[ad_1]

Eoneren/E+ via Getty Images

Investment Thesis

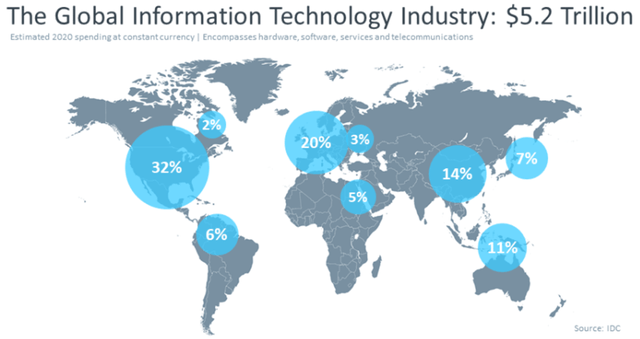

The United States has the most advanced software and IT services industry in the world. In addition, more than 34% of the $5.2 trillion global IT market is in North America, primarily the U.S. U.S. software firms generally operate in a mature, harmonized market and have a reputation for producing reliable and effective solutions that are adopted quickly by the market. International companies and top international talent have shown a keen interest in the U.S. market because of its strong intellectual property rights laws and enforcement, as well as to access one of the leading financial markets. U.S. companies lead the world’s packaged and custom-software markets and are competitive in nearly all other market segments with a stable overseas market share.

CompTIA – IT Industry Outlook

Strategy Details

The WisdomTree Cloud Computing ETF tracks the performance of the BVP Nasdaq Emerging Cloud Index, an equally weighted index designed to measure the performance of public companies focused on delivering cloud-based software to customers. This ETF can be used as part of a broader portfolio strategy to get exposure to emerging, fast-growing U.S.-listed companies that are primarily focused on cloud software and services.

If you want to learn more about the strategy, please click here.

Portfolio Composition

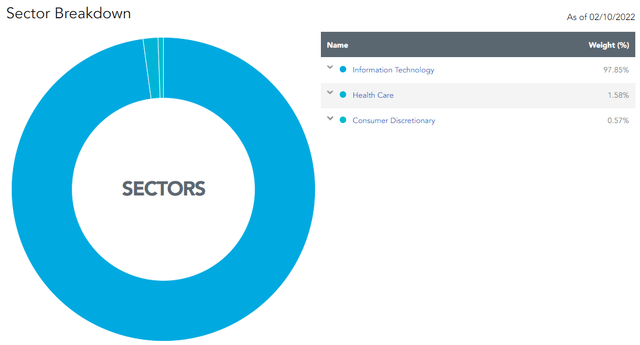

From the sector allocation chart below, we can see the index places a high weight on the information technology sector (representing around 98% of the index), followed by health care (accounting for 1.6% of the index) and Consumer Discretionary (representing around 0.6% of the fund). Unsurprisingly, the strategy is tilted towards tech stocks. These stocks generally have high betas, thus I think it is important to see if you are comfortable with a higher level of volatility before purchasing WCLD.

WisdomTree

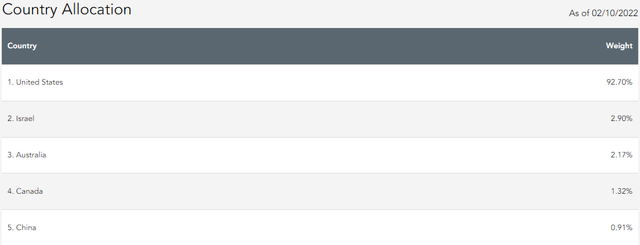

In terms of geographical allocation, the top five countries represent 100% of the portfolio. The United States accounts for ~93%, whereas other countries such as China seem to be underrepresented given the low weight (only a 0.9% allocation to China despite being one of the largest economies in the world).

