[ad_1]

MF3d/E+ via Getty Images

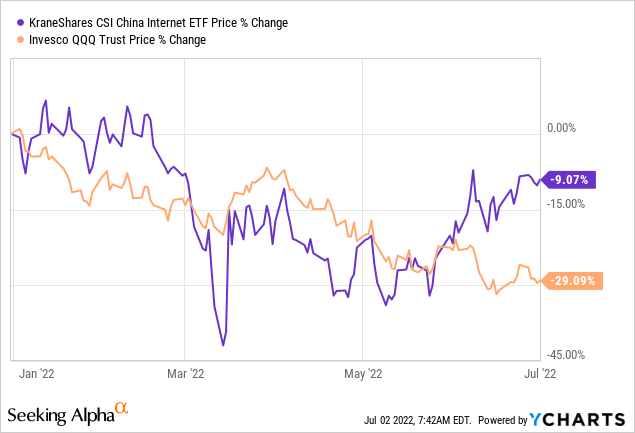

Painful memories take time to heal, especially for those who invested in China. I still remember how hard it was for me to sell my Baidu (BIDU) shares in mid-2021 after delisting fears in the U.S. and regulatory risks in China ended up offsetting the growth opportunities offered by the AI company. This time around, I consider a more diversified exposure in the form of the KraneShares CSI China Internet ETF (NYSEARCA:KWEB). I was encouraged by the fact that KWEB has been relatively less volatile than the Invesco QQQ Trust (QQQ) with its large-cap U.S. tech stocks since the beginning of 2022 as shown in the blue chart below.

In fact, most of the Chinese tech stocks forming part of the ETF have been on a winning spree since the end of May when China lifted nearly two months of lockdown on Shanghai and other parts of the country.

The objective of this thesis is to assess whether KWEB will enjoy a sustained upside and I start by analyzing the financial conditions in China.

Relatively better conditions in China

Compared to the U.S., Europe, and many other parts of the world, the economic environment in China is synonymous with more stability. This is no democracy, and sometimes you can be shocked by the news about large real estate companies risking to default on their debts thereby creating doubts in people’s minds about the effectiveness of financial services compliance. However, there is still the rule of law and the Chinese central government does have the financial might to pump in billions of dollars’ worth of stimulus measures.

Equally important, its central bank is not facing the same predicament as the U.S. Fed when it comes to interest rates and inflation. Thus, key interest rates were kept on hold in May while the five-year Loan Prime Rate (borrowing rate) has been reduced to boost the housing market. This signifies that the authorities do have more room to maneuver in case inflation rises or economic growth stalls.

As for fears of U.S.-listed Chinese stocks being delisted, there has been some progress on audit-related disputes between China’s Securities Regulatory Commission and the United States SEC (Securities and Exchange Commission).

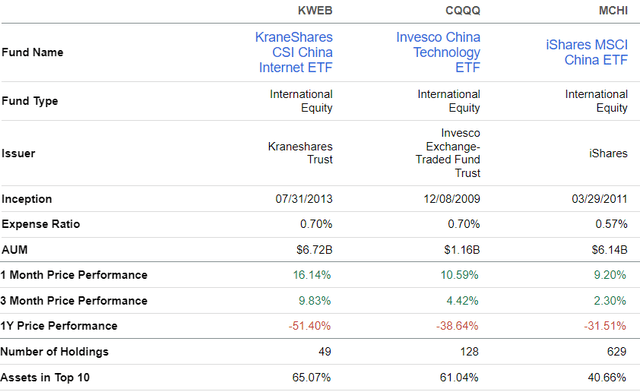

Pursuing further, at the height of the crackdown in September 2021, Chinese regulators were imposing rules which played havoc with the stock prices of tech and edutech (educational technology) companies. Looking at stock price performance, crackdowns, and economic slowdowns mainly due to Covid have resulted in considerable capital outflows. As a result, the tech sector has still not yet recovered with KWEB and its peers, namely the Invesco China Technology ETF (CQQQ) and the iShares MSCI China ETF (MCHI) being down by more than 30% on a one-year basis as shown below.

