[ad_1]

adventtr/E+ via Getty Images

Thesis and Background

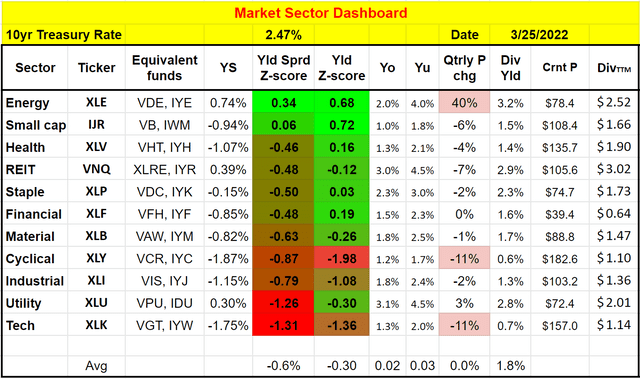

We use the following market sector dashboard to put our finger on the pulse of the market and its major sectors. Especially, the simple YS (yield spread, defined as the TTM dividend yield minus the 10-year treasury rates) is the first thing we look at. They give us a 30,000 feet view of where to look further – which sector, growth stocks, value stocks, bonds, or precious metals, et al. We will detail the meaning of each entry in the next section, and we update the dashboard monthly. Feel free to download or export the google-sheet via the following link too: Market Sector Dashboard.

A few overall impressions on the market and the Health Care sector this month:

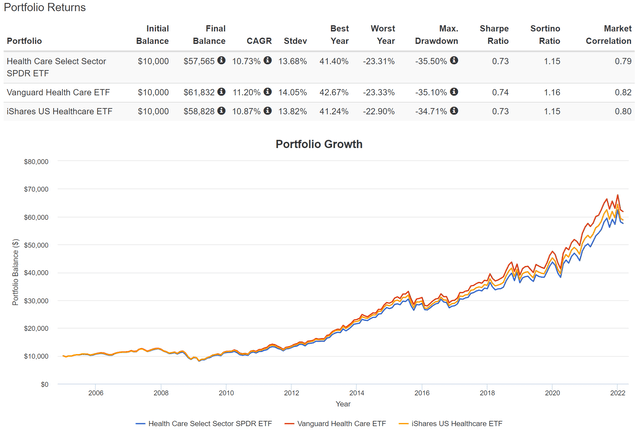

- Firstly, the results and dashboard apply to several of the popular Health Care sector ETFs, such as the Health Care Select Sector SPDR (NYSEARCA:XLV), the Vanguard Health Care ETF (NYSEARCA:VHT), and also the iShares U.S. Healthcare ETF (IYH). The reason is that these funds are quite similar and their valuation is closely correlated as you can see from the second chart below. As such, this article will present the results for XLV and VHT, but the results should be applicable for all similar funds.

- The yield spread between these Health Care ETFs and the risk-free rates is currently below their historical level by a good margin. With a YS Z-score that is significantly negative (-0.46), XLV and VHT are substantially overvalued compared to their historical spectrum.

- The rapid rise of treasury rates has made the yield from these funds unattractive. The 10-year treasury rates just surged above 2.5% for the first time since mid-2019 and are expected to rise further based on the latest Fed dot-plot.

- Although, on the positive side, you will see these funds have never lost money (when adjusted for dividends) in any two-year period in the past decade.

With the above overall discussion, we now move on to the specifics of the dashboard, XLV, and VHT

Source: author

Source: Portfoliovisualizer.com

The dashboard explained

Note: if you are familiar with our Market Sector Dashboard already, you can skip this section. It describes the mechanics of the dashboard.

- The yield spread Z-score. It gauges the dividend yield of a given sector relative to the 10-year treasury rates. How the yield spread is calculated will be detailed in the next section. A larger Z-score suggests larger undervaluation compared to the historical record and treasury rates. And vice versa.

- A Z-score that is closer to 1 means the yield spread is near the thickest level of the historical spectrum and is color-coded by bright green. And vice versa.

- The yield spread Z-score. Similar to the yield spread Z-score, it gauges the dividend yield of a given sector relative to its own historical record. A larger Z-score (greener) suggests a larger undervaluation compared to its own historical record. And vice versa.

