[ad_1]

FRadu/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

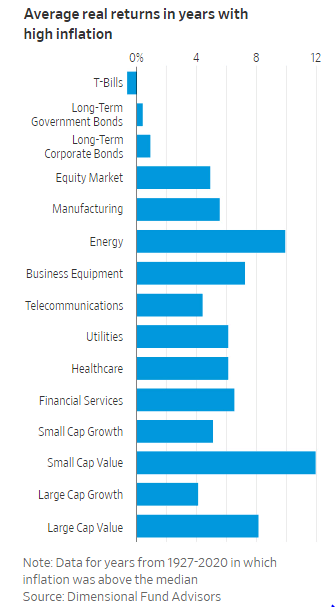

After my article that compared the iShares S&P Small-Cap 600 Value ETF (IJS) to the Vanguard Small-Cap Value ETF (VBR), it made sense to review a Mega/Large-Cap Value ETF as that segment placed third during prior high inflations times according to this chart I found in a Wall Street Journal article.

WSJ.com

Since the Schwab U.S. Large-Cap Value ETF (SCHV) was just reviewed, I chose to review the Vanguard Mega Cap Value ETF (MGV) instead. To be fair to the Mid-Caps, the performance review will include the Vanguard Mid-Cap Value ETF (VOE), the MGV ETF, the SCHV ETF, and the two Small-Cap ETFs listed above.

Value or Growth: A historical look

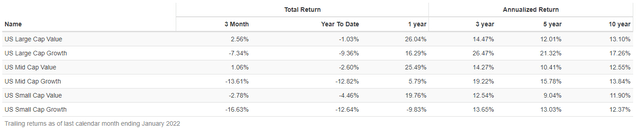

Since 1972, Value stocks are beaten Growth stocks in all three asset sizes, but that’s the long view. The chart presented shows more recent history.

PortfolioVisualizer.com

The past year shows Value once again ahead of Growth stocks, after trailing at the 3,5, and 10-year marks. That’s right about when inflation worries started. The 3-month data shows Value continuing the trend.

Vanguard Mega Cap Value ETF review

Seeking Alpha describes this ETF as:

Vanguard Mega Cap Value ETF is managed by The Vanguard Group, Inc. The fund invests in public equity markets of the United States. The fund invests in stocks of companies operating across diversified sectors. It invests in value stocks of mega-cap companies. The fund seeks to track the performance of the CRSP US Mega Cap Value Index. MGV started in 2007.

Source: seekingalpha.com MGV

MGV has $4.8b in assets and currently yields 2.2%. Vanguard charges only 7bps in fees, typical for one of their indexed ETFs.

The ETF invests based on the CRSP US Mega Cap Value Index, which CRSP describes as:

The CRSP U.S. Value Style Indexes are part of CRSP’s investable index family. Once securities are assigned to a size-based market cap index, they are made eligible for assignment to a value or growth index using CRSP’s multifactor model. Mega-Cap is considered the top 50% of the total CRSP market. CRSP classifies value securities using the following factors: book to price, forward earnings to price, historic earnings to price, dividend-to-price ratio and sales-to-price ratio.

Source: crsp.org

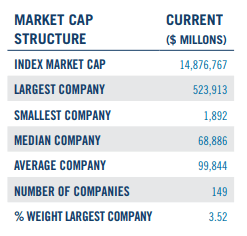

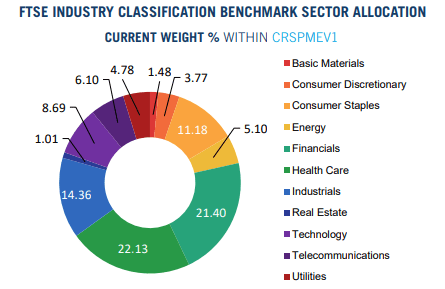

CRSP, like other index providers, has numerous rules for selection, weighting, exclusion, and reconstruction, all spelled out in their 81 page Methodology PDF. Despite the “MEGA-CAP” title, the smallest Index component is only $2b, a fraction of the Average or Median size held. Two other important points. First, this Index only holds 149 whereas the Total CRSP Market Index has over 4000 stocks. Second, CRSP uses the FTSE classification system, not the more widely known GICS coding system, though they are very similar.

CRSP.org

CRSP.org

While the above charts represent the Index, the ETF can drift between rebalancing dates.