WisdomTree

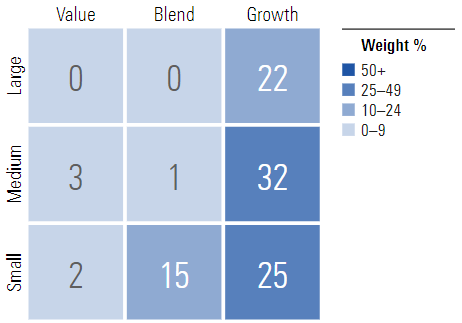

WCLD invests over 32% of the funds into mid-cap growth issuers, characterized as mid-sized companies where growth characteristics predominate. Mid-cap issuers are defined as companies with a market capitalization between $2 billion and $8 billion. The second-largest allocation is small-cap growth equities representing ~25% of the portfolio. Unsurprisingly, WCLD allocates approximately 79% of the funds to growth stocks, with a tilt toward small and medium-cap issuers. I personally like the higher allocation to these two categories since these stocks generally have a larger runway to grow and compound returns.

Morningstar

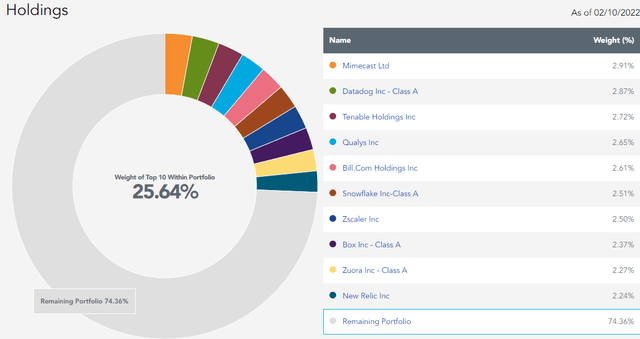

The fund is currently invested in 58 different stocks. The top ten holdings account for 25.64% of the portfolio, with no single stock weighting more than 3%. All in all, I would say that WCLD is pretty well-diversified.

WisdomTree

Since we are dealing with equities, one important characteristic is the valuation of the portfolio. According to data from Morningstar, the fund currently trades at an average price-to-book ratio of 6.7 and an average price-to-earnings ratio of 77.7. Although these multiples might seem high, keep in mind we are dealing with software companies that generally have an asset-light business model. For this reason, I am not surprised to see that WCLD has a price-to-book ratio above 5. That said, I believe the current tightening cycle will be detrimental to high multiple stocks. At the same time, there are cheaper alternatives in the market at the moment. One of them is the First Trust Cloud Computing ETF (NYSEARCA:SKYY).

Is This ETF Right for Me?

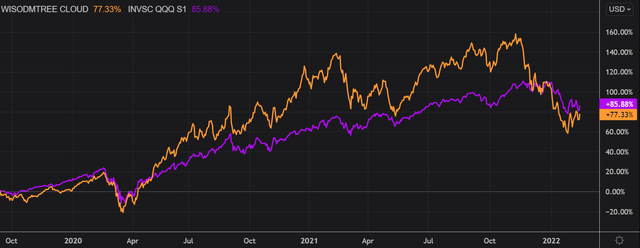

I have compared below the price performance of WCLD against the performance of the Invesco QQQ ETF (NYSEARCA:QQQ) over the last 2 years to assess which one was a better investment. Over that period, QQQ outperformed the WCLD. However, it is interesting to see that WCLD was in fact doing better than the market until late 2021 when the gap narrowed considerably. In my opinion, the recent pullback just shows how brutal the drawdown can get on these high multiple stocks strategies. To put WCLD’s performance into perspective, a $100 investment in WCLD at its inception would now be worth ~$177.3. This represents a compound annual growth rate of ~26% which is remarkable. That said, I don’t think that past returns are a good indicator of future returns, especially in WCLD’s case.

Refinitiv Eikon

Key Takeaways

In my opinion, the Tech sector, and particularly cloud computing, is going to continue on a strong growth trajectory. WCLD provides exposure to a basket of fast-growing US-listed companies that are primarily focused on cloud software and services. While I am pretty sure cloud computing is here to stay, I think it is hard to pick today’s winners. Moreover, current valuations add a lot of uncertainty to the bullish thesis, as this sector is highly vulnerable to change in monetary policy.

[ad_2]

Source links Google News