[ad_1]

Darren415/iStock via Getty Images

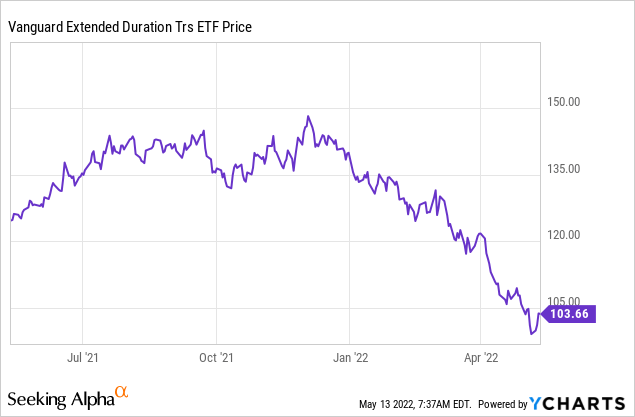

The objective of the Vanguard Extended Duration Treasury ETF (NYSEARCA:EDV) is to track the performance of an index composed of long duration zero-coupon U.S. treasury securities. Now, those who have invested in EDV at the first signs of market turmoil in November 2021 when the tech bubble started to deflate, or later in February when it became clearer that inflation would not be transitory, got the timing wrong as the ETF suffered from a relentless downside. Breaking up with the downside, as shown in the last part of the blue chart below, there seems to be a trend reversal.

With some uncertainties around the 50 basis point hike in interest rates at the beginning of May, there are now more reasons to think that the Vanguard ETF will pursue its upside as I will elaborate in this thesis. I base my arguments on market signals, uncertainties about the economy, and central bank actions.

Signals based on treasury notes

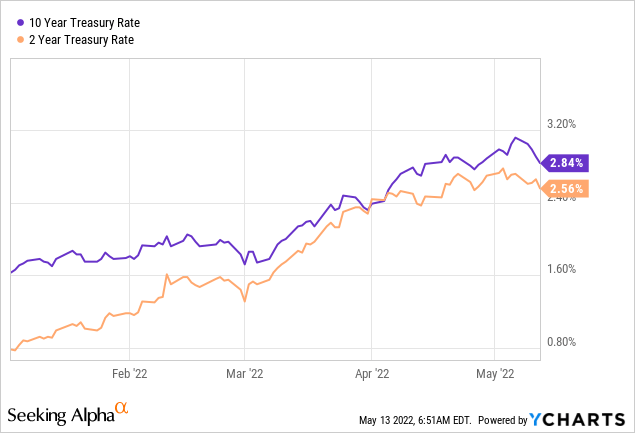

First, after moving to its highest point since 2018 last week on Thursday, the yield on the benchmark 10-year Treasury notes dropped to 2.84% as shown in the blue chart below.

Now rates normally drop when investors buy bonds as part of risk aversion against volatility in the equity markets as was the case last week with the S&P 500 losing 3.8% from Monday to Thursday.

Second, on March 31, this time as shown by the orange chart going above the blue one, the 2-year and 10-year treasury yields inverted. This was a significant event as it had not occurred before 2019. Analysts normally consider this as a warning signal of an imminent recession for the reason that borrowing costs for the short term (two years) are more than for the long term (10 years). This is not normal as when you lend money to someone, in this case to the U.S. government over a longer period of time, you are incurring more risks and expect to be rewarded accordingly, through a higher interest rate.

Third, there has been an acceleration in the rate at which the two-year treasury yield has appreciated as shown by the relatively steeper slope of the orange chart just before inverting. According to analysts at Deutsche Bank (DB), this phenomenon last occurred in 2009. Now, this year reminds us of the great financial crisis which occurred from 2007 to 2008.

Without going into details about the functioning of the debt market or the central banks’ monetary policy, these signals do matter especially in the context of the Federal Reserve raising its key rate from mid-March, thus breaking with the monetary support policy which had been in force since the COVID-19 pandemic as from April 2020.

This is therefore a major change and implies that the era of cheap money which enabled publicly listed companies to rapidly raise money through the selling of equities may be coming to an end, as well as their capacity to borrow money at a low rate of interest.

Turbulent times ahead

This is merely the beginning as there is more to come with more rate hikes expected this year, all within a short span of time. In comparison, there had been no hikes since 2018. Moreover, in normal circumstances, monetary policy normalization or moving away from quantitative easing (“QE”) which has been in place for the last ten years takes the form of a gradual process carried out by factoring in economic indicators like labor participation, industrial output, cost of living, etc.

