[ad_1]

The Goldman Sachs Treasury Access 0-1 Year ETF could help investors position their portfolios for higher interest rates and a potential recession.

jjgervasi

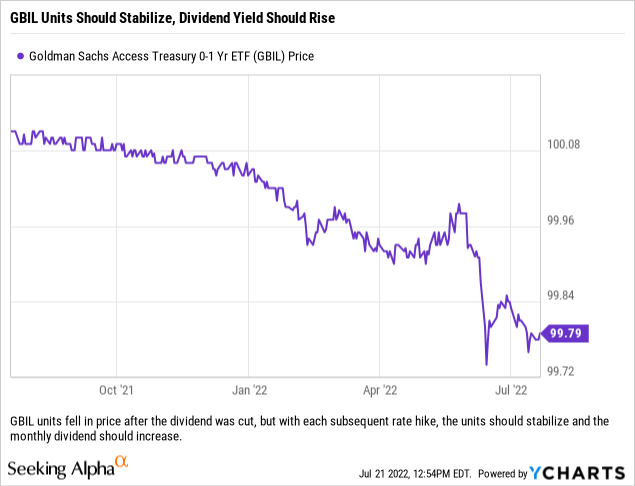

Back in May we wrote an article where we discussed the need for investors to be cognizant of the risks associated with the ETFs they were using in their portfolios as cash proxies. Many investors have been stung in recent months by their low duration fixed income ETFs (we are speaking of those with short to intermediate maturities) falling dramatically (in relative terms when compared to stable NAV issuances) due to the U.S. Federal Reserve’s shift in policy to ‘Monetary Tightening’. Rates have gone up dramatically, and the market is predicting that they shall continue to move higher through the end of the year and even into 2023. We do not disagree with the general market consensus, and because of that we believe that investors who want to utilize fixed income securities within their portfolios should focus on low duration (and maybe even more importantly, short maturity) investments. This will help preserve capital, allow for the portfolio’s yield to reset to market rates faster and should give investors the ability to exit the position to go longer in duration, at the right time, with minimal capital losses that could be covered by interest earned.

Previously we highlighted floating rate ETFs, but today we want to highlight the Goldman Sachs Treasury Access 0-1 Year ETF (NYSEARCA:GBIL) which we believe investors can utilize for some longer-term liquidity needs or as a fixed income place holder. We like this ETF here because if an investor is trying to preserve capital heading into a possible recession, by utilizing a government/treasury focused fund they are able to remove credit risk and corporate spread risk from the equation and can really focus on interest rate risk and preserving their capital.

Fund Structure

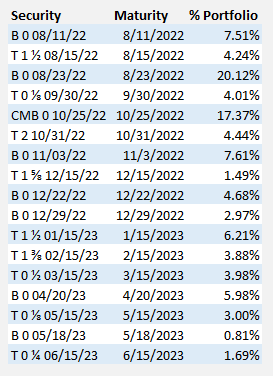

As previously mentioned, this is an ETF which holds only government/treasury issuances. Below we have included the current holdings, arranged by maturity date:

We like the composition of the current holdings, with over 30% of the portfolio maturing in the next month. (Securities Filings, Author)

The fund looks to replicate the performance of the Citi U.S. Treasury 0-1 Year Composite Select Index, which is an index that is designed to measure the performance of U.S. Treasury securities with a remaining maturity of 12 months or less.

In the current rate environment, we like that the ETF is structured to have significant maturities over the next month and 3-month periods. The U.S. Fed is expected to raise rates again at their next meeting, July 27, 2022, and continue tightening into 2023. With about 31.87% of the portfolio set to mature in the next 30 days, that will offer a pretty significant reset on the yield of the ETF – and enable larger distributions to investors. Better yet, as it stands now, roughly 57.69% of the portfolio will have matured by the end of October and another 7.61% of the portfolio will mature the day after the Fed meets in early November.

Based off of where rates currently are, the current yield curve, and the projected yield curve, as the portfolio’s current holdings mature they will be invested in securities which will have higher yields. With GBIL currently showing a net indicated yield of 0.79% each of these maturities over the next month to three months has the potential to help move the yield sharply higher – especially with each security purchased with a maturity close to 12 months.

The other positive of the structure here is that investors are avoiding having to deal with the inverted portion of the yield curve by avoiding going out into the 2-10 year space. With the market still trying to figure out how and when a potential recession could wreck havoc on the Fed’s tightening program, staying short and avoiding funds that are having to purchase fixed income securities that have lower yields with longer maturities is a smart play currently.

With monthly dividends having been reinstated recently, GBIL could be paired with money market mutual funds within one’s portfolio to generate income and manage duration risk.

Our Final Thoughts

We think that investors should sit on the sidelines for now and only start purchasing the Goldman Sachs Treasury Access 0-1 Year ETF after the next rate hike by the U.S. Fed (on July 27th). After that meeting we believe that GBIL can be used for funds that one wants to keep liquid but earn a little income on, or for funds that are currently invested in shorter duration fixed income that one might want to bring further in to avoid the larger losses of being further out on the yield curve in a rising rate environment (namely the 1-2 year space).

We still think that there may be losses here, but that is the nature of a fixed income holding during a period of aggressive rate increases by a central bank. The good news is that we see dividends increasing in the months ahead, and with the current maturity schedule, there should be meaningful dividend increases on a monthly basis for the next quarter or two.

Readers should also keep in mind how these short duration funds behave. When rates are rising, their value lags and can trade lower at the same time that their rates, while rising, will lag the Fed. On the other hand, when the Fed stops aggressively raising rates these funds can perform well as their expected income catches up to the yield curve, and if rates head lower the funds can actually increase marginally in value (which is a bonus during a recession and equity bear market). This should be kept in mind when deciding how to utilize short duration fixed income ETFs in one’s portfolio and exactly what purpose that holding will serve.

[ad_2]

Source links Google News