[ad_1]

skynesher/E+ via Getty Images

Main Thesis/Background

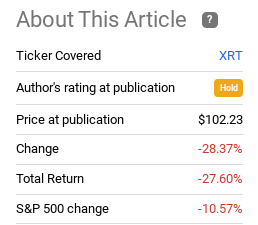

The purpose of this article is to evaluate the SPDR S&P Retail ETF (XRT) as an investment option at its current market price. The fund’s objective is “to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Retail Select Industry Index”. This is a fund that, despite owning, I was reluctant to add to or recommend as we neared the end of last year. I saw limited upside, and this outlook definitely was vindicated to a degree. However, I should have been more bearish, as XRT is down over 27%, far outpacing the S&P 500:

Fund Performance (Seeking Alpha)

Given this disaster of a return, I wanted to take another look at XRT to see if I should get more bullish or bearish in the near term. Given the fund is in a bear market, and America has proven resilient before, buying in here could definitely have some merit. However, there are a few key headwinds that suggest more pain could be forthcoming. These include rising energy/gasoline prices, sticky inflation figures, and continued uncertainty in Europe. These headwinds balance out the positives to some degree, in my view, and make me a reluctant supporter of the “hold” rating for XRT in particular.

Weakness Is Broad, XRT In Bear Market – Suggests Opportunity

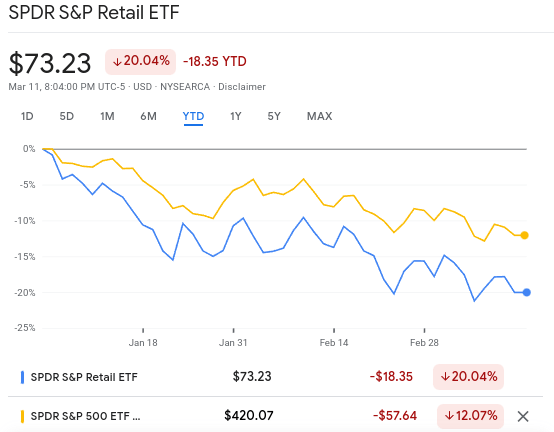

To begin, I want to first emphasize why I am not a “bear” on this fund. In truth, I should have been a few months ago. I underestimated the pressures facing the U.S. consumer, and I had not predicted a Russian invasion in Ukraine. As a result, the not surprising returns from XRT have been abysmal. Consumers are feeling concerned, appropriately so, and XRT has actually just entered bear market territory on a year-to-date basis. While it is true that the broader indices are also down, we should note XRT is an underperformer:

YTD Performance (Google Finance)

I bring this up because bear markets are often smart times to deploy cash. While this is not always true, and buying now in no way guarantees a positive return, the sharp decline in a traditionally strong performing sector like retail should entice at least some value buyers. While I will discuss why I am not overly optimistic in the next few paragraphs, I also can’t justify an alarmist outlook either. The fund has already hit a very low level, so it would be a little late to the game to call this a “sell” right now. This helps to support my hold rating.

Americans Are Being Forced To Spend

So, markets have sold off, and retail is down big. The question here is – why wouldn’t investors want to be piling in? After all, being during times of fear and uncertainty often yield “alpha”, when compared to just buy-and-hold strategies. With the current backdrop, couldn’t the argument be to get aggressive with new positions?

In fairness, the answer could be yes. And XRT’s drop over 20% since January 1 suggests there may be more upside than downside ahead. But there are a couple of key fundamental points that make me hesitant to get overly bullish.

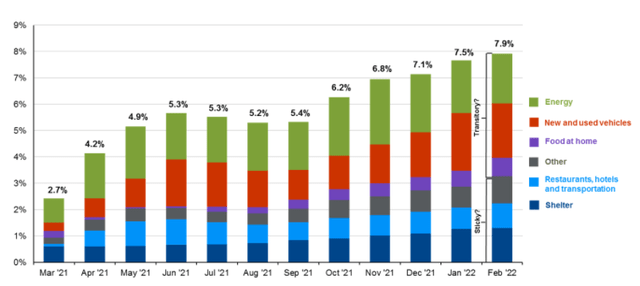

One, Americans as a whole are really under pressure from rising prices across the board. This is largely being driven by oil prices, but we should note that is only one factor of inflation. Even when we factor out rising energy costs, we would see that the CPI index is at a high level historically:

CPI (JPMorgan Chase)

The result from this is that Americans’ disposable income is under siege. While “spending” money can be good for retail, it depends how it is spent. As consumers spend more for the same amount of goods, that limits their overall discretionary purchasing power. Rising fuel prices are sucking off consumer dollars that could go elsewhere, and we also have to take into account that rising energy prices trickle down to other consumer staples and goods as well. As a result, while spending is up, Americans are not necessarily buying more stuff, just spending more money for the same basket of goods. Since XRT’s fortunes are tied to consumers buying more discretionary items, this is not a welcomed trend.