MGV Holdings review

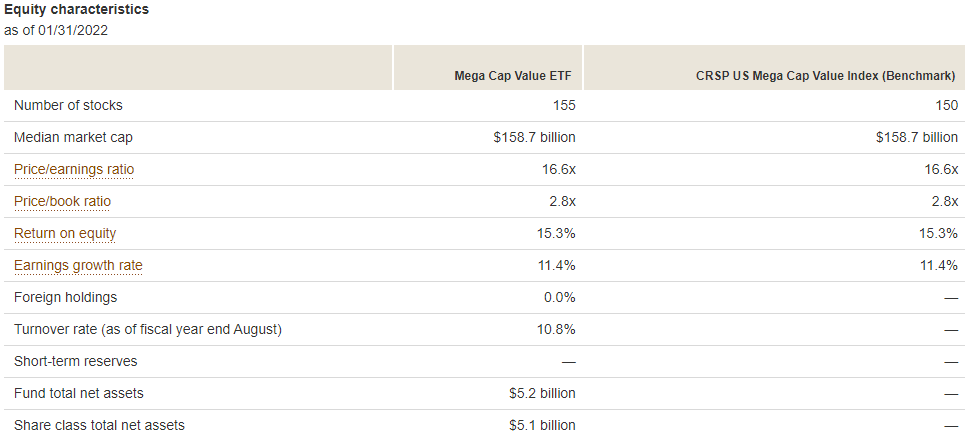

My apologies for using 1/31/22 data, but Vanguard has yet to post the 2/28/22 data.

investor.vanguard.com MGV

seekingalpha.com MGV

The comparison section will test whether size makes a difference in the sector selection for Value stocks. As you will see later, it truly does when comparing to Growth stocks in the same size category.

Top 10 Holdings

investor.vanguard.com MGV

One difference between reviewing Mega-Cap versus Small-Cap is all the names should be familiar to any active investor. The Top 10 reads like a list of industry “Whos who”. At 25%, the Top 10 does represent a significant portion of the assets.

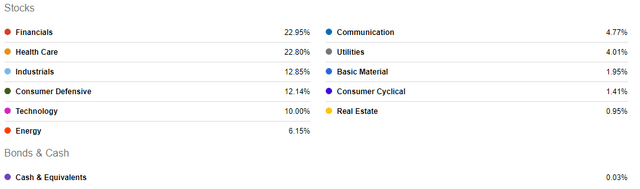

MGV Distribution review

seekingalpha.com MGV DVDs

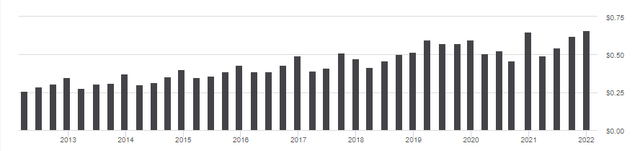

Dividends having been growing steadily over the past ten years, with a larger payout most Decembers. One thing income investors desire is for the payouts to be growing faster than inflation, and MGV delivers on that front until the recent inflationary spike. Seeking Alpha grades this overall record with a “B+”, with detail grades in seven categories.

seekingalpha.com MGV scorecard

Comparing Mega Value against Mega Growth

One good due diligence test is looking at the other side of the Value/Growth universe. The Vanguard Mega Cap Growth ETF (MGK) will be used for this comparison.

Seeking Alpha describes this ETF as:

Vanguard Mega Cap Growth ETF is an exchange traded fund launched and managed by The Vanguard Group, Inc. It invests in public equity markets of the United States. The fund invests in stocks of companies operating across diversified sectors. It invests in growth stocks of mega-cap companies. The fund seeks to track the performance of the CRSP US Mega Cap Growth Index. MGK also started in 2007.

Source: seekingalpha.com MGK

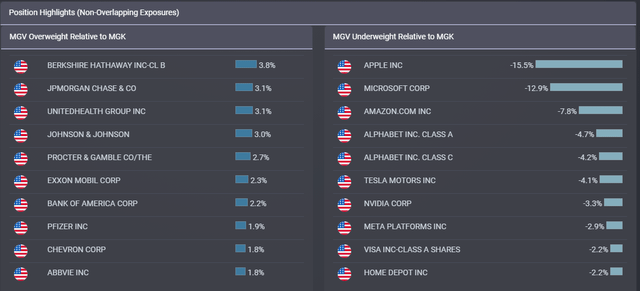

ETFRC.com

First thing you might have noticed is there are 14 stocks in both ETFs. As with most Index providers, their rules allow for this, with possibly the weighting differing between the Value and Growth ETFs. Those stocks are only 2% of the assets. As one would expect, the Sector weights between the two ETFs are extreme to say the least. Almost half differ by 10+%, and Technology is almost at the 40% level; heavily slanted to Growth of course. This is also seen in which stocks are the most over/under weighted in comparing the ETFs.

