[ad_1]

redtea/E+ via Getty Images

Main Thesis/Background

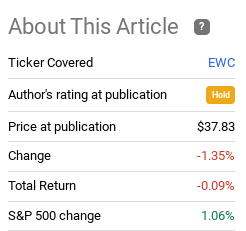

The purpose of this article is to evaluate the iShares MSCI Canada ETF (EWC) as an investment option at its current market price. This is a fund that is exclusively focused on Canadian equities, with a bias towards large and medium sized companies. I have held EWC for a while, but turned cautious on it when we started Q4 last year. I forecasted limited gains in the near term, and that is precisely what has happened. While the S&P 500 has squeaked out a slight gain, EWC’s return was about as flat as flat can be:

Recent Performance

Seeking Alpha

As we move further in to 2022, my outlook on Canadian stocks, and EWC by extension has gotten a little more optimistic. As a result, I decided to put some additional cash to work in this fund, for a few key reasons. One, the country now has one of its largest discounts ever compared to U.S. valuations (as measured against the S&P 500). This makes Canada a relative value play. Two, the country is overweight Financials. While this does pose concentration risk, this is an area I am bullish on as inflation remains high and interest rates are going to increase across the developed world. Three, oil prices have kept on increasing, and that has been a boon for the Energy sector, which is another area EWC is overweight.

Why Now? Discount To U.S. Is Very Large

The first point is one that is short and sweet, but still very important. After broad sell-offs, like what we have just seen across global markets, value often emerges as a winner. This is because investors are a bit shell-shocked from the losses, among other reasons, and start to take some risk off the table. This leads to a focus on quality, dividends, and often value. Further, value sectors right now are seen as areas that are going to actually benefit from the macro-enthronement. This is because what we are seeing across the Canada, the U.S., and the globe, is rising inflation, a prospect for higher interest rates, and continued strength in commodity prices. This environment bodes well for both Financials and Energy, and those sectors happen to be considered value at the moment.

So, what does this mean for Canada? If we look at Canadian equities as a whole and compare them to the S&P 500, we see that Canada has a distinct value advantage. While this has been the case for the last five years quite consistently, the point is amplified now in that the discount to the S&P 500 is near some of the widest values this century, as shown below:

Canadian Discount To U.S.

Yahoo Finance

The takeaway is straight forward. When considering EWC or the S&P 500, Canada wins in terms of value. This does not guarantee out-performance, nor even that we will see gains going forward. But with the continued desire to diversify a little bit away from my primary U.S. holdings that have gotten very Tech-heavy, EWC seems a good option. Canada is a developed market, a wealthy consumer base, and a much cheaper index that what we have at home. For me, this supports my position in the fund.

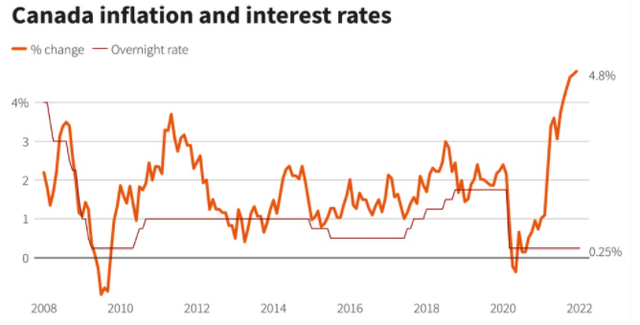

Inflation Not Just A U.S. Issue, Will Force Bank of Canada To Act

My next point looks at the broader inflationary environment, and how that might impact monetary policy. As readers are surely aware, inflation has been a major issue in the U.S., on the minds of politicians, investors, and households alike. Not surprisingly, this rapid increase in prices is not just a U.S. issue. The steady climb in inflation has taken the world by storm, and that includes our friendly neighbor to the north. While inflation took a nosedive in Canada in 2020, as in most countries, the trend has accelerated over the past few quarters. This has been aided by the fact that the Bank of Canada has kept its benchmark rate at .25% since the pandemic began:

Inflation vs Rates

Reuters

To me, this is not a sustainable course – here or in Canada. The governments / central banks are going to have to act to limit the increase in prices going forward. The most logical way to do this is begin to raise interest rates, which is overdue in my opinion. The past week, the Bank of Canada punted, saying the Omicron-variant was “wildcard”, forcing them to hold off on any action. But, as reported by Reuters, Governor Macklem was quoted post-meeting:

“The message is pretty clear. We’re on a rising path”

So, what does this mean for EWC? Fortunately, I view it positively. While I would have hoped the central bank would have acted already, it now seems clear rate hikes are going to begin sooner than later. This is important for the Canadian economy, and EWC in particular, because the nation’s index is heavily tilted towards the performance of bank stocks. This is reflected in EWC’s holdings list, which has 39% exposure to the Financials sector (up from 36% in my last review in October):

Holdings

iShares

The conclusion here is this is a positive backdrop for Financials. This fund in particular will benefit along with the banking/lending sectors as interest rates rise and net margins improve. While this won’t be an immediate benefit, as the Bank of Canada has pushed off rate hikes until (at least) their next meeting, this is a tailwind for the calendar year, in my view. With the U.S. index being heavily weighted more towards Tech and Consumer-oriented plays, I like the idea of using EWC as a way to diversify across nations and also sectors. For those investors who were thinking of bank stocks but didn’t want to add more U.S. exposure – EWC is a no-brainer play.

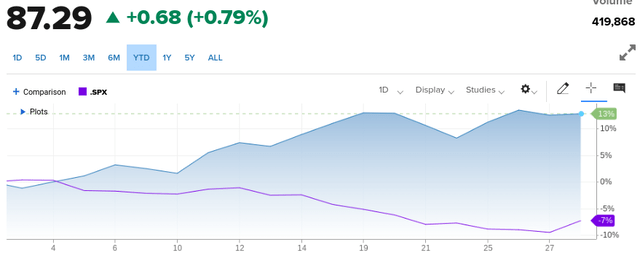

Oil Prices Another Positive For The Fund

I will now turn to oil prices. This is a topic I touched on in quite a bit of detail in my last review, so I will keep it short here. But it is worth highlighting again because Energy makes up the second largest sector by weighting for EWC. To me, this means one wants to be bullish on Energy as a whole when deciding to buy this particular fund. Fortunately, rising oil prices help support this sector, as this was a thesis I had for most of 2021 when I recommended EWC as an investment option. In the near term, this trend has not abated, with oil prices up significantly in 2022 already:

Oil’s Rise

CNBC

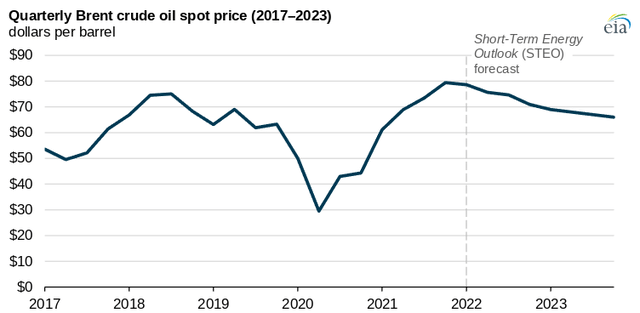

Longer term, oil prices are going to have to stabilize. Production will rise as oil rises, as the incentive to produce more becomes greater (as well as making it harder for OPEC+ to manage member’s compliance). Due to these realities, the U.S. Energy and Information Administration is currently forecasting a fall in prices throughout 2022:

Oil Price Prediction

EIA

However, in the short-term, a slowdown in oil prices is not materializing. These predictions have been hindered by the fact that global demand has been rising faster than expected. Further, there are geo-political risks, such as a potential for armed conflict in Ukraine, that are sending commodity markets higher. The idea here is that supply disruptions could result, exacerbating the supply shortage and supporting higher prices still.

Therefore, I see this as a bull-trend for EWC short-term, which will be useful to give Financials time before they really start to benefit from rising interest rates later in the year. Until the oil market sees a material change, the higher price level is here to stay, and that supports the underlying energy companies that sell it.

