[ad_1]

PercyAlban/iStock Unreleased via Getty Images

It has been a while since I provided an in-depth assessment of the First Trust Value Line Dividend Index Fund (NYSEARCA:FVD) in September 2021, when I concluded that though the strategy might look compelling given due attention paid to the safety characteristics of stocks (like volatility and financial position) it invests in and an image of defensiveness given heavy allocation to utilities, its excessive turnover is a drag, a 3-year drawdown compared to the S&P 500 ETF (IVV) back then was deeper (which begs a question whether the safety strategy works during market calamities like the coronavirus sell-off), while expenses are clearly bloated, which is suboptimal for long-term dividend investors; the standardized yield of 1.8% as of end-August was not especially compelling either. I concluded that the ETF is a Hold.

Today, I believe the fund deserves a reassessment for two principal reasons. First, it rebalances & reconstitutes its portfolio every month, so its equity basket currently looks different compared to the September version both in terms of individual stocks and their weights. Second, a broadly bearish mood on the Street amid inflation and growing interest rates means stocks with above-average yields and resilient financial positions should not be ignored.

What has changed and the assumptions why that could happen

To recap, FVD tracks the Value Line Dividend Index which represents a cohort of stocks selected from the 1,700 U.S. and international equities pool using systematic proprietary rules. To be eligible for inclusion, a stock must have a safety score of at least 2 and an indicated dividend yield above the one of the S&P 500. Small-caps valued at less than $1 billion are shown the red light. Those that qualified for the final version of the portfolio are weighted equally to ensure the mix does not become over-reliant on just a few most expensive companies.

Though the Safety™ Rank which lies at the crux of the strategy is a bit of a black box, it is known that the Price Stability and Financial Strength factors are its two pillars. In short, the latter considers the financial position and stability of earnings and revenue among other things, while the former focuses on the standard deviation of the stock price.

Overall, an intelligent strategy prioritizing a stock’s characteristics that are the most relevant for conservative dividend investors.

Turning to the portfolio recalibration, since September, the fund has eliminated its stakes in eight companies that accounted for ~4% of the net assets.

| Morgan Stanley (MS) | 0.53% |

| Arthur J. Gallagher & Co. (AJG) | 0.52% |

| AmerisourceBergen Corporation (ABC) | 0.50% |

| Constellation Brands (STZ) | 0.50% |

| Marsh & McLennan Companies (MMC) | 0.50% |

| W.W. Grainger (GWW) | 0.50% |

| PPL Corporation (PPL) | 0.49% |

| UnitedHealth Group (UNH) | 0.49% |

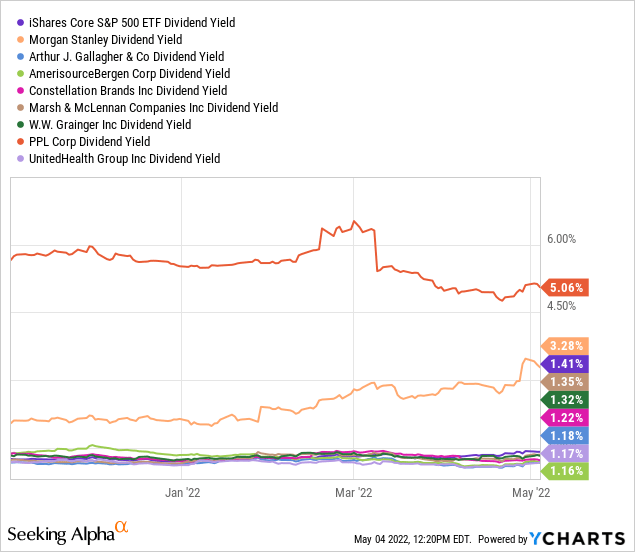

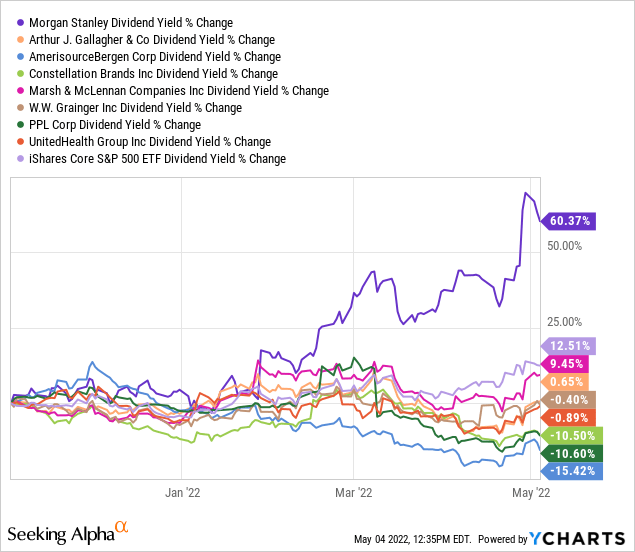

The reasons for the removal are not clear given the classified ingredients of the methodology; however, I surmise a few companies above have seen their safety rank downgraded because of either unfavorable trends in volatility or deterioration of financial position, which can be caused by an increase in the Debt/Capital ratio, a reduction in cash available, worrisome trends in sales or income, softer returns on capital, etc. At the same time, names with a dividend yield close to 1% were probably removed on account they did not pass the yield test mentioned above; as IVV has been declining, its yield has been slowly inching higher.

