[ad_1]

Csondy/E+ via Getty Images

Investment Thesis

U.S. retail earnings season begins this week with some of the biggest names reporting, including Walmart (WMT), Home Depot (HD), and Target (TGT). The April retail sales report is also expected Tuesday morning, with analysts expecting a 0.80% increase over March numbers. There’s a lot that can and probably will move markets this week, and if you’re looking to get targeted exposure to the segment, you may be considering the SPDR S&P Retail ETF (NYSEARCA:XRT). Positives include XRT being an equal-weight play with 108 holdings, a reasonable 0.35% expense ratio, and the possibility of good value, given that it’s down 25% YTD.

My concerns with XRT stem from its equal-weight methodology, which results in higher-than-suitable weightings given to poor-quality stocks, mainly in the Internet & Direct Marketing Retail industry. Sixteen companies have negative operating cash flow, 18 reported negative EPS last quarter, 38 missed revenue expectations last quarter, and 24 have Seeking Alpha EPS Revision Grades of D+ or worse. If you’re looking to speculate and potentially make a big score this week, XRT is worth trying. Otherwise, I hope you’ll consider another competitor with much better fundamentals at the end of this article.

ETF Overview

Strategy and Fund Basics

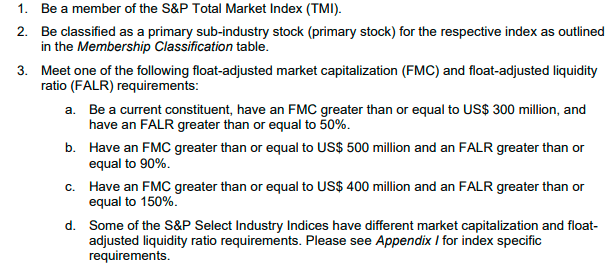

XRT tracks the S&P Retail Select Industry Index, selecting retail stocks in the Consumer Discretionary and Staples sectors meeting the following criteria:

S&P Dow Jones Indices

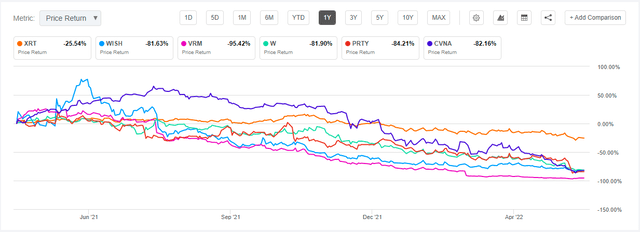

The Index follows a modified equal-weighting scheme that may sound advantageous to investors concerned about stocks with rich valuations. Amazon (AMZN) is a prime example. Amazon shareholders have lost 32% over the last year, and the stock’s forward price-earnings ratio is still 138.22. It’s essential to realize that equal-weighting an Index isn’t always beneficial. Adding small-cap stocks like Vroom (VRM) and Carvana (CVNA) to your portfolio severely decreases quality. Amazon’s 32% loss may be tough, but it’s nothing compared to the following collection of underperformers that XRT holds in equal weight.

Seeking Alpha

That’s just five stocks, but there are 19 others down more than 50% in the last year. I’m sure that at some point, these companies looked attractive from a technical perspective, but this chart serves as a reminder that stock prices can always go lower. Usually, unprofitable stocks bear the brunt of negative market sentiment, as is proper. Before we look at XRT’s exposures, here are some descriptive statistics you may find helpful.

- Current Price: $66.92

- Assets Under Management: $488 million

- Expense Ratio: 0.35%

- Launch Date: June 19, 2006

- Trailing Dividend Yield: 1.97%

- Five-Year Dividend CAGR: 19.14%

- Ten-Year Dividend CAGR: 17.65%

- Dividend Frequency: Quarterly

- Five-Year Beta: 1.38

- Number of Securities: 108

- Portfolio Turnover: 62%

- Assets in Top Ten: 12.76%

- 30-Day Median Bid-Ask Spread: 0.03%

- Tracked Index: S&P Retail Select Industry Index

- Rebalancing Schedule: Quarterly (March, June, September, December)

- Short-Term Capital Gains Tax Rate: 40%

- Long-Term Capital Gains Tax Rate: 20%

- Tax Form: 1099

- Rebalancing Schedule: Quarterly

The 0.35% is about average for specialty ETFs, and to get fees lower, you’ll have to venture into plain-vanilla ETFs like the Consumer Discretionary Select Sector ETF (XLY). However, those products have minimal overlap, so XRT is undoubtedly a niche ETF.

