[ad_1]

Elkhophoto/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) as an investment option at its current market price. The fund’s stated goal is “to track as closely as possible, before fees and expenses, the total return of the Dow Jones U.S. Dividend 100 Index”. This is an ETF I have owned for a long time, although I cover it infrequently on Seeking Alpha. This is because it is widely written about, so I generally don’t feel like I have much to add on it. Yet, I continue to see a compelling reason to own in as we move deeper in to 2022, so a review on it now seemed timely.

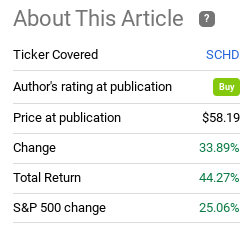

For perspective, note that I have long championed this ETF. I gave it a buy rating the last time I discussed it, and SCHD has indeed met my expectations since that piece was written:

Fund Performance (Seeking Alpha)

As I look ahead, it could be tempting to sit on the sidelines given all the macro-risks facing the global economy. Yet, it is precisely because of these risks that I see merit to building on SCHD. While that may sound counterintuitive, the logic is that when times are tough, buying quality dividend-payers is often a rewarding strategy. There are numerous reasons behind this, which I will touch on in the following paragraphs. This should explain why I am willing to list SCHD as one of my few select core holdings, and why I see gains ahead in the second half of the year.

Dividends Have Provided Protection

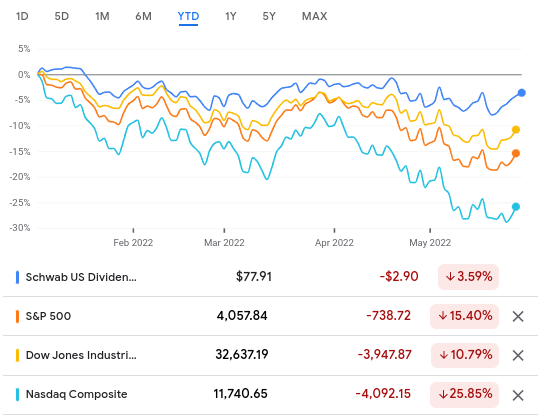

To start, let us acknowledge that 2022 has not been an easy year for equity investors. In fact, it has been downright disastrous in some corners of the market. If we look at the major indices all we see is red for 2022. However, this does not tell the whole story. Yes, the three major U.S. indices are heavily in the red, but losses have not been felt equally across the board. For instance, if we compare SCHD’s year-to-date performance against the Dow, Nasdaq, and S&P 500, an interesting story emerges:

YTD Performance Comparison (Google Finance)

A simple takeaway from this shows that dividend payers, and SCHD by extension, have out-performed during a turbulent market. To be fair, losses are still losses, so holders of SCHD cannot be overwhelmed by losing 3ish% this year (accounting for the Q1 distribution). But we have to put this in perspective. A minor loss may be quite attractive indeed when we figure the broader market is in either correction or bear market territory.

This amplifies why I like dividend payers, especially domestic ones. In the right climates, they provide downside protection, and that is something that is likely top of mind for most readers these days.

Aren’t There Too Many Risks To Buying Now? I Think Not

Expanding on the above paragraph, readers may be reluctant to be buying much of anything right now. While SCHD’s relative out-performance is strong, there is no getting around the fact that the fund is in the red for this year. As a consequence, some readers may be thinking waiting on the sidelines is the right move, and diving back in only when the outlook gets clearer.

In fairness, I would never suggest anyone get too aggressive or beyond their comfort zone at any point in time. The case for buying now depends entirely on a few individual factors: that one is not already too invested and that an individual has the ability to withstand more potential losses. I say this because while I like the idea of buying SCHD here personally, I am not going to declare this a “sure thing”. More losses can absolutely be on the horizon, although the relative strength of the holdings and the income stream from the dividends provide some sort of buffer. But this does not mean I would advocate moving beyond a comfort zone to buy at these levels. Bear markets can linger for a while, as can corrections. While SCHD is nowhere near those levels, it will be difficult for the fund to pump out strong gains if the broader market remains stuck at those levels.

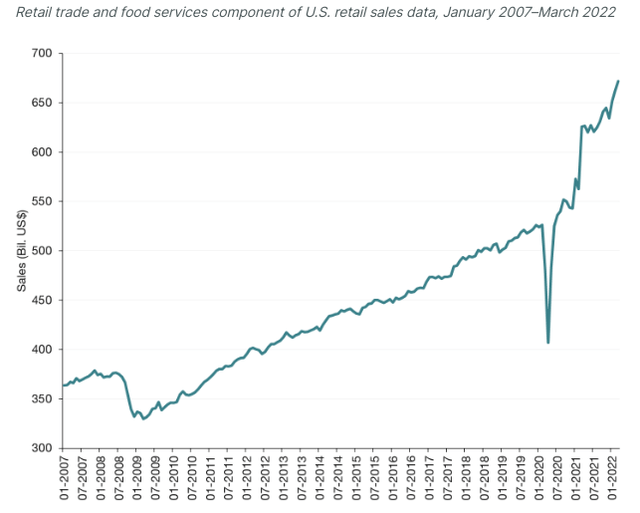

However, I do see some reasons for optimism. One is that the U.S. consumer continues to hold up reasonably well. There are challenges for sure – low labor force participation, rising interest rates, and stubbornly high inflation. Despite these trends, however, retail sales continue to climb. This suggests Americans are willing to tap in to their savings and/or have the income to handle the rising cost of living. While this may not be the most favorable backdrop, the rise on consumer sales helps to offset the potential for a recession:

Consumer Retail Sales (St. Louis Fed)

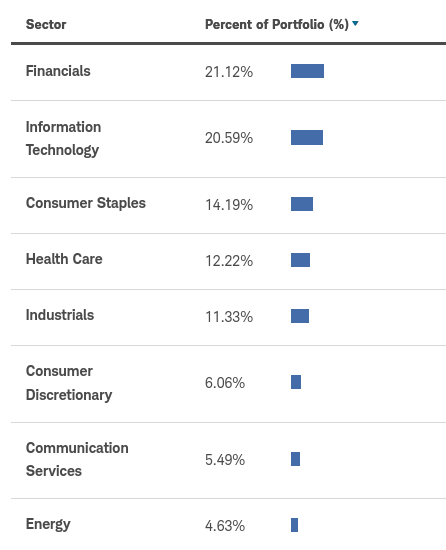

This is a broad point, but it is still relevant to SCHD. While the fund has a strong weighting to Financials and Tech, the consumer environment is just as critical to performance. This is because Consumer Staples and Consumer Discretionary combine to make up roughly one-fifth of total fund assets:

Portfolio Composition (Charles Schwab)

To me, I will acknowledge the difficult consumer climate. This does pose a challenge to SCHD this year. But consumers have been resilient, to say the least, in the face of rising cost pressures just about everywhere. If we see inflation begin to ease, the story is only going to get stronger going forward. When I consider that consumers have held up well enough so far, this suggests being exposed to consumer-oriented sectors is not as risky as it might appear.

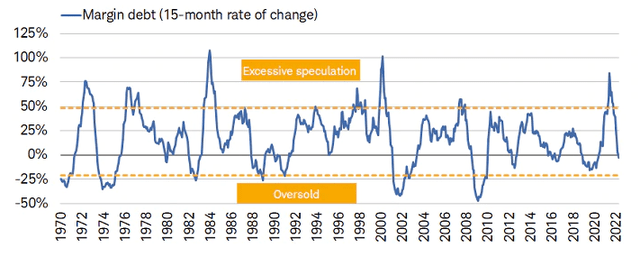

Margin Use Has Come Down, That Is A Positive For A Healthy Market

Another reason I am not bearish on the broader market at this point has to do with the underlying health of retail investors. One way to measure this is margin use. I track this because high levels margin use tends to correlate with overbought markets. There are a couple reasons for this. One, when margin use is already high, that limits how much additional buying can occur. Investors are tapped out, so to speak, which leaves little catalyst for pushing prices higher. Two, when there is weakness in the market or a sell-off begins, those drawdowns can accelerate because of the margin usage. Simply, if a margin-user starts to see their balances decline, they may have to sell (willingly or be forced to), and this could occur across the market. If everyone starts unloading their margin holdings at once, we see sharp and fast drawdowns – sound familiar?

As a result, when I see excessive holdings via margin, I tend to get nervous. This year has supported this viewpoint. Fortunately, that is no longer the case. While margin use was high earlier in the year, the sell-off has forced out many of the weak hands. As a result, margin use has declined considerably:

Margin Use (Charles Schwab)

This backdrop helps to justify my belief that buying in now is a reasonable play – whether through SCHD or any other equity fund. While calling a bottom is often an impossible task, I view the drop in equities combined with the decline in margin debt as signs that brighter days are ahead. For me, this means adding to SCHD has some value.

Financials To Benefit From Rising Rates

As the graphic posted above showing SCHD’s portfolio holdings indicated, this fund is overweight the Financials sector. While this includes multiple insurance companies, many of the Financials holdings are regional banks and other large industry players like BlackRock, Inc. (BLK). These are firms that tend to benefit from a rising rate environment, given their reliance on interest income and lending.

Of course, this is another aspect that is not a “sure thing”. While yields and interest rates have moved higher this year, Financials have not exactly been banner performers. In isolation, higher rates are a positive, but if rates move too high, too fast, that can cause a recession. This could translate to reduced loan growth, higher delinquency rates, and declining business activity. All of these negatives can offset the benefits of higher rates. I bring this up because, again, readers need to approach this sector with some care and due diligence.