However, in the case of MS, for instance, the yield factor is an unlikely culprit, as illustrated by the chart below.

At the same time, the following 20 names with a total weight of ~9.6% as of May 2 were added:

| AVY | Avery Dennison Corporation (AVY) | 0.53% |

| FIS | Fidelity National Information Services, Inc. (FIS) | 0.49% |

| ITT | ITT Inc. (ITT) | 0.49% |

| KDP | Keurig Dr Pepper Inc. (KDP) | 0.49% |

| LOGI | Logitech International S.A. (LOGI) | 0.49% |

| MMM | 3M Company (MMM) | 0.49% |

| SEIC | SEI Investments Company (SEIC) | 0.49% |

| TSCO | Tractor Supply Company (TSCO) | 0.49% |

| XYL | Xylem Inc. (XYL) | 0.49% |

| APD | Air Products and Chemicals, Inc. (APD) | 0.48% |

| DOX | Amdocs Limited (DOX) | 0.48% |

| FDX | FedEx Corporation (FDX) | 0.48% |

| MSI | Motorola Solutions, Inc. (MSI) | 0.48% |

| TTC | The Toro Company (TTC) | 0.48% |

| WDFC | WD-40 Company (WDFC) | 0.48% |

| DOV | Dover Corporation (DOV) | 0.47% |

| FLO | Flowers Foods, Inc. (FLO) | 0.47% |

| NDAQ | Nasdaq, Inc. (NDAQ) | 0.47% |

| AOS | A. O. Smith Corporation (AOS) | 0.46% |

| POR | Portland General Electric Company (POR) | 0.44% |

What has exactly triggered the addition is, of course, not completely clear, but I again surmise that the two reasons are likely: their solid safety profile and their superior yields compared to the S&P 500. Speaking of safety (another way of saying quality, to be frank), I also think it would be pertinent to remark that ten companies in the group have the Quant Profitability grades of A (+/-), like MMM, while the remaining ten have a B (+/-) rating. This hints that their resilient margins and sector-leading returns on capital secured a safety score enough to qualify for the FVD portfolio.

As I observed in my previous note, the fund’s tilt towards utilities is somewhat permanent. So it is anything but a surprise that 18.5% of FVD’s net assets are allocated to this sector, which makes it the first in the mix despite the fact that the allocation fell marginally from the September level of ~19%. At the same time, it is worth mentioning that FVD maintains only minimal exposure to the energy sector, with just one investment, Enbridge (ENB). The reasons are intuitively evident. The sector bore the brunt of the two oil price collapses, in the mid-2010s and during the pandemic, hence, for most oil & gas, OFSE, etc. companies, profits and sales were unstable, to say the least, let alone returns on capital. Volatility was another side effect. All these are clearly not supportive of an acceptable safety score.

Next, almost nothing has changed in terms of the size factor either. ~78% of FVD’s net assets are deployed to large-caps (above $10 billion market capitalizations) vs. ~80% in September.

Regarding the Quant factor exposure, I see just ~22.6% allocation to 47 stocks with value characteristics, which represents a close to 9% reduction since September when 67 companies in its portfolio were comfortably priced; I believe a capital appreciation of a few holdings or general valuation trends in the respective sectors were the likely culprits. For example, Lockheed Martin (LMT), the fund’s investment from the aerospace & defense industry with an ~0.5% weight that has delivered an around 25% price return since the beginning of the year, has seen its Valuation grade going down from B- in end-September to C- now. Anyway, in my view, this allocation is not ideal, and I would welcome at least a 40% share.

Speaking of quality, 83% of the holdings have a Profitability grade of B- or better vs. ~81% in September; a solid result, though it could be better.

Final thoughts

In a highly unusual step that was previously seen 22 years ago, the Fed has just increased the key policy rate by 50 basis points. The decision speaks for itself. Inflation is spiraling, and the Fed is doing its best to tame it. What does that mean for growth stocks? More likely, prolonged softness. At the same time, this is a seemingly perfect backdrop for high-quality, adequately priced dividend stocks, the cohort FVD invests in. Does that make it a Buy? There are a few issues to consider.

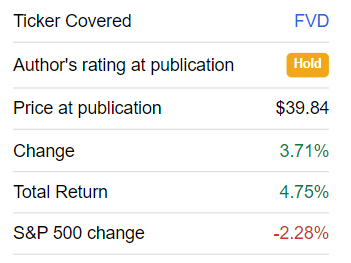

Certainly, since my previous coverage, it has outperformed the S&P 500, delivering an ~4.8% total return vs. ~(2.3)% of the index. Uncoincidentally, its Momentum grade has improved, now sitting at A-.

Seeking Alpha

It should be noted that its turnover fell from 86% to 47% as of the most recent summary prospectus, which I recommend reading. The document also shows an expense ratio of 67 bps, which is still rather high. I highlight this as a principal disadvantage. Another disappointment is a small exposure to the value style coupled with lackluster distribution growth. All in all, I maintain my Hold rating this time.

[ad_2]

Source links Google News