Thematic ETFs have been an investment darling for a few years now. I must admit I’ve been just as susceptible with quite a few of them sitting in my own portfolio. But are they worth their management fees and are they even suitable for most investors?

The layman might well ask, what even are thematic ETFs?

“Thematic ETFs provide Australian investors an ability to invest in a megatrend which is a long-term structural shift that transforms economies like battery technology or robotics and automation. Depending on the risk appetite and overarching investment goal, thematic ETFs could be suitable for many type of investors.” Kanish Chugh, Head of Distribution, ETF Securities.

The popularity of thematic ETFs shouldn’t come as a surprise. They can offer easy access to some of the most topical themes of the day, such as climate change, in one package diversified across many companies and in one simple trade.

It is difficult for many investors, not least those in Australia, to access up and coming companies in some of the megatrend fields – some companies might be start-ups, others might be listed internationally and therefore more complicated for an Australian investor to access outside of using an investment product like an ETF.

In some cases, it is also matter of investing on the basis of your values and interests. Love robotics? Buy a robotics ETF. Concerned about modern slavery in factory production? Buy an ETF with an ethical slant.

There’s no question thematic ETFs are meeting interest and demand, but are they suitable for every investor racing to buy them?

Unfortunately, not all thematic ETFs focus on megatrends. Many of them are effectively the latest headline to attract interest. As Investment strategist Giselle Roux says, “any idea that seems to be the flavour of the month suddenly becomes an ETF”.

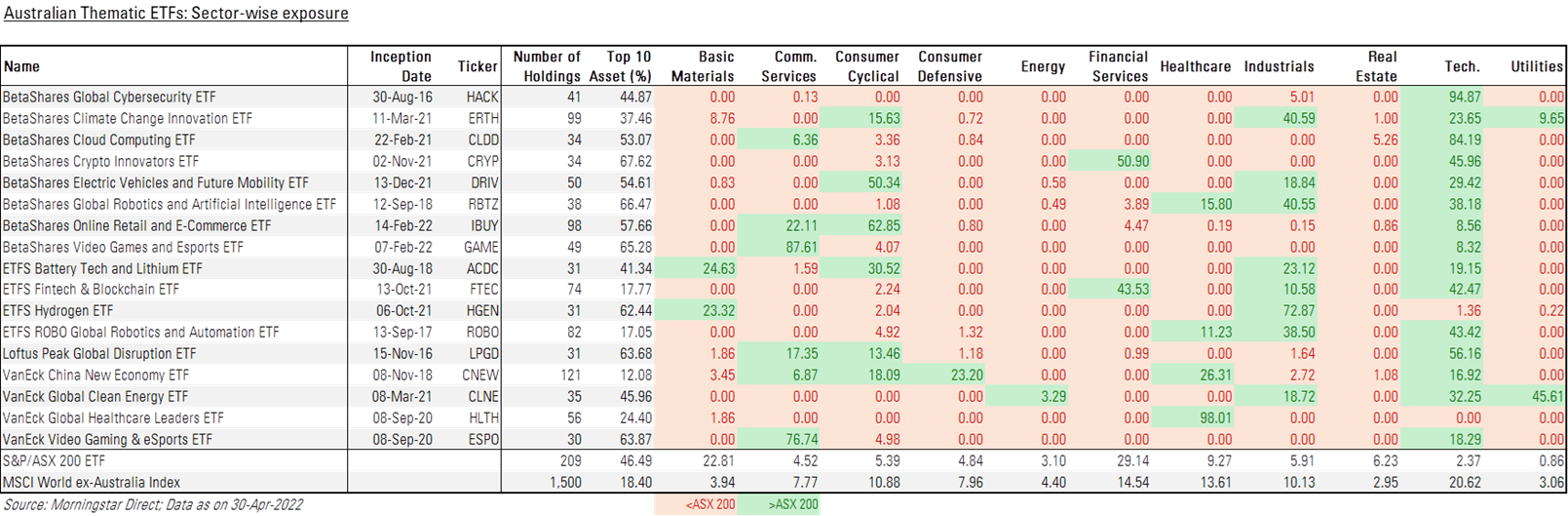

To assist in analysis, I’ve used Morningstar’s definition of thematic ETFs which are funds that target exposure to one or more investment themes, such as climate change or automation.

