[ad_1]

igorbondarenko

As noted in this week’s ‘Leaders/Laggers’ section of The Lead-Lag Report, there is something of an illusion going around that emerging markets have been coping quite well relative to the US markets; I’d like to disabuse prospective investors of that notion, as EM strength has been largely unidimensional, with much of that coming from China alone which is up 9-10% over the past month; conversely EMs (ex-China) have had a difficult period over the past 2-3 weeks.

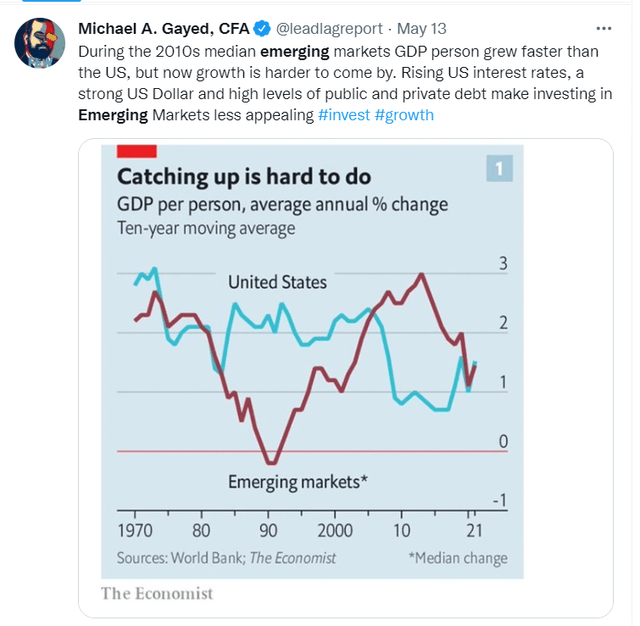

Notwithstanding near-term pressures, there’s good reason to also question the long-term merits of investing in EMs. As noted in The Lead-Lag Report, unlike in the previous decade, there doesn’t appear to be any significant edge in the GDP per person differential between US and EMs. Currently of course, sentiment has taken a beating on account of the dollar’s strength and heightened indebtedness.

Turkish conditions

As you can imagine from my commentary in the previous section, EMs are probably not my favorite “go-to” option at this juncture, and the iShares MSCI Turkey ETF (NASDAQ:TUR) is one EM-themed product I would view with even more trepidation.

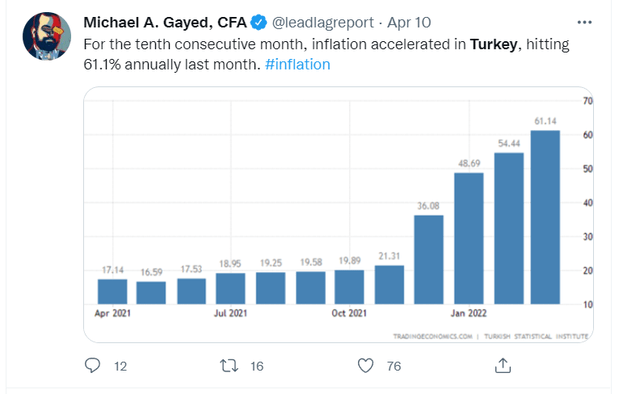

A few months back, I was getting dizzy about ever-growing inflation trends in Turkey which had just crossed the 60% mark; well, if you thought that was bad enough what about the most recent reading (for the month of June) of 78.6%, a level the economy has not hit in nearly 25 years! We’ve now had 13 straight months of accelerating inflation and it does not appear that we’re close to a ceiling. If you’re looking for the high base effect to kick in, you’d have to wait until Dec (where last year it had grown by 36%). The most recent Reuters poll numbers suggest that Turkey will finish the year with inflation levels of nearly 70%; incidentally, this has been scaled up from the May month poll which had year-end inflation at 63.5%.

With Turkish real rates deep in negative territories, the Erdogan administration (with an eye on the elections next year) thinks they can ameliorate the populace (particularly the lower strata that form an important voter base) with minimum wage hikes. In Jan we’d witnessed a 50% hike, and recently we’ve seen another hike of 30% that will affect 40% of the workforce. Measures of this sort don’t address the root of the problem which is taming inflation; in fact this may only continue to stimulate the inflationary fires even more.

Higher employee costs will hamstring the competitiveness of Turkish businesses as they will look to pass this on to the end customer who is already facing higher prices. Alternatively, faced with a more stringent OPEX base local businesses could be forced to curtail production which could limit supplies in the market. Higher minimum wages could also result in more money chasing fewer goods which will bring a different dimension to the inflationary malaise. Turkey is also not best placed to resort to ample import supplies to make up for gaps, given the remarkably weak positioning of the Turkish Lira which has lost over half its value this year. The central bank has done a lot to try and arrest the fall but the country’s gross FX reserves are now at 11-month lows of only $60bn or so.

Most recently they’ve resorted to yet another short-term fix by preventing companies who have excess FX reserves (if FX is >10% of their assets or annual sales) from taking on fresh commercial lira loans. To gain access to these lira loans, companies will then be forced to trim their FX, which may support the LIRA. Admittedly, the TRY has appreciated over the last few days but I don’t believe this can support the currency in the long run as Turkish companies will at some point want to boost their FX holdings once again.

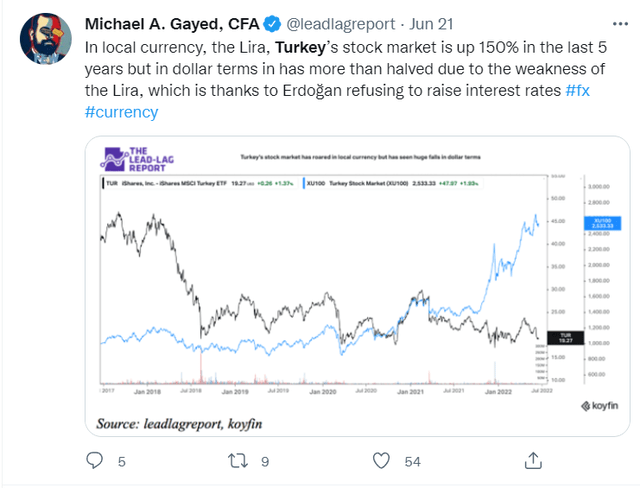

Nonetheless, the unappealing FX narrative is also likely to be a massive overhang on your own position, if you decide to go with this product. Last month, I had put out some content on the timeline of The Lead-Lag Report highlighting the massive differential in FX adjusted returns and local currency returns. At this juncture, it is difficult to see how this picture can be overturned.

All in all, I’m not sure how Turkey gets itself out of the rut; fundamentally what’s at the heart of its malaise? It’s Erdogan and his mind-boggling policies, and if any panacea is to be found, it will probably need to start with the potential ouster of Erdogan, after the elections next year. That’s no easy task though, as you’re looking to uproot someone who has held sway over the Turkish landscape for two decades now! Besides, there are plenty of Turkish voters who lack confidence in the opposition. Nonetheless, as things stand, the recent polls suggest that Erdogan could narrowly miss out, even as his party (AKP), loses control of parliament.

Conclusion

For all the unappealing aspects of investing in Turkey, it’s hard to turn a blind eye to how cheap the product is. According to YCharts, TUR only trades at a minuscule forward P/E of 4.7x, whereas conversely, your broad-based iShares MSCI Emerging Markets ETF (EEM), trades at a multiple that is more than 2.2x higher at 10.7x. In addition to that investors also get to lock in a fairly useful yield of nearly 3.5%.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

[ad_2]

Source links Google News