[ad_1]

jxfzsy/iStock via Getty Images

Thesis

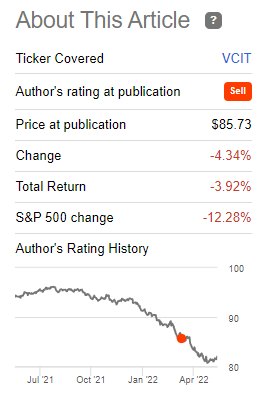

In March, we wrote an article regarding the Vanguard Intermediate-Term Corporate Bond Index ETF (NASDAQ:VCIT) where we assigned it a Sell rating based on its rates and corporate spreads components. The fund is down more than -4% since our article, driven by higher rates and wider corporate spreads. VCIT has a 6.4-years duration and has seen a lower price point as 7-year rates have risen by more than 100 bps since the beginning of March.

With the Fed rhetoric now changing to potentially a rate hike pause at the September meeting, it is becoming clearer that the market-anticipated 2.5% neutral rate on Fed Funds might be the correct ultimate goalpost. Financial conditions have been tightening, with rates higher, stocks down, and corporate bond spreads wider. The market has front-run the Fed, and we feel the move higher in rates is almost over. Investment-grade corporate spreads have also been trending wider, but are now reaching the top of their non-recessionary range.

We feel that the Fed will not save the stock market with a “Fed put,” but is very much concerned about the credit markets and corporations’ ability to place paper and fund themselves smoothly. While higher treasury rates increase corporate borrowing rates in net dollar terms, they act as a smooth dampening tool to tighten financial conditions. Much wider corporate spreads, though, are symptomatic of market stress and would act as a deterrent to further Fed tightening. We feel the market has already moved the yield curve up to anticipate the Fed tightening path and corporate spreads are at the top end of their normal economic environment range. With both factors affecting the VCIT pricing at the top of our range, we move from Sell to Hold on this fund.

Performance

VCIT is down more than -4% since our Sell rating:

Sell Rating (Seeking Alpha)

The fund is down more than -11% year to date, closely mirroring the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) performance:

YTD Performance (Seeking Alpha)

Interestingly, VCIT has outperformed the much better-known LQD by almost 3% on a year-to-date basis. On a longer-term basis, the two funds have very similar total return profiles:

5-Year Total Return (Seeking Alpha)

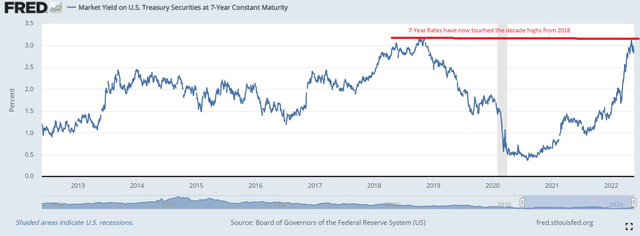

7-year rates have reached the decade-long high achieved in 2018:

7-Year Rates (The Fed)

We can observe that outside of 2018, the 7-year point in the treasury curve was bound by the 2.5% level, which acted as resistance. While inflation has not yet come down substantially, we feel it might have peaked, with financial conditions tightening.

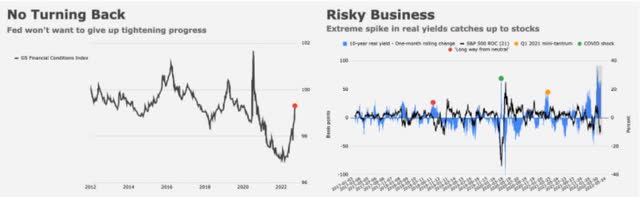

Ultimately, the move in rates is driven by the Fed and their tightening of financial conditions in order to contain inflation. We feel the market has already done this, and as Goldman Sachs illustrates, financial conditions are well underway to reach constrained levels:

Financial Conditions (Goldman Sachs)

With leading indicators stagnating and an escalation of recessionary discussions for 2023, the Fed does not have a lot of maneuvering space. The move higher in rates in our opinion is closer to being over than the market anticipates.

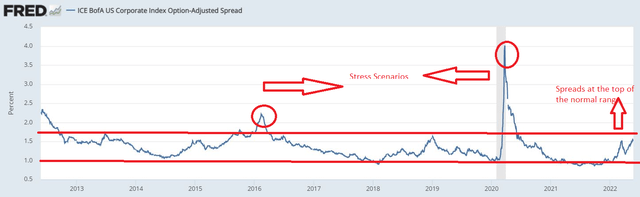

Corporate credit spreads are now at the top of their normal economic environment range:

Corporate Credit Spreads (The Fed)

We can see that outside stress scenarios (such as 2016 and 2020), corporate credit spreads are now trending towards the top of their normalized environment trading range.

Holdings

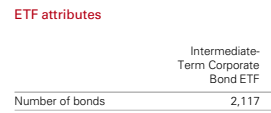

The fund has a very granular portfolio, with over 2,000 bonds in the portfolio:

Composition (Fund Fact Sheet)

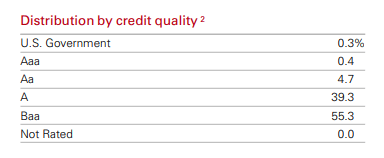

Although the ETF is exclusively an investment grade vehicle, the bulk of its holdings sit on the lower rungs of the high-grade rating spectrum:

Credit Quality (Fund Fact Sheet)

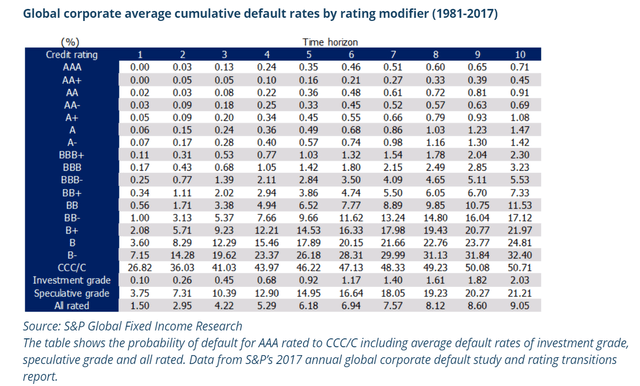

With a concentration of over 50% in the BBB bucket, the probability of downgrades in a protracted downturn is higher than funds which have higher portfolio percentages in double-A and single-A buckets. As a quantitative way of looking at probabilities of default from ratings, please find below an S&P study:

Default Probability (S&P)

We can see that for a 7-year tenor (the average maturity of the fund holdings), a single-A bond has a 0.86% probability of default, while a BBB- bond has a 4.09% probability of default. In a stressed economic scenario, those differentials matter.

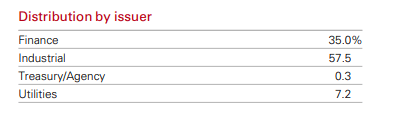

Financial and industrial issuers dominate the portfolio and have the top weightings, sitting at 35% and 57.5%, respectively:

Issuers (Fund Fact Sheet)

Conclusion

VCIT is an investment-grade bond ETF that is an alternative to the more popular LQD. The fund is down more than -11% year to date on the back of higher rates and wider investment-grade corporate spreads. With most of the rates move behind us and corporate spreads trading at the top of their normal economic environment range, we are no longer bearish on the fund. We are now moving from Sell to Hold on the vehicle.

[ad_2]

Source links Google News