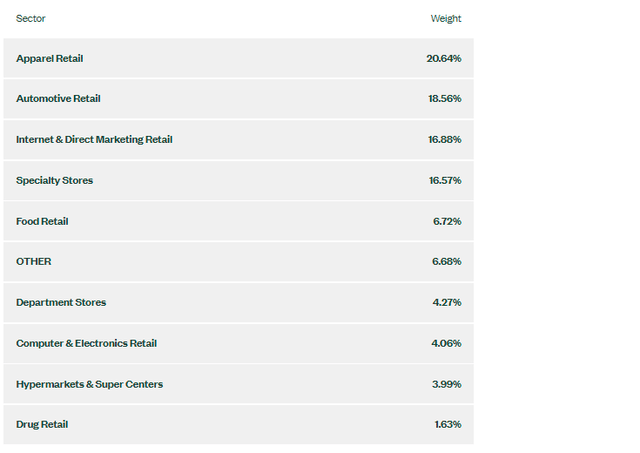

Industry Exposures and Top Holdings

XRT holds stocks in ten industries, but nearly three-quarters are in just four: Apparel, Automotive, Internet & Direct Marketing, and Specialty Retail. The “Other” category is the General Merchandise Stores industry which includes stocks like Dollar General (DG) and Dollar Tree (DLTR).

SPDR

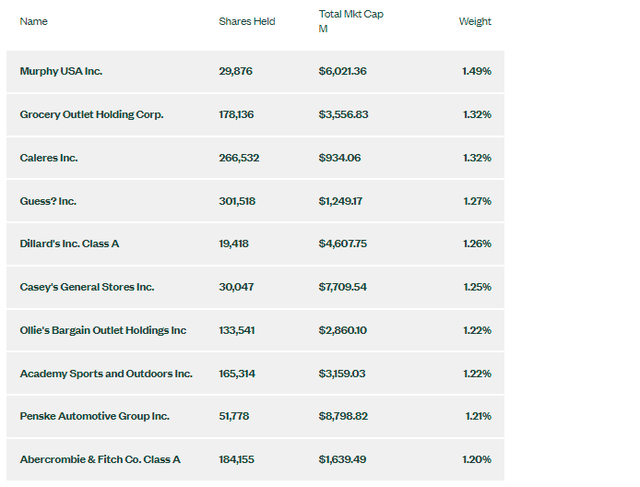

The top ten holdings are shown below, but this list won’t reveal much since it’s an equal-weight ETF. To be comprehensive as possible, I’ll conduct a fundamental analysis later by industry.

SPDR

Performance Analysis

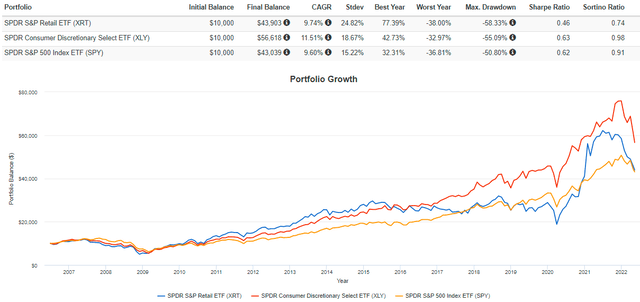

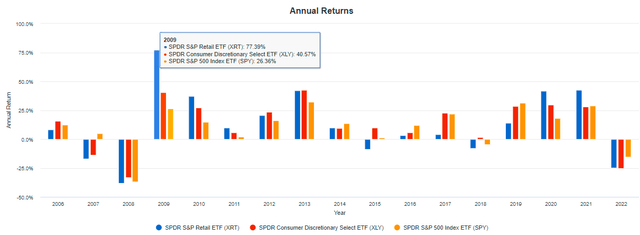

Since July 2006, XRT has lagged XLY by an annualized 1.76% but outperformed the SPDR S&P 500 ETF (SPY) by 0.14%. XRT is a much riskier fund with annualized standard deviation being six points more than XLY.