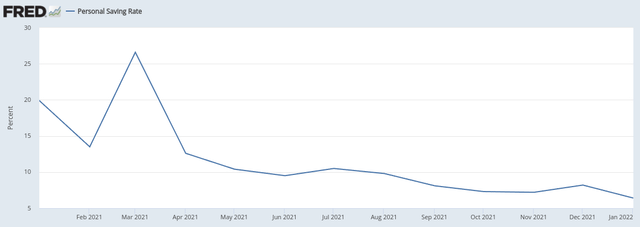

On the surface, Americans are still in reasonable financial shape. Wages are rising, stock market levels are still higher than they were a year ago, and households have savings to draw on from when they cut back during the onset of the pandemic. However, there is only so much longer this can last before households have to start cutting back, which would be bad news for the economy as a whole and XRT specifically. For support, consider that savings rates are way down from where they were over the past year. This suggests Americans are absolutely feeling pressure:

Personal Savings Rates (St. Louis Fed)

As you can see, this is a trend that really accelerated in the second half of 2021, and has continued to this day. Coincidentally, that is also around the time XRT began to fall, and continues to at the time of writing this piece. So, the two seem to go hand in hand.

My conclusion is that investors need to keep a keen eye on how the consumer story plays out in the months ahead. This is extremely dependent on energy costs, and broader levels of inflation. If we see cost pressures ease, then American households will see some major relief, and discretionary retail plays like XRT are going to push higher. But if inflation does not subside, and geopolitical pressures in Europe keep oil and gas futures at elevated levels, then it is difficult to see a scenario where XRT offers alpha in the short term.

Commodities Do Seem To Be In Bubble Territory

Expanding out the point above, I will offer a point that helps to balance out the negatives to the inflationary environment. While I correctly called that inflation would not be transitory in 2021, I do expect price increases to at least slow in the second half of the year. Again, I am not suggesting we are going to see rapid price decreases and will emphasize investors need to manage their inflation and duration risks in their portfolios. But, that said, there are signs that the inflation rates we are seeing currently are not sustainable. In fact, if we look at the commodities market – which measures everything from oil, metals, and raw materials – prices seem to actually be in bubble territory:

Commodities (Yahoo Finance)

This is part of the reason for my more neutral stance. Are things bad right now, in the sense of rising costs and rising prices? Absolutely. But these trends simply are not sustainable longer term. Something is going to give – whether it is on the supply or demand side. Producers and supply-siders have added incentive to produce, make, and distribute more goods. On the demand side, buyers and consumers are not going to be able to keep up with pace of price increases indefinitely. Something is going to give – and that will stop when appears to be insanity pricing (as evidenced in the above graph).

The problem is knowing when this will be. That is again why I am not a bull at this precise moment. Are price gains going to cool off? Of course. Is that going to happen in the next few weeks, months, or even this year? We cannot be sure. Until more clarity on this front is reached, it will be hard to be too bullish on consumer-oriented investments.

Consumer Sentiment Is Not Encouraging

I will not look at the underlying holdings of XRT. One of the reasons I like this fund is that it is not overweight at the top, as is the case with many consumer discretionary ETFs. Those funds tend to be dominated by a few names, such as Amazon (AMZN) and Alibaba Group (BABA). That is not the exposure I want, especially since my large-cap ETFs are already holding quite a bit of AMZN anyway. XRT, by contrast, has over 100 holdings and none of them have more than 1.55% of a weighting within the portfolio. Further, the sub-sector concentrations are a mix, including some staples like grocery chains and discretionary areas like apparel and department stores:

Holdings (State Street)

With this backdrop, it helps support why I like this fund as a long-term holding. It is well-diversified and includes exposure to companies that consumers shop at for their wants and needs. This balance makes it an attractive play for the retail space.

