[ad_1]

Exchange-traded funds are an excellent means of achieving instant diversification, outsourcing to experts, and doing so in a transparent and cost-effective manner. The cannabis industry is fortunate to have several well-managed ETFs. Popular offerings include the AdvisorShares Pure US Cannabis ETF (NYSEARCA:MSOS), Amplify Seymour Cannabis ETF (NYSEARCA:CNBS), and The Cannabis ETF (NYSEARCA:THCX).

In November, 2021 AdvisorShares partnered with Poseidon Asset Management and launched the Poseidon Dynamic Cannabis ETF (NYSEARCA:PSDN). The fund is differentiated by the deep and proven management team, flexible mandate, and the ability to leverage the portfolio up to 1.5x. Before diving deeper, let’s start with some context.

AdvisorShares History

AdvisorShares Investments is a US-based investment manger, which offers a suite of actively-managed ETFs. The firm is headed by Noah Hamman, Founder and CEO. They launched their first ETF in 2009, and by 2014 had 24 active ETFs and $1.83 billion under management.

Currently, the firm manages over $2 billion, spanning 24 ETFs that include: thematic, equity, multi-asset, and income strategies. They tend to operate in specialized areas where there are more likely to be inefficiencies. Cannabis investors will know AdvisorShares for managing the industry-leading MSOS Pure US Cannabis ETF. This fund is approximately $1 billion in AUM, making it the largest cannabis ETF.

AdvisorShares also manages YOLO Pure Cannabis ETF, a global fund popular with investors seeking exposure to cannabis markets outside the US. I have also been intrigued by their PSIL Psychedelics ETF, which launched in September, 2021. The complete roster of funds can be found here.

Poseidon History

Most know Poseidon as the violent and ill-tempered god of the sea, but in the cannabis world Poseidon is the long-running investment management founded in 2013 by siblings Emily and Morgan Paxhia.

Like many that end up operating with right intentions in the cannabis space, Emily and Morgan have a personal connection to the plant. In the mid ’90s, their father was stricken with cancer. Toward the end of a brutal battle, a nurse suggested their father try cannabis. Ultimately, he did not go this route, but it planted the cannabis seed in Morgan and Emily’s minds.

In 2013, the duo founded Poseidon Asset Management and the following year launched Fund One. This hedge fund holds 38 positions, with 80% private and 20% public holdings. It is invested globally, with positions spanning tech, vertically integrated plant-touch operators, and industrial hemp processing. Notable holdings include Green Thumb Industries, PAX, and Headset.

Fund Two followed in 2018, and is a venture capital fund focused on Series A and later companies. This vehicle is invested in only private companies and is focused on domestic opportunities. Investors will recognize positions like Ascend Wellness Holdings and Flowhub. According to their website, half of the capital is currently unallocated.

While Emily and Morgan are the founders, they are supported by a qualified team. Most relevant to PSDN is Tyler Greif. He has over 20 years of investment-management experience, mostly in hedge funds and private equity. Tyler met the Paxhias through his HomeBase business that provided outsourced CFO services. Originally, he served as the outsourced CFO for Poseidon, and this relationship culminated in Tyler, Morgan and Emily partnering with AdvisorShares to launch the Poseidon Dynamic Cannabis ETF. Today, the trio serves as co-portfolio managers for the strategy.

Poseidon Dynamic Cannabis ETF

AdvisorsShares and Poseidon launched the Poseidon Dynamic Cannabis ETF on November 16th, 2021. The fund trades on the NSYE under the symbol PSDN-and for simplicity we will refer to the fund by its symbol. The tagline is “intelligent leverage investing in cannabis.”

The strategy is differentiated by its flexible mandate. PSDN has the ability to invest globally. 80 countries offer some form of medical cannabis, and another 10 have legalized or decriminalized recreational use. MSOS only invests in US cannabis stocks.

The broader PSDN mandate gives them the flexibility to not only look at Canadian LPs, but also the ability to invest in exciting things going on outside the US. Examples include Germany’s imminent legalization and how that will impact broader Europe, or potentially adding exposure to South America.

