[ad_1]

Igor Borisenko/iStock via Getty Images

Main Thesis / Background

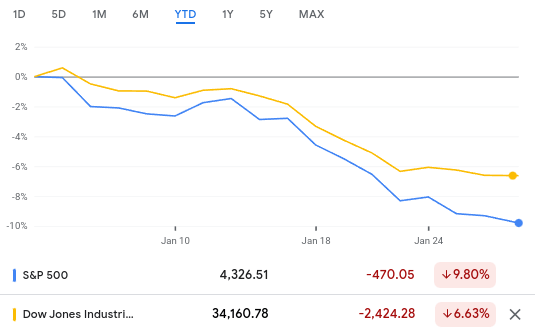

The purpose of this article is to evaluate the Vanguard Utilities ETF (VPU) as an investment option at its current market price. The fund’s stated objective is “to track the performance of a benchmark index that measures the investment return of stocks in the utilities sector” and is managed by Vanguard. I review VPU to give my broad outlook on the Utilities space, primarily because this is my preferred ETF to own these assets. During my most recent review in October, I maintained a modest outlook on the fund, but reiterated that I continued to remain long as this is a core holding of mine. In hindsight, this view was vindicated, as it has offered a slightly positive return while the S&P 500 has seen a sell-off:

Recent Performance

Seeking Alpha

Looking ahead, I continue to believe this is the right outlook. I expect the risk-on trade to get back on track once investors have truly come to terms with the Fed’s rate hiking plans. Using history as a guide, the equity market often delivers positive returns during these cycles, so investors will eventually come around. Therefore, I see my Utilities holdings as having provided a nice hedge for recent volatility, and will look now to take on a bit more risk.

Of course, I will continue to maintain a position, just somewhat smaller, because this is a sector that provides some relative stability during sell-offs, offers investors exposure to a product/service that American households not just want but need, and it will also benefit if we see an infrastructure spending bill get signed this year.

Some Good News: Stable Revenues, Declining Costs

To begin, I want to emphasize that I continue to believe Utilities, and VPU by extension, are attractive as a permanent place in an equity portfolio. As the last three months illustrates, this is often a spot for some relative safety. Investors look to Utilities because of the stable revenue streams, which is made possible because Americans need these services, they don’t just want them. The sector is heavily regulated, but this is balanced out by the stable outlay that households and businesses must make to them every month. Ultimately, this is one of the most stable areas of corporate America in terms of guaranteed revenues.

Of course, the profits are not as lofty as in other areas. This doesn’t excite investors, and is a key reason why this is seen as a defensive play. Even when compared against unprofitable, more speculative companies, the potential that those companies offer generally excites investors more. So holders of VPU have that to contend with – it is just never going to see that crazy valuation / momentum buying spree that other stocks/funds/sectors enjoy.

To me, this is not necessarily a bad thing. Would I want more profit? Of course, but I invest in VPU because I want to hedge my growth holdings, not add another one to the mix. Further, Utilities have become less boring than in decades past because of the shift into more renewable/green sources of energy. This has turned into an investment play that allows investors to get in on cutting edge tech and new trends – as well as capture the dollars of investors looking for “buzz word” investing (i.e. sustainable, green, clean, etc.).

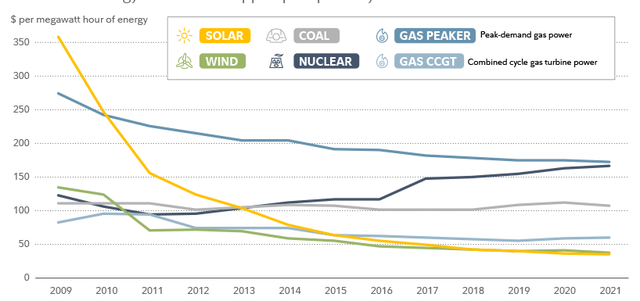

Fortunately, this shift is now only good for drawing in tax credits, government funding, and investment dollars, it also has helped to bring down input costs. With the exception of nuclear, the cost of providing energy has come down in all the major categories, as shown below:

Input Costs

Fidelity

The conclusion I draw is that this is a sector that is seeing quite a bit of inherent cost reduction, enjoying a shift in consumer/investor sentiment, and is building itself up on a more sustainable tract. While some of the spending plans coming out of the big utility firms are aggressive, they should hopefully reduce long-term operating costs. Further, this plans are helping secure government subsidies and other support, as the nation shifts to more renewable sources of energy. All of this is a positive for the merits of holding some exposure here for long term.