Based on their definition, Morningstar’s charts exclude some ETFs that issuers may otherwise consider thematic, such as ETFS S&P Biotech ETF (ASX code: CURE) or BetaShares Asian Technology Tigers ETF (ASX code: ASIA).

The recent explosion of investment into Thematic ETFs

In just two years, global assets under management for thematic funds nearly tripled to $806 billion as of the end of 2021.

Australia was no exception, with ETFs dominating flows. Today, thematic ETFs account for approximately 2% ($2.62 billion) of ETF assets under management.

According to Morningstar analyst Justin Walsh, of the 17 thematic ETFs available in Australia, only six were listed prior to 2020 so performance history has been limited and many ETFs were launched to capitalise on shorter-term interests, such as work-from-home technology.

Thematic funds typically operate in the growth space so it’s not entirely surprising that technology is the dominant theme accessed in these funds.

Cost, performance and risk

#1 Cost

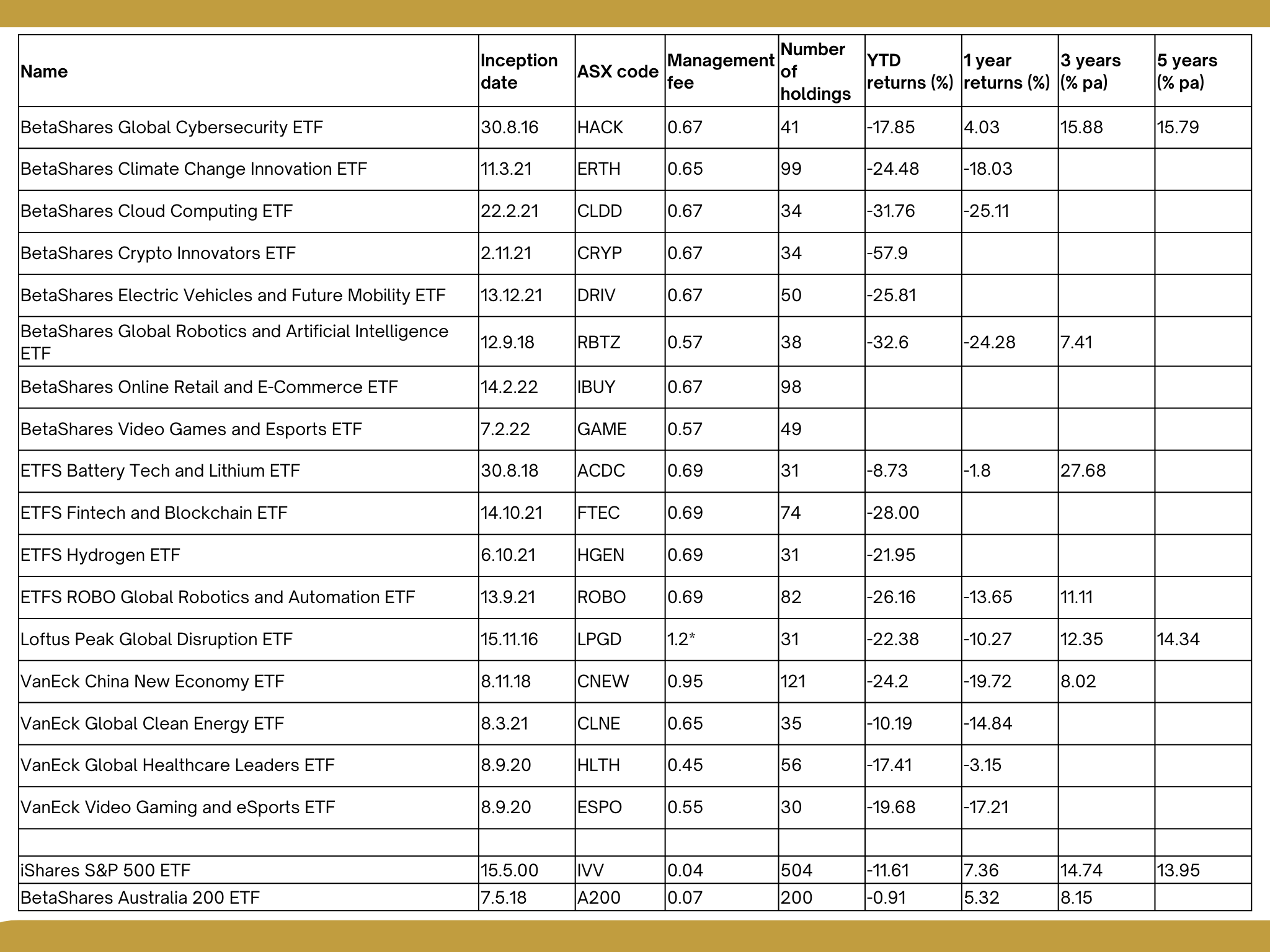

Thematic ETFs are a more niche investment, accessing more tailored indices and are typically more expensive fee-wise than broad-based index counterparts. Fees typically range from 0.57% to 0.95% (more if actively managed). It’s worth noting that fees can eat into returns, but investors tend to be less concerned about that as long as the performance is there.

The chart below shows performance against fees – for comparison’s sake, I’ve also included two of Australia’s cheapest ETFs covering the Australian market and the US market.

%20(1).png)

#2 Performance

Stockspot’s ETF Report 2022 suggests that Australian investors have lost more than $100 million investing in thematic ETFs in the last year and the performance numbers above support this in the short term– but is this enough to say they are not worth investing in?

Kanish Chugh, Head of Distribution at ETF Securities, says:

“In the current environment in which we face rising rates, higher inflation, and supply chain disruptions, many thematic ETFs have had their performance hit. But to many investors these ETFs now present an attractive opportunity for megatrends will always remain critical to the evolution of society.”

Most of the ETFs in the table have a limited performance history and have been released in challenging markets.

Even the broad-based indices have struggled more recently (though with far lower management fees, this is much more palatable). Of the few with a longer history, two offered performance enough in excess of the broad-based indices to justify their management fees.