The downside at this moment in time, and why I am not adding to my position, is because of the “want” companies. What I mean is the companies that sell those discretionary goods that consumers are going to cut back on (by choice or by fiscal realities) if inflation remains high. I expect this to be a plague on the retail sector for the next few months at least because consumers’ expectations about the future and about inflation are deteriorating.

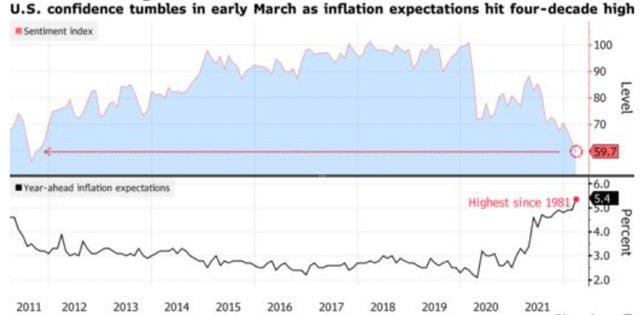

While inflation may end up subsiding sooner than we expect, consumers are not anticipating that for now. In fact, consumer sentiment has dropped to levels not seen in the years, on the expectation that inflation is going to keep on rising in the year ahead:

Inflation vs. Consumer Expectations (University of Michigan)

The thought here is this hurts the discretionary holdings in XRT. While these companies enjoyed pricing power while inflation was low, Americans weren’t driving, and stimulus checks were flying around, that whole dynamic has been turned around. Oddly, with the pandemic on the back-burner, consumers are just as nervous as ever. This is not helpful for investors who own XRT.

Remember, Companies Can Be Hurt By Inflation Too

My final point touches on the fact that rising energy costs and broader inflation are not necessarily a “win” for corporations at the expense of consumers. In reality, both tend to feel some sort of pain – as businesses generally are not able to pass along all of the price increase to the end-user. Prices go up across the supply-chain, meaning that while end buyers pay more, so does everyone else along the line. That includes retailers and other middlemen, so it is in their vested interest to see inflation and input costs decrease as well.

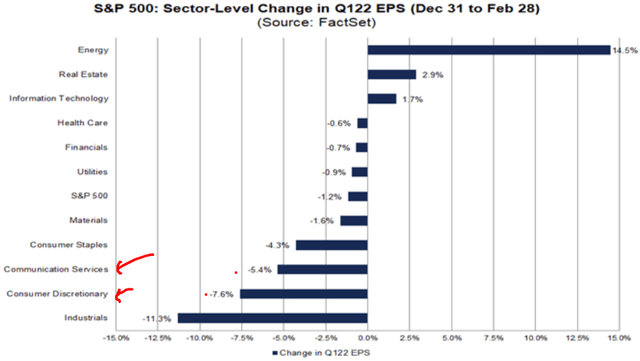

The point here is that while some producers have a lot of pricing power, that fact is not universal. If you own the means of production or own the rights to the commodities that are rising in value, then you are doing quite well. This would include energy exploration companies, miners of gold and precious metals, and owners of agricultural products. But for retailers and consumer-oriented companies, they are probably paying more for the goods they are buying too. And while they are passing on some of that cost, they are probably eating some of the cost and are also impacted when demand for their goods falls. This is likely why S&P 500 earnings estimates are all over the map. While companies within the Energy and Real Estate sector are reporting higher than expected earnings for Q1 2022, consumer-oriented sectors, among many others, are offering guidance of lower earnings than previously expected:

Impact to Earnings (FactSet)

Clearly, the impact to consumer sectors is worse than the average S&P 500 company. This again should underscore my less than optimistic outlook for XRT – the underlying companies are under pressure just like their consumer base.

Bottom line

XRT is my preferred retail ETF, but this is not a sector I am bullish on for the time being. The sell-off has pushed this particular fund into a bear market, which has piqued my interest to some degree. But the headwinds of higher energy costs, accelerating inflation, and declining consumer sentiment all suggest to me that lower prices could be on the way. As a result, I will stay patient and hope to see lower prices present themselves before committing more capital to this investment idea. This leads me to reiterate a neutral rating on XRT, and I would caution readers approach any new positions carefully.

[ad_2]

Source links Google News