[ad_1]

zxvisual/E+ via Getty Images

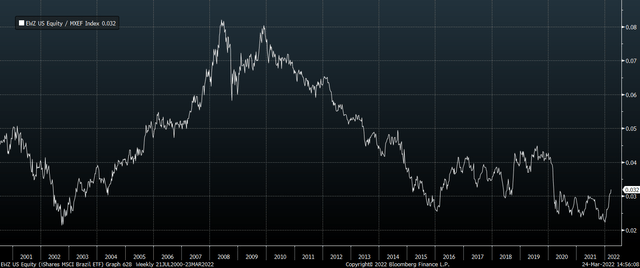

I wrote at the start of 2022 in ‘EWZ: 8% Dividend Yield Suggests Major Upside‘ that the EWZ was likely to post exceptionally strong returns over the next 12 months as the market was pricing in a full-blown economic and political crisis which was unlikely to occur. Since then, the ETF is up almost 40% in total return terms while the EM benchmark is down 7%.

Despite such impressive outperformance, Brazilian stocks remain cheap from a valuation perspective and look to be embarking on a sustained uptrend thanks in part to the recovery in commodity prices. The iShares MSCI Brazil ETF still yields 5.9%, and this is likely to rise absent a major stock price rally. The bulk of the rally since the January lows has been the result of the recovery in the Brazilian real, and while the surge higher in U.S. bond yields poses a risk, there are still reasons to believe the currency is fundamentally supported.

EWZ Vs MSCI Emerging Markets Index (Bloomberg)

The EWZ ETF

The EWZ tracks the performance of the MSCI Brazil index and charges an expense fee of 0.59%. The ETF holds 50 companies at present and is heavily weighted towards commodities. Thanks to the recent rise in iron ore prices, the Materials sector makes up 26% of the index, which is dominated by Vale’s 20% share. Financials are the next largest sector with a weighting of 25%, while the Energy sector makes up a further 17%, dominated by Petrobras. The EWZ’s dividend yield is currently an impressive 5.9% which dwarves the 0.57% expense fee. Due to the high degree of volatility of the Brazilian currency, the EWZ’s performance has tended to be driven as much by the BRL as it has by the stock market itself. However, the key underlying driver of both markets is the price of commodities, as higher export prices benefit both local earnings and the appetite for local currency in dollar terms.

Still Priced For A Crisis Despite Huge Outperformance

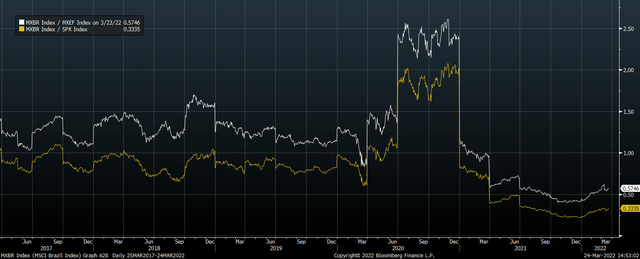

After outperforming the MSCI Emerging Markets index by almost 50% since the start of the year, readers may be surprised to see that the MSCI Brazil still trades at a 43% discount to the EM benchmark on a trailing price/earnings basis and a 47% discount on an EV/EBITDA basis. Meanwhile, its dividend yield is 3.1x and 5.3pp higher. This is an incredible degree of undervaluation, especially when considering that Emerging Market stocks generally are actually reasonably valued. If we compare the MSCI Brazil to the U.S. S&P500, the discount is staggering. Brazil trades at a 67% discount on an earnings basis and pays a 5.6x higher dividend yield.

MSCI Brazil P/E Discount Vs MSCI EM And S&P500 (Bloomberg)

While Brazilian stocks have typically traded at a slight discount to their peers, the current discount suggests investors continue to see a crisis developing in the country sufficient to cause earnings and dividends to collapse. However, as I have argued in previous articles on Brazil (see ‘EWZ: Brazil Is A Buy Amid Surging Dividend Yield’), the country’s macroeconomic fundamentals are far superior to previous periods when assets traded at similarly discounted levels. Meanwhile, despite socialist leader Luiz Inacio Lula da Silva leading in the polls ahead of the October election, the political risk outlook does not appear to be anywhere near as fragile as it did the last time Lula came to power in 2003.

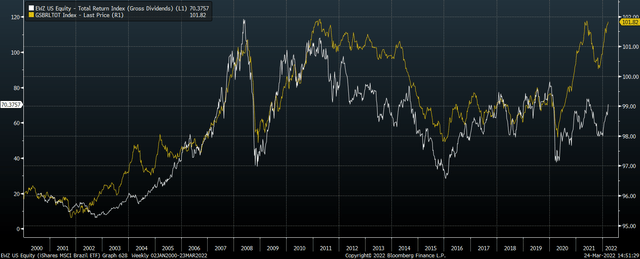

Back then, it was widely feared that he would default on the country’s external debt load and usher in a period of economic chaos. Thanks to a boom in commodity prices and less radical than expected policies, Brazilian corporate profits and stock prices increased eightfold over his 7-year presidency. This is by no means a prediction of what lies ahead, but it shows that Brazilian markets can perform extremely well following periods of panic driven valuation bargains and rising commodity prices. With the country’s terms of trade improving dramatically in recent months following the global commodity price surge, the risk-reward outlook remains extremely positive.

EWZ Total Return Vs Terms Of Trade (Bloomberg, Goldman Sachs)

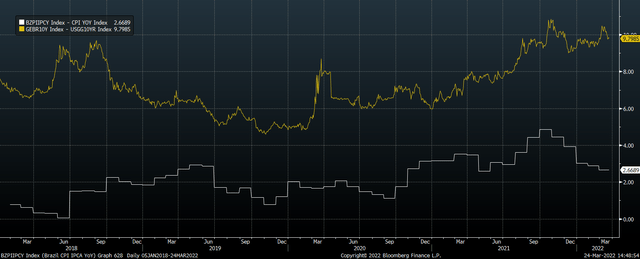

Currency Strength Is Well Supported

The outperformance of the EWZ so far this year has been largely down to the strong recovery in the Brazilian real, as is usually the case for Brazilian stocks. However, despite these gains the currency remains undervalued in real effective terms, while real interest rate differentials are significantly in Brazil’s favor. As the chart below shows, while U.S. bond yields have been surging on expectations of aggressive rate hikes, the same has been happening in Brazil, where 10-year bond yields are almost 10pp higher. Considering that the headline inflation differential is less than 3pp, this suggests the real should remain supported.

Brazil Vs US 10-Year Bond And CPI Differential, % (Bloomberg)

[ad_2]

Source links Google News