It’s difficult to make a judgment call on investing with such limited history – you effectively need to do your research on the strategy and holdings and take a chance if you think it’s worth it.

#3 Risk

The next consideration is risk. Thematic ETFs are typically concentrated and invest in niche areas which may be more subject to market volatility. For some themes, holdings may be less likely to be large-capitalisation companies, may even be start-ups and overall riskier investments than just buying your standard S&P/ASX200. Roux notes that investing in smaller companies in niche industries can be a liquidity issue as they tend to be less frequently traded. As an example of the various risks of investing in niche industries, Roux points to biotechnology where companies are in the process of research, are not typically profitable and are make-or-break so are high-risk investments – there is a high chance of losing money in those companies.

Thematic ETFs are also more likely to be focused in growth themes like technology which have been particularly volatile in the current inflationary environment.

Another risk is fund closure. Stockspot notes that in the US, many thematic ETF launched in 2020 didn’t make it to their third birthdays, closing due to lack of investor flows or performance. In some cases, this was a result of themes that were on-trend at a particular point in time but didn’t necessarily reflect longer-term growth patterns, such as the sudden influx of ‘Work from home’ themed ETFs.

“Investors should be aware that not all thematic ETFs are created equal. As a result, investors should be cautious about using any thematic ETF that is based on a short-term theme. A true thematic ETF should be based on a megatrend that will play out over the long term.

Investors should also take care to ensure a thematic ETF provides a pure play exposure. This means the securities contained in the index should represent the particular theme without its focus being diluted by exposure to other themes or sectors. To measure this metric, investors should look for a low correlation or overlap with a relevant broad market exposure like the NASDAQ-100.” Blair Modica, Director – Adviser Business, BetaShares

Following this, investors may want to reinvestigate performance in terms of correlation in periods of market volatility as well as consider how much overlap many tech-focused thematic ETFs are likely to have with the NASDAQ-100.

