[ad_1]

Nataya Saweddit/iStock via Getty Images

ETFMG Prime Mobile Payments ETF (NYSEARCA:IPAY) is a thematic fund offering a rare opportunity to capitalize on the long-term digitalization of finance (e.g., the gradual extinction of cash and credit cards and the rise of electronic systems) which should stimulate a steady expansion of the total addressable market creating a gamut of opportunities for names involved; most importantly, this long-term shift is not to be reversed even if a recession strikes in the short term though, in fairness, it can be significantly slowed down for a while. We see a plethora of tailwinds supporting a long-term bullish view but tactically, the fund is not yet priced adequately enough to safely accumulate.

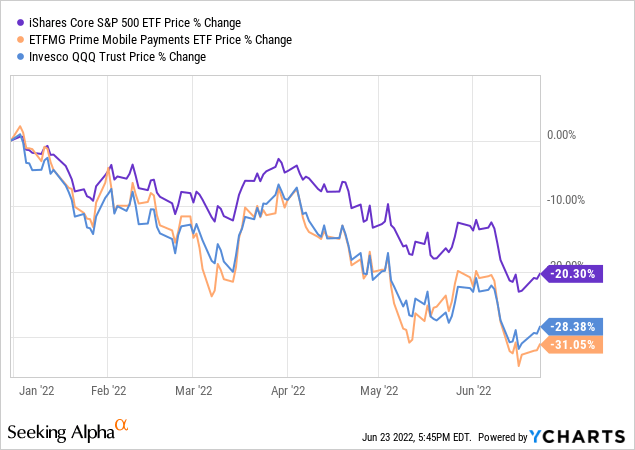

After a blockbuster run since inception in 2015, IPAY’s price has cratered this year, despite a few attempts to regain ground.

Contrarians might point to the fact that the performance was so lackluster that all froth was removed and multiples were normalized, so there is no downside left, and after a due consolidation, IPAY will be creeping higher. My view at this juncture is that with at least a 30% chance of the recession and up to a 4% terminal rate (we have heard even more hawkish voices) at the end of the year, boosting allocations to growth and especially speculative growth equity echelon is still a too risky move. To corroborate, the article provides a comprehensive look at IPAY’s exposure to the value and quality factors which should allow investors to decide whether the mix looks optimal for them.

Investment strategy

IPAY tracks the modified linear-based capitalization-weighted Prime Mobile Payments Index, which is rebalanced and reconstituted quarterly. The factsheet enumerates the key areas the index targets:

credit card networks, payment infrastructure and software services, payment processing services, and payment solutions (such as smartcards, prepaid cards, virtual wallets).

On its website, the fund cited Eminent Research & Advisory services, which forecasts the mobile payment market to explode to $590 billion by 2032 from $42 billion in 2022, which translates into a compound annual growth rate of 30%. This is an enormous opportunity to capitalize on. Of course, the due remark is that the growth prospects in the segment can be easily revised down should the economy contract, but I believe there is little to no chance that the digitalization of finance would be thrown into reverse, hence, the longer-term outlook is brighter regardless. Anyway, as a brief digression, valuation always matters, even in cases when future growth seems enormous.

In the current iteration, IPAY has 54 equity holdings, with the major ten accounting for around 48.4%. The fund is overweight in Visa (V), Mastercard (MA), and American Express (AXP), with this heavyweight trio sporting an 18.3% weight. Some way smaller players at the very bottom of the portfolio are Cantaloupe (CTLP) and Lesaka Technologies (LSAK), combined accounting for ~1% of the net assets. Of course, such household names from the industry as PayPal (PYPL) and Block (SQ) can also be found inside this portfolio, with 5.8% and 3.4% weights, respectively.

A due remark is that investors should be prepared for FX risks since apart from the U.S. stocks, the fund has exposure to other developed and even emerging markets (e.g., Brazil). Right now, when central banks have antithetical opinions on whether to tight or not to tight, it is worth paying attention to that as the NAV will be impacted should the USD continue appreciating.

According to the factsheet from 31 March 2022, IPAY’s equity basket encompasses predominantly U.S. equities, with almost 71% allocated as of that date. Aside from the Cayman Islands (~6.2%), the Netherlands is amongst the top three countries thanks to Adyen N.V. (OTCPK:ADYEY), an Amsterdam-based payments platform with operations across EMEA, North America, the Asia Pacific, and Latin America, having a 4% weight. In terms of sectors, we see the IT, industrials, and financials represented, with a clear tilt towards the former.

Is it premature to crank up bets on the mobile payments players? Let us consider factors

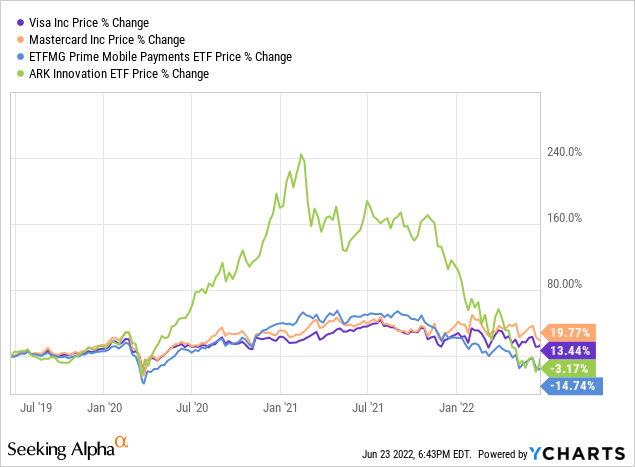

For most niche ETFs focused on overhyped, trendy themes it was 2021 that brought a moment of truth, with multiples trimmed and investors late to the party left nursing double-digit losses amid the capital rotation. The case of the ARK Innovation ETF (ARKK) is perhaps the best encapsulation.