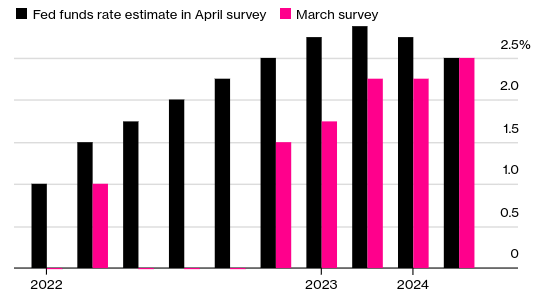

That aside, yields have already risen steadily for months. This improves the outlook for lenders as they increase what they charge for loans and mortgages. So far, defaults have been minimal, so it has been a net gain. Furthermore, market participants are anticipating that the Fed’s benchmark rate will continue its upward climb through 2022. Given the Fed has been pretty consistent on the need to tame inflation in the short-term, this is not an unrealistic outlook:

Interest Rate Outlook (Bloomberg)

The conclusion I draw here is that Financials, specifically banks and lenders, have a positive backdrop heading in to the second half of the year. If we see a marked slowdown in GDP numbers, heightened global geo-political risks, and further support for a recession, then this outlook goes out the window. But for now I expect modest growth for the next few quarters, and see higher rates being a tailwind for SCHD’s largest sector holding.

Dividend Showing Modest Growth

My next though looks at SCHD’s dividend. With a current SEC yield near 3%, this seems like a reasonable income play, even with current inflation rates. Yes, inflation is running hot, but SCHD offers a reasonable yield and the chance of capital appreciation that continues to offer a value proposition. Further, the fund’s Q1 distribution saw modest growth over last year’s payout, so that is a positive sign:

| 2022 Q1 Distribution | 2021 Q1 Distribution | YOU Growth |

| $0.5176 | $0.5026 | 2.98% |

Source: Charles Schwab

The takeaway here is straightforward. SCHD has a decent yield and is pumping out some dividend growth. As an income play, this isn’t the best option out there, but it is attractive compared to the S&P 500 (for now). When I couple this with the underlying holdings that I view favorably, SCHD still strikes me as a winner.

Don’t Under-Estimate The Power Of Dividends

My final topic emphasizes why I am partial to dividends as a whole. As I mentioned, SCHD is one of my core holdings for the long-term. I bought this fund early on in my investing career and have not looked back. It is one of three dividend ETFs I own, which all combine to make up a hefty portion of my portfolio. I have three different types of funds: SCHD for a total dividend policy – quality and yield, SPDR S&P Dividend ETF (SDY) for dividend aristocrats – offering consistency and stability, and iShares Core Dividend Growth ETF (DGRO) – offering companies that grow their payouts over time.

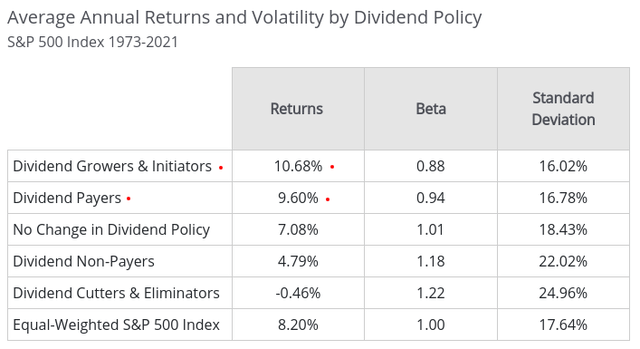

So, clearly, I like dividends. But I want to answer the question as to why I am so partial to them. While the income is favorable (who doesn’t like seeing cash show up in their brokerage account?), that is not the only reason. The primary reason actually is performance. The dividend payout is great, but it is the backdrop behind the payout that I like. A company paying a strong dividend signals two things to me. One, management has made returning capital to shareholders a priority. Two, the company is strong enough to part with cash on a regular, recurring basis. This tells me management is confident in the future outlook of the company, which gives me confidence as well.

Add this all up and we get quality companies with the right management mindset. For me, this bodes well for the long-term, and this perspective is well supported by history. In fact, if we look at average return for a variety of equity types over the past century, we see a very illuminating story emerge:

Average Returns (Hartford Funds)

A look-back at history has therefore only confirmed my desire to have a good deal of dividend exposure. Longer term, this thesis checks out. Shorter term, such as this calendar year, we also see a favorable risk-reward. Essentially, the merit of buying a fund like SCHD seems as relevant as ever, so I will be doing just that.

Bottom-line

SCHD has been a winner for me for years. It has been a core portfolio holding, and its strong out-performance in 2022 so far has kept it as a candidate on my “buy list” going forward as well. This does not ignore the difficult investment environment we are in, but now that stocks have corrected significantly, I see the value in putting cash to work. SCHD is one way I will do this, as it holds many large-cap, domestic dividend payers that offer both diversity from the S&P 500 and relative stability. As a result, I will continue to build my position throughout this year, and I would urge readers to give this fund some consideration at this time.

[ad_2]

Source links Google News