[ad_1]

PeopleImages/iStock via Getty Images

By Kara Marciscano

The WisdomTree Cloud Computing Fund (NASDAQ:WCLD) recently completed its semiannual rebalance in February.

Since launching in September 2019, the Fund has steadily added a handful of new companies at each semiannual rebalance. The February reset was notably different from the trend, as we added 20 new constituents to WCLD’s list of holdings.

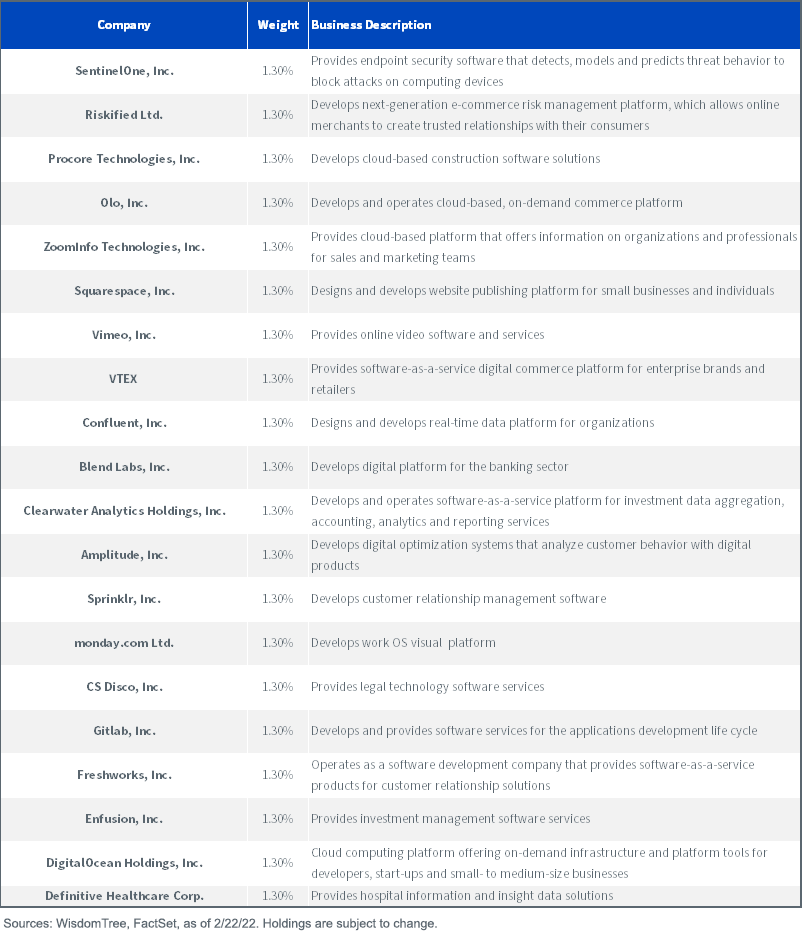

All except one of the additions to WCLD began trading in 2021. We note this is a continuation of the robust IPO trend that we have observed in the cloud computing industry.

The round of additions is impressively diverse, including a wide range of cloud application subcategories:

+ Infrastructure and security+ E-commerce and payment processing+ Real estate and construction+ Enterprise customer relationship management+ Publishing+ Communications+ Enterprise management and analytics+ Banking and financial services+ Enterprise storage, collaboration and communications+ Legal technology+ Health care technology

WCLD now holds 76 companies, 26 more than it did at its 2019 inception. Given that the Fund added 20 companies alone this February, investors may be surprised that the constituent list has only increased by a net number of 26 companies.

As we’ve written about previously, at each rebalance, many of WCLD’s holdings have been acquired or taken private at attractive valuations, often resulting in a positive performance catalyst for the Fund.

There were two removals from WCLD this rebalance, and both were M&A-related.

- Mimecast (3.3% weight previously) has agreed to be acquired by Permira and become a privately-held company for $80 per share, 30% above where the stock was trading in late-October when it was first reported that the company was exploring a strategic sale.

- Momentive Global Inc. (MNTV) (2% weight previously) is expected to be acquired by another WCLD constituent, Zendesk (ZEN), for an implied value of $28 per share, as of the deal announcement. This deal price is approximately 40% above where the stock was trading prior to an activist investor’s push for the company to sell.

The Rebalance Statistics

As a refresher, WCLD follows a rules-based methodology that resets constituents and weights back to equal weight every February and August. It is a simple, yet effective, approach that provides significant exposure to fast-growing, emerging businesses that are often overlooked or diluted in market cap-weighted benchmarks.

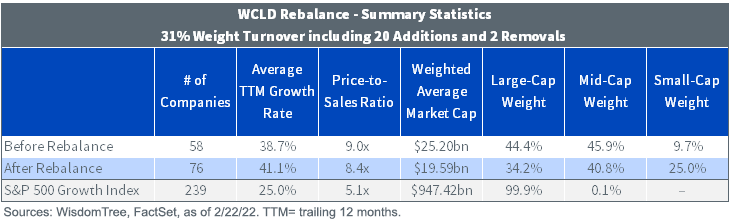

Due to the higher number of additions this cycle, we saw elevated turnover in the portfolio of 31%, compared to the mid-to-high teens turnover we have historically observed.

The valuation of the portfolio had a nice reduction from 9 times to 8.4 times price-to-sales as the strategy adjusted away from large- and mid-cap exposure and added 15% to small-cap cloud company exposure.

As the value over growth rotation took hold earlier this year, we did a pulse check on the valuations of our megatrend ETFs-at that point, WCLD was valued at 11.5 times price-to-sales. At today’s 8.4 times price-to-sales valuation, WCLD is two turns below its historical minimum valuation and 10 turns below its historical maximum valuation.

Despite the decrease in valuation, we continue to see the WCLD constituents deliver robust revenue growth of 41.1%, well above the 25.5% generated by the S&P 500 Growth Index. Elevated relative revenue growth is in part explained by WCLD’s strict rules on company inclusion. New additions to WCLD must generate at least 15% revenue growth, while current constituents must meet a 7% threshold.

WCLD: Strong Growth, Attractive Entry Point

We believe the current environment, with strong relative revenue growth and a consistent pipeline of new companies potentially eligible for inclusion, presents an attractive entry point for investors seeking to gain exposure to WCLD at a near-minimum historical valuation.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the internet and using a distributed network of servers over the internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Kara Marciscano, CFA, Associate, Research

Kara Marciscano joined WisdomTree in October 2018 as a Research Analyst. She supports the creation, maintenance, and reconstitution of our indexes and actively managed ETFs. Prior to joining WisdomTree, Kara was an Assistant Vice President in Equity Research at Barclays covering the insurance sector as well as Berkshire Hathaway. She began her career in the Finance department at Barclays after graduating from Boston College in 2014 with a B.S. in Finance and Operations Management. Kara is a holder of the Chartered Financial Analyst designation.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source links Google News