[ad_1]

lucky-photographer/iStock Editorial via Getty Images

Investment Thesis

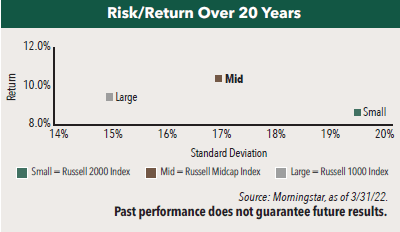

There has been a lot of research done over the years on the small-firm effect, which claims that there are two types of equities (big and small) and that small and mid-sized firms generate greater gains for shareholders over long periods of time. In the 90s, institutional investors established the “mid-cap” category, and risk-adjusted returns have been excellent in comparison to large-cap equities since then. According to Hennessy Funds, mid-cap stocks have outperformed 30% of the time in any given one-year rolling period since 2000, and more importantly, the longer a mid-cap stock is held, the more frequently it outperforms. In this article, I will review the Invesco NASDAQ Next Gen 100 (NASDAQ:QQQJ), which provides exposure to a basket of 100 mid-cap stocks that are not yet part of the NASDAQ 100 Index.

Hennessy Funds

Strategy Details

The Invesco NASDAQ Next Gen 100 Fund tracks the NASDAQ Next Generation 100 Index. The fund is designed to measure the performance of the next generation of Nasdaq-listed non-financial companies – that is, the largest 100 Nasdaq-listed companies outside of the NASDAQ-100 based on market capitalization.

If you want to learn more about the strategy, please click here.

Portfolio Composition

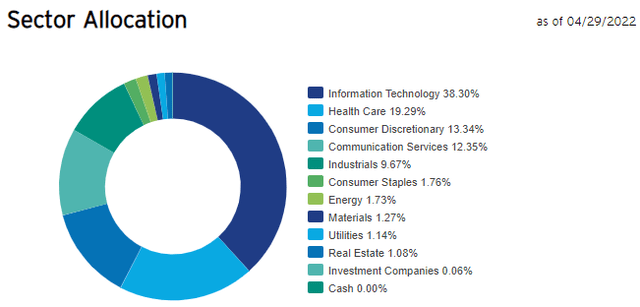

The index places a high weight on Information Technology (representing around 38% of the index), followed by Health Care (accounting for 19%) and Consumer Discretionary (representing around 13% of the fund). The largest three sectors have a combined allocation of approximately 70%. The strategy is tilted towards tech stocks. These stocks generally have high betas, thus I think it is important to see if you are comfortable with a higher level of volatility before purchasing QQQJ. In terms of geographical allocation, the US accounts for 89% of total assets.

Invesco

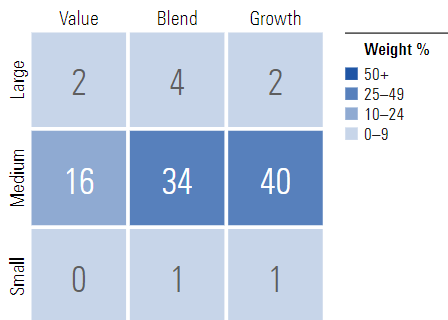

~40% of the portfolio is invested in mid-cap growth issuers, characterized as mid-sized companies where growth characteristics predominate. Mid-cap issuers are generally defined as companies with a market capitalization between $2 billion and $8 billion. The second-largest allocation is mid-cap blend equities. Unsurprisingly, QQQJ allocates over 90% of assets to mid-cap and small-cap issuers. This is in line with the fund’s strategy of betting on “small” players who have the potential to become large caps in the future.

Morningstar

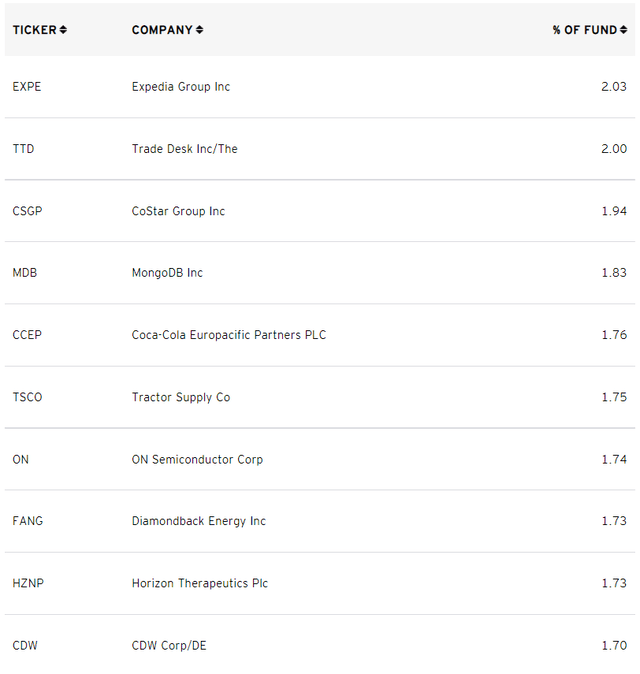

The fund is currently invested in 100 different stocks. The top ten holdings account for 18% of the portfolio, with no single stock weighting more than 3%. All in all, QQQJ is well-diversified and has a very low level of unsystematic risk as a result. That said, the correlation between stocks tends to increase in periods of financial stress, which is something to keep in mind.

Invesco

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to Invesco, the fund currently trades at an average price-to-book ratio of ~3.8 and at an average forward price-to-earnings ratio of ~22. In addition to that, the portfolio has a ~24% return on equity. I generally consider a company trading at a forward PE above 20 to be richly valued. That said, I think there are some exceptions where you can pay a premium for an outstanding business that earns a high return on capital and has good growth prospects. In QQQJ’s case, these companies have a very high return on equity on average and that could explain why the market is ready to pay a premium. However, I believe there is more downside risk at the moment for high multiple ETFs and QQQJ is no exception. The strategy could very well be trading at less than 18x earnings in the next months, which would imply an ~18% decline from the current level.

Is This ETF Right for Me?

I have compared the price performance of QQQJ against the Invesco QQQ ETF (QQQ) and the Schwab U.S. Mid-Cap ETF (SCHM) over the last 19 months to assess which one was a better investment. Over that period, SCHM outperformed both NASDAQ strategies. It is interesting to see that QQQJ was beating the NASDAQ 100 up until November 2021 when it started underperforming. This is the kind of outcome that I expect going forward since mid-cap stocks generally outperform when the market is going up and underperform when it is going down. However, I’m impressed by SCHM’s performance, which trades at a meaningful discount to QQQJ. SCHM’s average price-to-earnings stands at ~16.2 and it has a 16% ROE which is also very good. All in all, I think this shows that there are better options in the market at the moment and I think that SCHM is one of them.

Refinitiv Eikon

Key Takeaways

Mid-cap firms have historically outperformed large-caps. Therefore, investing in a fund such as QQQJ with over 90% exposure to small and mid-sized companies makes sense if an investor plans to hold for a long period of time. That said, higher rates make fundamentals more and more important in my opinion, and this fund is still expensive despite the recent pullback, trading at more than 20x next year’s earnings. This is clearly not cheap enough to justify a bottom and I think that downside risk is still significant. At the same time, there are other mid-cap strategies trading at a lower valuation and delivering solid results such as SCHM, which are more attractive from a risk-reward perspective.

[ad_2]

Source links Google News