News Is Not All Rosy

Through this review, I have been fairly bullish. But I do want to moderate this stance somewhat. Yes, I think EWC is a buy and I plan on adding further on weakness. Yet, I would not rush in too aggressively here. The global equity market has seen some turbulence, and that is not something I take lightly. The next few months could very well see more of the same, which means being selective on entry points will be very wise.

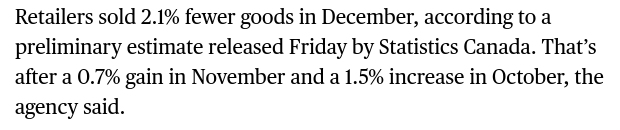

Further, the Canadian economy has some underlying issues as well. One case in point is the drop in retail sales, which has come about as consumer sentiment shifts downward and Covid-restrictions were put back in place:

Canada Retail Sales

Bloomberg

Of course, as the graphic shows, sales were up in the two preceding months before December. So a one-month drop is not something to get too alarmed about. But it does show how sensitive the consumer continues to be on news of Covid, and the corresponding variants. This reality will continue to disrupt the market, and global economies, for at least the first half of 2022.

This reiterates the selectivity I mentioned. Markets are not going to go up in a straight line. This is relevant for the S&P 500, as well as Canadian equities. This is why I would continue to advocate buying after we see drops, and taking some profit when there is an opportunity to do so. This is my approach across my global positions, including EWC.

Investors Are Feeling Riskier Countries

My last point is to touch on why I like Canada as an option for an international play. Specifically, this is geared towards investors who are more risk averse, in addition to being value-oriented. I bring this up because why I touched on EWC’s value advantage, that advantage is consistent across most of the investing world when we look at international equities against America. The indices in developed European markets, as well as developing markets in Asia and South America are all at valuation levels well below the S&P 500. This was true last year, and continued in to 2022 also.

Yet, readers should recognize that when the markets get jittery, emerging markets can struggle bringing in investment dollars. This is key to why I like a fund like EWC for the more conservative, value-oriented part of my portfolio. For emerging market funds/stocks, I use those options for more speculative, shorter-term plays. For readers who are concerned about ongoing volatility, then perhaps avoiding more speculative countries for sounder, developed markets like Canada, could make sense.

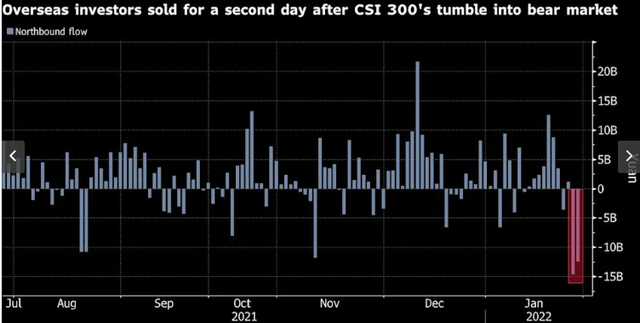

Case in point, this is part of a follow-the-herd mentality. During the last few weeks of market turmoil, international investors began to shed their exposure to Chinese equities. In fact, as stocks dropped, international fund flows were sharply negative, at levels rarely seen:

Investors Bailing On China

Yahoo Finance

Now, one could view this as a contrarian play, and use this to justify buying in to these Chinese assets now as everyone else is selling. There is merit to that belief, and I would not necessarily argue against the logic. But what I am saying in this illustrates the inherent riskiness of EM/Chinese investing. When the market’s mood sours, investors flee their riskier assets first. Canada would not be high on this list, so while it is not immune to sell-offs, it should fare better than developing markets if the global economy see more volatility.

Bottom line

I have built on my EWC position because I think Canada will see a nice recovery this year, Financial stocks are poised to do well, and Energy stocks are under-represented in the S&P 500 – so getting them through a Canadian ETF is quite useful. While short-term performance has been weak, I see brighter days ahead as 2022 progresses. There are some headline risks, most notably concerned with Covid-19, as well as concerns that oil prices could moderate later in the year. But, I see the recent market sell-off as a chance to put some of the cash to work that I had been building up over the last few months. EWC fits nicely with my objectives, and I suggest readers give this fund some consideration at this time.

[ad_2]

Source links Google News