[ad_1]

Vertigo3d/E+ via Getty Images

As an individual investor, I have an interest in ensuring that my portfolio is as diversified as possible, especially the portion that is devoted to index ETFs. One of the downsides of index investing is the phenomena of market-cap weighting. This can lead to mega cap tech names being over-represented in a supposedly ‘diversified’ portfolio of stocks. One possible way to overcome this deficiency is to invest a slice of one’s portfolio in a fund which carries different position weights than most ‘standard’ index funds do. The Invesco S&P 500 GARP ETF (NYSEARCA:SPGP) is one such fund. By insisting on growth at a reasonable price – or “GARP” – the fund avoids the market-cap weighting of most index funds and succeeds admirably as a portfolio diversifier.

SPGP came about in June of 2011. Since that time, it has accumulated over $800 million under management, on which it charges a high but not stratospheric 0.36% expense ratio. Liquidity for the fund is strong enough for most retail investors, with over $12 million in shares traded on the average day.

The methodology used by SPGP is to select the 75 stocks in the S&P 500 which score highest based on a ‘growth score’ (calculated based on earnings and sales growth rates), and a ‘quality and value composite score’ (calculated based on each firm’s financial leverage, return on equity, and P/E ratio). These stocks are then weighted based on their growth scores, although no security in the fund can have a greater than five percent weight in the fund.

As the above makes clear, any methodology which filters out over 80% of the S&P 500 will necessarily have a different portfolio makeup than a plain-vanilla index fund. A review of SPGP’s holdings amply confirms this hunch. While the SPY contains such well-known names as Apple (AAPL), Microsoft (MSFT), Tesla (TSLA), and Berkshire Hathaway (BRK.A)(BRK.B) among its top holdings, SPGP’s top holdings are composed of less well-known (but still largely reputable) names like Regeneron Pharmaceuticals (REGN), NRG Energy (NRG), eBay (EBAY), and Cincinnati Financial Corp. (CINF)

Another critical differentiator between SPGP and SPY are their weighting mechanisms. SPY’s market-cap weighting methodology forces the fund to overweight its top holdings, with the result that the fund allocates a large amount of capital to the first few stocks in its portfolio, while some of the smaller stocks of the S&P 500 have barely any representation in the index whatsoever. While the approach has its merits, it also does call into question how truly diversified a fund based strictly on the S&P 500 truly is. SPGP is different and weights its holdings based upon its proprietary factors. The result is that the relative weights of the holdings within SPGP are much less skewed than is the case in SPY.

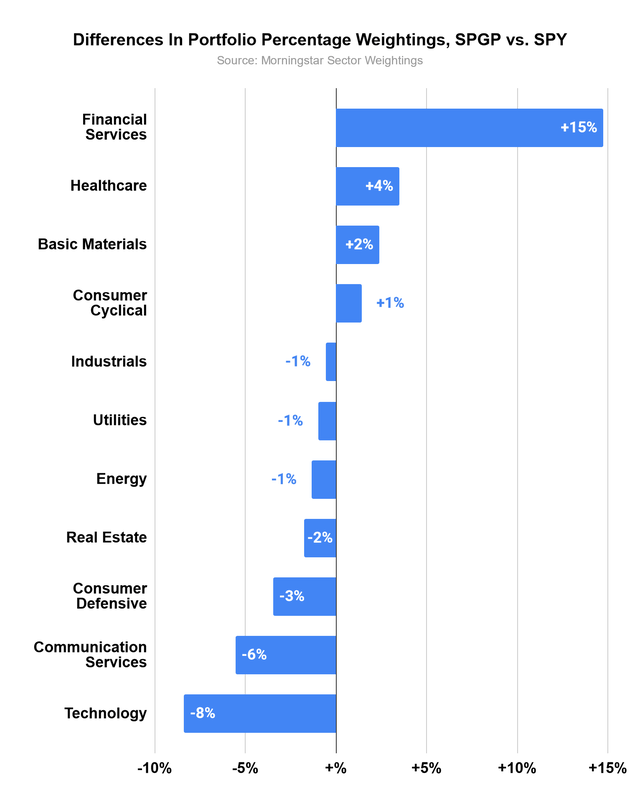

Another point of differentiation between the funds is the relative sector weightings between the two funds. It will probably not come as a surprise to learn that SPY is a relatively tech-weighted fund, with almost a quarter of the fund’s assets invested in the tech sector. SPGP takes a different tack, investing only 16 percent of its assets in the technology space, while (currently) overweighting financial services to the tune of almost 28 percent of fund assets. The chart below illustrates what the sector differentials look like for SPGP compared to the SPDR. For instance, for every dollar invested in SPGP, the fund allocates 15 more cents of that dollar to the financial services sector than would be the case had that dollar been invested in SPY. Conversely, SPGP’s underweight of the technology sector means that each incremental dollar invested in SPGP buys eight cents less tech exposure than would be the case if that dollar had gone into the SPY.