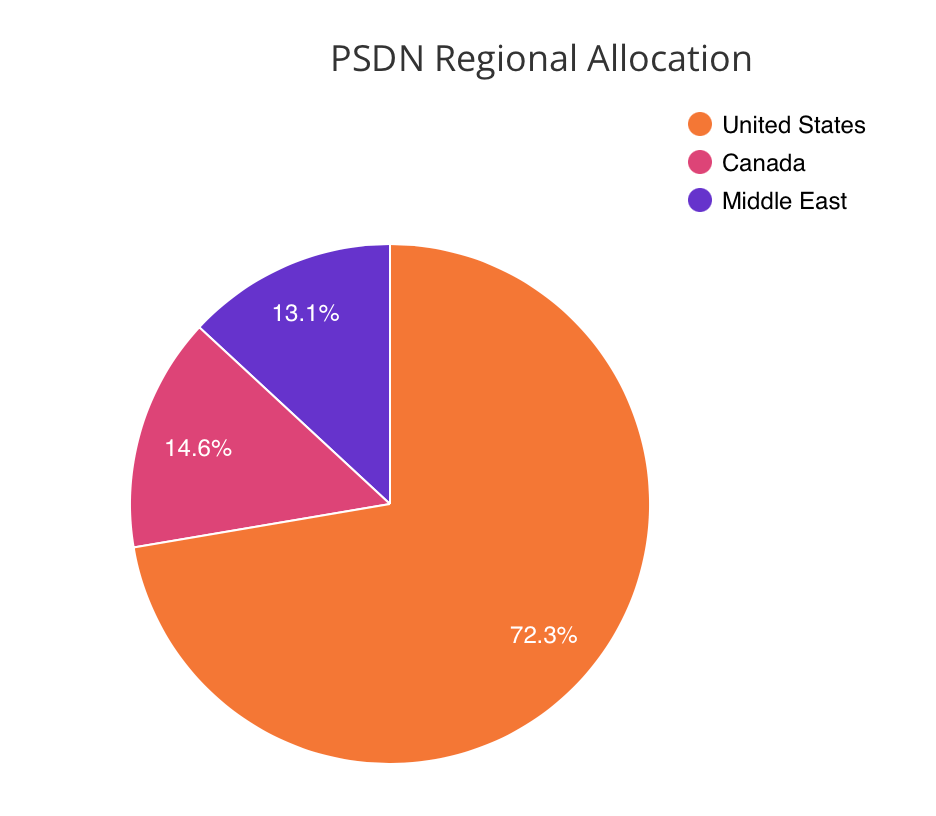

Below are country allocation as of December 31, 2021.

Broader geographic exposure has the potential to increase returns and reduce risk. If MSOs one day become overvalued, or otherwise unattractive, the team has the ability to shift into other markets to generate returns. Diversification is also a powerful risk-management tool, and if we see a meltdown in a certain country, the ability to be broadly diversified and tactically allocate are important.

Sector Exposure

When the fund initially launched, there were boos from the Twitter community known as the #MSOGang as the holdings were revealed. PSDN was first populated with Canadian exposure (groan), ancillaries (groans louder), and finally the MSO exposure arrived (cheers!).

I’m not interested in Canadian LPs. The market is smaller than California, the companies carry wild valuations, and are already up-listed to major exchanges-removing a major potential catalyst.

Ancillaries are slightly different. Fans here tout the “pick and shovel story”. In the gold rush, it was not the mining companies that got rich, but rather the businesses selling critical equipment to the miners. To date, these stocks have shown less upside than their plant-touching cohorts, massive drawdowns, and most are already up-listed. I’m sure there are good ones, but big MSOs are your best bet.

