[ad_1]

Jae Young Ju/iStock via Getty Images

Thesis

After the recent pullback, I believe the entire chip industry can produce future outsized returns for investors through VanEck Semiconductor ETF, (SMH). Semiconductors are the building blocks for technological advancement as they are increasingly used to power mobile devices, automobiles, medical devices, and data storage centers. Wide use cases for chips make investing in the total semi industry prominent in my opinion as individual sector cyclicality can be smoothed out. Along with demand coming from many different places, digital transformation across the globe continues to grow, driving secular growth in the total chip industry. While this digital transformation was accelerated during the COVID-19 pandemic, a global chip shortage was exacerbated. I believe as the global chip shortage becomes potentially alleviated, the semiconductor industry will continue to see heightened growth in the aggregate.

Background

Semiconductors play a vital role in modern civilization as they power technological advancement. Because of this role, I believe chips are a unique investment opportunity as secular growth is driven by a variety of end-user industries across geographies around the world.

I believe an easy way for investors to gain exposure to the aggregate semi industry is by investing in VanEck’s Semiconductor ETF (SMH). SMH seeks to track the price movements of the MVIS US Listed Semiconductor 25 Index, by using the full replication technique. The fund was created in 2000 and is domiciled in the United States.

Koyfin

Source: Koyfin

While SMH is purely a technology ETF according to GICS, I believe it is a fairly diverse subsector when looking at equity factors and geographical locations. Varying from a massive Taiwanese chip manufacturer (TSM) to a high growth American visual computing company (NVDA) to a lithography machine producer based in the Netherlands (ASML), SMH provides holders a unique portfolio of companies with high growth and profitability potential in my opinion.

Thesis Support

Secular Growth

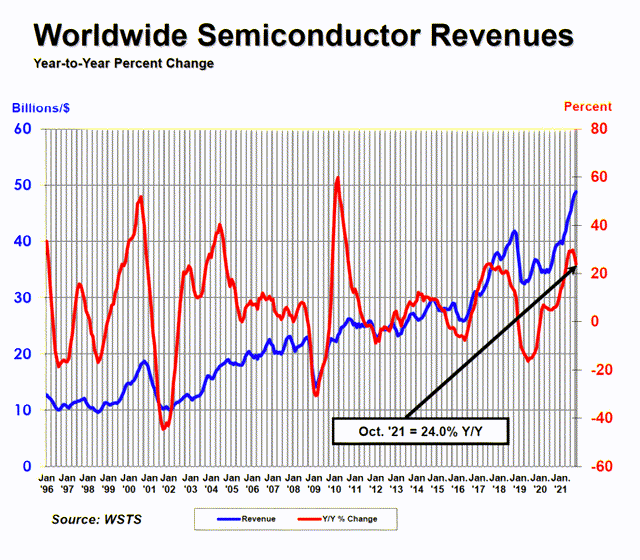

Before touching on short-term industry catalysts, highlighting the long-term growth trends in the semi industry is important. Since 2002, global semiconductor revenue has grown from ~$10 billion per month to $49 billion in October of 2021.

Semiconductor Industry Association

Source: SIA

Since 2002, the global chip industry has grown at an 8.4% CAGR and is expected to eclipse the $600 billion mark in annual revenues for 2022, according to SIA. I believe the 8.4% CAGR in the last two decades will potentially increase moving forward as general digital transformation may continue following COVID as the world becomes more interconnected.

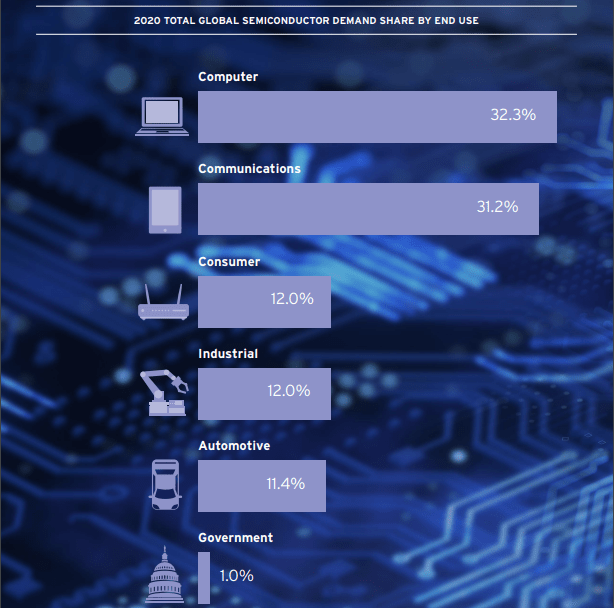

Demand drivers over the next decade will support the secular growth of the semiconductor industry in my opinion. The demand drivers include 5G, artificial intelligence, autonomous vehicles, and the internet of things. While these drivers can be key for excess growth in the semi industry, I believe consistent revenue growth will also be driven by current core use cases including computers, mobile devices, industrial, automotive, data centers, and gaming.