Comparison with peers (Seeking Alpha)

With fewer holdings and more assets in the top ten, KWEB suffers from more concentration risks, which explains why its one-year price performance is significantly depressed, by more than 50%. For investors, concentration, in this case, implies being relatively more exposed to big names (as a percentage of total assets) instead of diversifying assets among more companies as fund managers at Invesco and iShares ETFs have done.

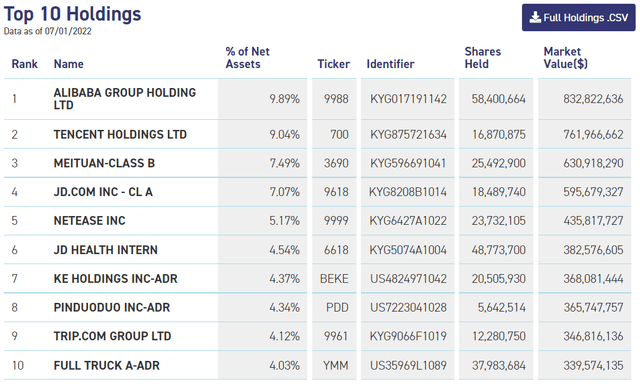

For this matter, more details about KWEB’s holdings are in the table below.

KWEB’s holdings and its non-correlation with U.S. stocks

The KraneShares ETF dedicates nearly 10% of its assets to Alibaba Group Holding (BABA) and 9% to Tencent (OTCPK:TCEHY). Its third and fourth holdings each also make up for above 7% respectively. KWEBs’ top four holdings which constitute about 31% of total assets have largely helped the ETF outperform its peers in the last month through better individual performances.

KraneShares (KraneShares)

Thinking aloud, KWEB, which tracks the CSI Overseas China Internet Index, makes sense for those who do not necessarily want to effect long-term investments in individual Chinese companies, but, instead, want to take advantage of the momentum starting to build around the tech sector. Still, I remind them that the ETF’s holdings are not significantly undervalued with respect to U.S. peers when considering the price-to-sales multiple. Consequently, do not expect a surge in its share price due to investors rotating from the growth to value strategy.

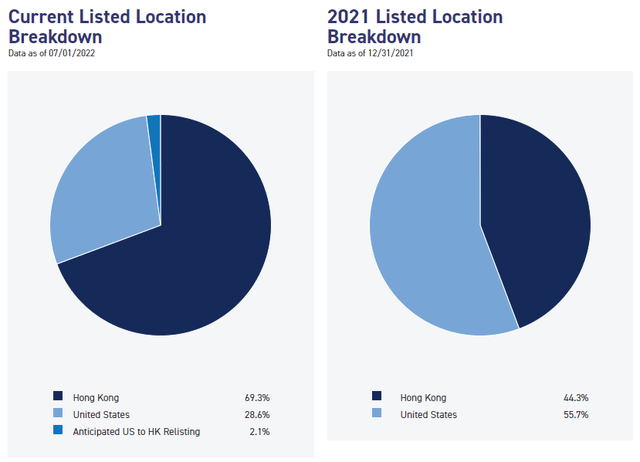

Additionally, since most (69.3%) of KWEB’s NAV or net asset value is made of the Hong Kong-based secondary listings, investors also have access to an asset class that is less correlated to the tech in the U.S. In this respect, KWEB’s underlying fund currently consists of only 28.6% of U.S. listed ADRs, down from 57.7% on December 31 2021 as illustrated in the charts below.

Listing breakdown (KraneShares)

Thus, in current volatile conditions for the U.S. and also European stock markets, Chinese internet stocks which are more shielded from the risks of high inflation make for an investment case, certainly not a destination where you want to transfer all your hard-earned cash to, but rather one which you want to use for part diversification purposes.