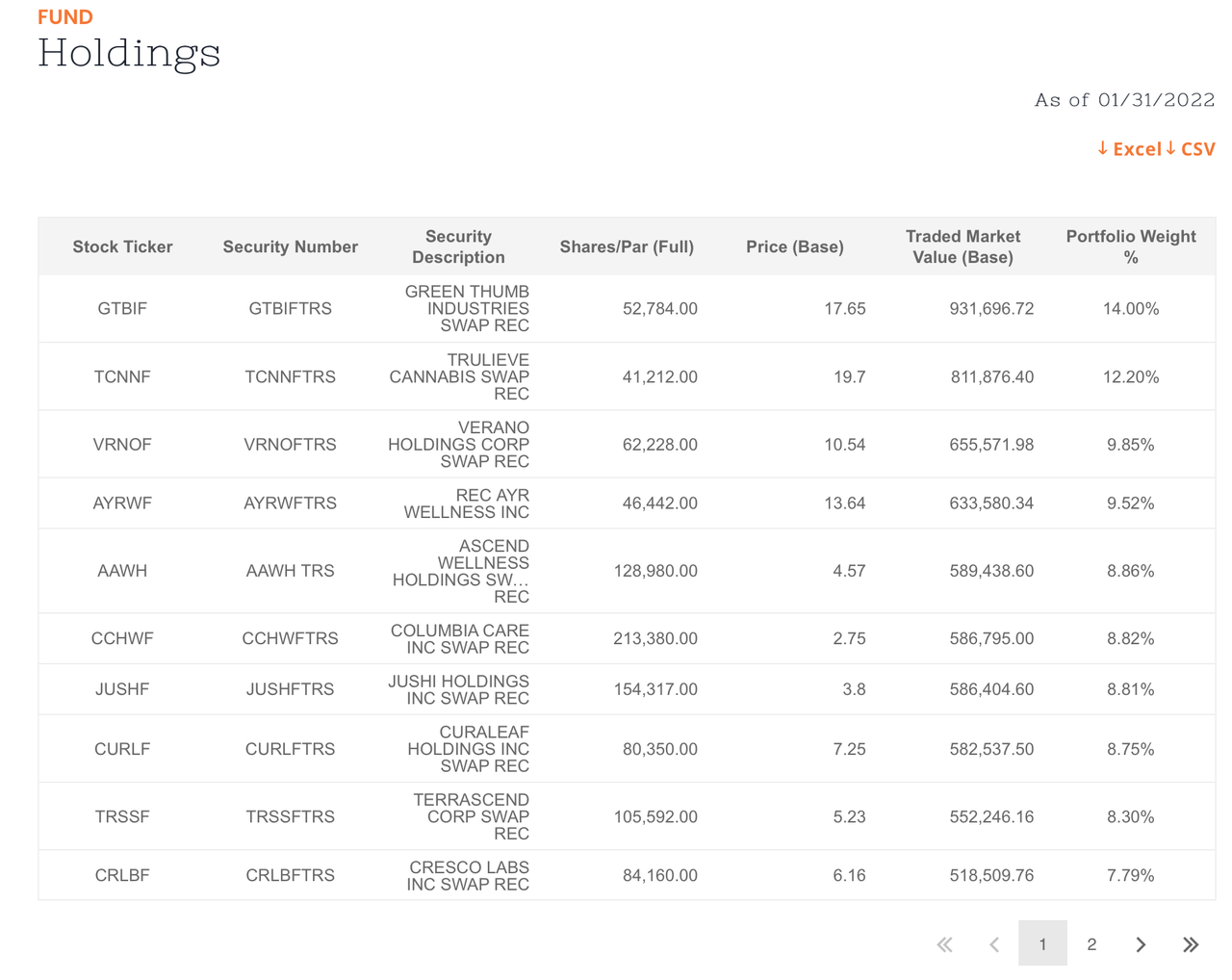

Recently, PSDN has been exclusively investing in MSOs. As of January 31, 2022 the fund has exposure to the top ten MSOs by market cap. While they own the top ten, the portfolio is not equally weighted. For example, as of January 31st, 2022 AYR is the eighth largest MSO, but is the fourth largest holding in PSDN. Here’s a link to the latest positions.

Leverage

The ability to use leverage is a differentiator when comparing PSDN to other ETFs, and versus what you may be able to achieve in your own trading account. To my knowledge, PSDN is the only cannabis ETF that has access to leverage.