Interest Rates A Headwind, But The Yield Spread Can Absorb Initial Moves

I now want to shift to some of the headwinds. One in particular is interest rates. This is an area that has been causing quite a bit of pain in the market, broadly speaking, since 2022 got underway. Simply, the risk-on play has taken a bit of a pummeling, and even sectors like Utilities are getting caught up in the selling. This is because, in some respects, the “party is over”, when it comes to Fed support. Of course, the Fed is not going away entirely, but tapering is going to occur and rates are going to rise. So the three year period of epic returns might be starting to cool.

In this environment, one might think Utilities and other defensive areas would be smart ideas. After all, I do continue to hold them, partly for the diversification benefits and for the reasons laid out in the prior paragraph. But, with investors getting jittery, why aren’t funds like VPU performing even better?

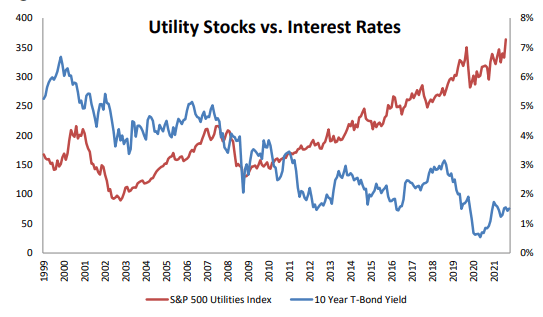

The answer lies in the why behind the market unease. As I mentioned, this primarily rests on the belief that interest rates are going to go up, and that gives investors another spot to park their cash and earn a return. This impacts the Utilities sector in terms of an income play. While investors enjoy the steady dividend stream funds like VPU and the underlying holdings offer, that income stream gets less attractive as bond rates and savings yields climb. In fact, over time, the inverse relationship between Utilities’ equity performance and interest rates is quite clear:

Relationship With Interest Rates

Edward Jones

This is absolutely part of why I am not upgrading my outlook. Am I saying to dump VPU and never look back? Of course not. But there is no denying the historical precedence that rising rates will pressure equity returns for this sector.

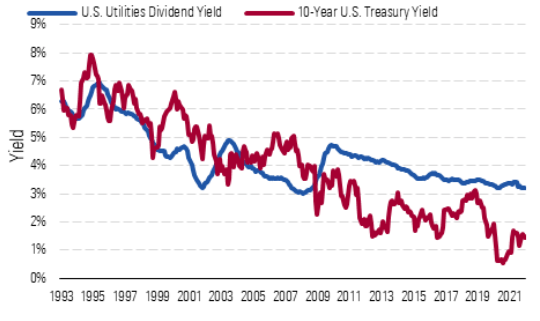

The good news is, rates have gotten so low that funds like VPU still have a pretty nice spread over treasury rates. When we combine this with the fact that VPU has seen strong dividend growth recently, it helps support the idea that this is still a reasonable income play. To illustrate, the graphic below shots that spread between the current yield from the sector against the 10-year treasury:

Yield Spread

Morningstar

This reality shows that rates can rise a bit before really taking away interest in a fund like VPU. Yes, rising rates are a headwind, and will be throughout 2022. But the starting point we have right now leaves a cushion for VPU to have a nice yield spread advantage, even after the first couple of rate hikes from the Fed. This balancing act supports my more neutral view, as opposed to one more bearish.

Why Take Profit Or Rotate Assets Here?

As I said at the start of the piece, I plan to take some profit on my Utility exposure and put that money to work in a more broad market fund. Primarily for me, this means investing in the S&P 500. Given the usefulness of VPU over the past quarter – why would I do that?

The logic behind this move is that I use sectors like Utilities, Energy, and Financials are a part long-term hold and part alpha-generating concept. I like to build my position up in VPU when I get concerned about broader market valuations and the potential for a pullback. Then, if and when a pullback does occur, I bank of VPU having held up better than the S&P 500, and shift some of the proceeds back into that index which is a stronger long-term play (in terms of total return). In this sense, I see now as a reasonable time to undertake that strategy.

