[ad_1]

Herbert Pictures/E+ via Getty Images

The Franklin FTSE Brazil ETF (NYSEARCA:FLBR), valued at around half a billion dollars in AUM, is a product that provides investors with targeted exposure to both large and mid-cap-based Brazilian stocks. What it lacks in longevity relative to some of its other peers (it has been around for less than five years whilst other alternatives have been around for decades), it makes up for in terms of cost-efficiency; FLBR has the lowest expense ratio amongst all Brazilian themed ETFs (by far) at only 0.19%; the expense ratio of other alternatives vary from anything between 0.57% and 0.90%. Besides, quite unlike a lot of EM-themed ETFs, FLBR is not overexposed to any particular sector. When you invest in a high-beta EM landscape, it pays to have a well-spread out ETF portfolio.

Macros

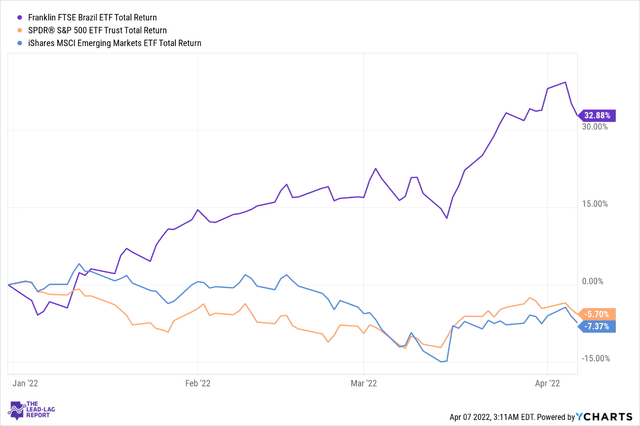

If you’ve been following The Lead-Lag Report on Twitter these last few months, you’d note that I’ve been particularly gung-ho about the prospects of Brazil since late 2021, and some of my bullish arguments appeared to have translated into a strong return profile for Brazilian equities. Note for instance that FLBR has proven to be one of the finest alpha generators this year, delivering returns of ~33% and comfortably outperforming the US markets and the broader emerging market pack.

YCharts

Even if you’ve been sitting on the sidelines and not deploying cash in Brazil, as an educative exercise, I’d urge you to keep track of developments across The Lead-Lag Report timeline as I tend to have discussions with some rather erudite and well-informed market participants on Twitter Spaces.

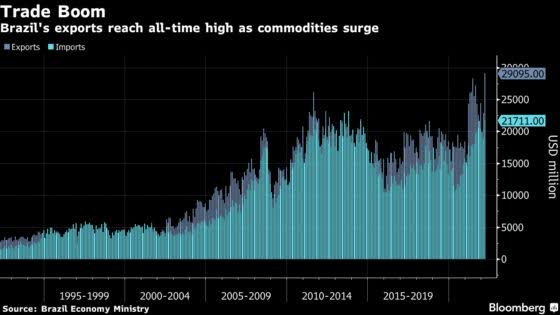

It’s no big secret that developments in Russia and Ukraine have torpedoed the supply-demand equations in the broad commodity markets. Whilst this could have serious ramifications for some import heavy nations such as Japan, India, etc., Brazil is finely positioned at the other end of the trade spectrum and looks to be in a fantastic place on account of its profile as a dominant commodity exporter. The Brazilian Economic Ministry recently reported that exports in March recently hit an all-time record of $29bn, representing 20% annual growth.

Brazil

I also don’t believe this will be a one-off, and you can expect the momentum to linger, as the ministry recently lifted its FY export forecasts to nearly $350bn; this would imply that Brazil continues to maintain this approx. $29bn monthly export run rate for the rest of the year. A $350bn FY export number would also represent an impressive trade surplus of $112bn.

You can imagine what a world of good this could do for the prospects of the Brazilian Real (BRL), particularly at a time when a lot of currencies are coming under pressure, as the respective central banks of other countries haven’t quite been able to keep pace with the US Fed’s aggressive intention to lift policy rates through this year. I don’t believe you can level that same accusation at the Brazilian Central Bank; in fact as noted recently in The Lead-Lag Report, the BCB has done a far better job than the US Fed of gauging underlying conditions in the economy and they have done a better job of communicating and managing expectations.

You can’t also say that they have been behind the curve with policy rates as the selic has already been raised to 11.75% from the 2% levels seen a year ago. Note that rates will be raised even further at the next policy meeting and will likely hit 12.75% (some economists think that rates could be extended even to the 13.25% levels). Unlike other currencies which have been vulnerable to the carry trade, the BRL has stood its ground and is up 20% vs. the USD. Needless to say, the elevated benchmark rates in Brazil will provide a shot in the arm for the net interest margins of Brazilian banks which should bode well for FLBR given that that sector has the largest weight.

Conclusion

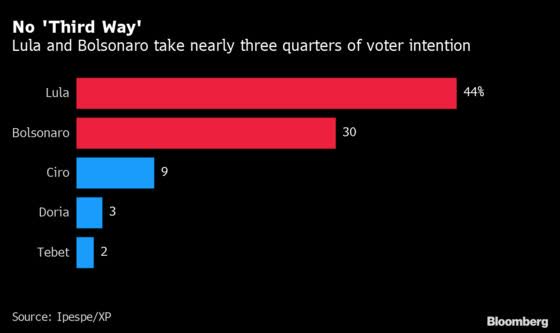

As noted in this week’s global view section of The Lead-Lag Report, after some weakness tied to the Ukraine issue, emerging markets (ex-China) appear to be settling down, whilst Latin American stocks, in particular, appear to be the pick of the bunch. Given how much it has already run up this year, the sustenance of a long trade on FLBR at current levels isn’t as attractive as it was since the turn of the year, but I still believe there’s still some juice left given the lingering commodity narrative and the rate hike dynamics. Also consider that election-related volatility is unlikely to be too pronounced as Luiz Inacio Lula da Silva looks to have developed quite a comfortable lead over the reigning Bolsonaro (as per recent opinion surveys carried out by Ipespe in early April) and the market will appreciate this clarity.

Bloomberg

Crucially, despite the appreciation in the ETF, FLBR still continues to trade at very attractive forward P/E valuations of just 6.7x. This represents a whopping 40% discount to the forward multiple of an ETF tracking the broader emerging markets – iShares MSCI Emerging Markets ETF (EEM).

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

[ad_2]

Source links Google News