To quote the prospectus:

“Using total return swaps, the Sub-Advisor may, at its discretion, dynamically adjust the Fund’s overall market exposure to marijuana and hemp companies through leverage of up to one and a half times (1.5x), or 150% of, the Fund’s total assets. The Sub-Advisor will adjust the Fund’s net exposure to leverage in order to seek exposure to a greater rate of growth over the long term and potentially deliver improved risk-adjusted returns, as compared to a fund without leverage.”

How Leverage Is Used

The fund has been levered for most of its existence. After putting on initial positions, PSDN had 29 holdings totaling 118% in exposure as of November 30th. This book contained a bunch of MSOs, but also held positions in Canadian LPs like Tilray (NASDAQ:TLRY), and ancillary stocks like Greenlane Holdings (NASDAQ:GNLN), that have since been abandoned.

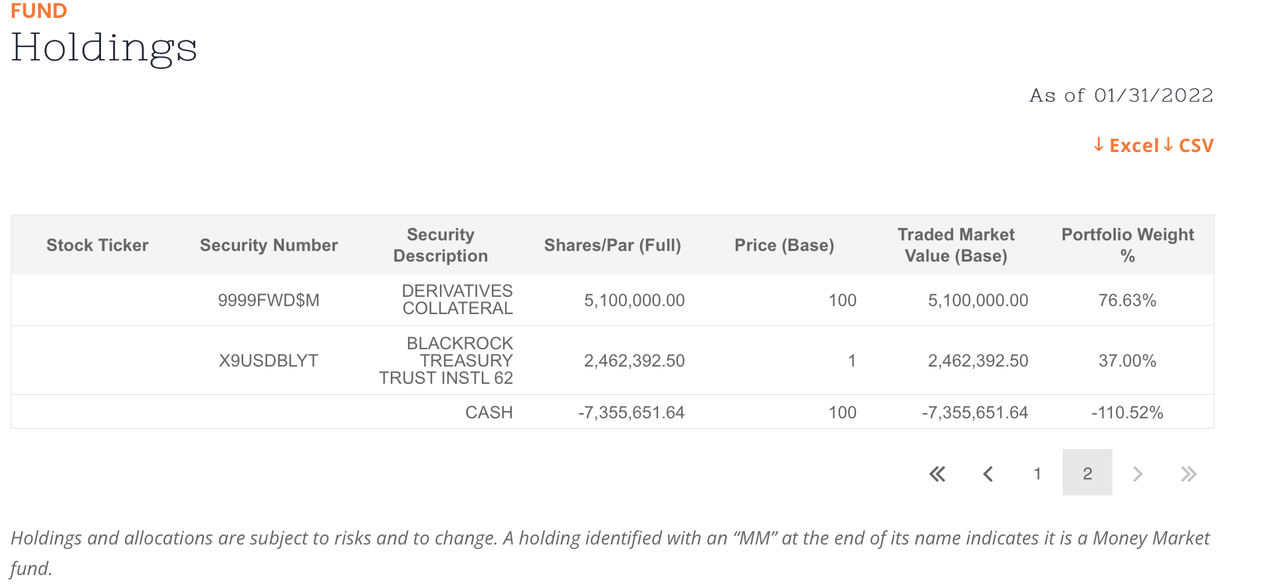

A month later, the holdings were beginning to be consolidated and leverage stayed relatively steady. As of December 31st, 2021 the fund held 18 positions, had shed the Canadian stocks and was running 1.24x leverage. For a final data point, as of January 31st, PSDN has just ten positions, all in US MSOs and a more modest 0.97x exposure–less than 1:1 exposure.

In a relatively short time period, we have seen the holdings change meaningfully-going from a fully diversified portfolio of MSOs, Canadian LPs and ancillaries, to being concentrated in the top ten MSOs. Over the same period, leverage has dropped from around 1.2x to un levered today.

