[ad_1]

Liliboas/E+ via Getty Images

ARK Genomic Revolution ETF (ARKG) is a biotechnology exchange traded fund actively managed by ARK Investment Management LLC. It invests in public equity of long-term growth oriented companies that are part of ‘Genomics Revolution’, primarily in the US market. It benchmarks the performance of its portfolio against the NASDAQ Healthcare Index, the S&P 500 Index and the MSCI World Index. The fund is currently trading close to its 52-week low and has a market capitalization of $3.8 billion.

“Genomic revolution focuses on the study of the human genome, a human (or organism’s) complete set of DNA…..Since most ailments have a link to our genetic condition, genomics involves the editing, mapping, and function of a genome”. Within another 30-40 years, the Genomic Revolution is going to revolutionize cancer detection, DNA sequencing, living drugs, and agricultural biotechnology.

Understandably the companies focusing on Genomic revolution have long-term growth prospects. The same goes for ARK Genomic Revolution ETF, which is a theme based fund. ARKG is also not meant for income seeking investors as it doesn’t have a good track record regarding payment of dividend. Incorporated in 2014, the fund declared annual dividends only in the past two years – $0.7901 in 2020, and $0.3824 in 2021. Yields in these two years were 0.85% and 0.62% respectively. This fund also paid special dividends of 0.3277, 0.4663, and 1.0539 in 2017, 2018, and 2019 respectively. These dividends can also be considered to understand the yield for income seeking investors. However, an average yield less than 1 percent will hardly be of any value. So, the investment decision will solely depend upon the expected future performance of the fund over the long run.

Moreover, the constituent biotechnology firms of ARKG’s portfolio will be engaged in the developing, producing, manufacturing or enabling bionic devices, bio-inspired computing, bioinformatics, molecular medicine and agricultural biotechnology. All these technologies can only deliver results over a long time. So, a fund like ARK Genomic Revolution ETF needs to be evaluated over a long-term horizon, and needs to be analyzed from three different angles – future growth prospects of Genomics Revolution, efficiency of portfolio reshuffling and Current Price multiples.

Faster cancer detection (a potential $150 billion market) is estimated to save 66,000 lives annually in the U.S. and may save thousands of lives worldwide. Living drugs (a potential $200 billion addressable market), are made from living organisms that harness a body’s immune system, and use them to fight disease. Long-read DNA sequencing ($5 billion market, growing at 82%) will enable the scientists to identify genetic sequences faster and more affordably. Genomic advances in agriculture (having potential of six-fold increases in farmer’s income) will lead to reduction in production cost, improvements in plant breeding, and enhancements in quality. Needless to say, the companies focusing on Genomic Revolution will attract huge investments and a number of genomic-focused companies have already shown abnormal price growth.

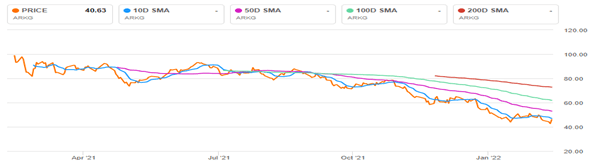

Weighted average forecasted Price to Book ratio of the component stocks of ARKG comes to around 1.3, compared to current Price to Book ratio of 2.7. This suggests that there is enough scope for a downward rally of this fund. This assumption gets further validation as the long-term moving average of this fund is above the short-term moving average.

ARKG Performance

Source: ARK Genomic Revolution ETF Momentum Performance

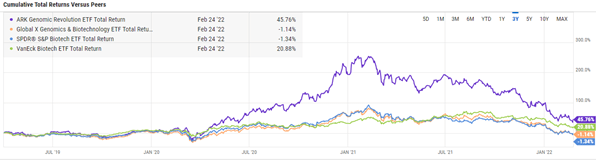

However, over the past 3 years, ARKG has shown much better performance over all its peers – Global X Genomics & Biotechnology ETF (GNOM), SPDR S&P Biotech ETF (XBI), and VanEck Vectors Biotech ETF (BBH). This seems to suggest that ARKG has made very effective investments. “However, certain of these companies do not currently derive a substantial portion of their current revenues from genomic-focused businesses and there is no assurance that any company will do so in the future”. So, there lies enough scope of drastically reshuffling its portfolio in order to fulfill its investment objective.

ARKG Momentum

Source: ARKG Performance

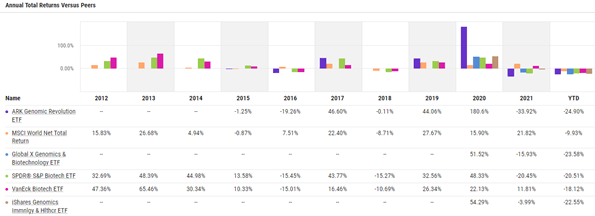

However, this price performance wasn’t consistent. ARK Genomic Revolution ETF recorded a stupendous 180 percent annual total return in 2020, which resulted in an above average growth. ARKG has been very successful in betting on some promising innovations in genomics. “Shares of gene-editing pioneers Editas (NASDAQ:EDIT) and CRISPR (CRSP) skyrocketed more than 100%, pacing the gains in ARKG”. Otherwise, ARKG has been in sync with the industry and its peer ETFs. However, even in those years, ARKG has shown higher volatility than its peers. Thus, there lies every possibility of stiff downward movement with every downward trend in the market. Moreover, being a biotechnology index fund, it cannot overcome its inherent volatility and market risk, which may arise due to changes in investor sentiment or any negative news about its constituent stocks or the sector as a whole.

