomed between the 0.5 and the 0.618 retracement of the Wave 3 up. So far, so Stock Charts 101. Nothing unusual here.

Now what?

Here’s now what.

QQQ Chart (TradingView, Cestrian Analysis)

You can open a full-page version of this chart, here.

The whole question with the Nasdaq – or the S&P for that matter – right now is, are we in a bear rally, or are we off to new highs? And how should you position yourself?

To our mind, it’s simple. While the market is going up, it’s going up, and our best guess is that QQQ can reach $317 without anyone being able to say whether the bull or the bear is calling the shots. Because $317 is both the top of that downward-sloping trading channel you see above, and, it’s the 0.382 retracement of the prior Wave 3 up. So it’s a big important number. If QQQ can’t get there, and it just swoons, as it did today, you know the answer. The bear was just having a snooze after having loaded up on fresh salmon. And now it’s hungry again and looking for fresh Chad to eat. Next stop, $240 or thereabouts, so, buckle up.

But if QQQ hits that $317 zip code and pushes up through it? That’s a signal that maybe, maybe, the bull is back and has the ball. And if QQQ pushes up over $317, comes back down, tests it as support a couple of times and then moves up? Then, then, friends, it’s time to look up at the stars from down here in the gutter and start dreaming of all-time highs once more.

We’ll leave this one with you. This is what we watch all day every day. (Not many windows in our office.) FOMC coming next week, meaning it’s Anything Can Happen Tuesday, Wednesday and Thursday. After that, we’ll see what the market wants to do.

Cestrian Capital Research, Inc. – 22 July 2022

[ad_2]

Source links Google News