[ad_1]

Eoneren/E+ via Getty Images

ICVT strategy and portfolio

The iShares Convertible Bond ETF (ICVT) has been tracking the Bloomberg Barclays U.S. Convertible Cash Pay Bond > $250MM Index since 06/02/2015. The expense ratio is 0.20% and the 12-month trailing distribution yield is 1.14%.

As described in the prospectus, “The universe of securities that are eligible for inclusion in the Underlying Index includes U.S. dollar-denominated securities with maturities of 31 days or more and $250 million or more of outstanding face value.” The index is market capitalization-weighted and rebalanced once a month.

The fund has 346 holdings, exclusively cash pay convertible bonds. It is a class of convertible bonds giving the option to convert into a pre-specified number of shares of the issuer’s common stock, but do not require conversion. Other classes of convertibles (zero coupon, preferred and mandatory convertible bonds) are not eligible. Due to embedded optionality, ICVT is classified by some brokers as a derivative product in the same category as leveraged, inverse and volatility ETFs. This may require some adjustments in your trading permissions parameters if you want to buy it.

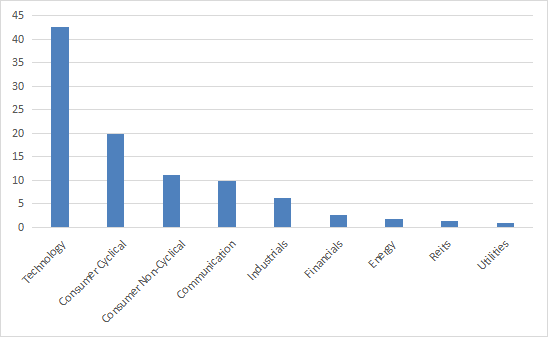

Optionality allows growth companies to borrow money at a lower rate and possibly avoid paying the principal, should the bond be converted (in this case, the debt is “paid” by common shareholders in dilution). Optionality is also attractive for lenders willing to mix fixed income and speculation on share price. As a consequence, ICVT portfolio is growth-oriented, and as a hybrid asset, its behavior is part equity, part fixed income. ICVT’s heaviest sectors are technology and consumer discretionary.

ICVT Sectors (Chart: author, Data: iShares)

The next table lists the top 20 issuers for about 28% of the portfolio. Each issuer may correspond to several bonds held in ICVT.

|

Name |

Sector |

Weight (%) |

|

PALO ALTO NETWORKS INC (PANW) |

Technology |

3.05 |

|

LIBERTY MEDIA CORP |

Communications |

2.96 |

|

DISH NETWORK CORP (DISH) |

Communications |

2.34 |

|

SEA LTD (SE) |

Technology |

1.8 |

|

DEXCOM INC (DXCM) |

Consumer Non-Cyclical |

1.32 |

|

WAYFAIR INC (W) |

Consumer Cyclical |

1.31 |

|

SNAP INC (SNAP) |

Technology |

1.29 |

|

SQUARE INC (SQ) |

Technology |

1.26 |

|

SPLUNK INC (SPLK) |

Technology |

1.21 |

|

ETSY INC (ETSY) |

Consumer Cyclical |

1.19 |

|

PIONEER NATURAL RESOURCES CO (PXD) |

Energy |

1.18 |

|

SOUTHWEST AIRLINES CO (LUV) |

Transportation |

1.18 |

|

FORD MOTOR CO (F) |

Consumer Cyclical |

1.16 |

|

BILIBILI INC (BILI) |

Communications |

1.13 |

|

AKAMAI TECHNOLOGIES INC (AKAM) |

Technology |

1.09 |

|

OKTA INC (OKTA) |

Technology |

1.01 |

|

BILL.COM HOLDINGS INC (BILL) |

Technology |

1 |

|

TWITTER INC (TWTR) |

Communications |

0.99 |

|

ZILLOW GROUP INC (Z) |

Consumer Cyclical |

0.96 |

|

EXACT SCIENCES CORP (EXAS) |

Technology |

0.93 |

The portfolio has significantly changed since my review of March 2021: at this time, the largest issuer was Tesla (TSLA) with a weight of 3.45%.

In summary, ICVT is a portfolio of 300+ corporate bonds with a weighted-average coupon rate of 0.95% and a weighted-average maturity of 3.5 years, attached to specific call options that are not separately traded.

Historical behavior

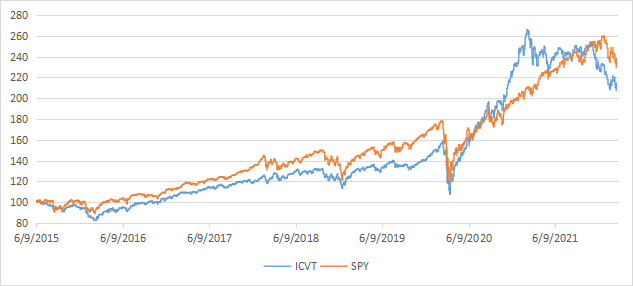

Due to its characteristics of hybrid asset, ICVT behavior is closer to a stock index than a bond index. Its correlation coefficient with SPY is 0.8 since inception. The next table shows similar risk metrics on this period (drawdown and volatility).

|

Annual Return |

Drawdown |

Sharpe Ratio |

Volatility |

|

|

ICVT |

12.00% |

-32.18% |

0.78 |

15.63% |

|

SPY |

13.77% |

-33.72% |

0.94 |

14.82% |

Data calculated with Portfolio123

The next chart plots the equity value of $100 investments in ICVT and SPY since inception.

ICVT vs. SPY (Author)

ICVT tactical rotation

Tactical allocation strategies consist of over-weighting assets with the highest probability of future gains. This probability is often arbitrarily measured by past performance. Countless variants are possible depending on the performance metric, weight calculation, look-back period, decision frequency, asset list, number of positions. The next table tracks a strategy with only two ETFs: ICVT and the iShares 7-10 Year Treasury Bond ETF (IEF). Every week, it goes long 100% in the ETF with the highest 3-month return, or in cash if both have their prices below the 200-day simple moving average. This ICVT-IEF rotational model is compared to two bond benchmarks: a total bond market ETF (BND) and IEF itself.

|

Since ICVT Inception |

Annual Return |

Drawdown |

Sharpe Ratio |

Volatility |

|

ICVT-IEF Rotation |

5.20% |

-11.02% |

0.81 |

5.55% |

|

Bond Benchmark (BND) |

2.50% |

-10.67% |

0.6 |

3.28% |

|

IEF |

1.31% |

-4.74% |

0.21 |

2.59% |

Calculations with Portfolio123. Past performance, real or simulated, is not a guarantee of future returns.

Takeaway

ICVT portfolio is overweight in technology but holdings may change significantly over time. It had an exceptional performance in 2020 due to its concentration in high momentum companies. Returns from 2015 to 2019 and in 2021 have been much less attractive. ICVT correlation to stocks may boost the performance of a bond ETF portfolio in a bull market. It may also be used in a tactical allocation strategy with other bond ETFs. The ICVT-IEF rotation presented here is a simplistic example. QRV Bond Rotation is based on the same idea.

[ad_2]

Source links Google News