Yield spread and yield spread Z-score

For bond-like equities fund XLV and VHT, an effective way to evaluate their valuation with interest rates adjusted is to calculate the yield spread. Details of the calculation and application of the yield spread have been provided in our earlier article. The yield spread is an indicator we first check before we make investment decisions. We’ve fortunately had very good success with this indicator because of:

- Its simplicity – it only relies on the most simple and reliable data points (treasury rates and dividends). In investing, we always prefer a simpler method that relies on fewer and unambiguous data points rather than a more complicated method that depends on more ambiguous data points.

- Its timeless intuition – no matter how times change, the risk-free rate serves as the gravity on all asset valuations and consequently, the spread ALWAYS provides a measurement of the risk premium investors are paying relative to risk-free rates. A large spread provides a higher margin of safety and vice versa.

With this background, you will see below that when adjusted for interest rates, their current valuations are not at an attractive level.

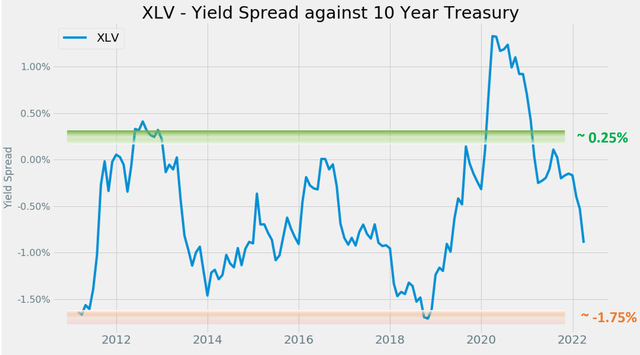

Take XLV as an example. The following chart shows the yield spread between XLV and the 10-year treasury. The dividend yield is calculated based on the TTM dividends. As can be seen, the spread is bounded and tractable most of the time. The spread has been in the range between about 0.25% and negative 1.75% the majority of the time during the past decade. Such a tractable YS suggests that when the spread is near or above 0.25%, XLV is significantly undervalued relative to the 10-year Treasury bond (i.e., I would sell treasury bond and buy XLV). In another word, sellers of XLV are willing to sell it (essentially an equity bond with growth built-in) to me at a yield that is 0.25% above the risk-free yield. So it is a good bargain for me. And vice versa.

You can see the screaming signal in 2020 when the yield spread surged to ~1% level – and this is why this dashboard is the first thing we look at when we make our investment decisions.

As of this writing, the spread is about -1% as you can see. It is a level that is substantially below the historical average, signaling a substantial overvaluation relative to risk-free rates.

Author based on Seeking Alpha data

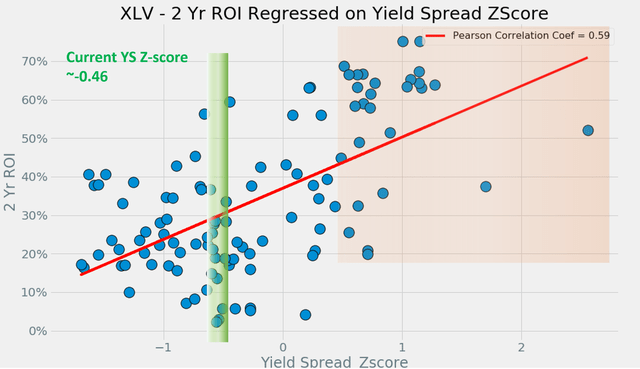

For readers familiar with our analyses, you know that the short-term returns are closely correlated with the yield spread for many of the funds and stocks. And as you can see from the chart below, it is also true for XLV. This chart shows the 2-year total return on XLV (including price appreciation and dividend) when the purchase was made under different yield spreads. There is a clear positive trend and a Pearson correlation coefficient of 0.59.

Again, the screaming buying opportunities in 2020 are shown by the two data points on the far-right side of the charts. And you see the outsized return in the next 2 years. In general, also shown in the green box, when the yield spread Z-score is above 1, the total returns in the next two years have been all positive and quite large (almost all above 40%). And when the yield spread Z-score is above 0.5, the total returns in the next two years have been all been about 20%.

