[ad_1]

ArkD/iStock via Getty Images

I know that I’m going to get a lot of stick from some readers in the comments section, but that’s okay. It’s necessary for all of those that are interested in ARK Innovation’s ETF (NYSEARCA:ARKK) to understand the latest literature on ETF construction, portfolio diversification, and market environments. I also think it’s necessary to understand that ARKK can be profitable if timed correctly but that it’s likely to underperform the market in the long run for a very good reason. Catherine Wood designed and marketed this ETF prior to a growth market, which caused it to experience tremendous success but I believe that it may have been short-lived.

I’m working on a similar concept myself for my Ph.D. thesis, and if the strategy is successful, I’ll look to list the concept on a traded exchange. Thus, it’s needless to say that my knowledge of modern ETF construction is on par.

With that being said, let’s get into it.

Modern ETFs and Factor Pricing

Modern-day ETFs and especially actively managed ETFs are constructed on something that’s called factor pricing or otherwise known as “smart beta”. BlackRock (BLK) provides a relatively good explanation of how the concept works and also wrote a piece on Seeking Alpha about the concept.

Factor ETFs provide a proxy for portfolio diversification and is the latest literature that provides evidence of general diversification.

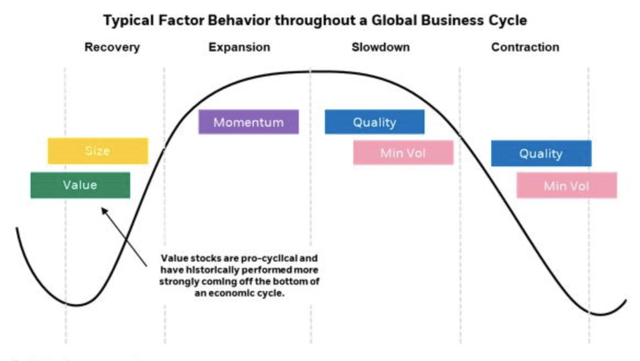

The chart below essentially explains how the prevalent factors move in accordance with the economic cycles. Portfolio managers will load these factors with sub-factors such as company-specific return on equity or the general expansion of technology with total factor productivity.

BlackRock on Harvest

There’s a strong argument that we’re entering a contraction and have just exited a recovery. This may seem counter-intuitive and contradicts conservative economic cycles but let me explain. The economic policies during the pandemic have been highly unusual, which caused an abrupt recovery, but geopolitical tensions and lackluster decisions by central banks have caused a rapid retreat into contraction, as we experienced during the initial breakout of COVID-19.

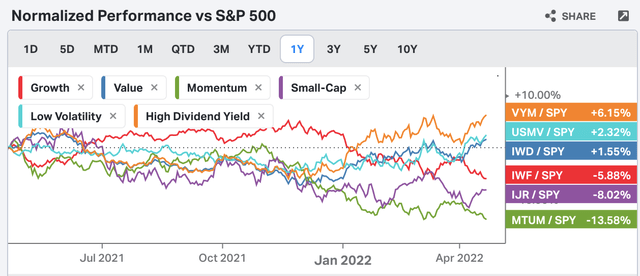

Inflation has given rise to value stocks and pretty much drawn down the rest of the market. This is because investors tend to opt for value and vertically integrated companies during uncertain times while cashing out their risk-on bets; I see this persisting for the foreseeable future. Nonetheless, below is the year-over-year factor performance, so I’d encourage investors to use their own judgment.

Koyfin

A Closer Look At What ARK Innovation Is Attempting

Catherine Wood is ignoring most of the pricing factors and is betting exclusively on growth outperformance for the long term. Her central argument is that a new industrial revolution will proliferate automation, thus driving down costs and giving rise to new innovative companies.

This sounds great in isolation, but it remains a folk tale to the stock market. Although her theory may unfold one day, that day isn’t now. I’ve yet to discover an overwhelming amount of portfolio management literature that supports her claim. In fact, we’re seeing much evidence of the fallacies in her model as growth assets are crumbling under rising inflation and general changes in economic circumstances.

In addition, ARK Innovation’s strategy has proven to be so underwhelming that its information ratio (“IR”) is -2.08. The IR is used to measure the skill attributed to a portfolio manager’s returns and should range between 0.40-and 0.60 to be considered good.

I’ll say this with confidence. I believe Catherine Wood’s ARK Innovation provides little value add from a portfolio management perspective and sells the public a product that most don’t understand. Her public appearances and omnichannel marketing exploits are a masterpiece, but her team’s abilities to maximize risk-return utility haven’t been up to scratch.

Recent Activity

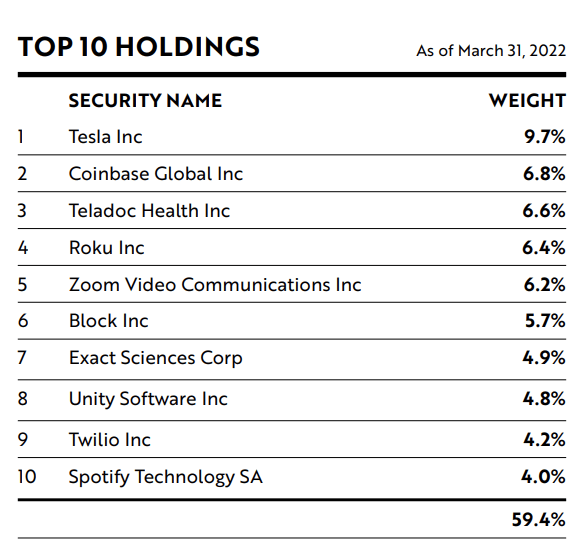

As mentioned earlier, ARK Innovation is an actively managed fund, thus rebalances its portfolio frequently, which is the main contributor to its expense ratio being significantly higher than the asset class average.