Portfolio Visualizer

Nevertheless, with excess volatility comes opportunity, and XRT gained 77.39% in 2009 after the Great Financial Crisis. It also gained 41.94% and 42.63% in 2020 and 2021. In my view, these abnormal returns coincide with periods of extreme positive market sentiment. I previously reported that in 2009 and 2020, value-weighted returns for unprofitable stocks were 63.05% and 79.31%. To be clear, I don’t believe we’re anywhere near one of those periods today, so the likelihood of these gains repeating is low.

Portfolio Visualizer

Q1 Earnings Season: The Good And Bad News

Forty-two of XRT’s holdings have reported earnings over the last three weeks and judging from the results so far, there are reasons for optimism. Put differently, the pain XRT experienced recently is hopefully over since most Internet & Direct Marketing Retail stocks already reported. Below are the average revenue surprises by industry to date, with the number of companies reported and left to report in parentheses.

- Apparel Retail: 8.27% (1, 19)

- Automotive Retail: 3.34% (11, 10)

- Computer & Electronics Retail: 4.18% (1, 3)

- Department Stores: 8.18% (1, 3)

- Drug Retail: N/A (0, 2)

- Food Retail: 1.04% (2, 5)

- General Merchandise Stores: 5.36% (1, 5)

- Hypermarkets & Super Centers: N/A (0, 4)

- Internet & Direct Marketing Retail: 0.37% (18, 4)

- Specialty Stores: 2.26% (7, 11)

These results suggest that except for Internet & Direct Marketing Retail, there’s some significant potential upside left in Apparel and Automotive Retail stocks, 19 of which are scheduled to report soon. The downside is that according to Yardeni Research, small-cap retail stocks only reported a 0.30% aggregate revenue surprise so far this quarter compared to 5.50% and 2.20% for mid-and large-cap retail stocks. And, there are still 33 small-cap stocks left to report. Fortunately, most are profitable Apparel Retail companies, but I hope you can still appreciate the downsides of owning too many speculative small-caps. As an investor and not a trader, I don’t see the appeal.

U.S. Retail Sales, Future of Everything Festival

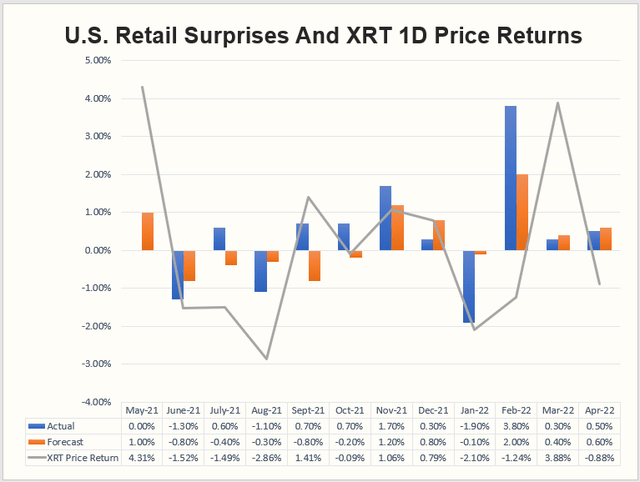

April U.S. Retail Sales figures are due before the market opens on Tuesday, with the consensus being a 0.90% increase over March. Targets were missed the last two months, but performance in the sector isn’t always tied to the results. The graph below highlights the previous 12 months of retail surprises and XRT’s price return on the release day.

The Sunday Investor

The average surprise over the last year is just 0.28%, while XRT’s price moved by just 0.11%. Moreover, a negative surprise doesn’t equal a negative result. For example, last year’s April growth was flat, but XRT managed to rally 4.31% that day.