To answer the why behind this move, let us consider that the market has seen a nice pullback very early in the year. While justifiable, we don’t get sell-offs like this very often. In fact, the S&P is sitting at correction territory on a year-to-date level, and the Dow Jones Index is not far behind it:

YTD Returns

Google Finance

Of course, these indices can keep dropping – I am not suggesting otherwise. But personally I pretty much always add to an index when it hits “correction” level (a drop of 10% or more). Over time, this is a winning strategy. Does it always signal a bottom? No. But it does typically represent both short and long term value for adding to a position. Furthermore, while the potential for rate hikes is spooking the market at present, I do not expect that to last all year.

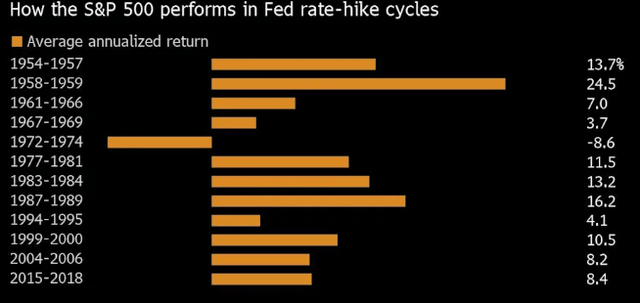

The reason for this is that is prior Fed hiking cycles, the S&P 500 will generally post positive returns. While they may not be the 15-20% gains we have been seeing the last three years consecutively, the gains are still pretty impressive:

S&P 500 Returns

Yahoo Finance

What is especially encouraging here is that the most recent rate hike cycles, 2004-06 and 2015-18, each saw sustainable gains in the 8% range. I will take those gains any year, especially at a time when there is so much worry and anxiety in the market. With the S&P 500 down about 10% YTD, and the expectation that returns will be positive this year, I want to build on that position going forward. For me, that means it will have to be at the expense of some of my VPU exposure, but I am comfortable with that trade-off.

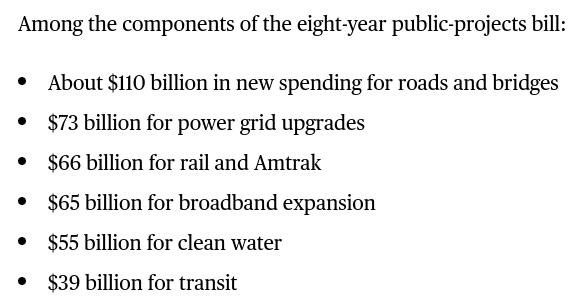

More Spending Could Boost The Sector

My last point reiterates a point I made during my last review that potential infrastructure spending could end up being a tailwind for VPU. At this point, federal spending is planned to be disbursed this year for items like broad-band networks, roads, and, notably, updating energy grids. As the 2022 mid-term elections loom, I expect another, fiercer push by the incumbent party to deliver more spending bills in order to improve standing with voters. Some of these funds could very well continue to make their way towards the underlying companies VPU holds, and that bodes well for the bottom-line at these firms.

To be fair, when dealing with Washington and potential legislative action, nothing is a certainty. We cannot count on this support coming, even if the president makes it a priority. But I do see the potential for smaller, more focused bills, that could support clean energy / grid upgrade projects in this sector. While these probably won’t be handouts, it will show support for the private-public partnership that utility companies have come to rely on.

Again, this is not meant to be a cure-all for the sector, and any forthcoming spending bills will probably not be solely directed at utility companies. In fact, even the one passed last year that had upgrading power grids as a top priority, had many other items as focus areas as well:

Spending Bill Breakdown

Bloomberg

The final word here is that while there is plenty of unknown with D.C. and Congress, if we do see meaningful spending bills in 2022, I would expect them to be a modest tailwind for VPU.

Bottom Line

VPU remains a core holding for me, although I will look to capitalize on the recent out-performance by locking in some profit and shifting to a more risk-on mode now that a broader correction has materialized. The utilities space has some things going for it – a relatively good yield, potential beneficiaries from federal spending, and input cost reductions. However, headwinds balance out some of these positives. The inverse relationship with interest rates is a course, giving the Fed has had to move to a more hawkish stance. Further, with risk-on assets selling off, I would expect to see a rotation back into those areas over the next few months. History suggests rate hike cycles are not enough of a deterrent to keep the broader market from rising, and investors are sure to pick up on that sooner or later. As a result, I will maintain my hold rating on VPU, and suggest investors balance the pros and cons of this fund very carefully at this time.

[ad_2]

Source links Google News