Relative Sector Weightings, SPGP vs SPY. (Data from Morningstar; Image created by author)

This differentiation between sectors relative to broad-market ETFs is something that I consider to be one of the primary value-adds of SPGP as part of a broader equity portfolio – you get a diversified range of stocks which do more to diversify your overall portfolio than adding another incremental amount of SPY or other traditional market ETF would.

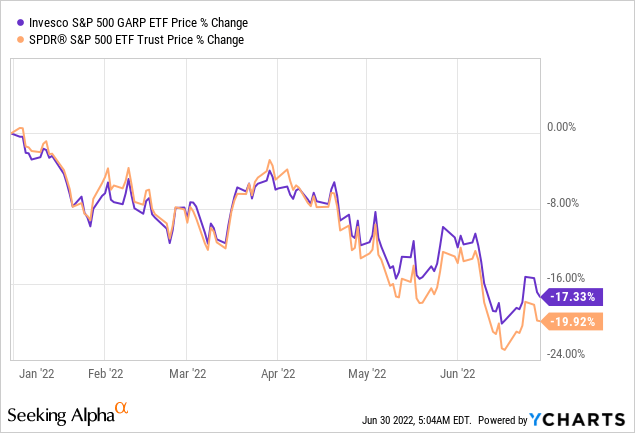

Since the start of the year, SPGP has followed the broader markets lower, but has declined at a slightly lower rate than more ‘standard’ index ETFs have. This is likely due to the fact that, in accordance with its selection methodology, SPGP shies away from the more overvalued portions of the market whose multiples have come crashing back to earth this year.

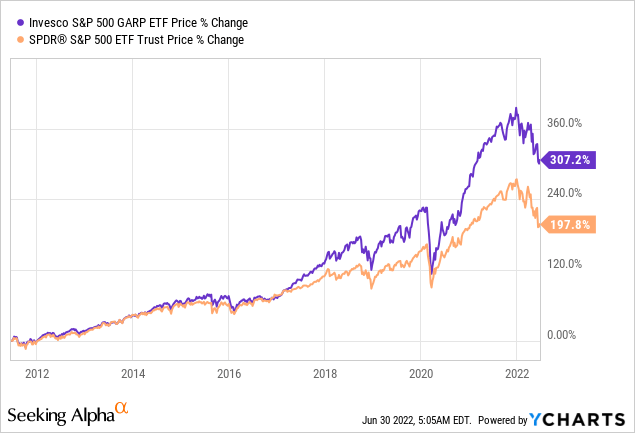

It is important to note that SPGP’s outperformance is not necessarily restricted to the current market environment. Since the inception of the fund, SPGP’s approach has yielded a superior price return to the SPY, though most of the divergence occurred after 2016. While it would be foolish to assume that SPGP will outperform the market in all circumstances going forward, the historical success of the fund relative to the market may indicate that the ‘GARP’ model which informs its portfolio construction may have some empirical validity after all.

Part of SPGP’s outperformance may be due to its much more active trading strategy — Morningstar reports 68% portfolio turnover for SPGP, as opposed to merely two percent for SPY. This suggests that there is more turnover in the rankings of SPGP’s value- and growth-based index ranking than there is in the S&P 500. That can work well when portfolio managers make the right decision about what stocks to move into — but could wind up being a double-edged sword should the market penalize SPGP’s value- and growth-weighting methodology at some point in the future.

Final Thoughts

They say that diversification is the long-term investor’s only free lunch. To that point, it makes sense to dedicate a good chunk of one’s portfolio to investments that represent one or more broadly-diversified equity indices. However, the weightings within these funds may lead to a situation in which a handful of stocks dictate the overall performance of the fund, thanks to market-cap weighting. SPGP can help to alleviate this tendency when used as a supplement to a broader equity portfolio. The fund’s value/growth-based methodology breaks free of the constraints of a market-cap based approach. This in turn allows investors to buy a basket of decently high-quality stocks, with the knowledge that companies which become overpriced relative to their growth prospects will be automatically pruned from the fund before they can ‘fall back to Earth’. I own this fund, and would recommend it for consideration as a supplement to an existing portfolio.

Note: Use my work as a starting point for your own due diligence, not as a substitute. All investments involve the risk of loss of income as well as the principal. Consider consulting with an investment adviser before making any investment. I am not a tax professional or investment advisor. Please consider consulting with a tax professional before making any investment. Author-generated charts are subject to error due to discrepancies in source data or securities being listed on multiple international markets.

[ad_2]

Source links Google News