[ad_1]

Win McNamee/Getty Images News

The First Trust Clean Energy ETF (NASDAQ:QCLN) is up 75% since my first Seeking Alpha coverage started with a BUY recommendation back in August of 2020 (see QCLN: EVs, Solar, And Wind, Oh My). And while the ETF has done basically nothing over the past year, the companies that make up the fund have been doing anything but standing still. That’s because global capital keeps flowing into the sector and many of these companies continue to demonstrate excellent growth. Given multiple positive catalysts for the clean energy sector (worsening global warming, strong global government funding, and high oil & gas prices), I don’t see the investment thesis for green energy and EVs changing for decades to come. Today, I will take a closer look at the QCLN Clean Energy ETF to determine if investors should consider allocating some capital to the fund.

Investment Thesis

The investment thesis here is quite simple: the latest working report from the UN’s IPCC Working Group III paints a dire picture. Group III co-chair Jim Kea said:

It’s now or never, if we want to limit global warming to 1.5°C. Without immediate and deep emissions reductions across all sectors, it will be impossible.

Governments across the globe are responding. The IEA reports that as of October 2021 governments around the world allocated some US$17 trillion in spending to mitigate the impact of the global pandemic. Of that amount, the IEA said:

Approved government spending on clean energy reached US$480 billion. The US$45 billion allocated to renewables – including electricity, heat and fuels (biofuels, advanced biofuels and biogas) – accounted for about 9% of announced public spending on clean energy. The majority of global clean energy stimulus is expected to be spent over 2021-2023.

And that is just government spending. Private sector funding, including foundations and philanthropy, also supports the green energy sector. Indeed, Bloomberg estimates that total global investment in green energy reached $755 billion in 2021. Investment was driven by renewable power and EVs.

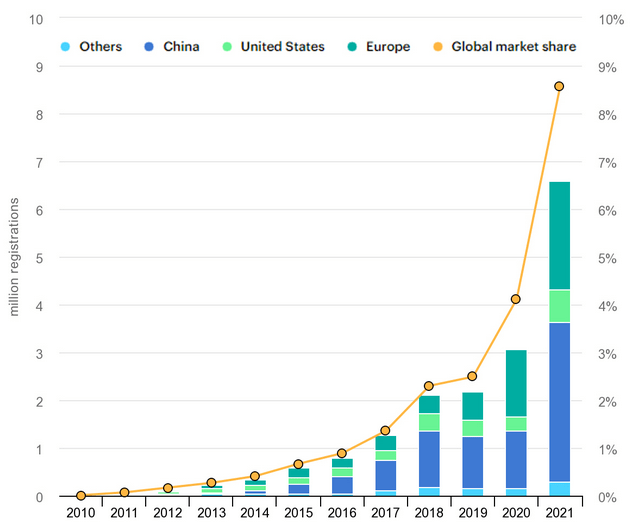

On an anecdotal basis, where I live it currently costs ~$10 to recharge a 300 mile range EV. To fill-up an ICE-based vehicle that gets 20 mpg with a 300 mile range, it costs $60+, or 6x the cost of recharging an EV. That being the case, the current high cost of oil (gasoline) and pain at the pump due to Putin’s war in Ukraine and the resulting sanctions placed on Russia by the U.S. and its Democratic allies, will likely cause many consumers who otherwise may not have considered an EV to do so. Regardless, the EV adoption is growing like crazy and more than doubled in 2021 yoy, led by Europe (on a per capita basis) and China:

Global EV sales growth (Green Car Reports)

So let’s take a look at the First Trust Clean Energy ETF to see how it has positioned its portfolio to benefit investors.

