Summary

Blanket global risk-off sentiment dominates this morning, following Russia’s decision to launch an offensive against Ukraine. However, many EMs have stronger fundamentals this time around, and this can create opportunities later on.

Russia/Ukraine Conflict Escalates

The Russia/Ukraine conflict took a sinister turn overnight, with Russia’s President Vladimir Putin launching a military offensive against Ukraine, including missile strikes on Ukraine’s capital Kyiv and some major infrastructure objects. As would be expected, risk-off sentiment is dominating this morning, with Russian and Ukrainian assets in a free fall – the ruble was down by 5.28%, Russian equities (RTSI$ Index1) were 40.5% lower and 5-year credit default swaps (CDS) 505bps (!) wider as of 9:20am ET (according to Bloomberg LP). A big question is whether the latest developments would lead to higher risk premia for emerging markets (EM) assets in the foreseeable future. On the upside, many EMs currently have stronger fundamentals – including external ones – than in the previous crises. So, there should be some attractive opportunities once the dust settles, but not yet.

EM and Higher Energy Prices

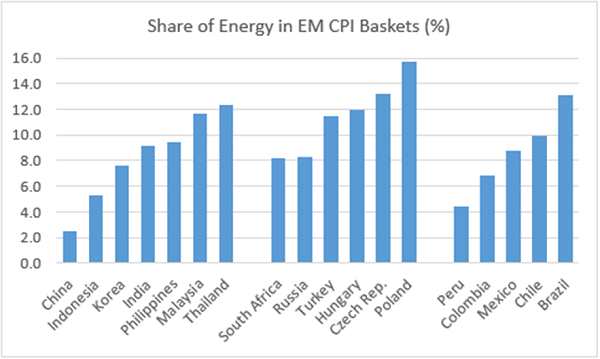

One area we are watching closely is the impact of the military conflict on global energy prices, which generally account for a larger share of EM consumer price baskets compared to developed markets (DM). The table below shows that EMEA is the most exposed region on this metric. In addition, geographical proximity to the conflict makes life particularly difficult for Central Europe and Turkey. Today’s price action – these were the worst-performing EM currencies at the time of the note – speaks for itself. In the case of Turkey, the country’s dysfunctional policy framework (recent rate cuts) is an extra negative as regards the market sentiment.

Mexico Policy Rate Outlook

In EM Asia, Malaysia’s headline inflation moderated more than expected – but is it just the calm before the storm? Malaysia has one of the highest inflation energy weights in the region (and EM). In LATAM, Mexico’s energy weight is not the highest, but even marginal price pressures will come at a time when inflation already posts one upside surprise after another. Mexico’s bi-weekly inflation beat expectations today – both core and headline – so another 50bps rate cut would be more than justified (and probably should be expected given the new governor’s hawkish stance during her inaugural meeting). Stay tuned!

Chart at a Glance: EM Inflation Exposure To Higher Energy Prices

Source: J.P. Morgan

Originally published by VanEck on February 24, 2022.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.