Best practices are to cut risk during drawdowns, and to use less leverage on a more concentrated portfolio. PSDN is in the midst of an over 30% drawdown and behavior in the cannabis space has been abysmal. While it would be tempting to lever up for a bounce, this is how accidents happen. We have learned cannabis stocks can get cheaper than we ever imagined, over a short period of time. Also, as the number of names as been cut from almost 30 to ten, the fund is spending more of their risk budget on concentration, so all things being equal, less leverage is prudent.

I would encourage any prospective investor to dig deeper into their risk-management philosophy around leverage, concentration, and liquidity. Managing a levered portfolio of concentrated, small stocks that trade on the OTC exchange is a risky affair. I see no red flags in their usage thus far, but before investing would encourage you to learn more.

If you are interested in tracking their leverage, the holdings page on AdvisorShares website is updated daily, or follow the awesome Jungle Java on Twitter to track daily buys, sells and total positions.

Who Provides The Leverage?

Currently, an investment in PSDN provides fully synthetic exposure to ten MSOs. They hold zero stocks. The fund cannot be listed on the NYSE and own US plant-touching operators, so they use synthetic tools to get exposure. SAFE Banking may lead to up-listing of MSOs to major exchanges, but for now work arounds are required.

PSDN has exposure to MSOs via total-return swaps. Rather than owning Green Thumb Industries (OTCQX:GTBIF), PSDN owns Green Thumb Industries Swap Rec (GTBIFTRS). This provides exposure to the performance of GTBIF, minus the cost of the swap.

Here’s where it gets tricky – AdvisorShares does not list their swap counter parties, or leverage providers, on the website. On a Twitter Spaces with Morgan and Tyler, I asked who provides the financing and the approximate costs associated. They said this is confidential. I had a follow-up email exchange with Emily and she stated they could not provide the name of the financing counter party or their the credit rating. She did offer, “It is a mid-tier, name brand bank with a long tenure.”

I would struggle to invest in a fully synthetic, levered portfolio without knowing the counter party, or at least their credit rating. If you own exposure to an underlying financial instrument and the counter party goes under, your investment becomes at best more complicated, and is quite possibly impaired. At this point, the PSDN counter party could be a regional bank with a shaky balance sheet, or it could be Goldman Sachs. It is impossible to evaluate the risk of PSDN without being able to do due diligence on the counter party.

I co-managed a $250 million hedge-fund portfolio that was levered 2x and we used the highest-rated counter parties we could find, and used multiple lenders to reduce bankruptcy or other impairment risk. This turned out to be critical in 2008 when Lehman went under and we had to rapidly transfer our assets to Credit Suisse. In finance, a thousand-year storm hits every decade.

I’m interviewing AdvisorShares CEO Noah Hamman and Poseidon co-PM Morgan Paxhia for Seeking Alpha’s CEO Interviews (airing this week). I’ll have the opportunity to explore the leverage questions, and much more.

Vehicle Structure

PSDN is an ETF and trades on the NYSE. As of January 31, 2022, AUM was $6.1 million. The liquidity isn’t great, yet, as the average-daily-trading volume is just under 35,000 shares. If performance improves, AUM will rise, and PSDN will become more liquid. Currently, it is a better long-term holding than trading strategy.

The fees are reasonable, 0.80% management fee and 0.12% other expenses for a net expense ratio of 0.92%. MSOS’s expense ratio is 0.73% and YOLO us 0.76%. Over time, these are not meaningful differences, and it will be the stock selection and dynamic use of leverage that drive the returns.