ETFRC.com

You have to go down to VISA (#9) to find the first non-Tech stock on the MGV under-weight list. MGK under-weight list is much more diverse.

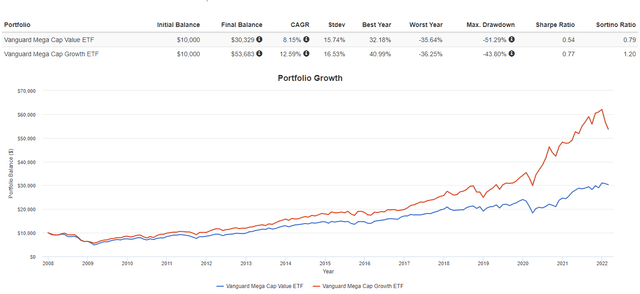

Performance results: MGV Vs. MGK

PortfolioVisualizer.com

Considering the weighting difference in Technology stocks, and their performance over the past few years, especially the Mega ones, the above chart comes as no surprise. What was surprising is how little MGV StdDev differs from MGK (15.74% vs. 16.53%). Note that the last three months, things were different, with MGV winning all three months by a total of 16.56%. By comparing the very different sector weights MGV and MGK have, an investor can pick between the Mega-Cap ETFs on how they feel those sectors will perform from here.

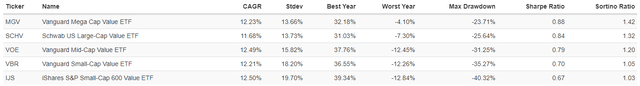

Comparing Mega Value against other Value ETFs

In this section, MGV will be compared against the following Value ETFs:

- Schwab U.S. Large-Cap Value ETF (SCHV)

- Vanguard Mid-Cap Value ETF (VOE)

- Vanguard Small-Cap Value ETF (VBR)

- iShares S&P Small-Cap 600 Value ETF (IJS)

PortfolioVisualizer.com

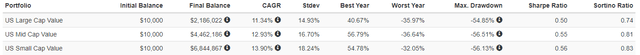

This data goes back to 1/2010 when the newest of these ETFs started: SCHV. The above chart gives an excellent example of where an investor has to make a choice between CAGR-only focus or one that takes risk measures into the account. IJS has the best CAGR (slightly) but the worst Sharpe ratio. MGV placed 3rd in CAGR but has the best values in all three important risk measures (StdDev, Sharpe & Sortino ratios). That more recent set of outcomes also shows itself within the asset class data back to 1972, though Mega wasn’t available, only the basic three asset-size classes.

PortfolioVisualizer.com

Digital Portfolio Developer Tools

Vanguard

Portfolio Strategy

This article presented two strategy alternatives to owning or adding the Vanguard Mega Cap Value ETF to their equity allocation. One is investing in Growth stocks instead of Value stocks. A year ago in Pondering Growth Vs. Value, I covered things an investor can consider in making that choice. Recently, The Sunday Investor posted MGC Vs. MGV: Why Mega-Cap Value Will Win, which states why he prefers MGV over the blended Mega-Cap ETF.

The second assumes you want an index-based Value-focused ETF. There you find MGV with the best risk statistics across those provided by PortfolioVisualizer. While it placed third in CAGR, it only trailed #1 by 27bps. That combination, plus the detailed analysis done by The Sunday Investor in his article, has me also giving MGV a Buy rating.

Final thoughts

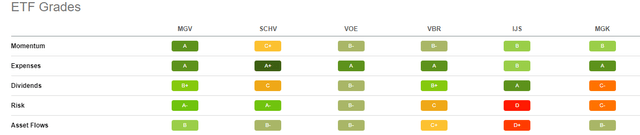

Seeking Alpha grades ETFs on several factors they think investors most care about. This chart was pulled together using the SA Peers function.

seekingalpha.com Grades

Some investors prefer actively-managed funds but not the extra fees involved. For those investors who are more drawn to Value, not the market-cap size, I suggest reading up on The Avantis U.S. Small Cap Value Fund (AVUV). I covered this ETF a year ago, and Juan de la Hoz recently penned AVUV: Actively-Managed Small-Cap Value ETF, Cheap Valuation, Market-Beating Returns.

[ad_2]

Source links Google News