So, to the big question: Are thematic ETFs suitable for all investors?

The short answer is no.

The longer answer is that different thematic ETFs will be suitable for different investors and there are some investors who, due to their risk tolerances, objectives and needs, should steer clear of them entirely. Ideally, they are unlikely to be large core parts of a portfolio but it’s not a stretch to say some investors are tilting too far towards more exciting investments and putting their assets at risk.

Just look at the patterns of investment in cryptocurrencies which have been replicated in ETFs.

BetaShares Crypto Innovators ETF (ASX code: CRYP) offers a more extreme case in point.

On the first day of trading, it finished with net buys of $39.7 million. Retail investors rushed in – cryptocurrencies are sexy even though most people don’t understand them, or the risks involved.

Yet here we stand today with year-to-date losses of 57.9% coinciding with extraordinary falls in the value of Bitcoin. While the fund doesn’t invest directly in cryptocurrency, it is fair to expect some alignment in performance because a number of the holdings are pure-play companies like Coinbase (NASDAQ code: COIN), while others have significant exposure.

Modica says, “Given the volatile nature of digital assets, investors may wish to make a very small allocation to an exposure like CRYP as part of a diversified portfolio. CRYP is best suited for investors who have a very high tolerance for risk and the capacity to absorb a rapid loss of some of their investment.”

On the basis of that, many retail investors shouldn’t be looking at any cryptocurrency exposure, directly or indirectly, but it’s too late to stop the race now. You can hardly blame the ASX and ASIC for being gun-shy when it came to allowing straight cryptocurrency ETFs on the Australian market.

On the less extreme end, ETFs investing in themes like robotics, biotechnology or cybersecurity may have a wider pool of suitability but still have higher risks and longer investment time horizons that investors should consider before diving in.

OK. SO how should you best use thematic ETFs?

The general school of thought is that thematic ETFs are for growth investors looking for small positions outside the main part of their portfolio – these could be long-term (strategic) or shorter-term (tactical) positions.

This falls into a core-satellite style of portfolio construction.

“The portfolio core should be based on low-cost ETFs like our Australia 200 ETF or our NASDAQ-100 ETF. Thematic ETFs can then be used by investors to tilt the portfolio towards genuine megatrends, such as electric vehicles, efforts to address climate change or artificial intelligence,” says Modica.

This approach is similarly taken by Chugh, but he has also seen clients with longer investment time frames and risk tolerances use thematics within the core as a strategic allocation, more likely to be institutions or clients with financial advisers guiding the decisions.

“Predominantly we see thematic ETFs being used as satellites. Here, investors use them to express a medium to long term view and make a smaller allocation to them than they would to core allocations. By taking them as satellites, investors can wait more patiently than they would if they were simply buying them as tilts or side bets,” Chugh says.

Investors should think of thematic ETFs in the way they would think of other important investments – you wouldn’t buy a house without doing an inspection and reading the contract at a minimum. Likewise, you should read the product disclosure statement and take a look into the portfolio holdings.

“It’s very very worthwhile to look at the underlying companies to have a good think as to whether they truly represent what they want.” Giselle Roux

In conclusion: Hype or not?

With limited performance history on many thematic ETFs, the jury may still be out on their overall value.

I think it’s safe to say putting the bulk of your investments in thematics is unlikely to offer you the same returns as a careful selection of broad-based indices but that doesn’t mean there isn’t a place for them in some portfolios as satellite investments.

What is clear is that thematic ETFs are a more complicated beast than many give them credit for, and they deserve more time and consideration before investing.

While some may not be the sleep-at-night additions investors hope for, while others may not have the sudden growth potential – and some may be just for temporary tactical tilts – Thematic ETFs are here to stay. Let the buyer beware.

Learn more about thematic ETFs and other investments here.