However, this time around, it will be carried out rather abruptly. To exacerbate things, there appears to be less consensus between central bankers and mainstream economists as to what constitutes the so-called “neutral rate” of interest. Adding 40-year high inflation to these concerns, you may have the ingredients for a recession.

On the other hand, contrarily to 2008-2009, the financial institutions are rock solid and people have money in their savings accounts, but supply chain concerns persist and the Russia-Ukraine conflict seems to have removed the ceiling off commodity prices. Moreover, Federal Reserve Chairman Jerome Powell has repeatedly said that he believes the US economy is strong enough to withstand rate hikes, but, after his “transitory inflation” rhetoric did not materialize people are losing confidence.

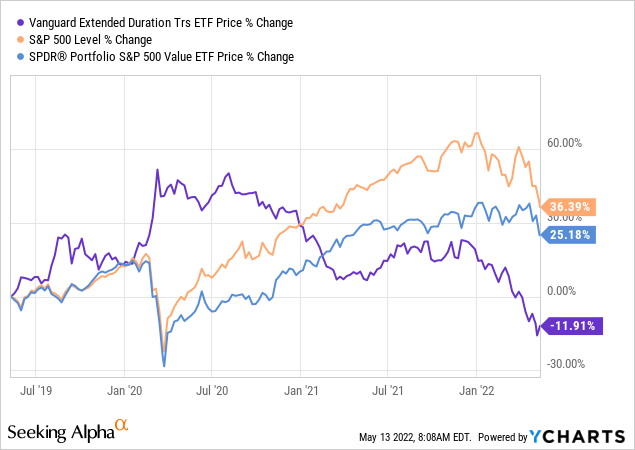

Thus, with CPI (consumer price index) readings still uncomfortably high, it may prove difficult for the Fed to engineer a soft landing for the economy. Some are even anticipating a mild recession, which can ultimately result in a market downturn as investors panic. In this case, as shown in the deep blue chart below, EDV can act as a hedge against severe volatility as it did in March 2020. At that time, both the S&P 500 and the SPDR Portfolio S&P 500 Value ETF (SPYV) plunged by more than 30% as shown by the orange and pale blue charts respectively.

Thinking aloud, no two market downturns are similar and some investors tend to opt for value stocks that pay high dividend yields so that they can continue to harvest cash in case economic woes persist. In this respect, my aim is not to propose EDV as an alternative to stocks, but more for capital preservation purposes as part of a diversified portfolio. In addition, the ETF pays quarterly dividends at a rate of 3.27% (30-day SEC yield).

Conclusion

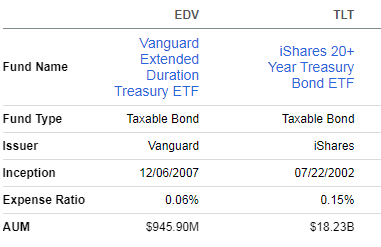

Scanning the ETF industry, I came across another peer which holds long-duration Treasury bonds, namely the iShares 20+ Year Treasury Bond ETF (TLT). It has much more assets under management compared to EDV. However, I prefer the Vanguard ETF as it is much cheaper. After the issuers recently reduced the charges, it is available at an expense ratio of only 0.06%.

Comparison with a peer (www.seekingalpha.com)

This said, I could be wrong in my prediction and there may be no recession, in case inflationary pressures start to subside and the Covid situation in China improves. There may also be a truce between Russia and Ukraine resulting in a fall in the price of oil. Furthermore, many veteran bondholders have dumped fixed-income assets from their portfolios after the sell-off which has accentuated since November as shown in the introductory chart. Many may not be willing to invest in this asset class again.

Still, even if there is an improvement in external economic conditions, the current volatility should persist as the Federal Reserve is in the process of carrying out relatively abrupt changes, and owning long-term U.S. treasuries as part of your portfolio is relevant in order to preserve capital in the face of an escalating degree of uncertainty. Additionally, with its quarterly distributions and upside potential, the Vanguard ETF not only acts as a hedge but can also reward investors with high returns.

Finally, I made the case for investing in EDV in view of three signals based on treasury yields, macroeconomic uncertainties, and doubts as to the ability of the Fed to steer the economy out of inflation smoothly. This said, as far as I can remember during my thirty years of investing experience, whenever there has been extreme market volatility, this resulted in a flight to assets like U.S. dollars, gold, or long-term treasuries for capital preservation purposes. This time around, it should not be different, and learning from the March 2020 crash when it went up by over 30%, EDV could easily climb back to the $130 level.

[ad_2]

Source links Google News