Performance

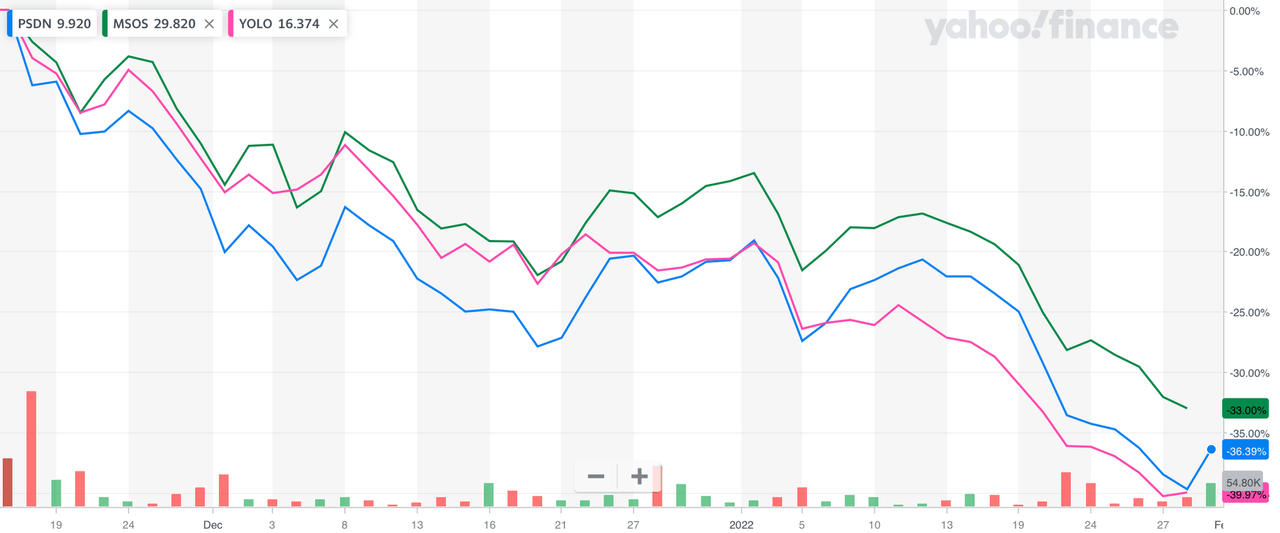

PSDN has only been trading for approximately 2.5 months and it’s been a brutal market environment. Since inception on November 16th, 2021 PSDN is -36.39%, MSOS is -33.00% and global YOLO is -39.37%. Below is a graphical illustration of how the trio has faired over the period.

I’ve learned not to draw meaningful conclusions from short data sets. It is too easy to be fooled by randomness. I see PSDN’s performance as inline with expectations, given the market conditions. By way of comparison, my Green Giants strategy fell -27.70% during the same period. It benefitted from a strict focus on dominant MSOs, no Canadian stocks, and no ancillaries.

Prospective investors in PSDN must be prepared to sit through extreme volatility to harvest the potential long-term upside. PSDN has already experienced a peak-to-trough decline of -42.67%. The worst drawdown is always in front of us, so we know to expect to sit through at least this level of decline.

It is critical for any long-term investor to assess their risk tolerance, evaluate the potential drawdown they are willing to endure, and determine if the investment is appropriate. PSDN is best suited for aggressive investors with high risk tolerances.

Moving Forward

We often benefit from outsourcing things we cannot do better, or more efficiently. Cannabis investing is complicated and requires expertise. Poseidon are experienced and proven cannabis investors. Morgan and Emily have been managing cannabis hedge funds since 2013, and adding Tyler’s experience makes the team even stronger.

The structure is very flexible and allows for tactical and strategic allocation across cannabis sectors and countries. Today, the fund is only in the top-ten MSOs, as this is where the team sees the greatest value. As dynamics change, they may reallocate more to Canada, ancillaries, or dip into smaller tier 3 MSOs. There is also the opportunity to explore new geographies as Europe and South America become increasingly important.

The ability to dynamically employ leverage is most unique feature. This is also the riskiest component, and requires the most trust. I would like to see more disclosure surrounding counter parties, credit ratings, and approximate financing costs.

I hope this piece can serve as a starting point in your due-diligence process. Read the prospectus, track the holdings, and keep an eye on the leverage. Follow Morgan, Emily, Tyler and Noah on Twitter. They’ve been hosting some great Spaces. I am excited about the potential of PSDN and look forward to following their progress.

Disclosure: I am not invested in PSDN and I was not compensated for writing this report.

[ad_2]

Source links Google News