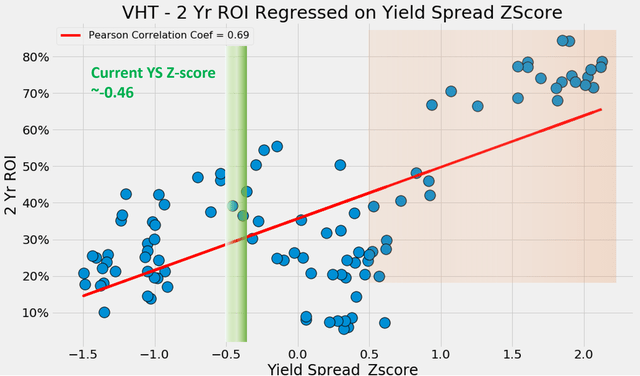

You can see a very similar correlation for VHT, again, because they share a similar underlying indexing approach. For VHT, the positive trend is even stronger and the Pearson correlation coefficient of 0.69. Also shown in the green box, when the yield spread Z-score is above 1, the total returns in the next two years have been all positive and even larger (all above about 65%). And when the yield spread Z-score is above 0.5, the total returns in the next two years have also been all been about 20%.

Again, as of this writing, the YS Z-score is about -0.5, substantially below the historical average.

Although, on the positive side, you will see these funds have never lost money in any two-year period in the past decade.

Author based on Seeking Alpha data

Author and Seeking Alpha data.

Risks and uncertainties

Before closing this article, we want to point out a few risks and uncertainties associated with the approach described in this article.

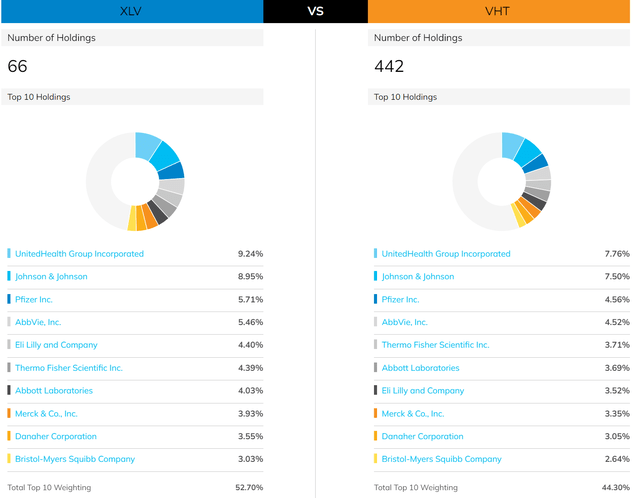

First, despite their similarities, XLV and VHT are not exactly the same. As you can see from the following chart, XLV holds a total of 66 stocks and VHT a total of 442 holdings. Although you can also see that A) their top 10 holdings are identical and their weights are also almost identical, and B) the top 10 holdings represent more than 44% of the total assets in both funds. Therefore, even though the valuations of these funds won’t be exactly the same, but should be quite close.

Second, as detailed in our earlier article, dividend yields do not always reflect business fundamentals due to the following factors:

- Tax law – dividend can change quite a bit depending on whether the tax codes favor it or not.

- Political climate – dividend can also change based on how politically popular it is.

- Composition of the market index – dividend yield of “the market” can also be biased if the index is dominated by a few mega-caps who do not pay dividends – like what we are experiencing now.

- As a result, we do not directly use the yield spread in our investment or asset allocation decisions. In practice, we first adjust for the above corrections and then use the adjusted yield spread in our investment decision. But the data and approach illustrated here is also the first place we check.

Source: ETF.com

Conclusions and final thoughts

We use a Market Sector Dashboard to put a finger on the pulse of the market and its major sectors. For this month, our key observations are:

- With a YS Z-score substantially negative (about -0.5), XLV and XHV (and other healthcare sector funds such as IJH) are not attractively valued compared to their historical spectrum.

- The 10-year treasury rates just surged above 2. 5% for the first time since mid-2019 and are expected to rise further based on the latest Fed dot-plot, further pressuring their valuation.

- Although, on the positive side, these Health Care funds have never lost money in any two-year period in the past decade.

- Furthermore, the overall market also features a slightly negative yield spread relative to the treasury rates (Z-score about -0.6%). It is almost zero. But for us, it is to be monitored closely as it could signal a fundamental change between bond valuation and equity valuation. The yield spread Z-score has been positive (or almost positive) since later 2019.

Thx for reading and look forward to your comments!

[ad_2]

Source links Google News