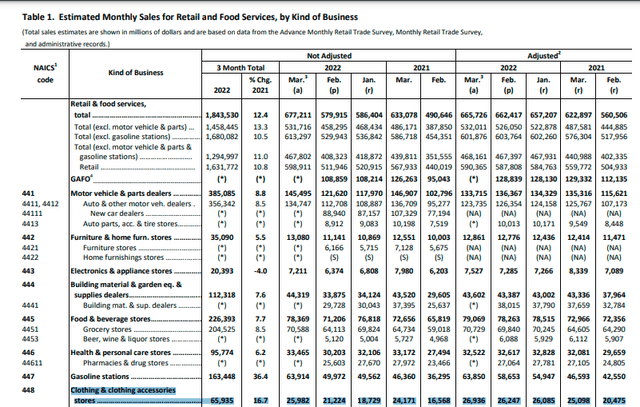

Investors should watch specifically for clothing sales estimates since that category represents potential growth in XRT. The table below highlights March’s advance estimate, showing an adjusted 2.62% gain over February’s preliminary estimate. The easiest way to access this is directly from the PDF posted on U.S. Census Bureau website.

U.S. Census Bureau

Investors should also pay attention to Federal Reserve Chairman Jerome Powell’s discussion as part of the Wall Street Journal’s Future of Everything Festival, which returns after a two-year break. Likely topics include the Fed’s outlook for the U.S. economy and the impact higher rates will have on inflation. This will be especially important since XRT is a highly volatile ETF, and any change in tone will likely find its way into retail stocks.

Fundamental Analysis

The following table highlights selected risk, growth, and valuation metrics for XRT’s ten industries compared with XLY. I also want to introduce you to the Invesco DWA Consumer Cyclicals Momentum ETF (PEZ), which has about 16 years of history but has yet to catch on. PEZ only has about $78 million in AUM, yet I think you’ll agree its fundamentals are more appealing.

The Sunday Investor

I want to begin by discussing valuation. The price-earnings ratios you view on third-party websites like Morningstar can be misleading if enough stocks are excluded from the calculation. Since you can’t calculate a P/E for a stock with negative earnings, many small-cap growth ETFs appear artificially cheap. You appreciate how easily ratios can be manipulated when working with the individual stock data. After applying Morningstar’s cap of 60 to the 22 stocks with negative expected earnings, XRT’s weighted-average P/E jumped from 13.46 to the 20.36 figure above. The actual P/E could be even higher if the cap is too lenient. For its part, XLY has two prominent stocks (Amazon and Tesla) with P/E’s exceeding 60. However, I only had to apply the cap to six companies in PEZ, representing 9.21% of the ETF. Therefore, I’m confident it’s a legitimately cheap fund, which is rare in this category.

Buying a high P/E fund isn’t always a problem, especially when sentiment is positive in bull markets. However, XRT substantially lags behind XLY and PEZ in growth. Despite a similar valuation, its forward revenue and EPS growth rates are 5-7% less than PEZ. Also, PEZ leads on Seeking Alpha’s Profitability and EPS Revision Grades, suggesting that the ETF is better prepared to weather an economic storm.

I’ve summarized the same metrics for PEZ’s top 20 companies below. A key difference is its zero exposure to Internet & Direct Marketing Retail companies. Also, it has exposure to 21 unique industries compared to XRT’s 10, so in that respect, it’s more diversified despite holding just 43 stocks.

The Sunday Investor

Investment Recommendation

XRT is not a great U.S. Retail ETF to own in the near term since it holds too many unprofitable small-cap stocks that analysts don’t favor. Admittedly, there’s a solid chance that most of the downside pain is over since most of XRT’s Internet & Direct Marketing Retail stocks have already reported. However, XRT looks inferior to most of its competitors I analyzed in my ETF database, especially PEZ. Therefore, I recommend selling XRT and considering switching to PEZ or sticking exclusively with the profitable large caps in XLY. Remember, stocks can always go lower, and speculating on volatile retail stocks in the middle of an earnings season isn’t wise.

[ad_2]

Source links Google News