[ad_1]

May Lim/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on January 25th, 2022.

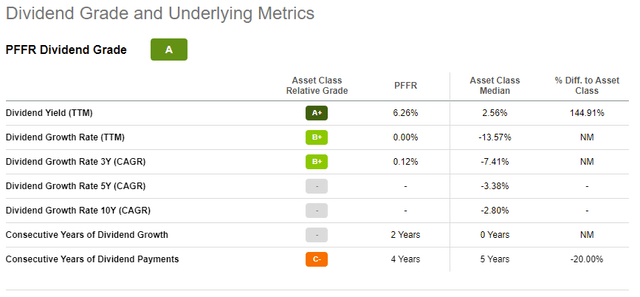

The InfraCap REIT Preferred ETF (PFFR) is exactly what it says on the tin: a REIT preferred shares index ETF. PFFR offers investors a strong, fully-covered 6.3% dividend yield, moderately higher than that of most preferred shares ETFs. PFFR’s holdings are also more concentrated, less diversified than average, which increases risk and volatility. PFFR’s strong, stable, fully-covered 6.3 % dividend yield makes the fund a buy, but the fund’s niche holdings means position sizes should be kept to relatively small levels.

PFFR Basics

- Investment Manager: Infrastructure Capital Advisors

- Underlying Index: Indxx REIT Preferred Stock Index,

- Dividend Yield: 6.26%

- Expense Ratio: 0.45%

- Total Returns CAGR (Inception): 5.08%

PFFR Overview

PFFR is a REIT preferred shares index ETF. Preferred shares are mostly similar to high-yield corporate bonds, offering investors strong, but risky, yields, but little possibility of substantial capital gains. Preferred shares are appropriate investments for most income investors and retirees, although risks might be unacceptable for more conservative, risk-averse investors.

PFFR itself tracks the Indxx REIT Preferred Stock Index, an index of these same securities. It is a relatively simple index, investing in all U.S. REIT preferred shares meeting a basic set of size, volatility, etc., criteria. The index only includes securities with yields greater than 3.0%. It is a market-cap weighted index, with certain rules to ensure a modicum of diversification, which is particularly important considering the index’s niche holdings. PFFR’s underlying index seems adequate enough, without any significant issues or negatives.

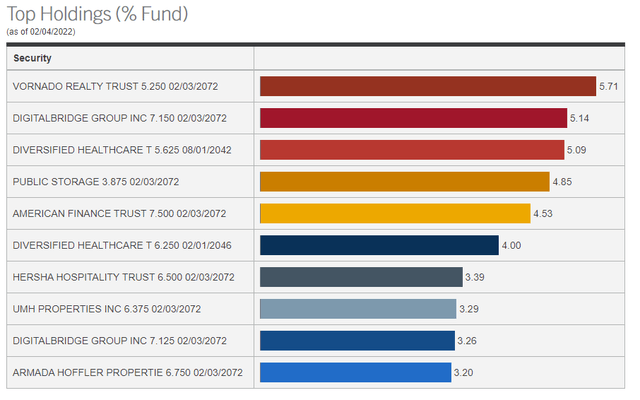

PFFR’s REIT preferred holdings are a niche within a niche. Preferred shares are a relatively small asset class, and REIT preferreds are a small sub-segment of these. This results in a relatively concentrated, undiversified fund. PFFR invests in just 45 securities, with the top ten of these accounting for 43% of its total value.

PFFR Corporate Website

PFFR does have some diversification within the REIT industry itself, although I don’t find this to be terribly material: concentration is high regardless.