Top-10 Holdings

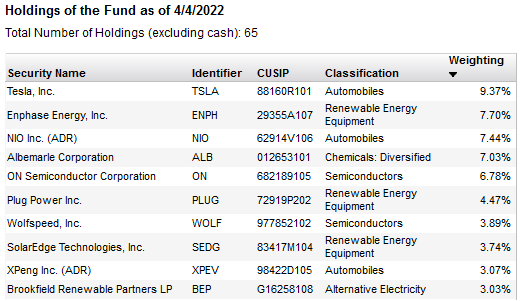

The top-10 holdings in the QCLN ETF are shown below and equate to what I consider to be a relatively concentrated allocation within the 65 company portfolio:

QCLN ETF Top-10 Holdings (First Trust)

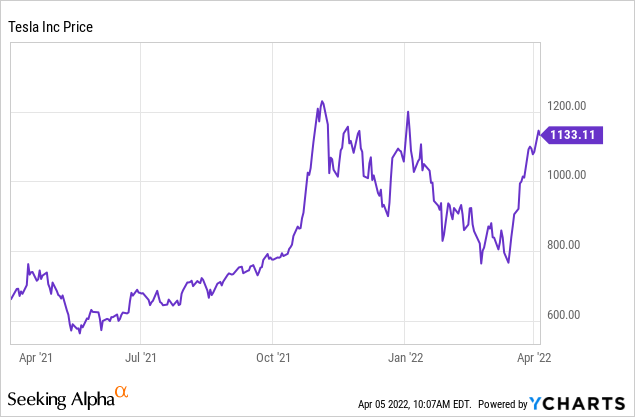

Not surprisingly, Tesla (TSLA) is the #1 holding with a 9.4% weight. Fueled by the prospects of another stock split, Tesla stock has really been on a roll lately – reclaiming the $1,000 level (and then some). But the company has been delivering as well: Q1 shipments reached 310,000 units and the company is expected to end the year with an exit capacity of 2 million EVs on an annual basis.

Enphase (ENPH) is the #2 holding with a 7.7% weight. Enphase makes micro-inverters, software, and monitoring services for the global home solar market. The company has a strong long-term track record of growing revenue and earnings.

Lithium miner Albermarle (ALB) is the #4 holding with a 7% weight. ALB is up 48% over the past year, but is currently down 20%+ from its high. The company trades with a forward P/E of 36.9x and is considered a critical link in the global lithium supply-chain.

ON Semiconductor (ON) makes a plethora of chip solutions for the EV market. ON is up 21% since my Seeking Alpha BUY rating article in October (see EVs Are A Primary Catalysts for ON Semiconductor).

QCLN’s top-10 holdings include two Chinese-based EV-makers’ ADRs, NIO (NIO) and XPeng (XPEV), that in aggregate account for ~10.5% of the entire portfolio. Both are fast growing companies, but come with the associated risks of a lack of accounting transparency, and possible fall-out from the continuing trade-war between the US & China, which could easily worsen if China supports Putin’s war in Ukraine.

The #10 holding is Brookfield Renewable Partners (BEP). BEP owns a portfolio of renewable power generating assets in North America, Colombia, Brazil, Europe, India, and China. The company currently yields 3.2%.

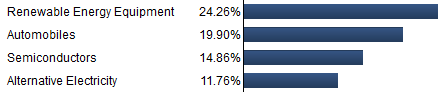

Overall, the QCLN portfolio is heavily invested in 4 primary sub-sectors:

QCLN ETF Portfolio Allocation (First Trust)

Performance

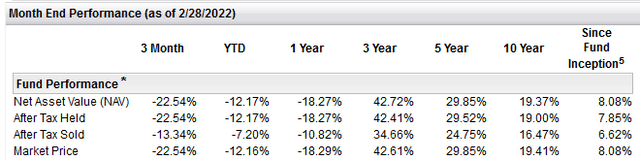

With an average annual 10-year return of 19.4%, the QCLN ETF has an admirable long-term performance track record:

QCLN Performance Track Record (First Trust)

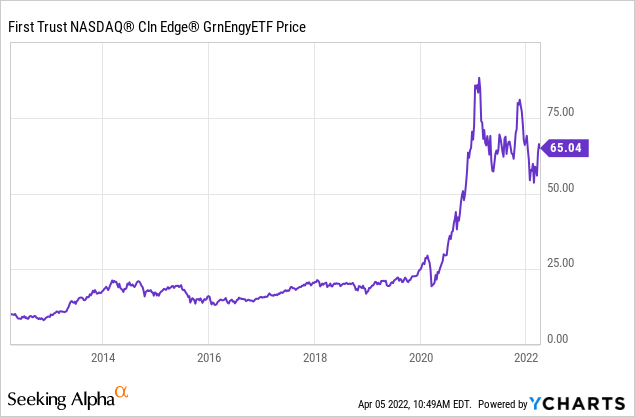

However, investors should be aware that the majority of those returns came in 2020-2021 alone:

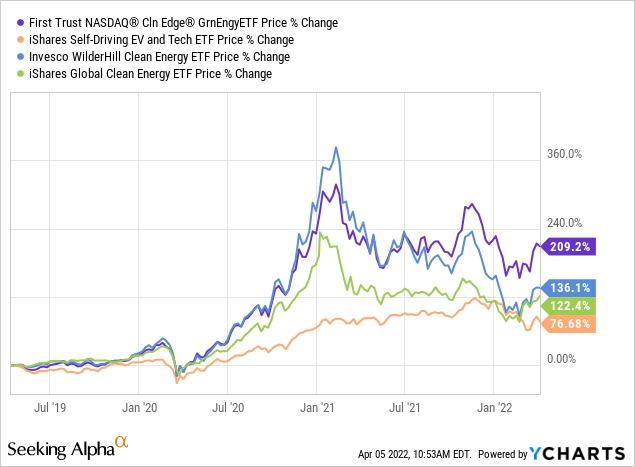

And, of course, there are alternatives. The following graphic compares the 3-year returns of QCLN with the iShares Self-Driving And EV Tech ETF (IDRV), the Invesco WilderHill Clean Energy ETF (PBW), and the iShares S&P Global Clean Energy Index (ICLN):

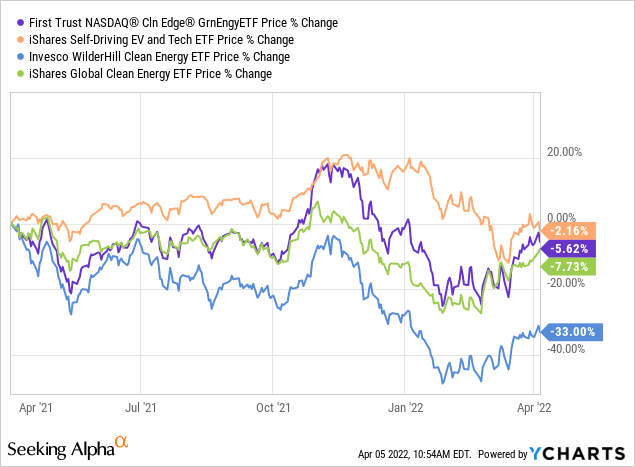

As can be seen, the QCLN ETF wins by a considerable margin – due mostly to its performance during the pandemic. However, if we look over the past one year, the returns look considerably different:

Risks

The difference in the two performance charts above are likely due to the outlook for higher interest rates given the high current inflation rate. That has taken the shine off of some of the high-flying growth names in the clean energy sector. During the pandemic, the market was flush with money and low rates. That encouraged more risk taking. Now, with significantly higher rates on the horizon, and the Federal Reserve also taking away the “punch bowl” of liquidity, investors are focusing much more on earnings, strong balance sheets, and businesses that can continue to thrive in a potentially slower-growth economy – perhaps even a recession.

That being the case, I prefer the IDRV ETF over QCLN. IDRV is more concentrated on larger companies that are cash-rich, generate strong free-cash-flow, and don’t need to borrow money (see 3 Reasons Why IDRV Will Outperform ARKQ).

Meantime, QCLN’s expense fee of 0.60% is quite high in my opinion, and compares to 0.47% for IDRV.

Summary & Conclusion

While I continue to be a long-term bull on the clean energy space, the QCLN ETF may not be the best place to allocate new capital at this time. I rate QCLN a HOLD and advise investors take a look at the IDRV ETF as a much better positioned alternative, although without the same exposure to renewable energy power generation that one can find in the QCLN ETF or some of the other alternatives. That said, I believe that rising rates will continue to put downward pressure on those companies that need to borrow money to build large-scale greenfield solar & wind projects. Which is another reason I favor the EV and EV-semiconductor thesis – and the IDRV ETF over QCLN – at this time.

[ad_2]

Source links Google News