[ad_1]

MF3d/E+ via Getty Images

Investment Thesis

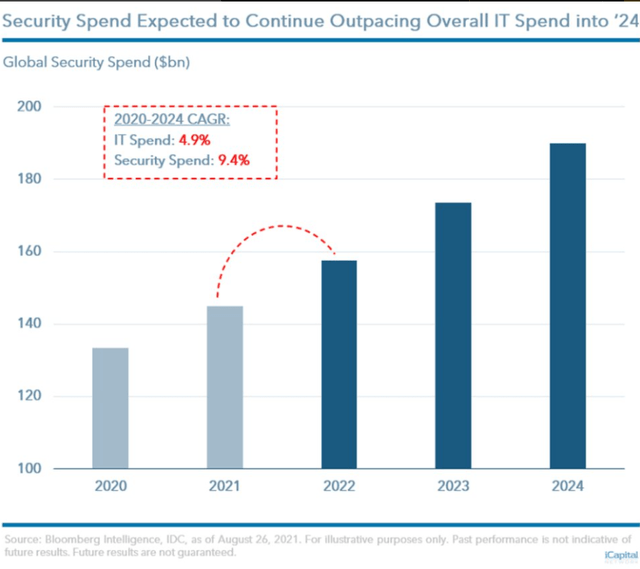

Cybersecurity protects against a wide range of cybercrimes, including ransomware and cyberattacks. This is a growing global concern, affecting both the public and private sectors. According to projections, the global cybersecurity market will grow from nearly $180 billion in 2021 to more than $370 billion by 2028, at a CAGR of 13%, outperforming other sectors of the S&P 500 index in the process.

Investors have been drawn to cybersecurity stocks in recent years in an effort to profit from the industry’s robust tailwinds. This has created a bidding war for a limited number of companies, driving stock prices and valuations higher across the cybersecurity sector. Despite the recent correction and the untapped potential of this sector, I believe cybersecurity stocks continue to be expensive in a rising rate environment, with many names trading at over 2x earnings growth. Further monetary policy tightening and the prospects of an economic downturn are likely to continue to put downside pressure on this sector and I expect cybersecurity stocks to trade lower over the next 18 months.

Strategy Details

The First Trust Nasdaq Cybersecurity ETF (NASDAQ:CIBR) tracks the investment results of the Nasdaq CTA Cybersecurity Index. The index invests in “companies primarily involved in the building, implementation, and management of security protocols applied to private and public networks, computers, and mobile devices in order to provide protection of the integrity of data and network operations.” The minimum market capitalization required to be part of the index is $250 million.

If you want to learn more about the strategy, please click here.

Portfolio Composition

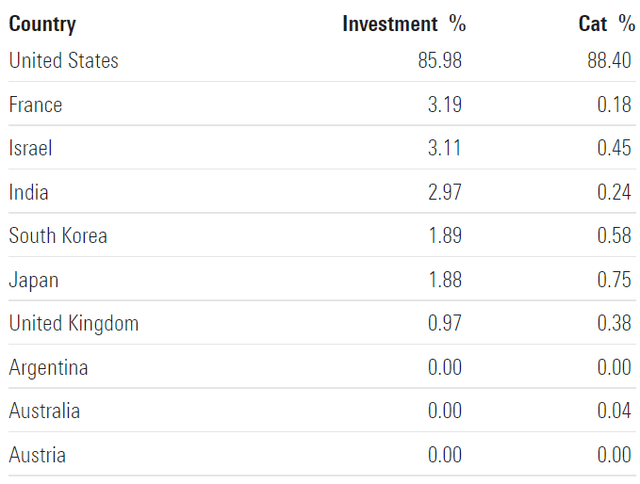

CIBR invests over 93% of its total assets in the Technology sector. In terms of geographical allocation, the U.S. accounts for ~86%, followed by France (~3%) and Israel (~3%).

Morningstar

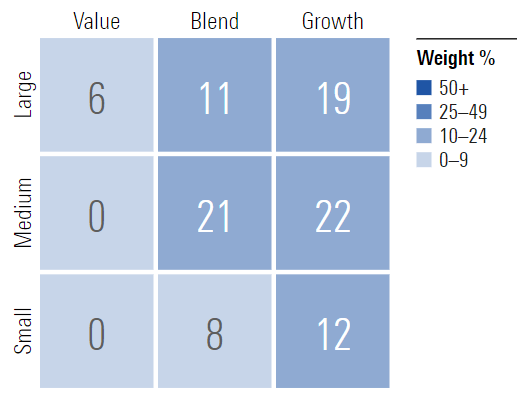

~22% of the portfolio is invested in mid-cap growth equities, characterized as mid-sized companies where growth characteristics predominate. Mid-cap issuers are generally defined as companies with a market capitalization between $2 billion and $8 billion. The second-largest allocation is mid-cap “blend” stocks, which account for 21% of the portfolio.