ARKG Historical performance

Source: ARKG Performance

However, ARK Genomic Revolution ETF is an active fund, and it can change the composition of this fund on frequent intervals. So, it cannot and should not rely on such highly volatile stocks in pursuit of abnormal growth. As this fund is designed to invest in long-term growth oriented companies that are part of ‘Genomics Revolution’, it has ample stocks to select from. Sensing this inherent volatility risk, the fund has changed its product mix.

As a result of this, the ARKG’s return has fallen drastically in 2021 and it’s still continuing. However, the industry as a whole has moved downwards during this period. The peers also have generated a negative return. Thus, there is no need to press any panic button even if ARKG’s downward movement continues, as long as the fund successfully achieves its primary objective of reshuffling its portfolio – taming down the volatility.

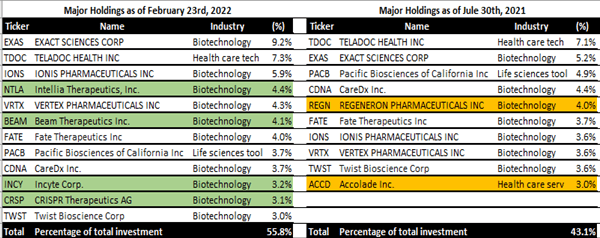

Holdings

Source: ARKG Holdings

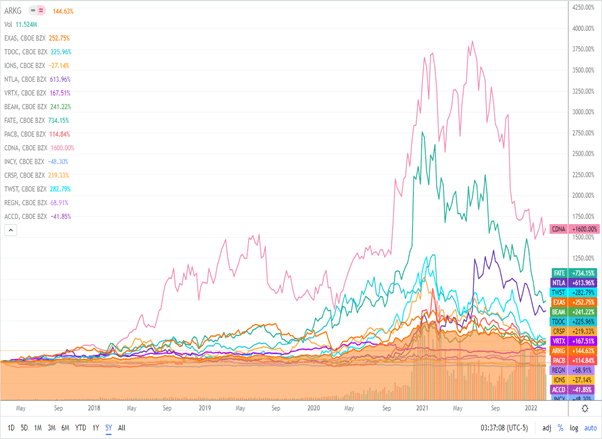

The current composition of major holdings (3 percent or above) of ARKG has generated very high returns over the past 5 years. 9 of the 12 stocks have outperformed the ARK Genomic Revolution ETF. Pacific Biosciences of California Inc. (PACB) though failed to outperform ARKG, has generated 114 percent growth over the period of the past 5 years. This stock along with Teladoc Health Inc. (TDOC), also provide a little bit of diversification among the pool of biotechnology stocks. Only Ionis Pharmaceuticals Inc. (IONS), and Incyte Corp. (INCY), generated negative return. However, these two stocks have stayed almost flat and have shown lesser volatility.

An interesting point to note here is that, this fund has shied away from investing in most renowned and sought after biotechnology stocks like Amgen Inc. (AMGN), Moderna (MRNA), Celgene Corporation (NASDAQ:CELG), Gilead Sciences Inc. (GILD), Regeneron Pharmaceuticals Inc. (REGN), Horizon Therapeutics PLC (HZNP), Illumina (ILMN), Biogen Inc. (BIIB), Seagen Inc. (SGEN), Alnylam Pharmaceuticals Inc. (ALNY), Qiagen (QGEN), and Novavax Inc. (NVAX), etc. Regeneron Pharmaceuticals Inc., which was part of its major holdings in June 2021, no longer fits into their scheme of things.

Removal of Regeneron Pharmaceuticals Inc., and more importantly Accolade Inc. (ACCD) from its major holdings seems to have paid well. Accolade Inc. had fallen by approximately 42 percent over the past 5 years. Baring Incyte Corp. (INCY), all other inclusions – Intellia Therapeutics, Inc. (NTLA), Beam Therapeutics Inc. (BEAM), CRISPR Therapeutics AG (CRSP) – have performed exceptionally well. One more interesting investment was made in Exact Sciences Corporation (EXAS), which went up from 5.2% in June 30th, 2021 to 9.2% in February 23rd, 2022. ARKG has also increased the total investment in its major holdings (holding 3% or more) from 43 percent to 56 percent. The fund’s portfolio has also played smart with one of its gene-editing pioneers – CRISPR Therapeutics AG. It sold after receiving more than 100 percent return, and then brought it back at a very lower price. This stock was trading around $190 to $200 in the middle of January 2021, which has come down to $55 to $60 at present.

ARKG chart (Seeking Alpha)

Despite all these positives ARKG is neither suitable for short-term investors nor income seeking investors. Genomic revolution was, is, and will have tremendous growth prospects. But, in order for stocks to realize their true potentials, the investors have to be patient and look for a much longer time horizon than other healthcare stocks. I am of the opinion of holding this fund over an extremely longer period as it passes on my three basic criteria of technology based funds – a) Future growth prospects of Genomics Revolution b) Efficiency of portfolio reshuffling and c) Current Price multiples.

[ad_2]

Source links Google News