The Growth Rationale

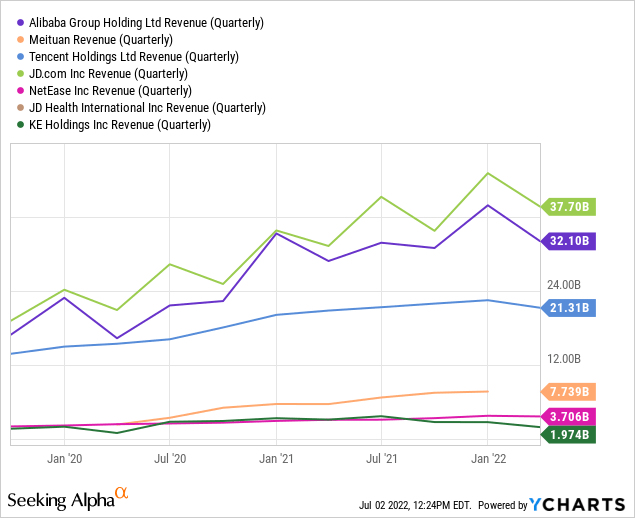

In addition to diversification, China’s internet companies provide real growth prospects. In this context, KWEB’s holdings can be envisioned to a certain extent as the Chinese equivalents of Google (NASDAQ:GOOG), Facebook (NASDAQ:META), Amazon (NASDAQ:AMZN), Twitter (TWTR), etc. in a country where domestic consumption is growing through expansion of the middle-class population. Thus, quarterly revenues for KWEB’s top seven constituents have been on an uptrend during the last three years as shown in the chart below with the exception of KE Holdings (BEKE), which has been impacted by the drop in the number of housing transactions on its integrated online platform.

Now considering that the internet population in China had reached a penetration rate of 73% in 2021, there are prospects for revenues to grow further. There should also be more online shopping transactions as these still accounted for 25% of retail purchases in China in 2021.

Discussion and Valuations

In a highly volatile market subject to perpetual fears about inflation on the one hand and recession on the other, where the S&P 500 Index has declined by more than 20% in the first half of the year, an investment in KWEB makes sense. As for valuations, compared with QQQ whose price-to-earnings ratio is 31.23x, KWEB, with a P/E of 23.95x, can appreciate to $43.3 based on an upside of 30%.

My bullish stance is reinforced by the fact that things appear to have eased on the regulatory front, and the mood among government officials is more towards promoting business development and fighting economic headwinds. To this end, a key observation is that since some hints about the end of the tech crackdown in March 2022, there have been no new cases of authorities imposing big fines.

Still, investors are reminded that with China’s zero Covid policy, complete lockdowns of whole cities and regions should not be excluded. This may in turn cause disruptions in demand for products sold through the internet as supply chains become constrained. This may result in volatility for the ETF’s holdings as was the case from April to May of 2022 when there was nearly a 20% downside as shown in the introductory chart in blue.

For this matter, the U.S. whose population is vaccinated against Covid and insulated from geopolitical risks plaguing Europe, still remains attractive despite current woes. This is mainly due to the fact that the country has a transparent regulatory system where lawmakers carry out intensive debates in Congress before implementing legislation, rather than calling for abrupt changes.

Conclusion

China’s big internet names are set to benefit from a marked decrease in the level of regulatory scrutiny since March, as well as an opening up of the economy which was in lockdown mode due to a rise in infection rates. In this respect, KWEB should also benefit from capital inflows as investors flee from economic uncertainty in the U.S. and Europe.

Additionally, the revenue growth trend seen by the tech sector should be sustained given that China has a huge population and the internet penetration rate still being far from the U.S.’s 97% figure. This said, also expect volatility risks given the country’s Zero-Covid approach.

Finally, more cautious investors may wait for the Communist Party Congress sometime in November this year, an occasion when key strategic directives are normally adopted.

[ad_2]

Source links Google News