PFFR Corporate Website

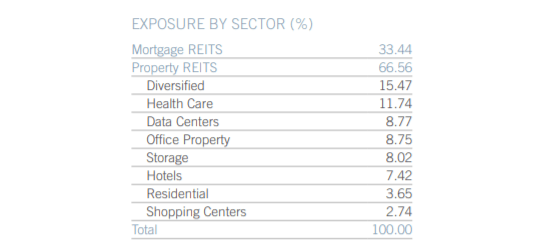

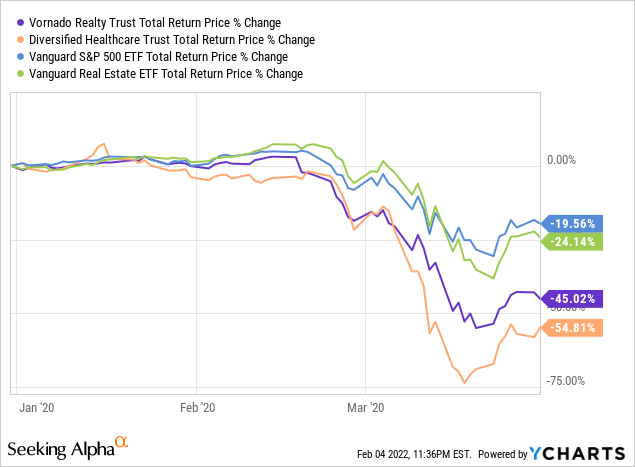

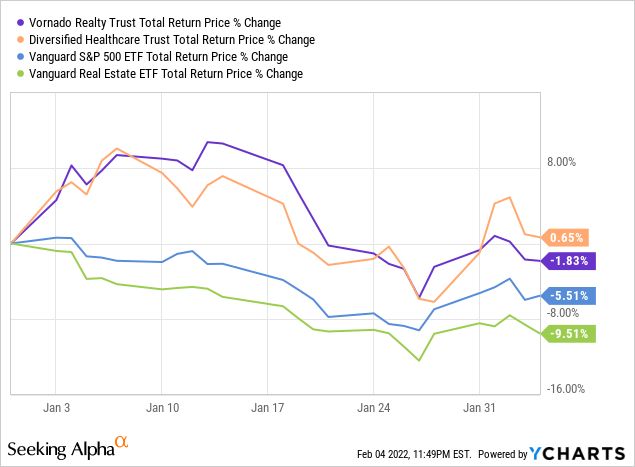

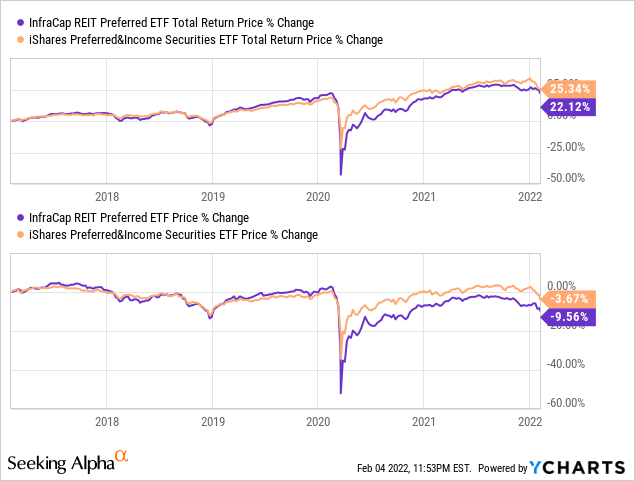

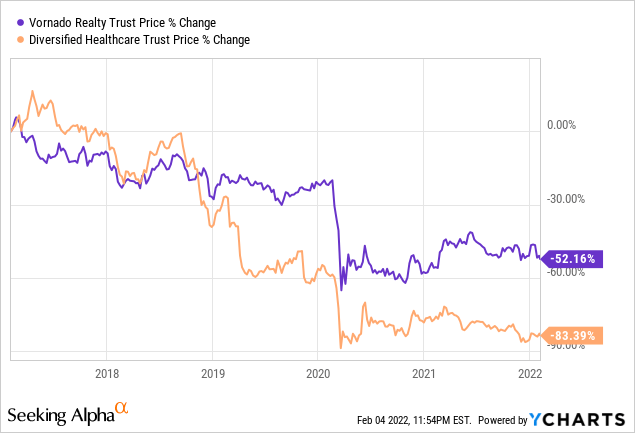

As a comparison, the iShares Preferred and Income Securities ETF (PFF), the industry benchmark, invests in 501 different securities, with the fund’s top ten holdings accounting for just 15% of its value. PFF is the more diversified, safer fund. PFFR’s concentrated, undiversified holdings increase portfolio risk and volatility, and expose the fund’s investors to idiosyncratic risk. Expect significant losses and underperformance if the fund’s larger holdings, including Vornado Realty Trust (VNO) and Diversified Healthcare Trust (DHC) underperform. As an example, these two holdings significantly underperformed during 1Q2020, the onset of the coronavirus pandemic.

PFFR underperformed too, as expected.

