[ad_1]

Vladislav Chorniy/iStock via Getty Images

This dividend ETF article series aims at evaluating products regarding the relative past performance of their strategies and quality metrics of their current portfolios. As holdings and weights change over time, I post updated reviews when necessary.

JOET strategy and portfolio

The Virtus Terranova U.S. Quality Momentum ETF (JOET) has been tracking the Terranova U.S. Quality Momentum Index since 11/17/2020. It has a portfolio of 125 stocks, $120.7M in asset value, a distribution yield of 0.48% and an expense ratio of 0.29%. JOET features an original strategy, mixing quality factors and momentum.

As described by Virtus, quality and momentum scores are calculated for the 500 largest US securities in market capitalization. The momentum score is based on the 12-month return. The quality score combines three factors: return on equity (ROE), debt to equity ratio and three-year sales growth rate. The underlying index selects a set of 125 stocks determined as the better half regarding the quality score within the better half regarding the momentum score. The index is reconstituted and rebalanced in equal weight every quarter.

JOET is cheaper than the S&P 500 (SPY) in price-to-earnings, but other valuation ratios are similar.

|

JOET |

SPY |

|

|

Price / Earnings TTM |

19.01 |

21.28 |

|

Price / Book |

4.01 |

4.08 |

|

Price / Sales |

2.73 |

2.85 |

|

Price / Cash Flow |

16.85 |

16.53 |

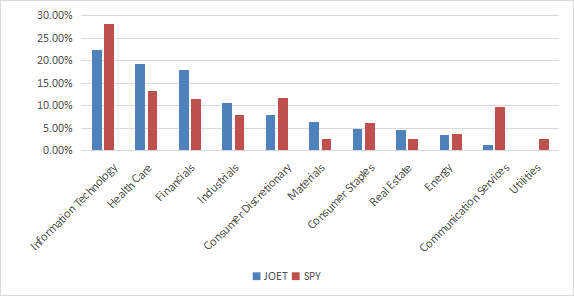

The fund invests mostly in U.S. based companies (97.8% of asset value). Technology is the heaviest sector, not as heavy as in SPY though (22.29% vs. 28.06%). Then come healthcare (19.34%), financials (18.04%) and industrials (10.66%). Other sectors are below 8% individually and 30% in aggregate. Compared to SPY, JOET overweights healthcare, financials, industrials, materials and real estate. It underweights technology, communication, consumer discretionary, consumer staples and ignores utilities.

JOET sectors (chart: author; data: Fidelity)

Holdings are in equal weight on rebalancing dates, but position sizes may drift with price action. The next chart lists the top 10 holdings as of writing. The heaviest position represents less than 1.2% of asset value, so the risk related to individual stocks is low.