Morningstar

CIBR is currently invested in 38 different stocks. The top 10 holdings account for ~47% of the portfolio, with no single stock weighting more than 7%. In my opinion, the fund runs a concentrated portfolio where a few stocks are likely to drive future returns. Investors need to feel comfortable owning such a portfolio before investing in it, as concentration can remove some of the benefits of ETF investing and increase volatility.

Morningstar

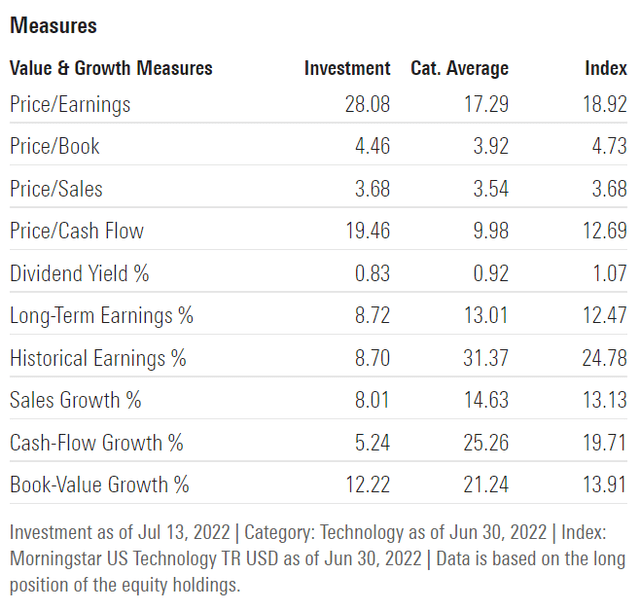

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Morningstar, CIBR trades at ~4.5x book value and ~28x earnings. Despite the huge growth potential of the sector, I believe CIBR is expensive from an absolute perspective. In the context of higher interest rates, we could very well see CIBR trading below 20x earnings at a PEG ratio of ~1, implying another ~30% drop from the current level.

Morningstar

Is This ETF Right for Me?

CIBR is a growth-oriented strategy suitable for investors that aren’t afraid of volatility. I believe volatility will be a key theme for this strategy and for the markets over the next couple of months since financial conditions have tightened considerably in recent weeks. However, there is still room for more tightening in the economy before something breaks as illustrated by the Chicago Fed National Financial Conditions Index. As a result, I expect volatility to remain high, especially for high-multiple stocks.

Federal Reserve Bank of Chicago

Over the long term though, I’m optimistic about the industry’s prospects, as I believe the demand for cybersecurity solutions will only be increasing over the next decade. That said, CIBR is trading at a ~2x PEG ratio, which makes it pricey in a rising rate environment where economic growth is reaching a tipping point. In this context, I think that investing in CIBR today doesn’t provide the best risk-reward opportunity for investors.

Bloomberg/IDC

I have compared below CIBR’s price performance against the Invesco QQQ ETF (QQQ) and the ETFMG Prime Cyber Security ETF (HACK) over the last 5 years to assess which one was a better investment. Over that period, QQQ outperformed both cybersecurity strategies. CIBR underperformed the tech index by a ~22 percentage points margin.

To put CIBR’s returns into perspective, a $100 investment in this fund 5 years ago would now be worth $181.64. This represents a compound annual growth rate of ~12.7%, which is a very good absolute return. However, investors shouldn’t expect past returns to be representative of future returns, especially since we have switched to a different liquidity regime.

Refinitiv Eikon

Key Takeaways

CIBR invests in companies primarily involved in the building, implementation, and management of security protocols applied to private and public networks, computers, and mobile devices in order to provide protection of the integrity of data and network operations. In recent years, investors have been drawn to cybersecurity stocks in an attempt to profit from the industry’s strong tailwinds. This has resulted in a bidding war for a small number of companies, rising stock prices, and valuations across the cybersecurity industry. Despite the recent correction and the sector’s untapped potential, I believe cybersecurity stocks remain expensive in a rising rate environment. Volatility remains a key theme of this market and investors should seek to take advantage of it over the next months by accumulating shares at lower prices. Given where valuations are across the cybersecurity sector, I wouldn’t exclude another 20% to 30% drop from the current level over the next 18 months.

[ad_2]

Source links Google News