Importantly, and notwithstanding the above, excessive concentration does not necessarily lead to higher losses during downturns. If, for whatever reason, PFFR’s larger holdings outperform during a downturn, the fund should outperform too. As an example, both VNO and DHC have outperformed YTD.

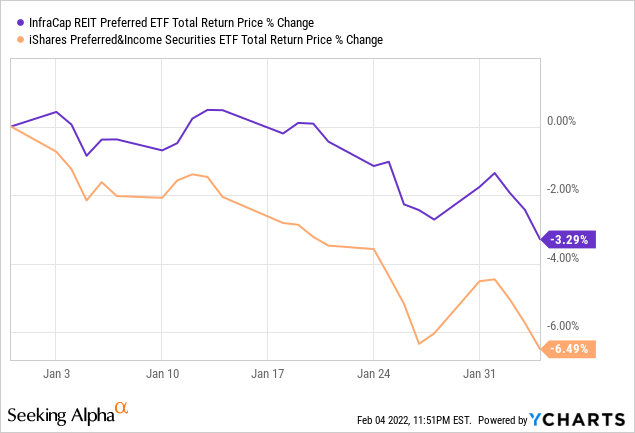

PFFR has outperformed too, as expected.

PFFR’s excessive concentration means the fund’s share price and dividends are strongly dependent on the performance of its larger holdings. As mentioned previously, this increases volatility and risk, but does not necessarily lead to underperformance during downturns. Still, I think the situation calls for limited position sizes in PFFR, to avoid the possibility of significant underperformance due to idiosyncratic factors. I would not go above 5%.

PFFR Dividend Analysis

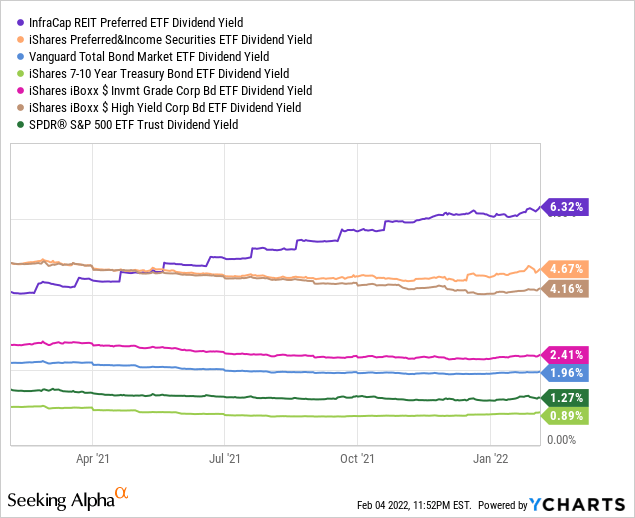

PFFR’s core investment thesis rests on the fund’s 6.3% dividend yield. This is a reasonably strong yield on an absolute, basis, and quite a bit higher than that of most relevant asset classes, including the broader preferred shares universe.