However, IPAY survived most of 2021 without a steep decline, climbing higher until August, partly owing to the mega-cap names like V and MA marching higher. Then the sell-off began, resulting in a total return of (12.7)% for 2021. This year, IPAY is down ~32.5%.

Have valuations finally normalized? We can use the Seeking Alpha Quant data to answer that question.

And there is something to like here. I see ~18.8% allocation to stocks that are comparatively cheap (a B- Valuation grade or better), like StoneCo (STNE) and Bread Financial Holdings (BFH). Still, we also see that ~30% are clearly overpriced compared to their respective sectors and historical averages. Please pay attention to the fact that this figure includes only stocks with a Quant rating (~78.3% of the portfolio is covered). That is to say, this does not mean that the rest are valued adequately. More likely, it is quite the contrary.

To bring a bit more color, let us look at the EV/EBITDA multiples. The analysis illustrated that close to 51% of the holdings have a multiple above 15x; amongst them are such players like SQ, with EV/EBITDA of ~272x; the forward multiple is a bit more comfortable, sitting at ~50x thanks to anticipated EBITDA growth, though also elevated. For context, the IT sector median trailing twelve months ratio is ~13.4x. Besides, approximately 60% of the IPAY holdings trade with EV/Sales above the tech sector median of 2.9x.

Yes, there is also something to like when it comes to the quality factor. Specifically, 64% of the portfolio has Profitability ratings of B- or better. However, I doubt that it is worth accumulating IPAY at this juncture only for exposure to quality stocks. Rather, this should protect its NAV against steeper declines should the sell-off continue (as high-quality companies are, in theory, more resilient and thus are capable of weathering a recession).

A quick peer comparison

Given niche focus and intricate investment strategy requiring profound research, there are not that many alternatives to the IPAY ETF. I have identified the following plays that may be considered its closest peers, with all being passively managed except for ARKF:

- Global X FinTech Thematic ETF (FINX),

- ARK Fintech Innovation ETF (ARKF),

- Ecofin Digital Payments Infrastructure Fund (TPAY).

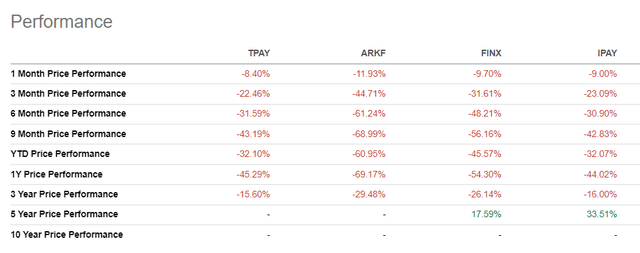

ARKF has been bearing the brunt of the bear attack on growth stocks, declining by a staggering 61% YTD.

Seeking Alpha

It is up to investors to choose which fund is apt for them, but I should highlight that TPAY is the most cost-efficient, with a 40 bps expense ratio, the lowest in the group, though its AUM of ~$7.6 million is fairly diminutive.

Final thoughts

The pandemic has given additional impetus to the mobile payments universe, accelerating the decline of the usage of cash. So there is no coincidence that IPAY delivered an over 34% total return in 2020.

However, the tables have turned. With a Strong Sell Quant rating given every single grade being utmostly lackluster, IPAY looks like a contrarian’s dream fund.

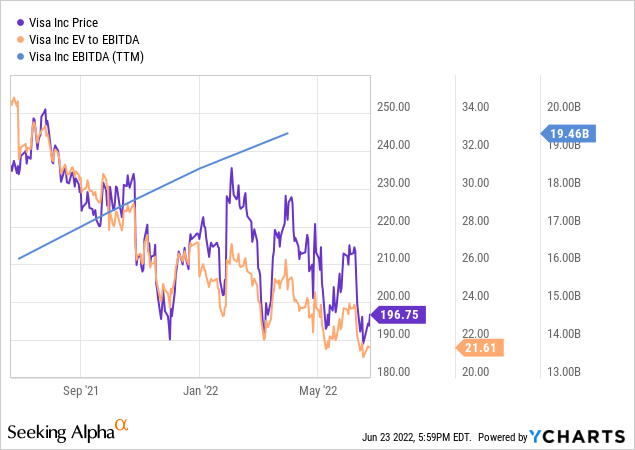

With the ten major holdings down in double-digits this year, including SQ’s and PYPL’s over 60% declines, a lot of froth has certainly been removed. Just for context, a year ago, Visa’s debt and equity investors were ready to accept a debt-adjusted earnings yield of ~2.8% (~35.2x EV/EBITDA).

Now, they are much more demanding as the yield has risen to ~4.6% even though V is forecast to deliver a 15.6% EBITDA growth next year, with a Return on Total Capital approaching 20%.

There are risks still. One of the harbingers of the shortage of capital is fintech IPOs being postponed, principally due to the somber outlook percolating into valuations. In other words, the downturns stifle growth as investors are no longer willing to accept additional risks amid uncertainty, looking for safe havens instead.

In sum, I would opt for a more cautious outlook at this point, as risks are likely not priced in yet.

[ad_2]

Source links Google News