Semiconductor Industry Association

Source: SIA

With a relatively even distribution of end use demand, the semiconductor industry will be able to reduce individual sector demand cyclicality in my opinion. I believe this presents an asymmetric opportunity as the diversity of demand will hedge out risk as the industry has a wide distribution of growth channels.

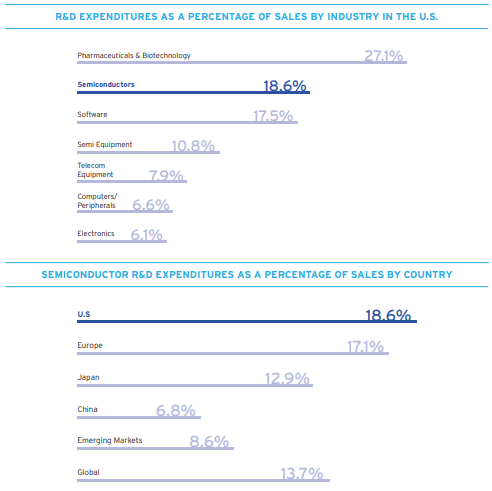

The reason I also believe the industry is poised for future growth is because of the high R&D spending used to keep up with the innovation.

Semiconductor Industry Association

Source: SIA

By continuing to reinvest in the industry at high rates around the globe, I believe the semiconductor industry will continue to innovate and expand driving long term earnings growth.

Chip Shortage

COVID-19 kickstarted a digital transformation acceleration and heightened chip demand hastily. From increased chip use in medical devices, public testing and tracing, accelerating vaccine development, remote healthcare, and work from home, chips were in extremely high demand.

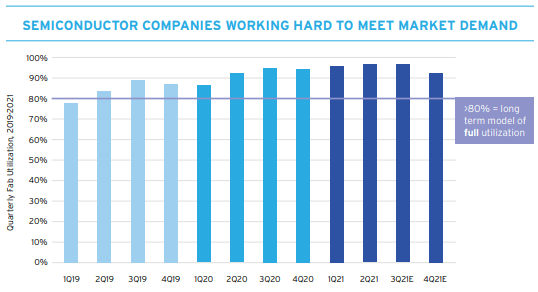

Because of the fast sway in supply and demand balance, some fabrication facilities were forced to run at 90-100% utilization capacity when most fabs run right above the 80% mark. While the semi industry used their power to help alleviate the issues in the short-term, there was still a wide variety of downstream sectors negatively affected on the demand side.

Semiconductor Industry Association

Source: SIA

While Intel CEO explains that this shortage may last all the way to 2023, it shows how the demand for this industry is extremely high. To help combat the shortage, governments are also stepping in with initiatives designed to bolster the industry. As an example, the American CHIPS Act will allow for big investing inflows for domestic chip companies. This means that the potential end of the chip shortage may be coupled with a surplus of investment and excess demand helping promote long-term industry growth.

Summary

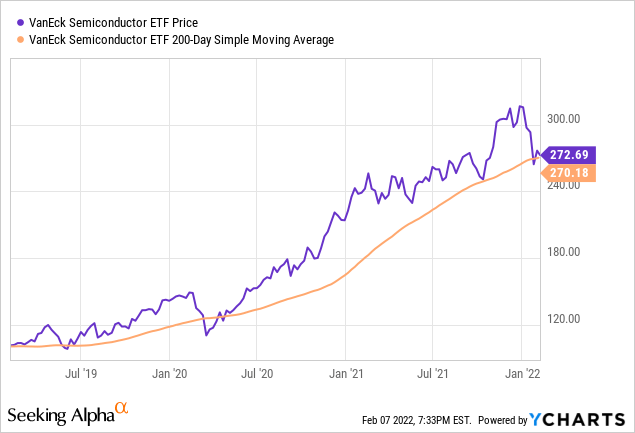

After falling into a bear market (-20%) to start 2022, I believe current entry into SMH may provide alpha-rich returns for investors long term. In my opinion, there are many factors playing into the correction like the chip shortage, inflation expectations, rising rates, quantitative tapering, and geopolitical risks. Even with these risks, I believe demand drivers will produce outsized returns for the industry in the long run. With SMH currently sitting on the 200-day moving average and trading at ~25x NTM PE, I believe the short and long-term risk-to-reward is high for investors today.

[ad_2]

Source links Google News