PFFR’s dividend is also fully-covered by underlying generation of income, although the situation seems a bit complicated. As per my calculations, the fund’s underlying holdings generate about 6.3% in income per year, effectively equivalent to the fund’s dividend yield, indicating fully-covered dividends. At the same time, the fund currently sports a 6.3% SEC yield, a standardized, short-term measure of a fund’s underlying generation of income. On the other hand, the fund’s latest tax documents indicate an estimated 37.5% return of capital distribution. From what I’ve seen, it seems that the discrepancy is due to differences in accounting standards versus federal income tax regulations. Some industries, including REITs and MLPs, get favorable tax treatment, of which these return of capital distributions are an example. It seems that PFFR’s shareholders get the best of both worlds: a fully-covered dividend and the favorable tax treatment of return of capital distributions. This is a solid combination, and a benefit to the fund and its shareholders. Do bear in mind that the return of capital figure is an estimate, and liable to change.

Finally, PFFR’s dividend growth track-record is also reasonably good. The fund has mostly paid the same $1.44 yearly dividend since inception, although there has been some volatility, mostly in 2019, during which the fund switched from quarterly to monthly dividends. There have been no real dividend cuts or hikes, besides the aforementioned volatility.

Seeking Alpha

PFFR’s stable dividend is also indicative of reasonably good quality holdings. If the fund’s holdings were excessively risky, the fund’s dividend would not have fared all that well during 2020, as the coronavirus pandemic led to increased corporate bankruptcies and defaults. No dividend cuts means no defaults, which was obviously good news for the fund and its shareholders.

PFFR’s strong, stable, fully-covered 6.3% dividend yield is a significant benefit for the fund and its shareholders, and its core investment thesis. This is an income vehicle, which you buy for the yield.

PFFR – Performance Analysis

Finally, a quick point on PFFR’s performance.

PFFR has slightly underperformed its benchmark since inception, exclusively due to small capital losses for the same.

From what I’ve seen, PFFR’s small capital losses were due to widening credit spreads in the fund’s holdings versus those of its benchmark. These widening credit spreads were, in turn, caused by financial weakness in the parent company. As an example, both VNO and DHC, issues of the fund’s two largest holdings, have seen significant share price losses these past few years. Preferred shares are higher in the capital stack, and so see lower capital losses than equity shareholders, but lower does not mean zero: they still go down, due to fears of bankruptcy or default, and that negatively impacts investors, including PFFR.

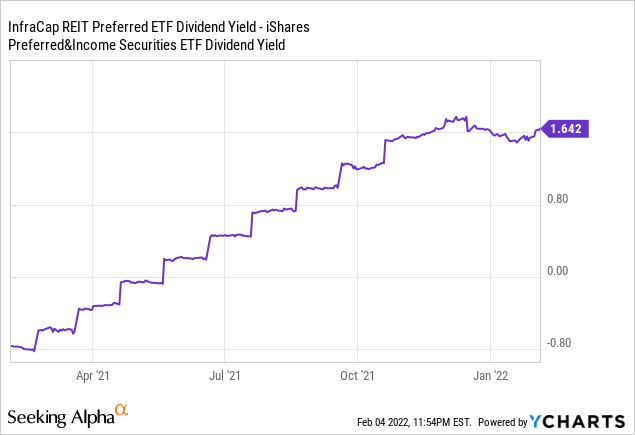

Although PFFR’s past underperformance was a negative for the fund’s past shareholders, it presents something of an opportunity for future investors. Lower share prices mean higher dividend yields, with PFFR yielding about 1.6% more than its benchmark as of today. The spread has rarely been higher.

At the same time, PFFR’s long-term underperformance is reversing itself, with the fund moderately outperforming its benchmark YTD, as investors shift towards beaten-down value stocks and the like.

Conclusion – Buy

PFFR’s strong, stable, fully-covered 6.3% dividend yield makes the fund a buy.

[ad_2]

Source links Google News