|

Ticker |

Name |

Weight |

EPS growth %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

NUE |

Nucor Corp |

1.19% |

890.61 |

5.65 |

6.89 |

1.51 |

|

ADM |

Archer-Daniels-Midland |

1.00% |

52.15 |

17.24 |

15.87 |

1.94 |

|

COP |

ConocoPhillips |

0.98% |

342.83 |

15.91 |

8.98 |

2.42 |

|

ABBV |

AbbVie Inc |

0.97% |

125.31 |

23.58 |

10.72 |

3.71 |

|

EOG |

EOG Resources Inc. |

0.96% |

862.56 |

14.51 |

9.30 |

2.59 |

|

WRB |

W. R. Berkley Corp |

0.95% |

93.57 |

17.09 |

16.92 |

0.56 |

|

CINF |

Cincinnati Financial Corp |

0.94% |

140.63 |

7.07 |

23.71 |

2.16 |

|

MKL |

Markel Corp |

0.93% |

13.10 |

7.68 |

17.76 |

0.00 |

|

PXD |

Pioneer Natural Resources Co |

0.93% |

1146.99 |

27.86 |

9.02 |

1.08 |

|

OKE |

ONEOK Inc |

0.92% |

144.80 |

19.26 |

16.58 |

5.80 |

Performance

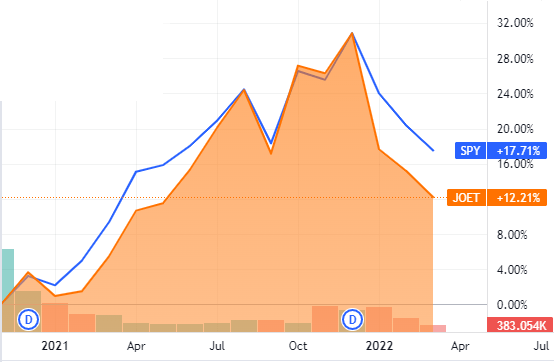

The next chart compares JOET and SPY share prices since JOET’s inception on 11/17/2020. JOET has lagged the large cap benchmark by 5.5 percentage points in 1 year and 4 months. Moreover, it is more volatile and currently is in a deeper drawdown.

JOET vs. SPY (TradingView on Seeking Alpha)

However, this is a short period of time and it may not be representative of long-term performance. I have tried to simulate the strategy as I understand it from January 2000 to June 2021 and the results are below. This needs a note of caution: the methodology is not 100% disclosed in the prospectus, so some points were left to my interpretation when I coded it.

|

Total Return |

Annual Return |

Max Drawdown |

Sharpe ratio |

Volatility |

|

|

Simulation |

664.31% |

9.96% |

-49.09% |

0.64 |

14.93% |

|

S&P 500 (SPY) |

325.48% |

7.00% |

-55.42% |

0.45 |

15.21% |

|

Equal-weight S&P 500 (RSP) |

652.00% |

9.88% |

-59.90% |

0.55 |

17.59% |

Data calculated with Portfolio123

ETF management fees are included in SPY performance, but must be subtracted from the strategy simulation result. My simulation of JOET would have outperformed SPY by about 2.7 percentage points annualized, doubling the benchmark’s total return in two decades. It would also have a slightly lower risk measured in maximum drawdown and standard deviation of monthly returns (named “volatility” in the table).

As the underlying index is equal-weighted, it also makes sense to compare it with the equal-weight S&P 500 (RSP). The excess return is immaterial, but risk reduction is significant.

Comparing JOET with my quality filter

In previous articles, I have presented my preferred quality metrics: Return on Assets, Piotroski F-score, Altman Z-score.

The next table compares “simulated JOET” from 2000 to June 2021 with a subset of the S&P 500: stocks with an above-average ROA, a good Altman Z-score and a good Piotroski F-score. The subset is reconstituted and rebalanced in equal weight quarterly, like JOET’s underlying index.

|

Annual Return |

Max Drawdown |

Sharpe ratio |

Volatility |

|

|

JOET Simulation |

9.96% |

-49.09% |

0.64 |

14.93% |

|

My quality subset |

11.45% |

-47.65% |

0.93 |

15.63% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

My quality filter beats JOET strategy in return, drawdown and risk-adjusted performance (I pick 14 stocks of my real portfolio in this subset, more info at the end of this post).

Scanning JOET with quality metrics

JOET holds 125 stocks. According to my calculations, the average ROA of the portfolio is far above the S&P 500: 12.29% vs. 7.86%. The Altman Z-score is also better: 5.32 vs. 3.42. There is no significant difference in Piotroski F-score. These metrics, which are more comprehensive than the factors used for the index constitution, point to an excellent portfolio quality relative to the large cap benchmark.

|

Altman Z-score |

Piotroski F-score |

ROA % TTM |

|

|

SPY |

3.42 |

6.43 |

7.86 |

|

JOET |

5.32 |

6.30 |

12.29 |

Takeaway

JOET follows a quantitative strategy based on 12-month return and a 3-factor quality ranking. My more comprehensive metrics confirm JOET has a high-quality portfolio. It is much better than the benchmark in aggregate Altman Z-score and return on assets. Price history is underwhelming, but too short to assess performance. A two-decade simulation of my interpretation of the strategy slightly beats SPY, but it is on par with the equal-weight S&P 500. JOET is a good product for investors seeking an equal-weight allocation in high quality large caps with an above-average momentum. Personally, in the quality ETF category, I prefer the WisdomTree U.S. Quality Dividend Growth (DGRW), reviewed here. JOET is not very liquid: using limit orders is always recommended. For transparency, I have a passive position in DGRW and a quality-oriented active portfolio of 14 stocks (“Stability” model).

[ad_2]

Source links Google News