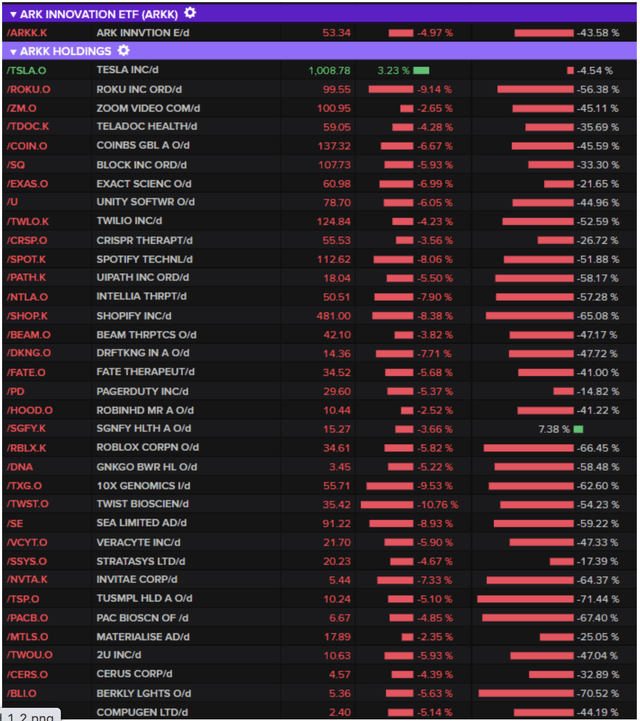

I don’t want to comment on each stock in this portfolio, but I’d say that they are quite sensitive to the economic cycle and are likely to suffer from growing household obligations and economic slowdowns. I’d make a separate case for Tesla (TSLA); we explained in one of our previous articles why Tesla could ascertain its returns during economic downturns.

ARK INNOVATION

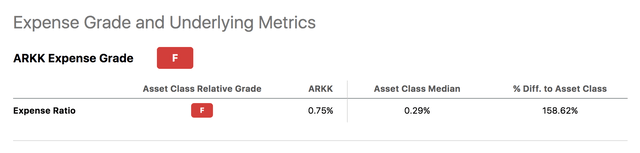

I’m reiterating the expense ratio below. If you compare the information ratio to the expense ratio, ARK Innovation really doesn’t make any sense as the fund demonstrates less skill than most ETFs but charges investors a premium.

Seeking Alpha

Seeking Alpha recently reported that ARK Innovation’s holdings all declined apart from Tesla. This just tells me that its diversification makes no sense and that it’s just spending unnecessary funds on brokerage fees and commissions to buy almost perfectly correlated assets.

Seeking Alpha

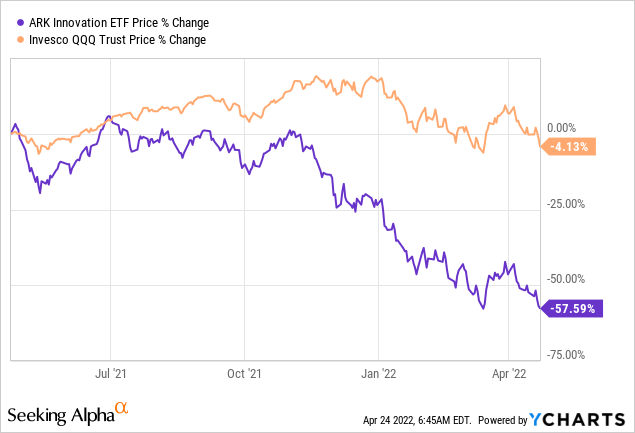

Furthermore, ARK Innovation’s focus on technology is closely aligned with Invesco’s QQQ Trust (NASDAQ:QQQ), which is a Nasdaq tracker fund. I don’t think I need to comment here; just look at the performance differential.

A Supporting Case

On the upside, Catherine Wood has challenged the status quo. There’s every chance that she may be correct but might have deployed the strategy a bit too early. This could mean that previous academic literature on smart beta is a matter of the past. Furthermore, ARK could’ve used the recent cycle as a learning curve. It could be that it adds new methodologies to its fund to manage drawdowns better. It certainly exhibits superior upside in growth markets, and if it can level out downsides with less volatility, one could see it outperform the market. This is just a possible counter-argument, but it remains a far stretch, in my opinion. The final thing I’d mention in this section is that investors could profit significantly if they manage to time ARK Innovation correctly, which would mean timing the growth cycle. This sounds simple, but it’s not. If it were, then we’d all be billionaires. Nonetheless, it can be done.

The Bottom Line

ARK Innovation has tried to challenge the smart beta concept and failed. It’s evident by observing the information ratio that the fund hasn’t exhibited the necessary ability to justify its expense ratio. The fund’s sensitivity to various economic cycles conveys the growth conviction strategy’s fallacies. ARK Innovation will need to reconsider its model before it loses more value.

[ad_2]

Source links Google News